Closing Bell: ASX dips, goldies lead, and Forrestania jumps 140pc on iron ore play

Forrestania jumps on iron ore play. Pic via Getty Images

- ASX 200 dips amid Wall Street closure for Memorial Day

- Commodities bounce back; gold stocks rise, uranium falls

- Forrestania jumps on iron ore play

The ASX 200 edged down -0.2% on Tuesday as local traders navigated a directionless market amid Wall Street’s closure for Memorial Day.

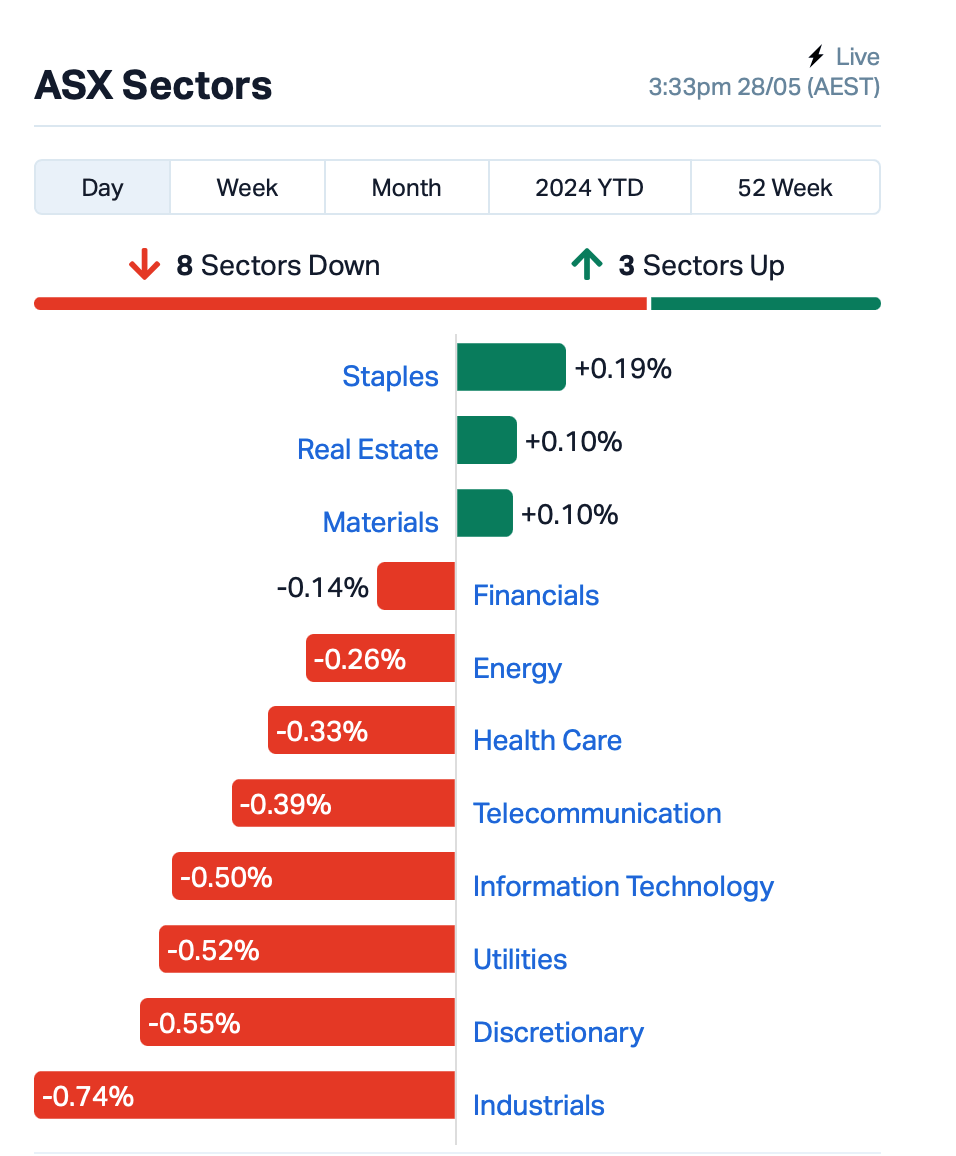

Losses in Industrials and Discretionary sectors were partly offset by gains in Staples and Real Estate.

