CLOSING BELL: ASX down 0.5pc, FMG down 10.2pc, and it looks like Rex is down for the count

Pic: Getty Images.

- The benchmark fell 0.5pc today, after a wonky night on Wall Street left local investors ball-shy

- Fortescue got dumped, with a $1.9 billion tranche of shares picked apart by vultures

- Small Cap winners did well to succeed on a very ordinary Tuesday

The ASX has rallied to a not entirely dismal -0.5% finish today, which – in the grand scheme of things – ain’t all that bad.

The day started with a precipitous drop, but a tortoise-like slow’n’steady approach by investors saw the benchmark wriggle back within sniffing distance of breaking even, on a day that is most likely going to be remembered more for the bad bits than the good bits.

I’ve gotta keep this brief, so forgive me if this gets a little bit “shorthand”, but hopefully you’ll get the broader picture by the time I’m done.

TO MARKETS

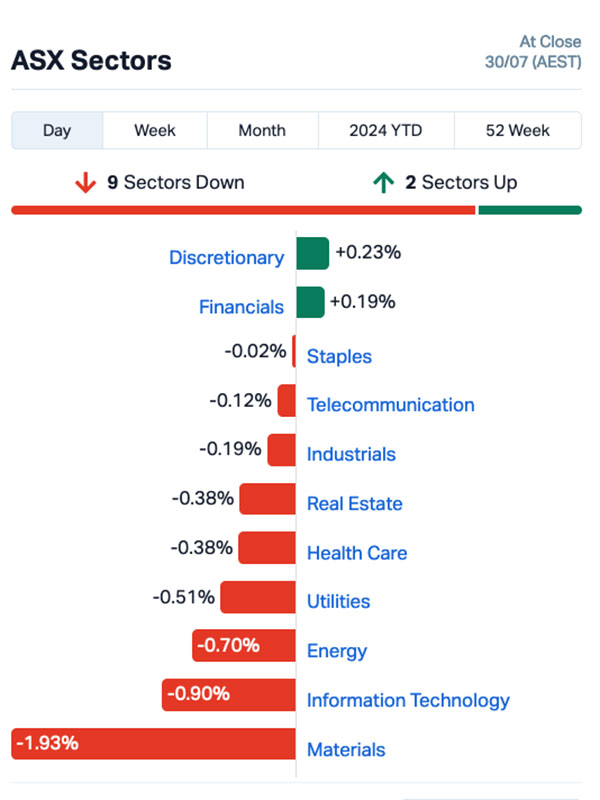

Everything started the day poorly, but a few things improved. At lunchtime, every sector was in the red, but by the time the market closed this arvo, Consumer Discretionary and Financials were back on the happy side of the ledger.

Not by much, though.

Quickly wrapping up today’s headline news, Fortescue took a complete hiding today, shedding 10.2% after a mystery shareholder got JP Morgan on the phone, and told them to dump $1.9 billion worth of FMG shares on the open market.

Predictably, chaos ensued. At the time of writing, there’s still no indication who it was that wanted out in a big hurry, or why they dumped the stock – but it’s been a rough few weeks for Twiggy’s baby, and this ruckus hasn’t helped much at all.

The other bad news is that it is starting to look very likely that Regional Express is about to go belly up.

Trading was halted, rumours flew about Ernst & Young coming in as administrators, and PM Albo said out loud that he’d do what he could to help Rex from collapsing.

Reports have emerged this arvo that customers are unable to book new flights on certain routes through Rex – only the routes with big planes and lots of seats are still available.

