Closing Bell: ASX bounces to the finish line as Nexsen shines on debut

After bouncing around much of the day, the ASX closes higher. Pic: Getty Images

- ASX 200 closes 0.19% higher after choppy session

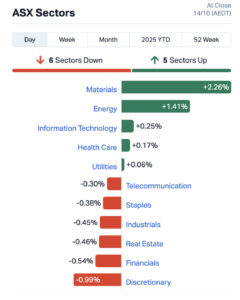

- Strength in mining and energy stocks offset pullback across six sectors, with big four banks among hardest hit

- In boost for healthcare sector, Biotech Nexsen makes strong debut to close 43% higher

The ASX 200 closed 0.19% higher at 8,899.40 on a day that bounced between gains and losses and at times looked set to finish in the red.

The market was flat at midday before rebounding in afternoon trade to sit 0.1% higher around 3:15pm (AEDT) only to pullback into the negative and then bounce into positive territory toward closing bell.

Wall Street overnight had a positive session after US President Donald Trump’s softer tone on China eased concerns over the latest trade flare-up following Beijing’s move to tighten rare earth export controls.

It seems the local market again priced in a round of TACO (Trump Always Chickens Out) trading on the ASX 200.

Overnight, the tech-heavy Nasdaq rose 2%, the S&P 500 gained 1.6% and the Dow Jones added 1.4%, recovering sharply from Friday’s steep selloff – the worst session for US investors since April – after Trump’s threat on his Truth Social to cancel a meeting with China’s president and impose higher tariffs from November 1.

US futures are pointing to further gains in Tuesday’s session.

Asian markets were mixed today with the Nikkei losing 2.53%, Hang Seng falling 0.19% and the SSE Composite Index up 0.21%.

Meanwhile Bitcoin has retreated and is currently trading ~$US113,500, while the Aussie dollar is trading near US65 cents.

Financials in red as materials and energy gain

Strength in mining and energy stocks helped offset a pullback across six of the ASX sectors. Discretionary and financials led the laggards with the big four banks dragging on the index.

Commonwealth Bank (ASX:CBA) closed down 0.79%, Westpac (ASX:WBC) slid 1.16%, National Australia Bank (ASX:NAB) lost 1.30% and Australia and New Zealand Banking Group (ASX:ANZ) fell 0.28%.

Materials was boosted by higher commodity prices with iron ore gaining 0.7% to US$106.53 a tonne and gold continued its record-breaking run, currently trading around US$4,168/oz.

Gold’s rally shows no signs of slowing, with Bank of America Global Research upgrading its 2026 price forecast to US$5,000 an ounce.

Energy stocks climbed as easing fears over a renewed US-China trade war lifted oil prices. After being up more than 1% earlier Brent crude is now trading 0.02% higher at US$63.34 a barrel.

Boost for biotechs with Nexsen up 43% on debut

The ASX healthcare sector received a boost with Nexsen (ASX:NXN) making a strong debut on the ASX at lunchtime today and closing 43% higher.

Nexsen is commercialising novel point-of-care diagnostic technology developed at RMIT University. The company raised $8 million through a well-supported IPO at 20c per share, with the stock climbing to 29.5c shortly after trading began.

Its platform builds on lateral flow testing technology, the same format used in Covid-19 and pregnancy tests, but powered by a nanoparticle system that delivers lab-grade accuracy at the point-of-care.

Nexsen has a diverse pipeline of diagnostic products in development spanning medtech, agritech and biosecurity.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AGD | Austral Gold | 0.11 | 134% | 6,698,496 | $28,778,634 |