Commodities like gold, copper, nickel, and aluminum rebounded this week after a pullback last week – reflecting investors’ reassessment of reduced expectations for US rate cuts.

Gold stocks did well today with Newmont Gold (ASX:NEM) adding 0.7% and Evolution Mining (ASX:EVN) rising by +1.2%.

Uranium miners, however took a hit, with Boss Energy (ASX:BOE) shaving -11% after its CEO, Duncan Craib, sold over $20 million in shares.

Still in the large cap space, ProMedicus (ASX:PME) rose around +2% after its subsidiary, Visage Imaging, secured five new contracts in the US totalling a minimum of $45m.

Oil-reated stocks were mixed after Brent crude climbed over 1% on a quiet Monday session overnight.

Global inflation data, OPEC+ supply meeting this coming Sunday, and US demand at the start of the summer driving season are all in focus when US traders return to their desks later tonight.

To data, Australian retail trade showed a small increase in April, but overall spending remained flat for the year as Aussies remained cautious about their expenses.

According to the ABS report released today, retail spending in April went up by 0.1% from March, following a 0.4% decrease in March.

“Since the start of 2024, trend retail turnover has been flat as cautious consumers reduce their discretionary spending,” said Ben Dorber across the street at ABS.

Wall Street trading will be faster

Across the region today, Asian stock markets saw gains as the US dollar weakened ahead of upcoming inflation reports. CPI data from Australia, Japan, the Eurozone, and the US will be released at various points this week.

Chinese property shares made gains following Shanghai’s decision to lower down-payment ratios and minimum mortgage thresholds.

Tech stocks in China saw an uptick as major state banks revealed their intentions to invest a total of 114 billion yuan (US$15.7 billion) in a semiconductor fund.

And… there’s a bit of a change coming to Wall Street.

Trading in US stocks markets will speed up big time, and starting tonight, trades in New York will settle in just one day, instead of two, cutting the time for each transaction in half.

Called T+1, this system was ditched before because things got too hectic. Now, it’s back but there are concerns.

“We know there are going to be some issues with a transition like this, so it’s about having the right resources to fix them quickly,” Christos Ekonomidis of BNY Mellon told Bloomberg.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FRS | Forrestania Resources | 0.050 | 163% | 73,404,356 | $3,073,929 |

| CAQ | CAQ Holdings Ltd | 0.070 | 133% | 301,157 | $21,533,588 |

| KCC | Kincora Copper | 0.054 | 50% | 551,470 | $7,378,901 |

| 1MC | Morella Corporation | 0.003 | 50% | 4,132,464 | $12,357,599 |

| VPR | Volt Power Group | 0.002 | 50% | 601,419 | $10,716,208 |

| PPY | Papyrus Australia | 0.016 | 45% | 2,667,824 | $5,419,619 |

| FAL | Falconmetalsltd | 0.230 | 44% | 2,515,451 | $28,320,000 |

| VN8 | Vonex Limited. | 0.022 | 38% | 5,042,069 | $5,789,258 |

| NAE | New Age Exploration | 0.004 | 33% | 10,000 | $5,381,697 |

| SIS | Simble Solutions | 0.004 | 33% | 2,499,417 | $2,097,117 |

| AQD | Ausquest Limited | 0.017 | 31% | 4,421,673 | $10,726,940 |

| BGE | Bridgesaaslimited | 0.026 | 30% | 34,139 | $2,387,941 |

| HFY | Hubify Ltd | 0.013 | 30% | 5,002,549 | $4,961,363 |

| CR1 | Constellation Res | 0.210 | 27% | 134,195 | $9,781,270 |

| RBX | Resource B | 0.038 | 27% | 96,790 | $2,480,535 |

| PNT | Panthermetalsltd | 0.060 | 25% | 111,229 | $4,183,976 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 5,873,842 | $57,785,344 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 136,592 | $4,471,956 |

