Closing Bell: ASX bounds into the green as defensive sectors lead gains

The market leapt higher today, gaining almost across the board after a brutal selldown last week. Pic: Getty Images

- ASX powers higher in fresh trading week, up 1.29pc

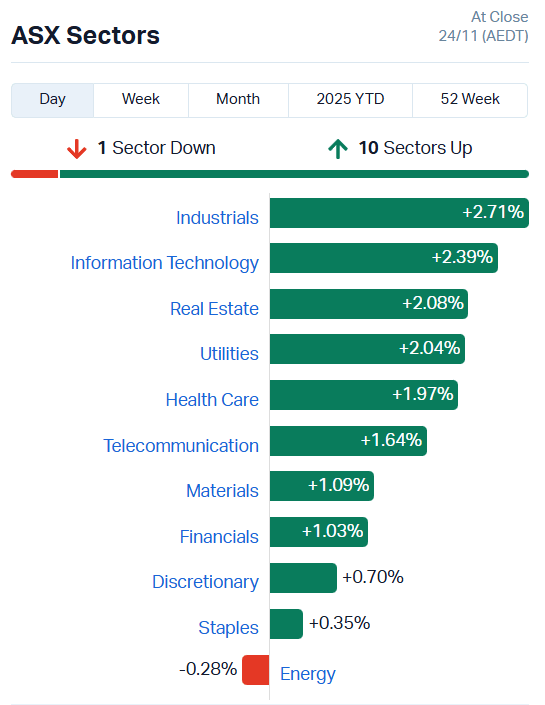

- Defensive sectors lead gains with strong support from gold index

- Energy was the only sector in the red as crude prices fall

Strong start to trading week

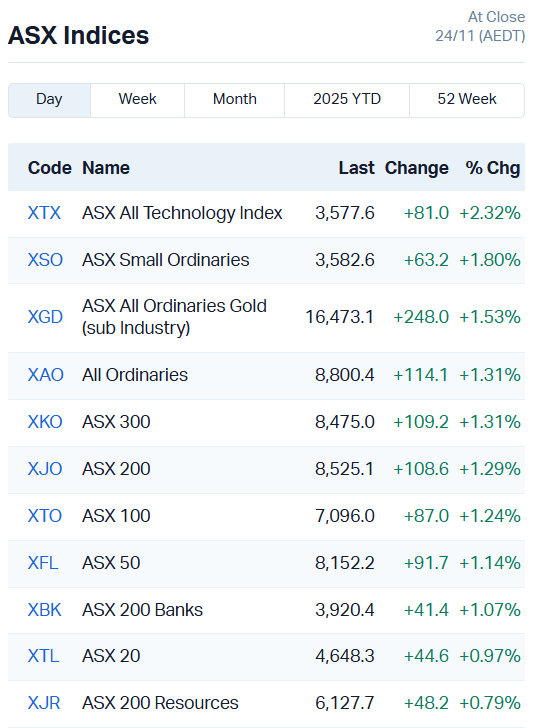

The ASX 200 has had a strong start to the last trading week of November, jumping firmly into the green and adding 1.29% or 108.6 points to 8525.1.

10 of 11 sectors made gains, led mostly by the defensive sectors of industrials, info tech and real estate, with only energy in the red.

Oil prices were the culprit, falling 1.3% to US$62.56 a barrel of Brent over the weekend as Ukraine and Russia continue peace talks.

Gold futures also tipped up 0.5% to US$4079.40 an ounce on Friday, providing the gold index – and resource stocks in turn – some momentum.

Of 200 stocks within the core index, 168 made gains while just 22 fell, offering strong breadth for an overall solid day of progress.

Movers and shakers

Qube (ASX:QUB) shot up 18.92% on fielding a non-binding takeover proposal from Macquarie Asset Management, offering $5.20 in cash per share via a scheme of arrangement.

Management has already flagged it intends to unanimously recommend the proposal.

It’s a solid one, valuing the company at $11.6 billion. The deal offers a 27.8% premium to Qube’s closing share price on Friday.

Continuing the takeover theme, Monash IVF (ASX:MVF) rocketed 44.26% after rejecting a proposal from a consortium led by Genesis and Washington H. Soul Pattinson, offering $0.80 per share in cash.

Executives said the bid undervalued the business and carried too much uncertainty. MVF finished the day at $0.88 a share, perhaps proving them right.

Some of the other big stock movements today came from broker updates.

Accent Group (ASX:AX1) got hammered from all sides, copping a downgrade from Morgans, UBS, JP Morgan, Morgan Stanley and RBC Capital all in one hit.

All five analysts also cut the stock’s price target from $1.50-$1.80 to $0.95-$1.20, compared to today’s per-share price of $0.96. AX1 fell 5.42% by end of trade.

