Closing Bell: ASX breaks through 9000 points for another trophy finish

In a powerful show of strength, the ASX has broken through its previous record to close at over 9000 points. Pic: Getty Images

- ASX smashes records to close at intraday high of 9019 points

- Market shows impressive strength, with every sector and index moving higher

- Industrials sector a powerhouse of momentum

It’s over 9000!!

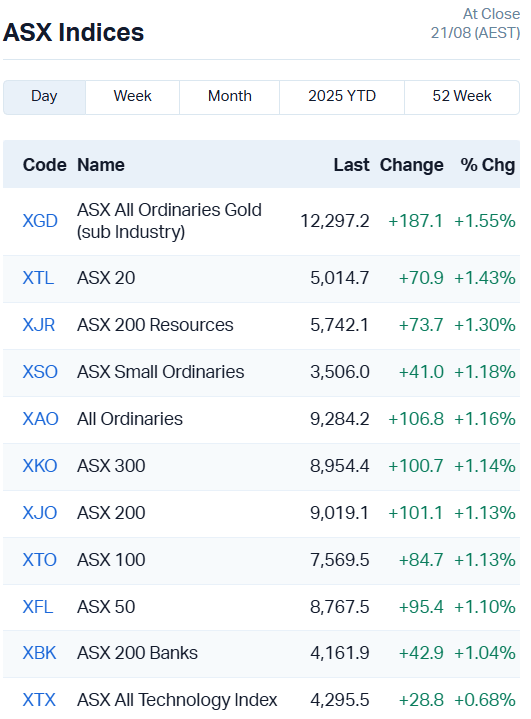

The ASX is well and truly showing its strength, smashing records once again to close at an intraday and record high of 9019.1 points.

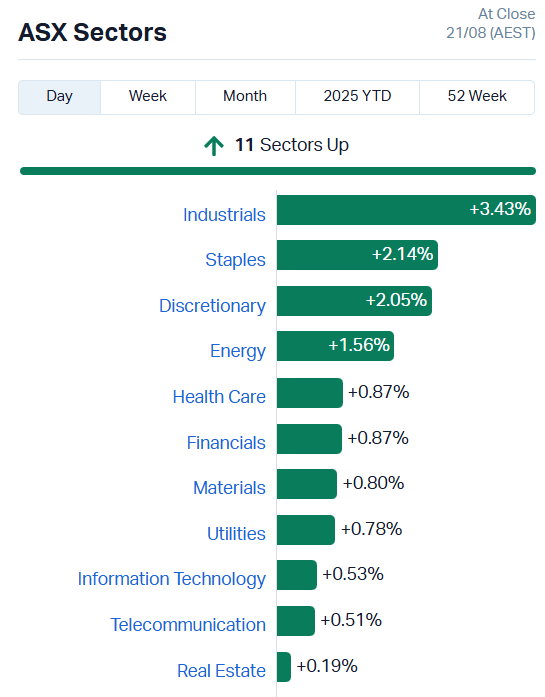

It was a ripper of a day for the bourse, with every single sector and index flexing their muscles to lift the market 1.13%.

The performance is even more impressive against a backdrop of losses on Wall Street overnight.

The US S&P500 slipped 0.2% overnight and the Nasdaq 0.7%, signalling once again that Australian fortunes are diverging from America’s.

While today’s performance was most certainly a group effort, we’ve got to give props to the Industrials sector’s Herculean efforts today, adding 3.43%.

That’s as much as the sector’s past two months of progress in a single day.

Chemicals and materials middleman REDOX (ASX:RDX) surged 26%, joined by supply chain specialist Bramble (ASX:BXB), which shot up 11.95%.

There were plenty of other full year result wins – over in consumer staples, family favourite Bega Cheese (ASX:BGA) added 7.4% while Super Retail Group (ASX:SUL) jumped 12.8%.

Technology company Codan (ASX:CDA) lifted almost 11% while healthcare stock Telix Pharma (ASX:TLX) climbed 7.7%.

There was also a near miss (à la CSL) for one technology heavyweight…

Megaport CEO talks the talk

Megaport (ASX:MP1) shares crashed out about 20% today on a pessimistic full-year report that predicted higher operating expenses and reduced earnings despite solid revenue growth.

The numbers weren’t actually that bad – MP1’s FY25 results came in above expectations for the most part.