| EDE | Eden Inv Ltd | 0.003 | 25% | 16,901,652 | $7,356,542 |

| IVX | Invion Ltd | 0.005 | 25% | 100,000 | $25,698,129 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 947,232 | $3,804,841 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 648,654 | $2,850,677 |

| BCC | Beam Communications | 0.155 | 24% | 247,532 | $10,802,740 |

| MQR | Marquee Resource Ltd | 0.016 | 23% | 6,221,597 | $5,373,997 |

| GBZ | GBM Rsources Ltd | 0.011 | 22% | 2,140,187 | $10,410,200 |

Gold, lithium and nickel hunter, Forrestania Resources (ASX:FRS), surged today on news related to iron ore, in the Yilgarn region, sending it triple-bagging upwards, about 200%.

The company has announced it’s entered into an option agreement with shareholders of Netley Minerals to acquire 100% of issued shares in Netley, which is the holder of highly prospective iron ore tenements right next to Mineral Resources’ (ASX:MIN) Koolyanobbing operations.

It’s potentially big for FRS, that, which enters into a three-month option period, in which the company will drill test several iron ore targets identified by Netley and its advisors. The potential is there, with surveys and rock chip sampling correlating with the geophysical trends, indicating mineralisation potential. All else, including infrastructure – road, rail, port and service centres – lines up well.

Falcon Metals (ASX:FAL) soared after receiving high-grade results for its 91-hole aircore (AC) drilling program at its Farrelly mineral sands prospect in Victoria, which is a follow-up on high-grade reconnaissance drilling results announced in early March.

The new results confirm Farrelly as a high-grade mineral sands discovery with a thick zone of mineralisation (Main Zone) now defined covering an area of about 1,200 metres by 600 metres and remaining open in several directions.

Significant drill intercepts include: 26m at 8.9% THM (total heavy mineral concentrate) from 6m, with 15m at 12.9% THM from 13m; and 22m at 9.2% THM from 8m, including 12m at 15.1% THM from 16m as well as 3m at 20.3% THM from 21m.

Papyrus Australia (ASX:PPY), which makes fibre, fertiliser and food packaging out of banana waste, made tidy gains on news that it has signed two contracts worth US$1.7m with the Egyptian Government’s National Authority for Military Production (MP).

Kincora Copper (ASX:KCC) has signed itself a $50m earn-in and joint venture agreement with a unit of the NYSE-listed AngloGold Ashanti for KCC’s Northern Junee-Narromine Belt (NJNB) copper and gold project in New South Wales. This is located in the near-unexplored undercover extension of a porphyry-related, rich gold and copper mineralised zone known as the Macquarie Arc. The company notes that a “wide range of virgin, large intrusive-related copper-gold targets will be drill tested” under the new agreement.

AngloGold will have the right to spend up to $50 million to earn a 80% interest through:

• $25 million of exploration expenditure to earn a 70% joint venture interest (Phase I) including a minimum A$2 million expenditure obligation, with Kincora the initial operator for a 10% management fee.

• Completion of a Pre-Feasibility Study (PFS) or funding of a further $25 million of expenditure to earn a 80% joint venture interest (Phase II).

Battery metals and precious metals hunter, Marquee Resources (ASX:MQR), has inked an option agreement with two parties to buy a gold and silver project in Sardinia, Italy, called Sa Pedra Bianca. Shareholders are enjoying the 30% rise in MQR that’s come on the back of the news today.

The Sa Pedra Bianca project covers a large portion of the old Osilo project, which contained a non-JORC resource of 1.65Mt at 7.06g/t gold and 29.7g/t silver for a total of 376,140oz gold and 1.58Moz silver. Timothy Spencer is named as one of the two parties and is the ex-MD of Essential Metals, which was acquired by Develop Global (ASX:DVP) in November last year.

Spencer will be appointed as a consultant of the company and will join the Marquee board on exercise of the option agreement.

Based on its due diligence so far, Marquee believes the Sardinian project to have “exceptional upside with real potential to become a 1Moz+ gold district”.

AusQuest (ASX:AQD) has news today from its Peruvian operations – it’s now begun drilling at its new copper-gold target at the Cerro de Fierro project.

