Closing Bell: ASX claws higher from 200-day low to close just above neutral

The market spent the majority of the day firmly in the negative, managing to struggle its way back to a flat finish by session’s end. Pic: Getty Images

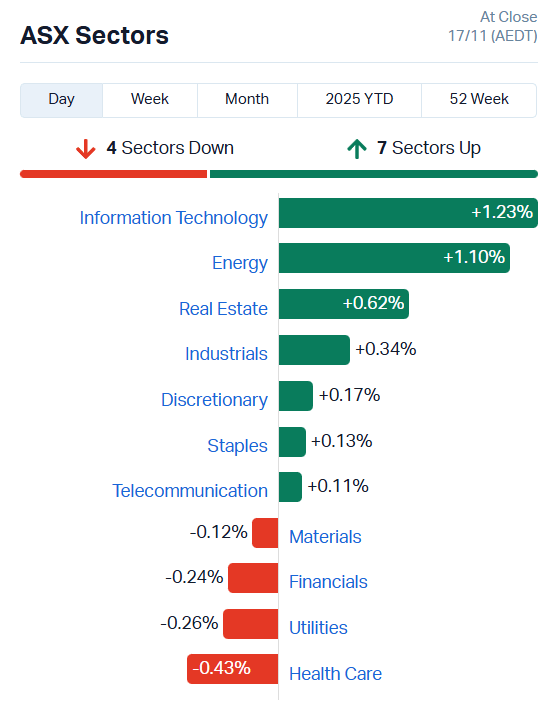

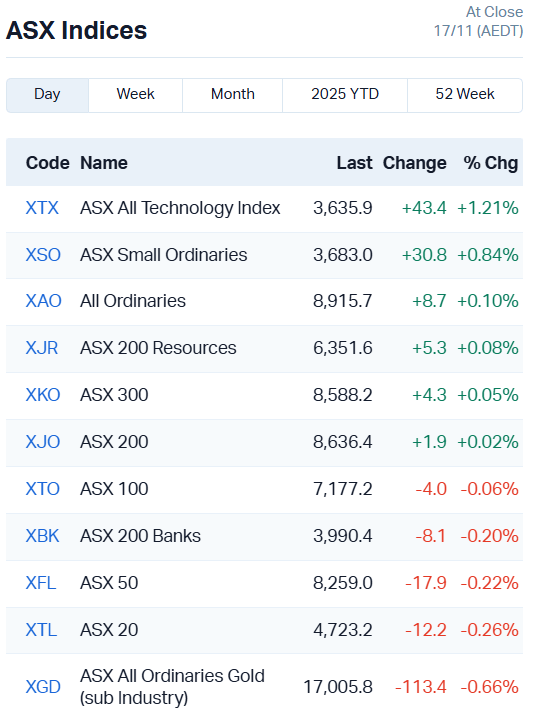

- ASX resists session lows of -0.53% to close 0.02% higher

- Info tech, energy, real estate lead gains

- Banks and finance stocks in retreat

ASX recovers from session lows

The ASX 200 started the day in the red and stayed there until the last half hour of trade.

The market recovered from a session low of -0.53%, tipping under our 200-day moving average briefly before staging a swift climb back to neutral by the second half of the session.

By day’s end, seven sectors were on the up, with 118 of 200 companies making gains.

The info tech sector led gains as Aussie traders remembered that the AI “bubble” sports a star-spangled red and white stripe.

Metal detection and communication solutions stock Codan (ASX:CDA) added 3.05%, Megaport (ASX:MP1) climbed about the same, and anti-drone stock Elsight (ASX:ELS) surged 12.58%.

It wasn’t the only ASX-listed stock to benefit from Ukraine’s very public destruction of the Novorossiysk oil depot in Russia.

Droneshield (ASX:DRO) traded up 10.52% despite lingering questions over some big stock sales by executives and Electro Optic Systems (ASX:EOS) climbed 7.38%.

Oil markets added about 2% on Friday night, climbing to US$64.39 a barrel of Brent on the continued supply disruptions.

Prices have only dipped marginally since to US$63.79 a barrel, providing support for energy companies throughout trade today.

