Closing Bell: Another year, another near record high as ASX200 rises to within a whisper of its best

It's not cancer, you idiot... it's that piece of chocolate you lost on Boxing Day. Pic via Getty Images.

- ASX200 up +0.5pc to get the year off to a semi-decent start

- Sectors led by +1.5pc Energy gains, after a surge in oil and uranium prices

- Small Cap Winners include Perpetual Resources, and MTM Critical Minerals

2024’s been just a total cakewalk for the Aussie benchmark index.

The ASX200 made it to lunchtime straddling a 22-month high of almost 7633 points, laughing off Friday’s end-year fall on Wall Street.

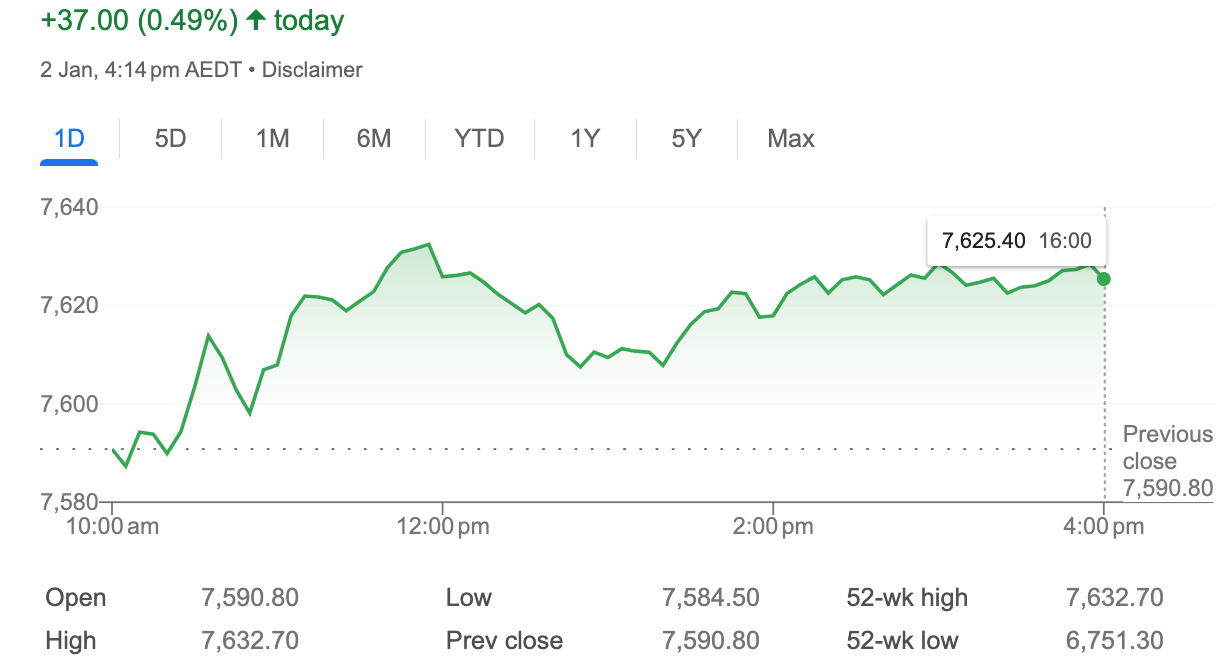

At 4.15pm on Tuesday, 2 January the ASX200 was 37 points or 0.49% higher at 7627.8:

Just before burger-time in Sydney, the index hit 7,632.7 points, putting it within a single percentage point of its best-ever intraday high of 7,632.8 points (struck back on August 13, 2021).

In 2023, the benchmark index advanced circa +8% to help staunch the emotional bleeding of 2022 and end 2023 at such near-record highs.

Those gains came as a rebound in commodity prices lifted our resource-heavy bourse, while traders have shown their hands on how to best play easing inflation and interest rate cut expectations.