Rex, meanwhile, hasn’t said boo to anyone about it all. The mystery, it seems, shall remain as such until tomorrow.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| APX | Appen Limited | 0.67 | 55.8 | 31,207,188 | $95,890,706 |

| APC | Aust Potash Ltd | 0.0015 | 50.0 | 517,856 | $4,070,189 |

| HLX | Helix Resources | 0.003 | 20.0 | 31,958,156 | $8,160,484 |

| LPD | Lepidico Ltd | 0.003 | 50.0 | 251 | $17,178,250 |

| RMX | Red Mount Min Ltd | 0.0015 | 0.0 | 250,000 | $5,135,366 |

| A1G | African Gold Ltd. | 0.034 | 41.7 | 11,935,340 | $5,741,177 |

| CDT | Castle Minerals | 0.004 | 14.3 | 599,780 | $4,647,392 |

| DOU | Douugh Limited | 0.004 | 14.3 | 268,176 | $3,787,241 |

| IEC | Intra Energy Corp | 0.002 | 33.3 | 6,630,005 | $2,536,172 |

| NAG | Nagambie Resources | 0.012 | 33.3 | 1,518,921 | $7,169,721 |

| E25 | Element 25 Ltd | 0.265 | 26.2 | 54,433 | $46,181,604 |

| AHN | Athena Resources | 0.005 | 25.0 | 12,651,017 | $4,281,870 |

| CAV | Carnavale Resources | 0.005 | 25.0 | 1,079,000 | $13,694,207 |

| NRZ | Neurizer Ltd | 0.005 | 25.0 | 2,808,009 | $7,609,723 |

| RNE | Renu Energy Ltd | 0.005 | 11.1 | 764,310 | $3,267,603 |

| MEM | Memphasys Ltd | 0.011 | 22.2 | 1,380,986 | $12,444,733 |

| SOC | Soco Corporation | 0.14 | 21.7 | 10,000 | $15,920,561 |

| NGSDA | NGS Ltd | 0.035 | 20.7 | 57,857 | $1,183,724 |

| BXN | Bioxyne Ltd | 0.006 | 20.0 | 250,328 | $10,233,227 |

| CTN | Catalina Resources | 0.003 | 20.0 | 1,000,800 | $3,096,217 |

African Gold (ASX:A1G) was flying quickly on Tuesday morning, on news of a maiden gold resource from the Blaffo Guetto prospect at the Didievi Project in Cote d’Ivoire, which has come in at an Inferred 4.93Mt for 452koz of gold at 2.9 g/t (1.0 g/t Au cut off). The company says that several key assays tell an exciting story, such as 10.0m at 123.0g/t gold from 66m including 2.0m at 613.0g/t gold, and 80.0m at 3.0g/t gold from surface, including 23.0m at 9.5g/t gold.

Small explorer Castle Minerals (ASX:CDT) delivered its quarterly, revealing that things are progressing much as you’d expect them to, with the company recently raising close to $600k in a placement to boost its warchest to around $1 million, while it continues its search for graphite and gold across three projects.

Appen (ASX:APX) also dropped its quarterly this morning, with mixed (but still mostly positive) news that revenue for Q2 FY24 was $55.0 million, down 16% on previous corresponding period – however, excluding Google revenue from the equation has the company’s revenue for Q2 FY24 grew 16% from $47.2 million in Q2 FY23.

Regener8 Resources (ASX:R8R) was up on news that the company has executed an agreement covering the acquisition of tenement application ELA6755, known to its friends as North Achilles, in the Cobar district of western NSW. Regener8’s purchase lies approximately 2km along strike from Australian Gold and Copper (ASX:AGC) recent Achilles discovery, which has returned drill intercepts up to 5m @ 16.9g/t Au, 1,667g/t Ag, 0.4% Cu and 15% Pb + Zn.

RooLife Group (ASX:RLG) delivered its quarterly, and while it’s not an at-a-glance smash hit, it was enough to get investors excited. The company has, by the looks of things, been trimming some of the fat from the expense side of the ledger this past quarter, and while revenue was down the company still has a handy million or so in cash reserves.

