Closing Bell: ASX adds 0.15pc as uranium stocks burn white hot

Whispers the US nuclear industry is about to benefit from a sweeping executive order has lifted ASX uranium stocks sharply. Pic: Getty Images.

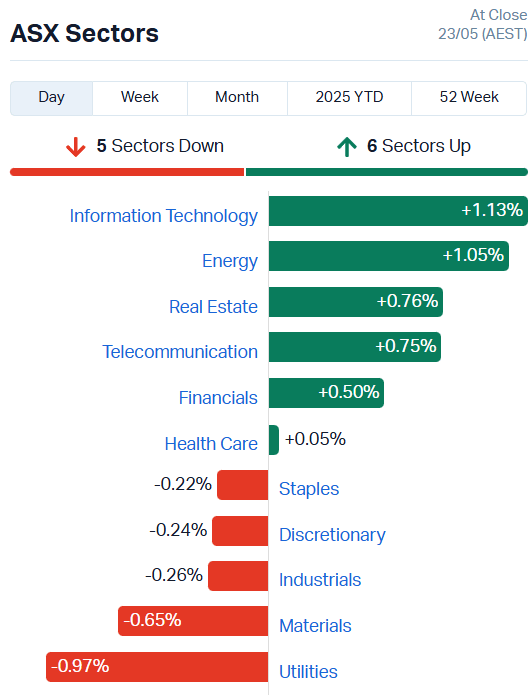

- Info Tech, Energy sectors leads ASX higher

- Trump rumoured to sign nuclear executive order tonight

- Uranium stocks surge higher

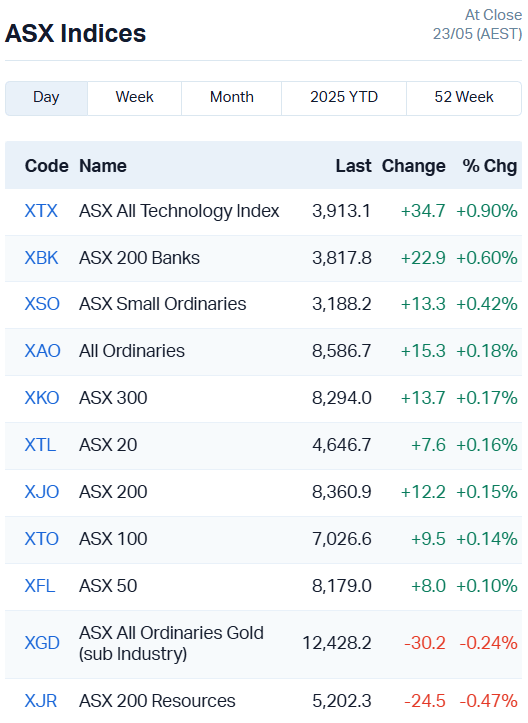

The ASX posted a 0.15% gain in trade today, resisting uncertainty from a mixed session on Wall Street.

The Info Tech and Energy sectors were the MVPs, up more than 1% each.

Silex Systems (ASX:SLX) added 16.44%, Novonix (ASX:NVX) gained 10.23% and Fineos (ASX:FCL) lifted 5.51%.

Otherwise, the big movements were pretty much all in uranium stocks:

- Boss Energy (ASX:BOE) +12.82%

- Lotus Resources (ASX:LOT) +11.77%

- Bannerman Energy (ASX:BMN) +11.66%

- Deep Yellow (ASX:DYL) +9.13%

- Paladin Energy (ASX:PDN) +7.02%

Those gains boosted the ASX Small Ordinaries index, which added 0.42% alongside strength in ASX200 Bank and All Technology indices.

So, why is uranium so hot right now?

Is Trump about to kick-start the nuclear industry?

Reuters has reported US President Trump will sign an executive order to boost the nuclear energy industry in the US as early as this evening, according to four unnamed sources said to be familiar with the matter.

