Closing Bell: ASX celebrates as AI ‘bubble’ refuses to pop

The ASX 200 rebounded a full 1.24% today, as a solid performance from Nvidia soothed AI bubble fears. Pic: Getty Images

- ASX bounces back after Nvidia brings the goods, up 1.24%

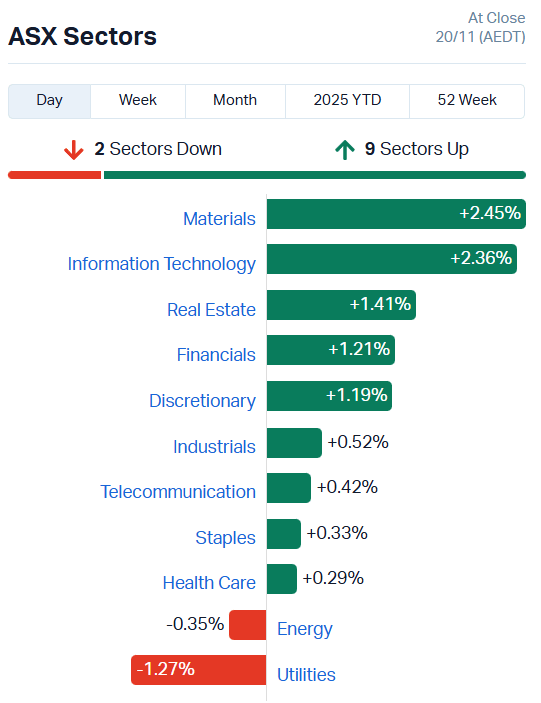

- Materials and info tech lead gains, just energy and utilities lower

- Strong moves in lithium as macro conditions improve

ASX rides high on Nvidia passing mark

Like a death row prisoner with a stay of execution, markets breathed a heavy sigh of relief today.

Nvidia brought the goods, CEO Jensen Huang was suitably bullish about forward guidance, and fears of an imminent AI bubble bursting faded into the background.

Despite some reassuring comments from Huang, an increase in the concentration of Nvidia’s customer base still raised some red flags.

In Q2, just four customers accounted for 56% of Nvidia’s sales. This quarter, that’s risen to 61%.

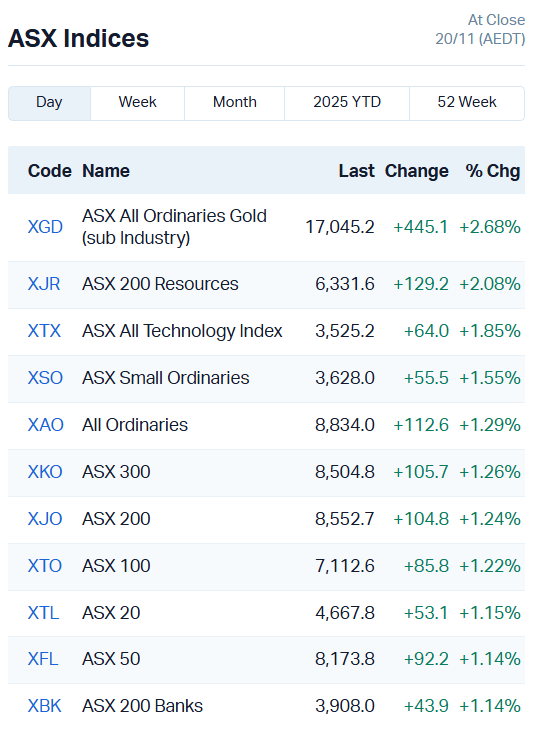

Either way, Aussie investors were happy. The ASX 200 surged 1.24%, adding 104 points to climb back to 8552.7.

The bourse is still down 2.29% for the last five days, but another bounce tomorrow could bring us back to just about neutral territory.

Info tech and materials led gains, with nine of 11 sectors on the up and a total of 144 of 200 stocks making headway.

Mayne Pharma (ASX:MYX) was right at the front of the pack, up 20.46%.

The Foreign Investment Review Board (FIRB) extended the deadline for its decision on an acquisition by Cosette Pharmaceuticals to November 20.

Cosette seems a little reluctant at this point, indicating its debt arrangements will only be available until November 25.

MYX is unconcerned – management says Cosette’s payment obligations under the current scheme of implementation deed aren’t conditional on any particular debt facilities.

Translation: Pay up, even if you’ve changed your mind.