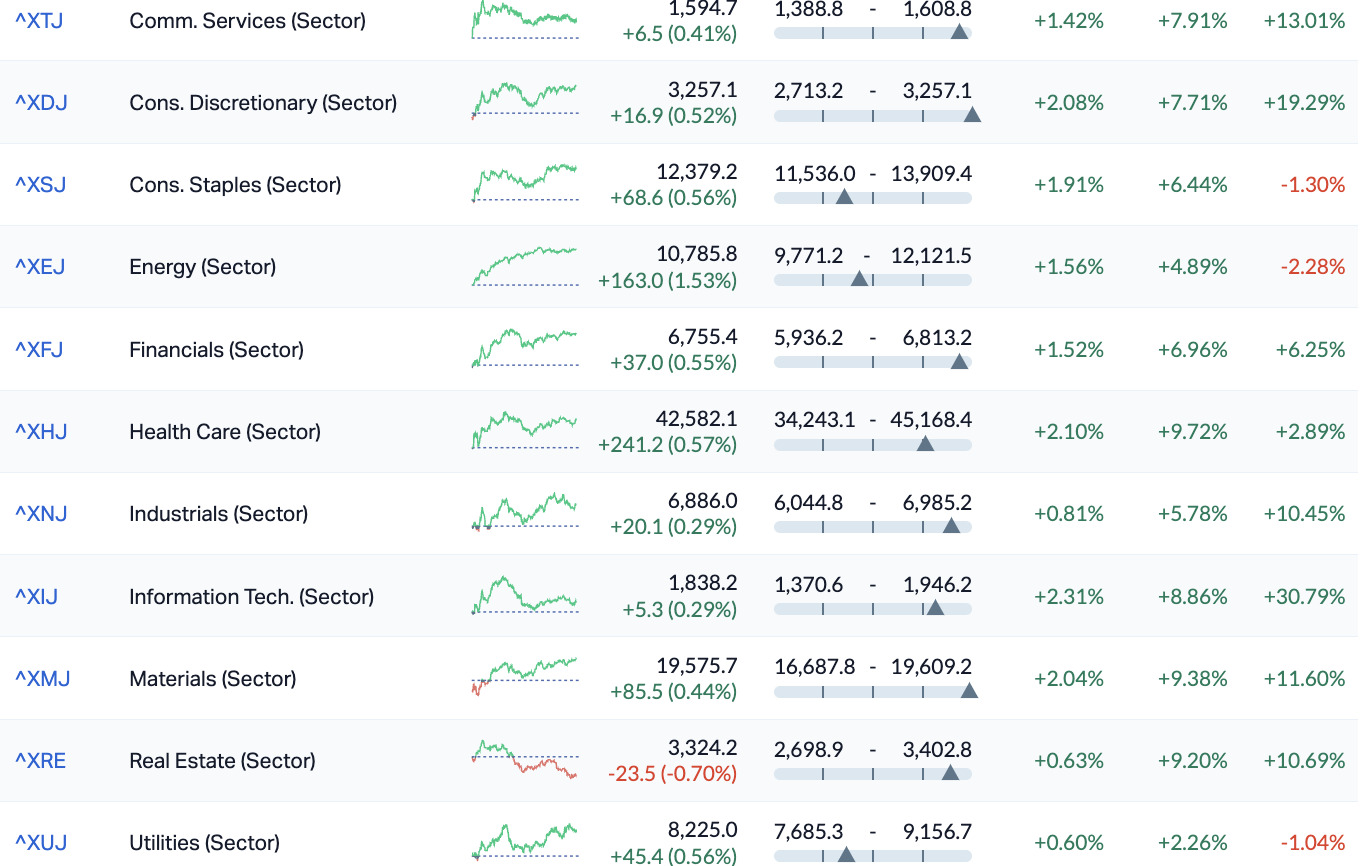

All sectors rose, but it was gains in the energy sector which roused already excited traders.

Tracking the long weekend’s higher crude prices – jumping on the idea of Iran sending a (single) warship into the soon-to-be-a-shooting-gallery we used to call the Red Sea… in response local majors like Ampol (ASX:ALD), Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) all enjoyed strong support on Day 1.