Reece (ASX:REH) was the opposite story.

Macquarie and JP Morgan both upgraded REH to neutral from underperform or underweight, also raising their price targets from $10.10-$10.25 to $11.

REH gained 13.12% to $12.42 a share.

Lovisa (ASX:LOV) crept up just 2.47% after getting caught in the middle of an analyst stoush.

Macquarie upgraded the stock to outperform despite lowering its price target from $40.9 to $37.3, while UBS maintained a neutral rating while also reducing its price target from $42 to $33.

Of a pool of 13 analysts, 23% rate the jewellery chain a buy, 62% a hold and 15% sell, according to MarketWatch. Their average price target is about $36.91, compared to today’s closing price of $30.76.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CHM | Chimeric Therapeutic | 0.004 | 60% | 13253111 | $9,105,341 |

| BMO | Bastion Minerals | 0.0015 | 50% | 9487500 | $2,566,450 |

| SFG | Seafarms Group Ltd | 0.003 | 20% | 1438509 | $9,673,198 |

| C29 | C29Metalslimited | 0.027 | 42% | 773570 | $3,309,576 |

| MVF | Monash IVF Group Ltd | 0.865 | 42% | 30119606 | $237,677,252 |

| IS3 | I Synergy Group Ltd | 0.023 | 35% | 1067596 | $29,506,306 |

| CTN | Catalina Resources | 0.004 | 33% | 300800 | $7,323,057 |

| ALV | Alvomin | 0.059 | 26% | 9042967 | $9,177,446 |

| OEL | Otto Energy Limited | 0.005 | 25% | 2568029 | $19,180,039 |

| AVA | AVA Risk Group Ltd | 0.067 | 24% | 1023769 | $15,701,350 |

| FLG | Flagship Min Ltd | 0.19 | 23% | 736038 | $45,163,879 |

| MRD | Mount Ridley Mines | 0.04 | 21% | 46392169 | $41,230,076 |

| GTK | Gentrack Group Ltd | 7.95 | 20% | 796666 | $712,074,631 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 9865520 | $6,235,795 |

| QUB | Qube Holdings Ltd | 4.835 | 19% | 13674111 | $7,202,320,889 |

| PSL | Paterson Resources | 0.033 | 18% | 335659 | $14,732,283 |

| SFX | Sheffield Res Ltd | 0.084 | 17% | 1275155 | $28,477,966 |

| KRR | King River Resources | 0.014 | 17% | 1368883 | $17,563,044 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 1180185 | $16,824,763 |

| SMM | Somerset Minerals | 0.014 | 17% | 17293568 | $11,503,862 |

| SPX | Spenda Limited | 0.0035 | 17% | 673911 | $14,594,575 |

| FRX | Flexiroam Limited | 0.015 | 15% | 933615 | $19,726,182 |

| SVY | Stavely Minerals Ltd | 0.015 | 15% | 2967115 | $8,902,223 |

| EUR | European Lithium Ltd | 0.1775 | 15% | 8922351 | $266,033,575 |

| TWD | Tamawood Limited | 3.08 | 14% | 22500 | $104,132,975 |

In the news…

Chimeric Therapeutics (ASX:CHM) has added just under $4.5 million to its war chest in the form of an R&D research tax refund from the ATO.

The clinical stage cell therapy company will channel the fresh funding into its first-in-class autologous CAR T cell therapies and best in class allogeneic NK cell therapies.

CHM is developing its pipeline across multiple disease areas in oncology with 4 clinical stage programs in progress.

Gentrack Group (ASX:GTK) fielded strong FY25 results, lifting revenue 8% to $230.2 million, recurring revenue up 13% and EBITDA up 18%. GTK is also debt free, with cash in hand sitting at about $84.8 million.

More importantly, management reckons growth will accelerate in FY26, with a maturing pipeline of opportunities across Europe and Asia.

Somerset Minerals (ASX:SMM) has hit a thick intersection of copper at the Jura North prospect, part of the Coppermine project in Canada.

SMM hit copper in all holes drilled to date, with results topping out at 16.8m at 3.96% copper from 41.15m within 42.7m at 2.69% copper from 15.24m.