AFT Pharmaceuticals (ASX:AFP) surged 9% intraday on news the biotech is preparing for a 1000-patient phase III study for a new iron deficiency treatment that could compete with CSL’s (ASX:CSL) acquired Vifor arm.

It’s since given up most of those gains, up just 1.11% by day’s end.

Check out today’s Health Check for more on that.

Lithium back in vogue

Momentum in the lithium sector has been slowly gaining steam in recent months.

Prices began to lift soon after China announced plans to double its energy storage capacity over the next two years.

Beijing followed that up with increased scrutiny, royalties, and higher levels of regulation for the local lithium processing industry, essentially lifting the cost of producing the battery metal by at least 4%.

While the combination drew plenty of attention within the lithium sector, it was Mineral Resources’ (ASX:MIN) partial sale of its Wodgina and Mount Marion lithium mine interests to major South Korean company POSCO that turned broader market heads.

The deal valued MIN’s 50% stake in the projects at $3.9 billion, a juicy premium over analyst consensus of $2.6 billion.

If that wasn’t enough, Rio Tinto (ASX:RIO) placed its Serbian lithium project into care and maintenance in an effort to avoid glutting the market with excess supply, and Li Liangbin, chair of major Chinese producer Ganfeng Lithium Group, predicted lithium demand could climb 30% in 2026.

Yesterday, Chilean producer SQM chimed in with its own prediction of a 25% rise in lithium demand.

Today, our own Liontown Resources (ASX:LTR) auctioned 10,000 wet metric tonnes of spodumene lithium (SC6 grade) for US$1,254 per tonne.

It’s all coming together in a perfect storm for lithium stocks:

- Core Lithium (ASX:CXO) +17.05%

- Galan Lithium (ASX:GLN) +11.36%

- Liontown Resources (ASX:LTR) +9.56%

- Pilbara Minerals (ASX:PLS) +4.9%

- Mineral Resources (ASX:MIN) +4.34%

- IGO (ASX:IGO) +4.36%

- Rio Tinto (ASX:RIO) +2.38%

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.035 | 59% | 64408686 | $26,331,718 |

| ALV | Alvomin | 0.055 | 57% | 38853698 | $6,834,268 |

| GT1 | Greentechnology | 0.039 | 39% | 24556431 | $16,630,951 |

| MEM | Memphasys Ltd | 0.004 | 33% | 42583 | $7,364,677 |

| WEL | Winchester Energy | 0.002 | 33% | 7740270 | $2,044,528 |

| CXU | Cauldron Energy Ltd | 0.022 | 29% | 20754793 | $30,419,904 |

| AS2 | Askarimetalslimited | 0.015 | 25% | 2983399 | $5,624,436 |

| AOK | Australian Oil. | 0.0025 | 25% | 70664 | $2,504,457 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 500000 | $6,336,765 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 1000000 | $3,106,827 |

| M2M | Mtmalcolmminesnl | 0.017 | 21% | 283400 | $4,349,522 |

| CND | Condor Energy Ltd | 0.023 | 21% | 6445168 | $13,617,648 |

| MYX | Mayne Pharma Ltd | 5.76 | 20% | 1178407 | $389,167,511 |

| 1AI | Algorae Pharma | 0.012 | 20% | 4993075 | $16,883,947 |

| 4DS | 4Ds Memory Limited | 0.012 | 20% | 4458103 | $20,608,987 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 4681366 | $18,014,426 |

| LIB | Liberty Metals | 0.003 | 20% | 1872945 | $15,314,476 |

| SPX | Spenda Limited | 0.003 | 20% | 15719481 | $12,162,146 |

| AXE | Archer Materials | 0.38 | 19% | 942842 | $81,551,044 |

| HWK | Hawk Resources. | 0.032 | 19% | 1024729 | $9,143,869 |

| KGD | Kula Gold Limited | 0.039 | 18% | 12440810 | $38,001,714 |

| PMT | Pmet Resources | 0.52 | 18% | 8754318 | $242,495,361 |

| ATC | Altech Batt Ltd | 0.026 | 18% | 10411834 | $58,705,378 |

| FRS | Forrestaniaresources | 0.235 | 18% | 3004579 | $99,820,491 |

| SNS | Sensen Networks Ltd | 0.1175 | 18% | 598509 | $82,980,248 |

In the news…

Cauldron Energy (ASX:CXU) has hit pause on trading, entering a halt until it can release results from exploration at the Manyingee South uranium project, after its shares rocketed up almost 30%.

