Closing Bell: ASX calls in the banking cavalry as lithium stocks slump

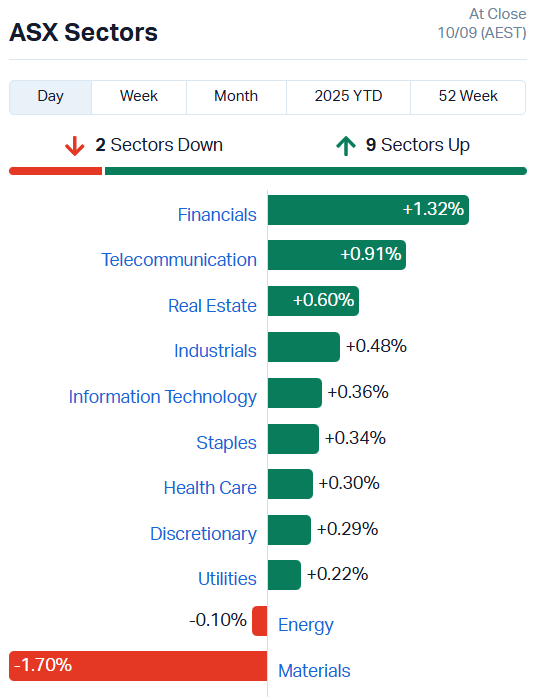

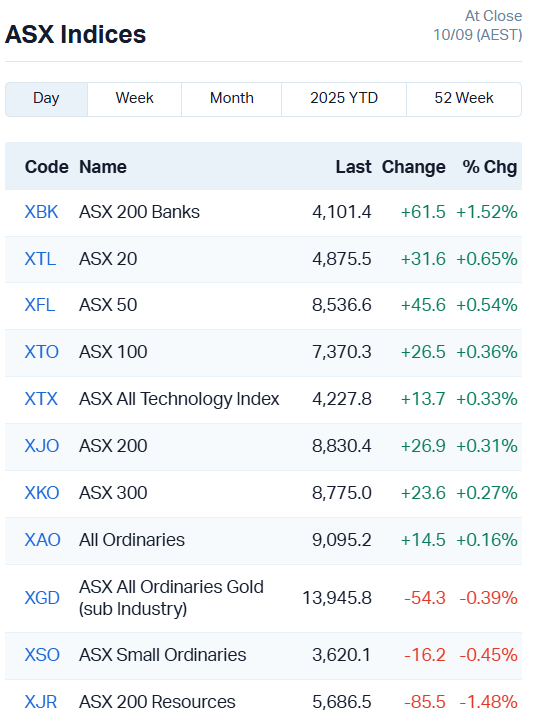

The ASX charged 0.31pc on the back of strong gains in major banking stocks, outweighing stinging losses in ASX-listed lithium companies.

- ASX breaks losing streak to rise 0.31pc

- Banks provide support as lithium stocks flounder

- ASX All Ord Gold index falls 0.39% despite high gold prices

Banks charge higher as materials sector retreats

The ASX has broken its two-day losing streak, rising 0.31% or 26.9 points with nine of 11 sectors higher.

It was an uncertain start to trade this morning, with the bourse zigzagging around neutral until gains in the major banks managed to outweigh a lagging materials sector.

A 0.39% fall in the All Ords Gold index plus a full retreat from the majority of ASX-listed lithium stocks gave the market plenty of ground to make back up. More on the lithium pain in a second.

The major banks were able to bring their weight to bear, adding between 0.9% and 1.7% to lift the greater finance sector 1.32%.

September is following the usual bearish pattern at present, with the ASX sitting 2.48% off its 52-week high.

CATL restart bulldozes lithium stocks

Lithium stocks were in full rout today, staging a swift strategic retreat as much-anticipated supply constraints evaporated as quickly as they’d materialised.

Major Chinese battery manufacturer CATL briefly shut down its Jianxiawo lithium mine in Yichuan when its licence expired on August 9.

Lithium carbonate prices on the Chinese market surged as much as 24% during the production halt, but the month-long shut down is soon to end.