| COB | Cobalt Blue Ltd | 0.29 | 93% | 35,864,958 | $74,179,261 |

| ASM | Ausstratmaterials | 1.97 | 66% | 9,087,126 | $268,632,819 |

| RML | Resolution Minerals | 0.069 | 53% | 175,702,386 | $80,918,185 |

| EUR | European Lithium Ltd | 0.3925 | 51% | 84,815,832 | $376,727,038 |

| 1AD | Adalta Limited | 0.003 | 50% | 31,573,203 | $3,073,744 |

| VFX | Visionflex Group Ltd | 0.003 | 50% | 509,340 | $6,758,296 |

| PL3 | Patagonia Lithium | 0.08 | 45% | 532,832 | $9,851,355 |

| NTU | Northern Min Ltd | 0.072 | 44% | 166,774,742 | $417,857,791 |

| BEL | Bentley Capital Ltd | 0.02 | 43% | 155,899 | $1,065,791 |

| NXN | Nexsen Limited | 0.285 | 43% | 4,195,436 | $14,513,219 |

| AON | Apollo Minerals Ltd | 0.011 | 38% | 2,572,623 | $7,427,655 |

| AYM | Australia United Min | 0.004 | 33% | 963,453 | $5,527,732 |

| RAN | Range International | 0.004 | 33% | 11,506,320 | $3,237,871 |

| RGL | Riversgold | 0.008 | 33% | 10,673,238 | $12,502,276 |

| AR3 | Austrare | 0.365 | 33% | 7,065,623 | $58,656,661 |

| HAS | Hastings Tech Met | 0.76 | 31% | 4,550,259 | $121,267,441 |

| GLL | Galilee Energy Ltd | 0.013 | 30% | 3,188,079 | $7,071,929 |

| ITM | Itech Minerals Ltd | 0.066 | 29% | 6,375,297 | $12,183,155 |

| SRG | SRG Global Ltd | 2.65 | 29% | 7,499,502 | $1,255,919,210 |

| CUL | Cullen Resources | 0.009 | 29% | 2,276,571 | $4,853,813 |

| DTM | Dart Mining NL | 0.009 | 29% | 92,667,890 | $9,621,897 |

| KTA | Krakatoa Resources | 0.018 | 29% | 42,540,255 | $13,553,876 |

| AHK | Ark Mines Limited | 0.495 | 29% | 555,574 | $25,471,869 |

| ARV | Artemis Resources | 0.0115 | 28% | 41,090,162 | $33,938,299 |

In the news…

Austral Gold (ASX:AGD) closed 134% higher after announcing it had resumed gold production at the Casposo mine in Argentina, updating the mine’s mineral reserve and refurbishing the plant.

Casposo’s proven and probable reserves now total 2.149Mt at 1.13g/t gold and 58.52 g/t silver, representing 80,000 ounces of gold and 3.276 million ounces of silver.

Cobalt Blue Holdings (ASX:COB) has inked an MoU with Legacy Minerals Holdings (ASX:LGM) to evaluate strategic options for cobalt and other products produced at the NiCo Young cobalt-nickel project.

The MoU focuses on potential synergies between COB’s Kwinana Cobalt Refinery and Broken Hill Cobalt Project and LGM’s asset portfolio.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AGD | Austral Gold | 0.11 | 134% | 6,698,496 | $28,778,634 |