Not faraway, The Big Diggers have had a rousing welcome from Singapore to start 2024. The city-state’s iron ore futures index has surged over +1.7% during the local session.

Fortescue (ASX:FMG) hit a new record at $29.48 a share intraday, while Rio Tinto (ASX:RIO) and BHP (ASX:BHP) also made gains.

Elsewhere, the big banks and stocks across Tech, Healthcare, Utilities and Comms all had little trouble finding buyers.

ASX SECTORS at 3.45pm on TUESDAY

Looking further afield, a little action out of China has helped sharpen the cheque writing quills on Tuesday.

The official talk over the weekend from the Grand Chatterer himself, paramount leader of China, (2012- 4EVA) President Xi Jinping was all about inferring that there’d be big money on hand in ’24 to help reawaken the nation’s dormant economic dragon.

Eagle-eared traders probably noted that the third-term President, ongoing General Secretary of the Chinese Communist Party and Chairman of the Central Military Commission, told local telly in a speech to mark the non-Chinese new year, that China will “consolidate and enhance the positive trend of economic recovery, and achieve stable and long-term economic development.”

He says that all the time. What was exciting was Xi’s astonishing version of a devastating CCP Mea Culpa.

It sure was a trying year, he said.

“Some (Chinese) enterprises had a tough time. Some people had difficulty finding jobs and meeting basic needs.”

Xi never talks shop in his annual New Year’s message. It’s usually 15 hours of drummed up achievements contrasted with Western backsliding.

Hunting for fresh leads local investors took the bait, calculating that if Xi’s talking down the economy, then it stands to reason he’ll do something about it more significant than 2023’s rearranging of the Titanic’s deck furniture.

This morning, Caixin’s General Manufacturing PMI for December lifted to an unexpected 4-month high, beating market forecasts of by a decent range. Both output and new orders grew at faster paces, as Beijing continues to tweak and fiddle its largely ineffective fiscal and monetary levers to unearth an actually sustainable recovery. Meanwhile, deflation remains a closet-dwelling skeleton – Caixin reporting that very little good in the country’s cost pressures.

Still, the Hang Seng Index was down a spectacular -1.5% at lunchtime in Honkers, pressured by the growing whispers and the sticky uncertainty around China’s property sector and ongoing headwinds at home and abroad.

On Friday last, Hong Kong’s stockmarket finished nearly unchanged for the day leaving it short about -14% for an abysmal year.

The CSI300 edged up 0.5% on Friday but was found out by almost -11.5% in 2023.

And dropped quietly over the holiday long weekend – China’s official NBS PMI data showing mainland manufacturing – and its service sectors remain well in contraction.