The company believes their “is room for a sizeable deposit to be found”, affirmed by historic drilling returning multiple copper-gold intersections at the prospect.

The RC drilling program will test a structural target close to a drill hole that intersected multiple zones of copper-gold mineralisation, including 30m at 0.43% Cu, 0.16g/t Au; 43m at 0.43% Cu, 0.35g/t Au; 28m at 0.42% Cu, 0.15g/t Au and 33m at 0.24% Cu, 0.13g/t Au.

The project is located at the southern end of a recognised IOCG metallogenic belt in southern Peru and is within ~150km of the Mina Justa deposit (~337Mt @ 0.76% Cu) – being developed by the Marcobre JV. Assay results are expected within four weeks of this drilling program.

Matador Mining (ASX:MZZ) reported assay results from the final 110 drillholes of the 157 hole reverse circulation (RC) drill program at the Malachite Project in Newfoundland, Canada. New gold-in-bedrock anomalism has been identified, including drillhole CRC0142 which graded 127 parts per billion gold from 6 to 7m.

Playside Studios (ASX:PLY), the games maker, provided an update to its FY24 revenue and earnings guidance announced in February. Based on year-to-date trading, PLY now expects FY24 revenue to come in between $63m-$65m (previously $60-$65m). FY24 EBITDA is to come in between $16-$18m (previous guidance $11-$13m).

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCT | Holista CollTech Ltd | 0.006 | -40% | 2,577,068.00 | $2,788,001 |

| APC | Aust Potash Ltd | 0.001 | -33% | 5,860,966.00 | $6,030,284 |

| GCR | Golden Cross | 0.002 | -33% | 32,000.00 | $3,291,768 |

| MCT | Metalicity Limited | 0.002 | -33% | 1,832,578.00 | $13,455,285 |

| RIE | Riedel Resources Ltd | 0.002 | -33% | 1,600,000.00 | $6,671,507 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 250,000.00 | $36,612,769 |

| WEL | Winchester Energy | 0.002 | -33% | 15,125.00 | $3,061,266 |

| DY6 | Dy6Metalsltd | 0.115 | -30% | 2,906,805.00 | $6,667,787 |

| CTN | Catalina Resources | 0.003 | -25% | 113,009.00 | $4,953,948 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 558,468.00 | $2,357,944 |

| VML | Vital Metals Limited | 0.003 | -25% | 2,995,444.00 | $23,580,268 |

| SBW | Shekel Brainweigh | 0.040 | -23% | 207,467.00 | $10,960,859 |

| ADY | Admiralty Resources. | 0.008 | -20% | 1,909,585.00 | $16,294,739 |

| AUK | Aumake Limited | 0.002 | -20% | 1,515,000.00 | $4,786,017 |

| ICU | Investor Centre Ltd | 0.008 | -20% | 424,553.00 | $3,045,113 |

| ROG | Red Sky Energy. | 0.004 | -20% | 20,383.00 | $27,111,136 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | 3,518,210.00 | $2,411,789 |

| FRE | Firebrickpharma | 0.058 | -17% | 324,137.00 | $12,551,472 |

| LVH | Livehire Limited | 0.015 | -17% | 310,499.00 | $6,652,762 |

| BCT | Bluechiip Limited | 0.005 | -17% | 16,619.00 | $6,604,601 |

| BPP | Babylon Pump | 0.005 | -17% | 800,000.00 | $14,997,294 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 675,591.00 | $18,000,000 |

| VRX | VRX Silica Ltd | 0.047 | -16% | 996,328.00 | $32,669,199 |

| AAU | Antilles Gold Ltd | 0.006 | -14% | 29,431,658.00 | $6,975,745 |

Peter Warren (ASX:PWR) plunged over -11% today after warning about earnings as new car sales slow down and profit margins shrink.

PWR expects its underlying profit before tax for the FY24 to be between $52 million and $57 million – approximately 30% less than the $81.9 million it earned in FY23.

This comes after a smaller drop in profits in the first half of the financial year ending December 31, when underlying profit before tax fell from $43.2 million to $34.4 million.