CATL expects to resume operations much faster than the market anticipated, having made steady progress in ticking off the necessary mining rights certificates and permits.

ASX lithium stocks are bearing the brunt of the market’s surprise, shedding most of the value gained over the suspension period.

Liontown Resources (ASX:LTR) plunged 18%, Pilbara Minerals (ASX:PLS) 17% and Mineral Resources (ASX:MIN) 6.7%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OLL | Openlearning | 0.022 | 57% | 34839714 | $6,759,312 |

| SRJ | SRJ Technologies | 0.015 | 36% | 19107612 | $15,170,596 |

| LKY | Locksleyresources | 0.29 | 32% | 17859214 | $55,420,339 |

| EQX | Equatorial Res Ltd | 0.23 | 28% | 1214878 | $23,660,164 |

| ANR | Anatara Ls Ltd | 0.014 | 27% | 46399718 | $2,349,494 |

| SP3 | Specturltd | 0.035 | 25% | 1280064 | $8,873,203 |

| ALM | Alma Metals Ltd | 0.005 | 25% | 1170003 | $7,402,948 |

| AOK | Australian Oil. | 0.0025 | 25% | 452024 | $2,122,566 |

| KRR | King River Resources | 0.016 | 23% | 6933909 | $19,026,631 |

| MBK | Metal Bank Ltd | 0.016 | 23% | 1881587 | $6,466,967 |

| IR1 | Irismetals | 0.135 | 23% | 1796744 | $25,443,235 |

| WC1 | Westcobarmetals | 0.022 | 22% | 1132213 | $4,588,636 |

| EVR | Ev Resources Ltd | 0.012 | 20% | 30330905 | $22,275,033 |

| MEM | Memphasys Ltd | 0.006 | 20% | 2224616 | $9,917,991 |

| SPQ | Superior Resources | 0.006 | 20% | 13921945 | $11,854,914 |

| A3D | Aurora Labs Limited | 0.049 | 20% | 1406004 | $16,389,436 |

| HAR | Harangaresources | 0.1025 | 19% | 25703598 | $25,649,066 |

| NTI | Neurotech Intl | 0.019 | 19% | 2740758 | $16,793,951 |

| T88 | Taitonresources | 0.083 | 19% | 15999 | $5,212,016 |

| EMC | Everest Metals Corp | 0.13 | 18% | 77208 | $24,769,938 |

| SKO | Serko | 2.6 | 18% | 504 | $274,120,330 |

| ADG | Adelong Gold Limited | 0.007 | 17% | 9517227 | $13,901,018 |

| BUY | Bounty Oil & Gas NL | 0.0035 | 17% | 350000 | $4,684,416 |

| FAU | First Au Ltd | 0.007 | 17% | 13554703 | $15,698,908 |

| RNX | Renegade Exploration | 0.0035 | 17% | 2100000 | $6,156,090 |

In the news…

Metal Bank (ASX:MBK) is going all-in on its Western Australian gold portfolio, moving to acquire all of Hastings Technology Metals’ assets in the region in return for $2.3m in MBK shares.

The deal will give MBK majority ownership of the Whiteheads gold project, Ark gold project, and Darcy’s gold project. At the same time, MBK is running up a scoping study for its Livingstone projects, which both contain sizeable resources totalling more than 100koz gold.

EV Resources (ASX:EVR) and Locksley Resources (ASX:LKY / OTCQB:LKYRF / FSE:X5L) are tapping into US supply chains, inking a non-binding antimony ore supply agreement that will see LKY make a $750k investment in EVR should it become binding.

EVR recently snapped up the high-grade Dollar antimony project in Nevada, while LKY is developing its own antimony project alongside its DeepSolv processing technology that promises much lower energy requirements compared to traditional pyrometallurgy methods.

Both companies are capitalising on burgeoning demand for domestic US supply of antimony, a defence-critical mineral that has been in short supply since China cut off exports in 2024.

Superior Resources (ASX:SPQ) has hit startingly high grades of copper in rock chip sampling at the Greenvale project, with results up to 46.5% copper, 6.58 g/t gold and 24.5 g/t silver from Halls Reward.