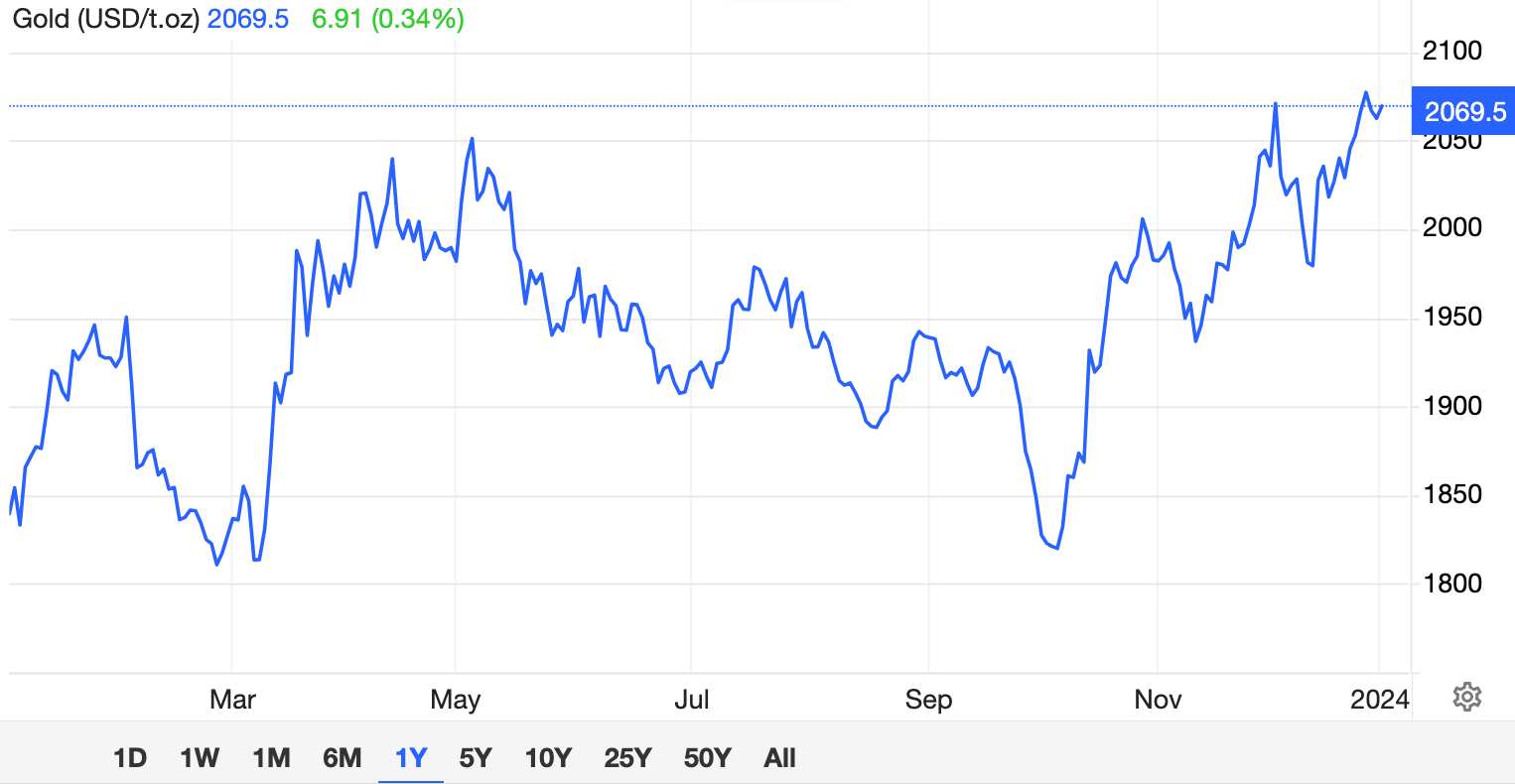

We’re watching gold

Which is sitting uber-comfy at around US$2,070 on the first trading day of the new year, after a 2-day slide despite the exultant expectations the US Federal Reserve will start trimming interest rates around March.

Wall Street’s positioning for disco

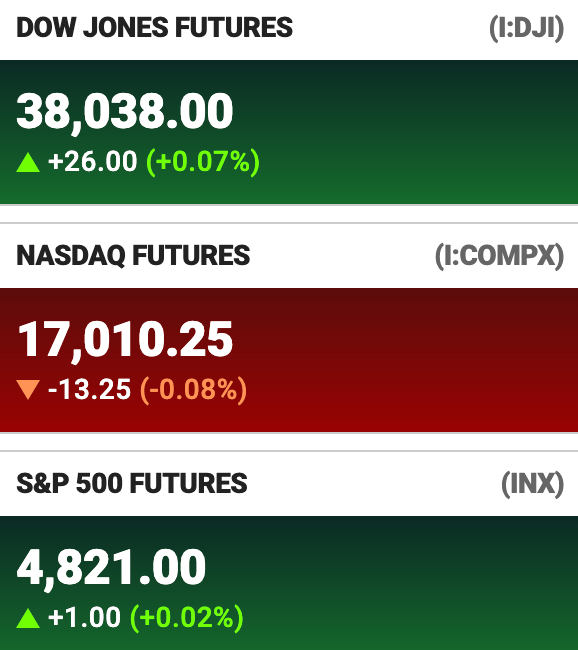

All 3 US majors rose for 9 straight weeks to end 2023.

Over at the S&P500 this was its longest winning streak since 2004.