Otto Energy’s (ASX:OEL) quarterly had some great news for shareholders, with the company reaffirming its decision to give as much money as it can back to investors. Otta says it had $60.8 million in cash balances at the end of the quarter – and after the proposed return of capital of up to $40 million, will still have at least $20.8 million of cash at bank – and will, from time to time, continue to look for ways to hand it out.

SaaS technology company AD1 Holdings (ASX:AD1) released its quarterly this morning, and investors were enjoying what it had to say. AD1 says that its North American business has grown by over 100%, a rebranding is well underway and the company has about 200 grand in the bank.

DXN (ASX:DXN) revealed in its quarterly report that total revenue for the quarter of $3.8 million was up 145% over this time last year, (4Q23: $1.6 million). FY24 revenue rose 41% to $10.9 million – up from $7.8 million in FY23, adding that sales growth has been driven by the deployment of new modular data centre sales across multiple clients.

Elixinol Global (ASX:EXL) issued its quarterly, and it’s jam-packed with healthy news that’s tasty as well. Q2 Group revenue was up 118% to $3.7 million from $1.7M a year ago, and that represents the seventh consecutive quarter of revenue growth. Additionally, record Q2 sales of $3.2 million are a twofold increase over Q2 FY23, a 29% improvement on Q1’s $2.5 million and have handed Elixinol an unaudited H1 revenue that has almost doubled to $6.8 million from $3.5 million on PCP.

Later in the day, Carnavale Resources (ASX:CAV) delivered a quarterly that got investors jiggling this arvo, despite there being no ‘fresh news’ in it – but as far as “we’ve had a cracker of a quarter” reports go, Carnavale’s was pretty solid, highlighting the work the company has completed and reminding us all that they have a MRE from the Swiftsure deposit at the Kookynie Gold Project that clocks in at 457kt @ 5.8g/t for 85koz. Mmmm… juicy.

Bioxyne (ASX:BXN) dropped its quarterly as well, revealing that it took in revenue of $3.1 million for the quarter, taking the company’s full year total to $9.43 million – which is a 25% increase on the aggregated revenue for FY2023 of $7.5 million. Bioxyne also noted that it’s back on track after some third-party delays, with its milestone of being awarded Australia’s first GMP certification for psilocybin and MDMA following rescheduling of these medicines heralded as a monumental achievement by the board.

ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | -50.0 | 32,733,680 | $2,430,946 |

| ERA | Energy Resources | 0.02 | -42.9 | 14,685,626 | $775,190,472 |

| RCR | Rincon | 0.051 | -33.8 | 37,281,817 | $22,428,227 |

| CL8 | Carly Holdings Ltd | 0.0095 | -32.1 | 3,347,796 | $3,757,185 |

| HE8 | Helios Energy Ltd | 0.014 | -26.3 | 9,571,617 | $49,476,939 |

| LNR | Lanthanein Resources | 0.003 | -25.0 | 285,002 | $9,774,545 |

| OAR | OAR Resources Ltd | 0.0015 | -25.0 | 3,662,000 | $6,444,200 |

| PKO | Peako Limited | 0.003 | -25.0 | 20,000 | $2,108,339 |

| SNT | Syntara Limited | 0.03 | -25.0 | 8,631,514 | $47,761,271 |

| CTE | Cryosite Limited | 0.73 | -20.7 | 42,351 | $44,904,798 |

| ALR | Altairminerals | 0.004 | -20.0 | 10,174,676 | $21,482,888 |

| EFE | Eastern Resources | 0.004 | -20.0 | 120,000 | $6,209,732 |

| OVT | Ovanti Limited | 0.004 | -20.0 | 7,949,867 | $6,200,527 |

| VRC | Volt Resources Ltd | 0.004 | -20.0 | 8,204,556 | $20,793,391 |

| RWD | Reward Minerals Ltd | 0.044 | -20.0 | 262,069 | $12,531,923 |

| NKL | Nickelxltd | 0.021 | -19.2 | 94,714 | $2,658,993 |

| ASE | Astute Metals NL | 0.032 | -17.9 | 100,000 | $16,537,175 |

| TEG | Triangle Energy Ltd | 0.014 | -17.6 | 47,117,371 | $30,828,945 |

| ICL | Iceni Gold | 0.054 | -16.9 | 1,856,280 | $17,729,468 |

| BSN | Basinenergylimited | 0.05 | -16.7 | 91,926 | $4,988,996 |

TRADING HALTS

African Gold (ASX:A1G) – pending an announcement updating the market on the Exploration Target for the Didievi Project.