A draft of the orders apparently details several measures the administration will take, including:

- Directing agencies to permit new nuclear facilities

- Streamlining development processes

- Encouraging increased loan guarantees and direct loans to increase the rate of reactor construction

While this information comes from only a draft of potential orders, if Trump does sign them as expected, it could kick-start the US uranium industry.

Australia has one of the largest uranium resources in the world. After Russia and China, we’re also one of the largest producers of uranium ore globally.

Given the US is very keen to divest away from those two spheres of influence at present, the Australian uranium market is a very attractive – and strategically viable – option.

Even without Trump’s intervention, the uranium market has been moving back into bullish territory based on market fundamentals, with demand beginning to outstrip supply.

Spot uranium prices hit a 17-year-high in January at US$107/pound before dramatically pulling back to US$63.45/pound by mid-March.

Since then, the commodity has soared 20% to US$71.25 per pound, with term contract pricing remaining steady at US$80/pound.

Unlike most commodities, uranium generally isn’t traded on the open market. Most demand comes from utilities who buy directly from producers in long-term contracts.

Those utilities are currently buying uranium in the spot market, an indication they’re testing the waters before locking in new long-term contracts.

Regardless of whether the bullish sentiment will last, ASX uranium stocks are already benefiting.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RPG | Raptis Group Limited | 0.025 | 79% | 438470 | $2,454,864 |

| BMO | Bastion Minerals | 0.0015 | 50% | 1795015 | $903,628 |

| IS3 | I Synergy Group Ltd | 0.003 | 50% | 275833 | $1,001,460 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 1042927 | $1,733,666 |

| MRD | Mount Ridley Mines | 0.003 | 50% | 35000 | $1,556,978 |

| LKY | Locksleyresources | 0.049 | 48% | 21190464 | $4,840,000 |

| CCE | Carnegie Cln Energy | 0.059 | 37% | 1011600 | $15,746,749 |

| JNS | Januselectricholding | 0.295 | 34% | 1771128 | $19,630,557 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 261227 | $9,000,000 |

| M2R | Miramar | 0.004 | 33% | 9531101 | $2,990,470 |

| CXU | Cauldron Energy Ltd | 0.009 | 29% | 40399653 | $10,229,832 |

| REC | Rechargemetals | 0.019 | 27% | 2051248 | $3,854,850 |

| G50 | G50Corp Ltd | 0.125 | 25% | 594487 | $16,059,766 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 272810 | $5,533,072 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 8000100 | $11,082,268 |

| ECT | Env Clean Tech Ltd. | 0.0025 | 25% | 21587 | $7,293,621 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 600000 | $7,943,347 |

| OM1 | Omnia Metals Group | 0.011 | 22% | 4894861 | $1,953,825 |

| CML | Connected Minerals | 0.195 | 22% | 346077 | $6,617,314 |

| CMO | Cosmometalslimited | 0.018 | 20% | 385865 | $4,832,034 |

| BCA | Black Canyon Limited | 0.06 | 20% | 188152 | $6,482,535 |

| AHN | Athena Resources | 0.006 | 20% | 16406354 | $11,329,785 |

| CCO | The Calmer Co Int | 0.003 | 20% | 3686955 | $7,528,289 |

| FBR | FBR Ltd | 0.006 | 20% | 4962507 | $28,447,261 |

| PIL | Peppermint Inv Ltd | 0.003 | 20% | 838 | $5,594,098 |

Making news…

Locksley Resources (ASX:LKY) is sending its exploration team to the Mojave Project in California this June, ahead of expected drill permit approvals.

It’s prepping for a September quarter drill campaign targeting rare earths and antimony, with up to 12.1% TREO and 46% Sb reported at key sites. The project sits near MP Materials’ Mountain Pass Mine and includes the historically high-grade Desert Antimony Mine.

Janus Electric Holdings (ASX:JNS) is also climbing, after listing to the ASX two days ago at a share price of $0.20. JNS has since climbed as high as $0.29 intraday, a strong indication of investor interest in the newly listed heavy vehicle conversion and swappable battery company.

Cauldron Energy (ASX:CXU) is riding a bullish uranium wave higher today. Yesterday, the company identified an extensive palaeochannel system at Manyingee South, recently acquired from Wyloo Metals.