For the year, the Dow and S&P 500 rallied +13.7% and +24.4%, respectively, as inflation decelerated, the US economy remained robust and the Fed looked fallible.

According to Reuters, US markets are already pricing in a circa 90% chance that the Fed will be unwinding in a few short months, with analysts suggesting that the dominant question is how aggressive the Fed will have to ease. Traders now look ahead to key US data this week including jobs openings and nonfarm payrolls, as well as minutes of the Fed’s December meeting.

Meanwhile, punters are less certain that the European Central Bank (ECB) and the Bank of England (BoE) will snip the cost of borrowing cash as quickly. Both central banks have less cause for optimism and more RBA-like preference for the ol’ higher-for-longer position on interest rates.

Elsewhere, the Bank of Japan (BoJ) remains under pressure to abandon its negative rate policy, while the People’s Bank of China (PBoC) is expected to ease policy further to support growth and maybe do the deflation dance as required.

US Futures (4pm in Sydney) look fairly undecided for the first trading day of the year:

SMALL CAP LEADERS

Today’s best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BPP | Babylon Pump & Power | 0.006 | 50% | 27,787,803 | $9,986,590 |

| PEC | Perpetual Res Ltd | 0.014 | 40% | 3,720,740 | $6,300,294 |

| MTM | MTM Critical Metals | 0.092 | 35% | 19,839,754 | $6,761,722 |

| NVQ | Noviqtech Limited | 0.004 | 33% | 2,783,216 | $3,928,336 |

| AMM | Armada Metals | 0.037 | 32% | 239,230 | $5,824,000 |

| CPO | Culpeominerals | 0.044 | 26% | 5,384,229 | $4,079,683 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 740,741 | $7,334,027 |

| PAM | Pan Asia Metals | 0.155 | 24% | 761,053 | $20,877,679 |

| CDR | Codrus Minerals Ltd | 0.07 | 23% | 4,157,750 | $4,998,188 |

| BFC | Beston Global Ltd | 0.011 | 22% | 6,066,217 | $17,973,422 |

| LLI | Loyal Lithium Ltd | 0.375 | 21% | 1,071,106 | $25,240,547 |

| EYE | Nova EYE Medical Ltd | 0.29 | 21% | 5,822,227 | $45,750,934 |

| AL8 | Alderan Resource Ltd | 0.006 | 20% | 1,002,882 | $5,534,307 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 3,298,685 | $8,796,859 |

| PKO | Peako Limited | 0.006 | 20% | 133,334 | $2,635,424 |

| RDS | Redstone Resources | 0.006 | 20% | 714,285 | $4,606,892 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 165,007 | $2,947,430 |

| VAR | Variscan Mines Ltd | 0.012 | 20% | 390,318 | $3,644,448 |

| DXB | Dimerix Ltd | 0.245 | 20% | 6,292,959 | $87,346,959 |

| NWM | Norwest Minerals | 0.032 | 19% | 533,126 | $7,764,377 |

| CR9 | Corellares | 0.026 | 18% | 677,395 | $10,231,999 |

| SGC | Sacgasco Ltd | 0.013 | 18% | 348,567 | $8,547,609 |

| DYM | Dynamicmetalslimited | 0.165 | 18% | 25,000 | $4,900,000 |

| CBL | Control Bionics | 0.054 | 17% | 53,362 | $6,664,095 |

| MVP | Medical Developments | 0.89 | 17% | 253,700 | $65,591,966 |

he first day back for the ASX in 2024 started with a confused bang for MTM Critical Metals (ASX:MTM), when surged more than 35% on no news early in the day, before a trading halt was requested at 11:23am “pending [the company] releasing an announcement”.

At the time of writing, that announcement hasn’t landed yet. We’ll have something on it once it does.

Culpeo Minerals (ASX:CPO) was also enjoying a rapid rise in fortune, ostensibly off the back of last December’s announcement of significant widths of visible copper mineralisation intersected at very shallow depth at the El Quillay Prospect, Fortuna Project in Chile.