Energy Resources of Australia (ASX:ERA), a particularly diluted stock for its $1.01 billion market cap, added 25% to 0.3c a share, while Ampol (ASX:ALD) climbed 3.61% and Viva Energy (ASX:VEA) tipped up 2.65%.

The biggest drags on the market included two of our biggest banking stocks – Commonwealth Bank (ASX:CBA) shed 0.96%, now down 7.44% for the month, and Macquarie (ASX:MQG) fell 2.31%.

Several gold and silver miners also experienced some profit-taking. Kingsgate (ASX:KCN) slid 9.48%, Focus Minerals (ASX:FML) 7.43% and Silver Mines (ASX:SVL) 7.14%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZAG | Zuleika Gold Ltd | 0.047 | 57% | 13879694 | $22,406,398 |

| AUK | Aumake Limited | 0.003 | 50% | 106256 | $6,046,718 |

| HLX | Helix Resources | 0.0015 | 50% | 1421064 | $5,346,291 |

| TDO | 3D Energi Ltd | 0.16 | 39% | 19707674 | $48,166,277 |

| CXL | Calix Limited | 0.645 | 39% | 1554100 | $100,003,062 |

| 1AD | Adalta Limited | 0.004 | 33% | 9502534 | $5,676,588 |

| SCP | Scalare Partners | 0.125 | 28% | 159055 | $8,252,175 |

| TGH | Terragen | 0.028 | 27% | 19806 | $11,110,378 |

| MBK | Metal Bank Ltd | 0.019 | 27% | 10058026 | $9,626,562 |

| RMX | Red Mount Min Ltd | 0.038 | 27% | 32365150 | $23,755,769 |

| ERA | Energy Resources | 0.0025 | 25% | 1291207 | $810,792,482 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 110000 | $14,070,414 |

| CPN | Caspin Resources | 0.155 | 24% | 9387446 | $26,675,201 |

| ILA | Island Pharma | 0.52 | 22% | 5805360 | $108,214,956 |

| ATR | Astron Ltd | 0.845 | 21% | 1153046 | $293,690,256 |

| AVL | Aust Vanadium Ltd | 0.012 | 20% | 30482009 | $86,694,998 |

| RAN | Range International | 0.003 | 20% | 5180306 | $4,462,785 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 624500 | $6,235,795 |

| VTX | Vertexmin | 0.26 | 18% | 4485078 | $63,033,801 |

| SP8 | Streamplay Studio | 0.013 | 18% | 11331853 | $14,095,010 |

| ADO | Anteotech Ltd | 0.02 | 18% | 3172572 | $46,366,457 |

| KPO | Kalina Power Limited | 0.02 | 18% | 1713837 | $49,860,927 |

| BNR | Bulletin Res Ltd | 0.055 | 17% | 743280 | $13,799,826 |

| OVT | Ovanti Limited | 0.007 | 17% | 57974950 | $33,094,738 |

| DY6 | Dy6Metalsltd | 0.15 | 15% | 589951 | $12,708,447 |

In the news…

Zuleika Gold (ASX:ZAG) has wrapped up court proceedings over its interest in the Plutonic gold mine, giving up any beneficial or legal interest in the asset in return for $48 million in cash and Catalyst Metals (ASX:CYL) shares.

CYL will pay $31 million in shares, closing out the remainder with $17 million in cold hard cash.

3D Energi (ASX:TDO) has hit gas-bearing intervals in two sections of the Essington-1 well, part of the VIC/P79 exploration permit offshore Otway Basin, Victoria.

Management reckons the first section holds about 58.5 metres of net gas play, while the second boasts about 31.5 metres. According to the company’s pressure data, the well is showing evidence of moveable gas.

TDO will use ora wireline formation testing to collect downhole gas samples and assess the deliverability of the reservoir.

Calix (ASX:CXL) has inked a joint development agreement with Rio Tinto (ASX:RIO) to demonstrate and commercialise CXL’s Zero Emissions Steel Technology (Zesty) for steel decarbonisation.

CXL reckons the deal is worth more than $35 million in cash and in-kind support. The company also enjoys support from the Australian Renewable Energy Agency, which has awarded Calix a grant of up to $44.9 million, subject to matched funding.