The prospect is rapidly developing, shaping up as a 250m by 60m target area stretching down as far as 600m of depth.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.002 | -33% | 300000 | $3,943,840 |

| M2R | Miramar | 0.002 | -33% | 2462499 | $3,584,770 |

| AEU | Atomic Eagle | 0.24 | -31% | 3062675 | $133,369,185 |

| SAN | Sagalio Energy Ltd | 0.011 | -27% | 893 | $3,069,902 |

| CCO | The Calmer Co Int | 0.003 | -25% | 35785 | $12,233,413 |

| QXR | Qx Resources Limited | 0.003 | -25% | 201000 | $7,370,653 |

| AUR | Auris Minerals Ltd | 0.016 | -24% | 848301 | $11,510,517 |

| CXU | Cauldron Energy Ltd | 0.017 | -23% | 10640827 | $39,366,935 |

| VHM | Vhmlimited | 0.365 | -22% | 1487189 | $121,810,569 |

| BCK | Brockman Mining Ltd | 0.014 | -22% | 291461 | $167,044,178 |

| YRL | Yandal Resources | 0.24 | -20% | 734281 | $113,852,680 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 1644076 | $7,920,957 |

| LNU | Linius Tech Limited | 0.002 | -20% | 5743296 | $20,074,651 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20% | 24999 | $3,883,533 |

| MYX | Mayne Pharma Ltd | 3.66 | -18% | 3108669 | $361,543,930 |

| MPP | Metro Perf.Glass Ltd | 0.033 | -18% | 11705 | $39,345,553 |

| GTE | Great Western Exp. | 0.015 | -17% | 1170469 | $10,219,643 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 21348654 | $11,203,252 |

| BIT | Biotron Limited | 0.0025 | -17% | 21071 | $4,578,998 |

| ERA | Energy Resources | 0.0025 | -17% | 195522 | $1,216,188,722 |

| AVLDA | Aust Vanadium Ltd | 0.21 | -16% | 691995 | $86,346,581 |

| RWD | Reward Minerals Ltd | 0.04 | -15% | 371355 | $12,794,320 |

| PHX | Pharmx Technologies | 0.115 | -15% | 147484 | $80,933,417 |

| HAL | Halo Technologies | 0.042 | -14% | 95169 | $14,305,037 |

| HIQ | Hitiq Limited | 0.018 | -14% | 211835 | $10,235,032 |

In Case You Missed It

Cynata Therapeutics (ASX:CYP) has confirmed the final patient visit has been completed in its phase III SCUlpTOR trial evaluating therapeutic candidate CYP-004 in knee osteoarthritis.

Redcastle Resources (ASX:RC1) has passed another milestone on the path to gold production, submitting mine development and closure plans for the Redcastle project.

Maiden diamond drilling at Mammoth Minerals’ (ASX:M79) Excelsior project in Nevada has intersected shallow, high-grade gold.

Locksley Resources (ASX:LKY) has appointed experienced Lockheed Martin executive Stacy Newstead as strategic advisor.

Drilling by Osmond Resources (ASX:OSM) has confirmed the potential for globally significant titanium, zircon and rare earths at its Orión project in Spain.

Island Pharmaceuticals (ASX:ILA) has been accepted into the Medical Countermeasures Coalition, focused on protecting populations from pandemics, emerging diseases and biological threats.

Trek Metals (ASX:TKM) completes a $1 million placement to fast-track exploration at its manganese discovery at Christmas Creek in WA.

Pinnacle Minerals (ASX:PIM) has begun trading on the OTCQB market in the US under the ticker PIMLF, opening the door to potential US federal funding.

Pivotal Metals’ (ASX:PVT) exploration along the Belleterre-Angliers belt in Canada has revealed a new copper-gold target 6.6km southeast of the Lorraine mine.

Alchemy Resources’ (ASX:ALY) 15-hole RC drilling program is testing down dip and along strike from high grade iron hits.

West Coast Silver (ASX:WCE) is running a near-mine aircore program targeting potential silver extensions at surface around the historical Elizabeth Hill mine.

Aura Energy (ASX:AEE) grows its Häggån uranium project in Sweden through securing new adjacent exploration tenements.

Power Minerals (ASX:PNN) has delivered more strong niobium and rare earth results from shallow auger drilling at Santa Anna in Brazil, reinforcing consistent mineralisation.

Last Orders

Andromeda Metals (ASX:ADN) has fulfilled its obligations to the Department of Energy and Mining, paying a $670,000 bond to the Native Vegetation Fund to allow site works to resume at the Great White project.

ADN will begin with construction of the mine access road and bulk earthworks for the Stage 1A+ processing plant. The company will then move on to grade control and geotechnical drilling.

Trading halts

Axel REE Limited (ASX:AXL) – metallurgical results at Caladão project

Great Divide Mining Limited (ASX:GDM) – proposed acquisition

InhaleRx Limited (ASX:IRX) – capital raising and new drug asset

Patrys Limited (ASX:PAB) – proposed acquisition

Santa Fe Minerals Limited (ASX:SFM) – capital raising and gold-project acquisition

Sarytogan Graphite Limited (ASX:SGA) – capital raising

Iress Limited (ASX:IRE) – reporting obligations

At Stockhead, we tell it like it is. While Andromeda Metals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.