Revenue lifted 16% on a constant currency basis, and the info tech company is predicting another 17% rise next year.

The pain comes from ballooning operating expenses, forecast to rise 35% and undercut EBITDA by 25% in the FY26.

It was enough to reverse months of share price progress, until CEO Michael Reid stepped into an investor call with just the right things to say.

Consensus from that call appeared to indicate the chief exec did a good job explaining the company’s forward strategy, discretionary investment, and how it’s positioning for growth.

Megaport shares reversed back into the positive during the call, ticking up about 1.6 cents at the time and ending the day down just 3.3% or 50c per share, a 17% recovery.

Not a bad result from a single Q&A session.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OMG | OMG Group Limited | 0.015 | 114% | 81775130 | $5,098,064 |

| ASP | Aspermont Limited | 0.009 | 80% | 1121082 | $12,565,884 |

| T3D | 333D Limited | 0.014 | 56% | 544777 | $1,699,684 |

| EV1R | Evolution Energy - Rights | 0.003 | 50% | 17250112 | $290,120 |

| JNS | Janus Electric Holding | 0.145 | 46% | 3568662 | $8,981,385 |

| XGL | Xamble Group Limited | 0.03 | 43% | 1907996 | $7,119,299 |

| TON | Triton Min Ltd | 0.007 | 40% | 692484 | $7,841,944 |

| BPM | BPM Minerals | 0.085 | 39% | 4935177 | $5,325,320 |

| AYA | Artrya Limited | 1.79 | 38% | 4380670 | $148,315,852 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 1015121 | $4,154,089 |

| BMO | Bastion Minerals | 0.002 | 33% | 265000 | $3,307,430 |

| OCT | Octava Minerals | 0.05 | 32% | 12687446 | $2,897,854 |

| FNX | Finexia Financial Grp | 0.14 | 27% | 250965 | $6,853,436 |

| TMB | Tambourah Metals | 0.059 | 26% | 6358565 | $7,777,374 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 114894 | $9,267,345 |

| FBR | FBR Ltd | 0.005 | 25% | 7303983 | $23,665,031 |

| MOH | Moho Resources | 0.005 | 25% | 350000 | $2,981,656 |

| TKL | Traka Resources | 0.0025 | 25% | 15000 | $6,055,348 |

| CC9 | Chariot Corporation | 0.078 | 24% | 307439 | $9,771,537 |

| RDX | Redox Limited | 2.6 | 24% | 5052565 | $1,102,670,999 |

| GED | Golden Deeps | 0.043 | 23% | 5532578 | $6,199,400 |

| RAD | Radiopharm | 0.03 | 22% | 46600598 | $57,941,263 |

| PR2 | Piche Resources | 0.14 | 22% | 362906 | $9,601,270 |

| HMY | Harmoney Corp Ltd | 0.79 | 22% | 951145 | $67,636,864 |

| CVB | Curvebeam Ai Limited | 0.175 | 21% | 899520 | $47,294,034 |

In the news…

OMG Group (ASX:OMG) will almost double the number of Woolies stores stocking its Barista Oat Milk product, jumping from 544 stores to 900 in a strong vote of confidence from the largest grocery retailer in Australia.

The move follows a series of recent onboarding deals with petrol and convenience chains, including 7-11, Quikstop and Canteen One.

Digital asset management company 333D (ASX:T3D) is riding the Bitcoin wave, pulling in $1 million in customer cash receipts in FY25, a more than 400% increase compared to just under $200k in FY24.

The company also locked in service agreements with healthcare providers Align Radiology and Next Healthcare, agreeing to manage software development, digital management and 3D printing services.

Janus Electric (ASX:JNS) is pushing into African markets, inking an MoU with EVUNI Pte Ltd for exclusive distribution and deployment of Janus’ technology on the continent. The deal includes a principal investment of up to $5 million by EVUNI, in exchange for up to 25m ordinary JNS shares.

Janus will allocate a minimum of 250 electric drivetrain conversion modules per year to EVUNI for the duration of the five-year contract, with an option to renew for a further five years.

Artrya (ASX:AYA) has gotten the 501(k) green light from the US FDA for its proprietary Salix® Coronary Plaque module, a cloud platform designed for near-real time, point of care assessment and management of coronary artery disease.