| COB | Cobalt Blue Ltd | 0.29 | 93% | 35,864,958 | $74,179,261 |

| ASM | Ausstratmaterials | 1.97 | 66% | 9,087,126 | $268,632,819 |

| RML | Resolution Minerals | 0.069 | 53% | 175,702,386 | $80,918,185 |

| EUR | European Lithium Ltd | 0.3925 | 51% | 84,815,832 | $376,727,038 |

| 1AD | Adalta Limited | 0.003 | 50% | 31,573,203 | $3,073,744 |

| VFX | Visionflex Group Ltd | 0.003 | 50% | 509,340 | $6,758,296 |

| PL3 | Patagonia Lithium | 0.08 | 45% | 532,832 | $9,851,355 |

| NTU | Northern Min Ltd | 0.072 | 44% | 166,774,742 | $417,857,791 |

| BEL | Bentley Capital Ltd | 0.02 | 43% | 155,899 | $1,065,791 |

| NXN | Nexsen Limited | 0.285 | 43% | 4,195,436 | $14,513,219 |

| AON | Apollo Minerals Ltd | 0.011 | 38% | 2,572,623 | $7,427,655 |

| AYM | Australia United Min | 0.004 | 33% | 963,453 | $5,527,732 |

| RAN | Range International | 0.004 | 33% | 11,506,320 | $3,237,871 |

| RGL | Riversgold | 0.008 | 33% | 10,673,238 | $12,502,276 |

| AR3 | Austrare | 0.365 | 33% | 7,065,623 | $58,656,661 |

| HAS | Hastings Tech Met | 0.76 | 31% | 4,550,259 | $121,267,441 |

| GLL | Galilee Energy Ltd | 0.013 | 30% | 3,188,079 | $7,071,929 |

| ITM | Itech Minerals Ltd | 0.066 | 29% | 6,375,297 | $12,183,155 |

| SRG | SRG Global Ltd | 2.65 | 29% | 7,499,502 | $1,255,919,210 |

| CUL | Cullen Resources | 0.009 | 29% | 2,276,571 | $4,853,813 |

| DTM | Dart Mining NL | 0.009 | 29% | 92,667,890 | $9,621,897 |

| KTA | Krakatoa Resources | 0.018 | 29% | 42,540,255 | $13,553,876 |

| AHK | Ark Mines Limited | 0.495 | 29% | 555,574 | $25,471,869 |

| ARV | Artemis Resources | 0.0115 | 28% | 41,090,162 | $33,938,299 |

In Case You Missed it

Audeara (ASX:AUA) has inked a distribution deal with Eyear System Inc, opening a pathway to the Japanese market.

Ballard Mining (ASX:BM1) has highlighted 35 new gold targets at the Mt Ida gold project, building out a strong exploration pipeline of 53 total target areas.

Nova Minerals (ASX:NVA) has been invited to provide a briefing ahead of the meeting between Australian Prime Minister Anthony Albanese and US President Donald Trump.

Strong market interest in Altech Batteries’ (ASX:ATC) initiatives have crystallised in the form of a $6 million placement of shares priced at 4.5c each.

Tryptamine Therapeutics (ASX:TYP) has enrolled the first patient in its world-first intravenous psilocin trial for Binge Eating Disorder.

ReNerve (ASX:RNV) has secured first sales for its EmpliQ products, designed to support faster recovery from post-surgical wounds.

Stellar Resources (ASX:SRZ) has hit up to 2.75% tin in wedge drilling at Severn deposit of its Heemskirk project in Tasmania as prices for the metal pass US$37,000t.

Resolution Minerals (ASX:RML) will provide a briefing on its Horse Heaven antimony project ahead of Prime Minister Anthony Albanese’s meeting with US President Donald Trump.

Brightstar Resources (ASX:BTR) hits a record September quarter with a 91% increase in mine production across its Laverton Hub operations.

EMVision Medical Devices (ASX: EMV) will evaluate use of its emu brain scanner for stroke diagnosis and management in regional settings through $3 million CRC-P grant.

Titanium Sands (ASX:TSL) has locked in $800,000 in corporate funding as it works with the Sri Lankan Government to get its Mannar Island project off the ground.

Last Orders

Elevate Uranium (ASX:EL8) is offloading the Oobagooma uranium project to Orpheus Uranium (ASX:ORP) in exchange for cash consideration of $225,000 and 20m Orpheus shares.

EL8 is also due some milestone equity payments should all go as expected for the project’s initial exploration, with up to 40m ORP shares on the table.

Sierra Nevada Gold (ASX:SNX) is bidding for gold and copper exploration blocks in round 9 of a multi-round auction in the Kingdom of Saudia Arabia.

The company is looking to secure exploration ground in the Kingdom in a bid to leverage its extensive in-country knowledge.

In parallel, SNX has secured a mining permit to re-open the New Pass Mine in the US and is poised to begin a drilling program at the Warrior project.

Trading Halts

- Johns LYNG Group (ASX:JLG) – being acquired by Sherwood BidCo Pty Ltd

- Wildcat Resources (ASX:WC8) – denial of media speculation on project sale

- Liberty Metals (ASX:LIB) – pending acquisition

- SQX Resources (ASX:SQX) – acquisition and cap raise

- Hawk Resources (ASX:HWK) – acquisition and cap raise

- Jade Gas Holdings (ASX:JGH) – cap raise

- Titan Minerals (ASX:TTM) – strategic placement

- American West Metals (ASX:AW1) – cap raise

- Pinnacle Minerals (ASX:PIM) – acquisition and cap raise

At Stockhead, we tell it like it is. While Elevate Uranium and Sierra Nevada Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.