Terragen (ASX:TGH) has fielded an order for 70,000 litres of its Great Land Plus (GLP) bio-stimulant from Mort & Co Fertilisers after a successful product trial. TGH predicts its total GLP sales will increase 57% for the 2026 calendar year, estimating total annual revenue from the product of about $700,000 for the period.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GEN | Genmin | 0.0115 | -48% | 45003600 | $19,520,294 |

| BUY | Bounty Oil & Gas NL | 0.002 | -33% | 562500 | $4,684,416 |

| CT1 | Constellation Tech | 0.001 | -33% | 2250000 | $2,212,101 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 565500 | $10,036,083 |

| RLG | Roolife Group Ltd | 0.003 | -25% | 3529816 | $7,513,982 |

| VBS | Vectus Biosystems | 0.19 | -24% | 386576 | $13,333,333 |

| TMKDD | TMK Energy Limited | 0.115 | -23% | 619599 | $32,447,408 |

| BEL | Bentley Capital Ltd | 0.016 | -20% | 169287 | $1,522,558 |

| LNU | Linius Tech Limited | 0.002 | -20% | 2925829 | $20,074,651 |

| QXR | Qx Resources Limited | 0.004 | -20% | 2012127 | $9,213,317 |

| AMS | Atomos | 0.03 | -17% | 1423629 | $44,070,783 |

| VRC | Volt Resources Ltd | 0.005 | -17% | 1618301 | $29,840,096 |

| WBE | Whitebark Energy | 0.0085 | -15% | 215889 | $8,535,127 |

| SQX | SQX Resources Ltd | 0.15 | -14% | 41690 | $6,835,938 |

| NAE | New Age Exploration | 0.003 | -14% | 6470879 | $11,577,995 |

| GCM | Green Critical Min | 0.013 | -13% | 28101032 | $43,183,147 |

| GLA | Gladiator Resources | 0.013 | -13% | 3470073 | $12,207,786 |

| DKM | Duketon Mining | 0.165 | -13% | 182371 | $23,286,387 |

| BKY | Berkeley Energia Ltd | 0.465 | -13% | 984923 | $238,501,243 |

| FBR | FBR Ltd | 0.0035 | -13% | 1627985 | $26,747,890 |

| SHE | Stonehorse Energy Lt | 0.007 | -13% | 300000 | $5,475,481 |

| CMO | Cosmometalslimited | 0.021 | -13% | 356710 | $10,421,922 |

| ATC | Altech Batt Ltd | 0.029 | -12% | 24242362 | $88,058,066 |

| AKG | Academies Aus Grp | 0.11 | -12% | 1 | $16,576,808 |

| KM1 | Kalimetalslimited | 0.185 | -12% | 420648 | $19,216,566 |

In Case You Missed It

Race Oncology (ASX:RAC) has identified major new opportunities in two new cancer indications for its RC220 therapy after identifying its unique mechanism of action.

Adavale Resources (ASX:ADD) is preparing to drill test untapped gold resource potential at the London-Victoria pit based on an independent geological review.

StockTake: Tylah Tully looks into Locksley Resources (ASX:LKY) and a research agreement with Columbia University to advance next-generation US processing technology for rare earths.

White Cliff Minerals (ASX:WCN) has finalised digitisation and analysis of historical drilling and surface data for Danvers 1 at the Rae project.

With recent legal victories under its belt, Energy Transition Minerals (ASX:ETM) is taking the next step to advance its Kvanefjeld rare earths project licence claim in Greenland.

Australian Critical Minerals (ASX:ACM) has launched a geophysical survey to narrow down targets for first-pass drilling in Peru’s world-class gold belt.

Bayan Mining and Minerals (ASX:BMM) has defined three new drill targets at its Bayan Springs South project in Nevada, thanks to a recent CSAMT survey.

StockTake: Tylah Tully looks at Vertex Minerals (ASX:VTX) and the increasingly alluring gold grades coming out of its Reward gold mine in New South Wales.

Osmond Resources (ASX:OSM) has drilled five out of seven holes to date its Orión project in Spain which looks set to provide a non-China supply of rutile, zircon and titanium.

Trading halts

Alvo Minerals (ASX:ALV) – material exploration results

Ausgold (ASX:AUC) – cap raise

Catalina Resources (ASX:CTN) – cap raise

TPG Telecom (ASX:TPG) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.