Achieving the milestone means AYA can now charge a fee per scan assessed with Salix, with customers receiving an reimbursement rate of US$950 for each assessment.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KLR | Kaili Resources Ltd | 0.19 | -82% | 9974703 | $159,192,392 |

| PPY | Papyrus Australia | 0.015 | -53% | 8001371 | $19,292,215 |

| SFG | Seafarms Group Ltd | 0.001 | -50% | 467718 | $9,673,198 |

| ASR | Asra Minerals Ltd | 0.0015 | -40% | 41624585 | $10,000,495 |

| CZN | Corazon Ltd | 0.002 | -33% | 750000 | $3,703,717 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 680333 | $20,225,588 |

| C7A | Clara Resources | 0.003 | -25% | 6137 | $2,973,180 |

| CHM | Chimeric Therapeutic | 0.003 | -25% | 1597558 | $13,018,235 |

| HLX | Helix Resources | 0.0015 | -25% | 2203333 | $6,728,387 |

| ICU | Investor Centre Ltd | 0.0015 | -25% | 480 | $609,023 |

| ECTDC | Env Clean Tech Ltd. | 0.047 | -22% | 66680 | $16,061,742 |

| DTM | Dart Mining NL | 0.002 | -20% | 2475086 | $2,995,139 |

| WEL | Winchester Energy | 0.002 | -20% | 49068 | $3,407,547 |

| IPH | IPH Limited | 4.5 | -19% | 13650655 | $1,456,442,928 |

| LML | Lincoln Minerals | 0.009 | -18% | 1249950 | $23,403,267 |

| OEC | Orbital Corp Limited | 0.255 | -18% | 2101304 | $51,081,712 |

| GRL | Godolphin Resources | 0.014 | -18% | 4955668 | $7,630,846 |

| MGTRG | Magnetite Mines | 0.025 | -17% | 285146 | $1,225,577 |

| AZI | Altamin Limited | 0.02 | -17% | 10567 | $13,788,069 |

| HHR | Hartshead Resources | 0.005 | -17% | 2842484 | $16,852,093 |

| OVT | Ovanti Limited | 0.01 | -17% | 78388420 | $51,291,883 |

| RC1 | Redcastle Resources | 0.01 | -17% | 5486137 | $8,922,803 |

| SPQ | Superior Resources | 0.005 | -17% | 20000 | $14,225,896 |

| VEN | Vintage Energy | 0.005 | -17% | 4623198 | $12,521,482 |

| RAU | Resouro Strategic | 0.195 | -15% | 25800 | $11,013,256 |

In Case You Missed It

LinQ Minerals (ASX:LNQ) says a combination of geochemical, gravity and drilling data points to potentially sizeable porphyry system at Gidginbung.

Diablo Resources (ASX:DBO) is progressing drilling the Trenton and Philadelphia prospects at Phoenix in Utah, hunting for copper in the US.

Nimy Resources’ (ASX:NIM) hunt for the elusive copper-nickel source at Masson has taken a compelling twist with the discovery of three conductive plates.

Metallium (ASX:MTM) has secured exclusive options to lease two additional sites in the US for its electronic waste processing operations.

Octava Minerals (ASX:OCT) has released strong bio-leaching recovery rates for rare earths and lithium from its Byro project in WA.

Hillgrove Resources’ (ASX:HGO) drill results indicate the new Saddle Zone at its Kanmantoo copper mine in South Australia is part of a larger mineralised system.

Sipa Resources (ASX:SRI) has completed a crucial heritage survey at its Crown gold project in WA to get into maiden drilling.

Kingsland Minerals (ASX:KNG) has hit a significant milestone after metallurgical testing of its Leliyn project returned outstanding results with purified spherical graphite grading 99.97% carbon.

European Lithium (ASX:EUR) has reported outstanding new rare earth diamond drilling results from its Tanbreez project in Greenland.

TinyBeans (ASX:TNY) lifted subscription revenue 12% in FY25 as parents turn to privacy-first platforms in the booming “anxiety economy”.

Trading halts

Gateway Mining Limited (ASX:GML) – exploration results

Locksley Resources Limited (ASX:LKY) – material agreement

Meteoric Resources NL (ASX:MEI) – exploration licence process

SkyCity Entertainment Group Limited (ASX:SKC) – cap raise

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.