The company reckons the new tenements are within a fertile uranium province, with favourable geology for uranium mineralisation.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FTC | Fintech Chain Ltd | 0.002 | -67% | 3987832 | $3,904,618 |

| ALR | Altairminerals | 0.002 | -33% | 2116764 | $12,890,233 |

| PRM | Prominence Energy | 0.002 | -33% | 362264 | $1,167,529 |

| VML | Vital Metals Limited | 0.002 | -33% | 60320883 | $17,685,201 |

| GMN | Gold Mountain Ltd | 0.0015 | -25% | 313580 | $10,267,776 |

| OVT | Ovanti Limited | 0.003 | -25% | 94727528 | $11,174,060 |

| FGH | Foresta Group | 0.007 | -22% | 465911 | $23,876,158 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 7564125 | $9,253,431 |

| ERA | Energy Resources | 0.002 | -20% | 5216771 | $1,013,490,602 |

| PKO | Peako Limited | 0.002 | -20% | 306870 | $3,719,355 |

| ENX | Enegex Limited | 0.013 | -19% | 10000 | $6,094,753 |

| REZ | Resourc & En Grp Ltd | 0.013 | -19% | 603338 | $10,746,226 |

| CRN | Coronado Global Res | 0.11 | -19% | 30458267 | $226,321,254 |

| APC | APC Minerals | 0.009 | -18% | 17205 | $3,222,267 |

| JGH | Jade Gas Holdings | 0.028 | -18% | 960000 | $57,352,362 |

| EXL | Elixinol Wellness | 0.015 | -17% | 738101 | $3,974,762 |

| ANR | Anatara Ls Ltd | 0.005 | -17% | 542291 | $1,280,302 |

| BUY | Bounty Oil & Gas NL | 0.0025 | -17% | 502755 | $4,684,416 |

| TRI | Trivarx Ltd | 0.01 | -17% | 5587540 | $7,408,730 |

| FNR | Far Northern Res | 0.13 | -16% | 132591 | $6,241,203 |

| HYT | Hyterra Ltd | 0.028 | -15% | 2612279 | $53,920,643 |

| TAS | Tasman Resources Ltd | 0.017 | -15% | 43039 | $3,682,852 |

| RAU | Resouro Strategic | 0.17 | -15% | 25780 | $8,357,564 |

| CRR | Critical Resources | 0.003 | -14% | 163000 | $9,149,774 |

| DTM | Dart Mining NL | 0.003 | -14% | 100000 | $4,193,195 |

Fintech Chain (ASX:FTC) has applied to delist from the ASX, due to a consistently low share price, low liquidity, and negative market sentiment.

Vital Metals (ASX:VML) has consolidated its shares, reducing its quoted securities from 5 trillion to 117 million.

The company’s shares have been consolidated on a 50 to one basis, with both options and performance rights following the same ratio.

IN CASE YOU MISSED IT

West Coast Silver (ASX:WCE) is gearing up for a diamond drilling program at the Elizabeth Hill project in WA. The company is targeting down-plunge extensions to silver mineralisation, focusing on high-grade zones.

Assays for two diamond holes have dramatically increased the scope of the rare earths, niobium and molybdenum discovery at Aldoro Resources’ (ASX:ARN) drilling program at the Kameelburg rare earths and niobium discovery in Namibia.

EBR Systems (ASX:EBR) has raised $55.9 million, alongside a $6 million share purchase plan, to progress commercialisation of its WISE CRT system.

Trading Halts

American West Metals (ASX:AW1) cap raise

Barton Gold (ASX:BGD) – cap raise

Hastings Technology Metals (ASX:HAS) – material acquisition

M3 Mining (ASX:M3M) – acquisition and a cap raise

QEM (ASX:QEM) – cap raise

Tambourah Metals (ASX:TMB) – cap raise

Western Mines Group (ASX:WMG) – cap raise

At Stockhead, we tell it like it is. While West Coast Silver, Aldoro Resources and EBR Systems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.