IN CASE YOU MISSED IT

Alma Metals (ASX:ALM) has appointed a drill contractor for the upcoming core drilling program at its large-scale Briggs copper project in central Queensland to upgrade resources and collect material for metallurgical testing.

Basin Energy’s (ASX:BSN) Phase 2 drilling at the Geikie project in the prolific Athabasca Basin in Canada has identified a 1.5km-long alteration zone, typical of basement-hosted uranium mineralisation.

Everest Metals Corporation (ASX:EMC) could be looking at a significant maiden rubidium resource for its Mt Edon project in WA’s Mid-West after resource drilling intersected multiple pegmatites and expanded the existing target area.

NickelX (ASX:NKL) has appointed Uvre (ASX:UVA) founder Peter Woods as its new managing director as it transitions away from nickel towards uranium and gold exploration.

White Cliff Minerals (ASX:WCN) is gearing up for its first field operation at the pre-discovery Nunavut project in northern Canada, where historical drilling results point to potential sedimentary-hosted copper deposits.

Lithium Universe (ASX:LU7) has established a “same equipment, same supplier” strategy for its Bécancour lithium refinery as it seeks to replicate the procurement success demonstrated by the Jiangsu lithium carbonate plant in China. By using proven equipment and dealing with the same well-known and reliable suppliers used by the Galaxy team, it will reduce the engineering work required for the definitive feasibility study while minimising the cost and time associated with repeated detailed engineering by tapping into the original supplier’s design and construction experience.

Many Peaks Minerals (ASX:MPK) has started a 6500m reconnaissance drilling campaign to test juicy targets at its recently acquired Odienné project in northwest Côte d’Ivoire.

Miramar Resources (ASX:M2R) has received Programme of Work approval to carry out drilling at its Trouble Bore nickel-copper-cobalt-PGE project in WA’s Gascoyne region. The approval paves the way for the company to carry out drilling, which is co-funded by the WA state government’s Exploration Incentive Scheme, at the Trouble Bore and Mount Vernon projects to test Norilsk-style targets associated with Kulkatharra Dolerite sills and highlighted by airborne and ground electromagnetic surveys. This drilling seeks to show “proof of concept” of its Bangemall nickel-copper-cobalt-PGE deposit model by identifying nickel-copper sulphide mineralisation. It will now work towards obtaining heritage approvals and planning for the maiden drill program.

Sun Silver (ASX:SS1) has started investigations into project grants and alternative funding via various USA government departments including, the Department of Energy (DOE) and the Inflation Reduction Act (IRA) mechanism.

Summit Minerals (ASX:SUM) has received overwhelming interest for a $2m placement that will help to fund an aggressive exploration campaign on its Brazilian niobium and rare earth projects.

TRADING HALTS

Pointerra (ASX:3DP) – pending an announcement regarding a capital raising.

Copper Search (ASX:CUS) – pending an announcement to ASX regarding a capital raise.

Australian Gold and Copper (ASX:AGC) – ending the release of an announcement to the market regarding a capital raising.

Si6 Metals (ASX:SI6) – pending an announcement in relation to Brazilian exploration results.

Latrobe Magnesium (ASX:LMG) – pendin an announcement to the market regarding a proposed capital raising.

Gryphon Capital Income Trust (ASX:GCI) – pending an announcement by the Responsible Entity regarding a capital raising.

Papyrus Australia (ASX:PPY) – pending an announcement to be made to the market clarifying some comments in the ASX announcement made on 28 May 2024.

Kula Gold (ASX:KGD) – pending an announcement by the Company regarding an acquisiƟon and a capital raise.

Nanoveu (ASX:NVU) – pending an announcement regarding an exclusive distribution agreement update.

Buxton Resources (ASX:BUX) – pending an announcement of a capital raising.

Merchant House (ASX:MHI) – pending an announcement to the market regarding a material asset divestment.

At Stockhead, we tell it like it is. While Alma Metals, Basin Energy, Everest Metals Corporation, NickelX, White Cliff Minerals, Lithium Universe, Many Peaks Minerals, Miramar Resources and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.