SPQ also drummed up results of up to 10.99% copper, 0.21 g/t gold and 12 g/t silver from the Telegraph prospect, some 3km to the northwest of Halls Reward – management reckons there are at least 1.1km of unmined extensions to the Halls Reward lode to investigate.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.11 | -56% | 8746518 | $47,213,453 |

| BMO | Bastion Minerals | 0.001 | -33% | 299999 | $3,307,430 |

| NTM | Nt Minerals Limited | 0.002 | -33% | 300000 | $3,632,709 |

| HLX | Helix Resources | 0.0015 | -25% | 2260000 | $6,728,387 |

| TON | Triton Min Ltd | 0.007 | -22% | 68136 | $14,115,499 |

| PAT | Patriot Resourcesltd | 0.036 | -20% | 609921 | $7,426,010 |

| JAY | Jayride Group | 0.004 | -20% | 2060906 | $7,139,445 |

| DAL | Dalaroometalsltd | 0.048 | -19% | 1468226 | $17,390,363 |

| BOT | Botanix Pharma Ltd | 0.11 | -19% | 38056789 | $264,779,097 |

| LTR | Liontown Resources | 0.7775 | -18% | 50214606 | $2,727,046,865 |

| PLS | Pilbara Min Ltd | 1.9925 | -17% | 1.12E+08 | $7,724,386,070 |

| LU7 | Lithium Universe Ltd | 0.0125 | -17% | 16089752 | $21,584,694 |

| PFT | Pure Foods Tas Ltd | 0.025 | -17% | 613157 | $4,212,769 |

| BGE | Bridgesaaslimited | 0.02 | -17% | 627249 | $4,796,621 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 2800000 | $2,763,100 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 1378616 | $18,756,675 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 440833 | $20,225,588 |

| SER | Strategic Energy | 0.005 | -17% | 6075467 | $5,020,150 |

| GL1 | Globallith | 0.31 | -16% | 1199783 | $96,840,886 |

| BAS | Bass Oil Ltd | 0.021 | -16% | 3160996 | $7,984,672 |

| AGY | Argosy Minerals Ltd | 0.032 | -16% | 11882465 | $58,364,995 |

| ALR | Altairminerals | 0.016 | -16% | 25112150 | $86,388,139 |

| KLR | Kaili Resources Ltd | 0.375 | -16% | 402814 | $65,593,162 |

| SNS | Sensen Networks Ltd | 0.074 | -15% | 2077722 | $68,994,260 |

| MML | Mclaren Minerals | 0.023 | -15% | 993897 | $5,365,839 |

In Case You Missed It

Albion Resources’ (ASX:ALB) drilling at the Yandal West project has demonstrated that gold mineralisation at the Collavilla prospect is open at depth.

Gold miner Brightstar Resources (ASX:BTR) is eyeing high-grade gold beneath the planned open pit at its Lord Byron deposit near Laverton in WA.

DY6 Metals (ASX:DY6) is about to get boots on the ground and start soil sampling at its rare earths and gallium projects in Malawi.

Axel REE (ASX:AXL) has boosted the Caladão project’s footprint in Brazil’s Lithium Valley with fresh gallium and REE discoveries.

St George Mining (ASX:SGQ) has teamed up with REAlloys to bring its Araxá niobium-rare earths project in Brazil closer to commercial reality.

Magmatic Resources (ASX:MAG) has kicked off a maiden drilling program at the Weebo gold project as it moves in on advanced targets.

Star Minerals (ASX:SMS) has taken another step towards bringing its Tumblegum South gold project into production in early 2026 with the submission of a mining proposal application.

Aldoro Resources (ASX:ARN) says new assays will be included in an updated resource estimate at the Kameelburg niobium and rare earths project.

Trading halts

Fortuna Metals Ltd (ASX:FMM) – material acquisition

Krakatoa Resources (ASX:KTA) – cap raise

Cobalt Blue Holdings (ASX:COB) – cap raise

Element 25 (ASX:E25) – cap raise

At Stockhead, we tell it like it is. While Locksley Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.