Meanwhile, Pan Asia Metals (ASX:PAM) jumped around 20% early in the day on news that the company has signed on the dotted line to convert existing MOUs into binding Option Agreements to purchase 100% of the ~1,200km2 Tama Atacama Lithium Brine Project, one of the largest lithium brine projects in South America.

PAM says that Tama Atacama is a Tier 1 asset in a Tier 1 jurisdiction “in the truest sense of the term ‘Tier 1’”, citing “extensive lithium surface anomalies with elevated lithium results up to 2,200ppm Li and averaging 700ppm Li (270ppm Li cutoff) extending over 160km north to south”.

The landscape changed a little over the course of the afternoon, with minnow Perpetual Resources jumping 40% just after lunch, despite no news since it announced rock-chip and grab samples showing “encouraging presence of pathfinder elements, suggesting potential for LCT-type pegmatites within Perpetual’s Brazil exploration permits” a couple of weeks before Christmas.

Nova Eye Medical (ASX:EYE) has picked up where it left off at the tail end of last year, adding nicely to its tally on the back of news that proposed changes to the US Medicare system that would have negatively impacted the company are no longer going to be pushed into effect.

The company had been staring down the barrel of five major Medicare Administrative Contractors altering what’s known as Local Coverage Determinations to restrict or deny coverage for several procedures, including canaloplasty for minimally invasive glaucoma surgery at the end of January, 2024 – however, those proposals have now been completely withdrawn.

SMALL CAP LAGGARDS

Today’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAL | Jameson Resources | 0.031 | -31% | 175,000 | $19,607,999 |

| PKD | Parkd Ltd | 0.02 | -26% | 35,401 | $2,808,375 |

| LSR | Lodestar Minerals | 0.003 | -25% | 1,456,296 | $8,093,589 |

| ME1 | Melodiol Glb Health | 0.0015 | -25% | 1,327,728 | $9,457,648 |

| ICE | Icetana Limited | 0.0265 | -22% | 54,001 | $8,997,367 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 4,393,004 | $123,204,013 |

| NOV | Novatti Group Ltd | 0.067 | -19% | 843,184 | $28,108,493 |

| BCT | Bluechiip Limited | 0.013 | -19% | 3,422,706 | $12,725,981 |

| ST1 | Spirit Technology | 0.066 | -18% | 1,699,357 | $58,955,043 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 163,526 | $7,931,183 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | 520 | $4,276,016 |

| CLU | Cluey Ltd | 0.071 | -16% | 800 | $17,137,153 |

| EQS | Equitystorygroupltd | 0.031 | -16% | 105,000 | $1,576,747 |

| AVE | Avecho Biotech Ltd | 0.003 | -14% | 8,782 | $11,092,540 |

| IEC | Intra Energy Corp | 0.003 | -14% | 35,000 | $5,812,736 |

| L1M | Lightning Minerals | 0.12 | -14% | 86,100 | $5,911,509 |

| OAU | Ora Gold Limited | 0.006 | -14% | 181,224 | $39,826,416 |

| RIL | Redivium Limited | 0.006 | -14% | 851,937 | $19,115,984 |

| HIQ | Hitiq Limited | 0.019 | -14% | 6,200 | $7,182,069 |

| MTC | Metalstech Ltd | 0.19 | -14% | 108,958 | $41,570,010 |

| OEC | Orbital Corp Limited | 0.091 | -13% | 118,266 | $15,309,707 |

| FCT | Firstwave Cloud Tech | 0.035 | -13% | 173,456 | $68,383,225 |

| HMI | Hiremii | 0.036 | -12% | 1,919,286 | $4,940,235 |

| PHX | Pharmx Technologies | 0.036 | -12% | 82,236 | $24,538,778 |

| A8G | Australasian Metals | 0.15 | -12% | 41,718 | $8,860,484 |

Trading Halts

Infinity Mining (ASX:IMI) – Requested pending amendment to announcement dated 29 December 2023

MTM Critical Metals (ASX:MTM) – Requested pending an announcement regarding assay results from previous

drilling at its Pomme REE project in Quebec and provision of a response to ASX in relation to a pricing query

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.