State Gas (ASX:GAS) – pending an announcement regarding a material financing transaction and an accelerated non-renounceable entitlement offer.

Elementos (ASX:ELT) – for the purpose of considering and executing a proposed capital raising.

QMines (ASX:QML) – ending the release of an announcement in relation to a proposed equity raise.

South Harz Potash (ASX:SHP) – for the purpose of considering, planning and executing a capital raising.

PM Capital Global Opportunities Fund Limited (ASX:PGF) – pending an announcement to ASX in connection with a capital raising.

ICYMI – PM EDITION

BlinkLab (ASX:BB1) has formed a partnership with Netherlands-based Mental Care Group, the fifth-largest outpatient mental health provider in Europe, to improve and accelerate the way attention-deficit/hyperactivity disorder (ADHD) is diagnosed and managed, by leveraging its cutting-edge technology to improve diagnostic accuracy.

Equinox Resources (ASX:EQN) continues to progress drilling on the highest sample areas across its early-stage Mata da Corda ionic clay hosted rare earths project. Surface sampling at these areas had returned grades of up to 5024ppm TREO.

The final batch of assays from maiden drilling at Fin Resources’ (ASX:FIN) White Bear prospect at its Cancet West project in Canada has returned grades of up to 3.27% Li2O. Lithium mineralisation has been identified across widths of up to 12m.

Haranga Resources’ (ASX:HAR) auger drilling at its Sanela project in Senegal has delivered promising results that have reinforced the potential for a significant uranium discovery.

Indiana Resources (ASX:IDA) has received the first US$35m in its US$90m settlement in relation to the Tanzania Government’s unlawful expropriation of the Ntaka Hill base metals project. The company is now well funded through the A$10m repayment of an intercompany receivable from the Claimant group to advance its gold and REE exploration assets in South Australia’s Gawler Craton.

QMines (ASX:QML) has submitted a mining lease application for its Mt Chalmers copper-gold project, which has plenty of immediate and known upside, with five additional deposits at the Mt Chalmers and Develin Creek projects that fall outside of the current mine plan.

Race Oncology (ASX:RAC) has successfully concluded the investigator-sponsored Phase 1b/2 trial of lead drug bisantrene in combination with clofarabine and fludarabine (Bis/Clo/Flu) in relapsed or refractory acute myeloid leukaemia (R/R AML) patients after it reached its primary endpoint for efficacy.

Regener8 Resources (ASX:R8R) has acquired a new tenement immediately adjacent to the third-party, high-grade polymetallic (gold-silver-zinc-lead-copper) Achilles discovery in NSW.

Strategic Energy Resources (ASX:SER) has received approvals for a 25-hole reverse circulation program that will test the potential of the Achilles polymetallic prospect within its South Cobar project in NSW to host multiple discoveries.

Viridis Mining & Minerals’ (ASX:VMM) step-out drilling outside the existing resource at its Colossus project has delivered record results of up to 9m at 6551ppm TREO. Drilling has also found high-grade dysprosium and terbium in the new step-out areas, with sections up to 221ppm of Dy & Tb oxide.

At Stockhead, we tell it like it is. While BlinkLab, Equinox Resources, Fin Resources, Haranga Resources, Indiana Resources, QMines, Race Oncology, Regener8 Resources, Strategic Energy Resources and Viridis Mining & Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.