Archer Materials (ASX:AXE) played up its role as the only ASX-listed company in quantum technologies in its most recent AGM.

AXE is developing a biochip based on quantum chip technology it hopes will one day allow for at-home management and treatment of chronic diseases, specifically chronic kidney disease and similar conditions.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.001 | -33% | 68000 | $3,849,675 |

| AUK | Aumake Limited | 0.003 | -25% | 3165579 | $12,093,435 |

| RNV | Renerve Limited | 0.1175 | -24% | 4318455 | $17,177,254 |

| MBK | Metal Bank Ltd | 0.014 | -22% | 1658861 | $12,066,160 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 750000 | $17,588,018 |

| XGL | Xamble Group Limited | 0.013 | -19% | 965549 | $7,232,303 |

| BUY | Bounty Oil & Gas NL | 0.0025 | -17% | 325000 | $4,684,416 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 30938291 | $20,705,349 |

| PSL | Paterson Resources | 0.029 | -15% | 7550836 | $17,889,201 |

| 1AD | Adalta Limited | 0.0035 | -13% | 1010100 | $7,568,784 |

| FAU | First Au Ltd | 0.007 | -13% | 345359 | $20,971,878 |

| PIL | Peppermint Inv Ltd | 0.0035 | -13% | 527502 | $10,036,083 |

| VMS | Venari Minerals | 0.014 | -13% | 3133468 | $16,909,062 |

| GBE | Globe Metals &Mining | 0.045 | -12% | 115779 | $43,259,060 |

| 8IH | 8I Holdings Ltd | 0.016 | -11% | 93386 | $6,266,895 |

| VSR | Voltaic Strategic | 0.032 | -11% | 1691366 | $20,431,808 |

| EVE | EVE Health Group Ltd | 0.025 | -11% | 586237 | $7,920,545 |

| SIO | Simonds Grp Ltd | 0.13 | -10% | 25000 | $52,186,435 |

| TEA | Tasmea Limited | 4.56 | -10% | 2697430 | $1,296,617,082 |

| NTD | Ntaw Holdings Ltd | 0.27 | -10% | 81436 | $50,312,283 |

| APC | APC Minerals | 0.009 | -10% | 24697 | $2,929,334 |

| IFG | Infocusgroup Hldltd | 0.009 | -10% | 4653233 | $4,530,026 |

| SPQ | Superior Resources | 0.009 | -10% | 830635 | $23,739,827 |

| YAR | Yari Minerals Ltd | 0.009 | -10% | 1146329 | $8,394,638 |

| OLI | Oliver'S Real Food | 0.01 | -9% | 59544 | $5,948,051 |

In Case You Missed It

Island Pharmaceuticals (ASX:ILA) has appointed a Washington DC–based government affairs and health policy consulting firm to support its engagement across the US biodefence and health security landscape.

Perpetual Resources (ASX:PEC) has revealed a lithium-bearing pegmatite trend over 400m at its Igrejinha project in Brazil’s Lithium Valley.

QMines (ASX:QML) continues to shine a light on the scale and quality of the Sulphide City deposit at the Develin Creek project in central Queensland.

ReNerve (ASX:RNV) raises $3.2 million from new and existing, and institutional and sophisticated investors.

Lumos Diagnostics (ASX:LDX) teams up with AcuityMD to strengthen US commercialisation of its rapid FebriDx test to distinguish between bacterial and non-bacterial acute respiratory infections.

Strata Minerals (ASX:SMX) is preparing to get the drill spinning for the first time at Zelica in the Laverton gold province by the end of November.

Independent testing has confirmed Green Critical Minerals’ (ASX:GCM) VHD tech is a leader in thermal management.

Another impressive copper-gold hit has come out of Cannindah Resources’ (ASX:CAE) Cannindah Breccia prospect, with the latest drillhole returning 120m at 1.16% copper equivalent.

Decidr AI Industries’ (ASX: DAI) will enter the US market after signing a binding agreement to acquire New York-based AI knowledge transfer platform Sugarwork Inc.

West Wits Mining (ASX:WWI) has completed the first blast for the Qala Shallows underground decline as it advances toward first gold pour in March 2026.

Trading halts

Black Dragon Gold (ASX:BDG) – cap raise

Elementos (ASX:ELT) – cap raise

G11 Resources (ASX:G11) – cap raise

Skylark Minerals (ASX:SKM) – cap raise

Trek Metals (ASX:TKM) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.