Closing Bell: A very hot ASX banks on big banks after big central banks start cutting

Pic via Getty Images

- Aussie shares rally

- Rate sensitive stocks gain, led by Tech

- FTL soars on Newfoundland deal

Aussie shares climbed strongly on Thursday closing above 7,820 as major global central banks began to cut interest rates and in the US, the S&P500 and Nasdaq indices clocked rich new record highs.

Just before 4pm the ASX200 (XJO) index was 0.7% higher.

Tech stocks and industrials led a broad based rally, though everyone else wasn’t too far behind.

All 11 sectors were higher late in the session.

ASX Sectors on Thursday at 3.30pm

Local stocks were boosted by the strength of the US tech sector, amid increasing confidence that the US Fed would join Canada in culling high interest rates as Wall Street digested the latest favourable indicators, in the shape of a shoddy US labor data read.

Local goldies lifted on positive gold sentiment – both majors Northern Star Resources (ASX:NST) and Evolution Mining (ASX:EVN) were ahead by circa 2.5%.

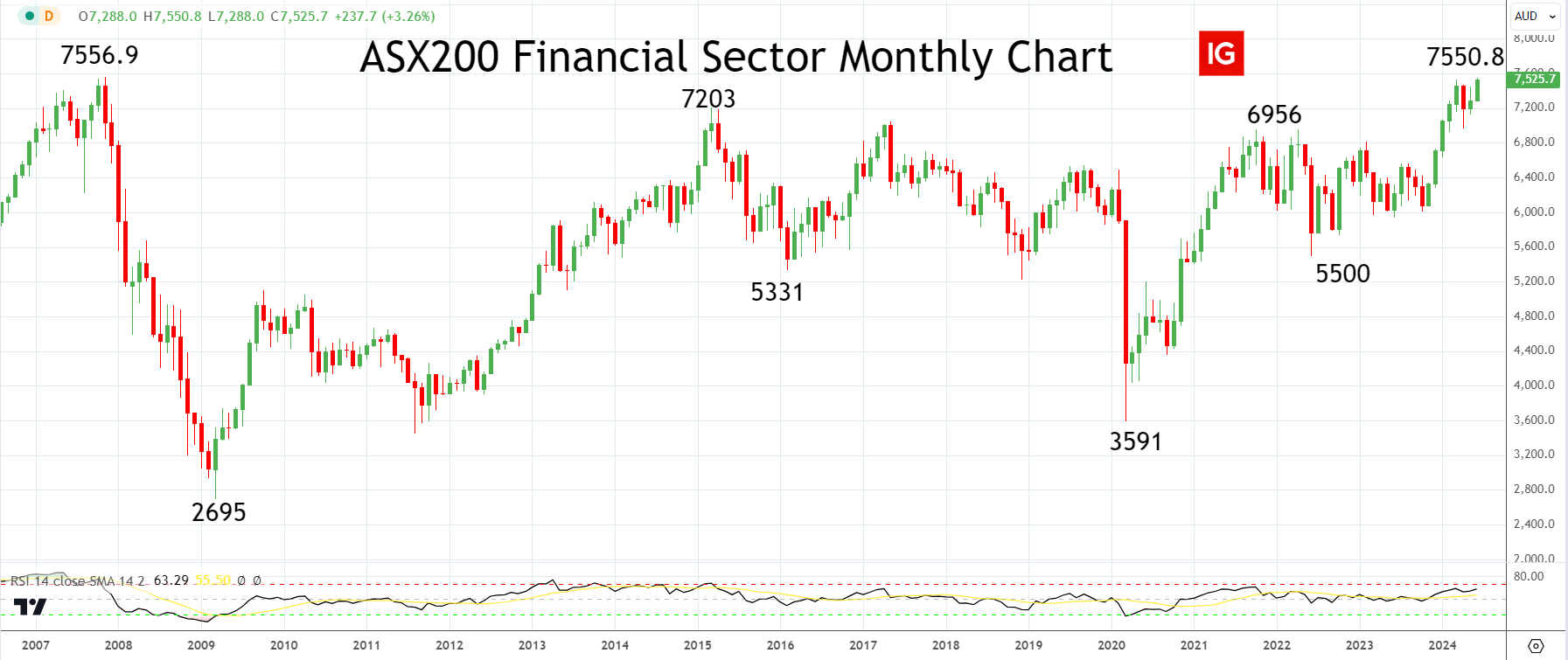

The major banks lifted the Financial Sector by an easy 1%, IG Markets’ analyst Tony Sycamore points out the sector’s already surged over 3% this week high-fiving its November 2007 high watermark, (before losing some 64% during the Global Financial Crisis).

Big bank daddy CBA has added more than 2% to a fresh record high.

“The ASX200 Financial sector is up more than 12% in 2024, confounding the analyst community, which overwhelmingly have “sell” or “underweight” calls on the big banks,” Tony says.

Big 4 banks YTD:

Westpac (ASX:WBC) +17.3%

National Australia Bank (ASX:NAB) +13.35%

Australia and New Zealand Banking Group (ASX:ANZ) +11.96%

Commonwealth Bank (ASX:CBA) +11.78%

Stealing a lot of thunder on Thursday, Firetail Resources (ASX:FTL) is up 130%+ after revealing a corker of a deal to acquire 80% of the York Harbour copper, zinc and silver project in Newfoundland.

In conjunction with the acquisition, the company is planning to raise $1.57 million.

Stockhead’s attractive and intelligent Fraser Palamara breaks it all down:

Finally, on the shite side of Thursday:

SkyCity Entertainment Group (ASX:SKC) stocks have been gutted after the casino operator cut guidance and declared there would be no divvy to declare this year.

Shares in SKC fell away by almost 15%.

Some positive late news though – the High Court will allow it to appeal the Supreme Court decision stating “SkyCity Adelaide misinterpreted the amount of tax owed from earnings on customer loyalty points.

SKC told the ASX that if it loses its appeal, it could have to pay up to $22.8mn.

Mercury NZ (ASX:MCY) was the best-performing ASX200 stock, up 6.4%.

While both Coronado Global Resources (ASX:CRN) and Genesis Minerals (ASX:GMD) added more than 5%.

Top 10 XJO stocks on Thursday

NOT THE ASX

This morning nice and early the Bank of Canada cut its policy rate by 25bps to 4.75%, making it the G7 member to start what might well be an all-round cycle of easing cycle.

Canadian inflation continued to ease in April and within the Bank of Canada’s (BoC) 1-3% control range with BoC governor Macklem adding that it’s “reasonable to expect further cuts”.

CBA’s international economics team says there’ll be two further interest rate cuts from the BoC this year.

Tonight will see the European Central Bank hold its fourth rate-setting meet for 2024. It’s a big call.

CBA’s economics crew expect the ECB to also cut its key policy rates by 25bps tonight.”

Meanwhile, Wall Street rallied to new records once again on the back of tech stocks.

The S&P 500 rose by +1.18%, its 25th record high this year. The blue chips Dow Jones index was up by +0.25%, and the tech-heavy Nasdaq surged by +1.96%.

Nvidia added 5% becoming the second most valuable company in the world with its market cap surpassing Apple’s US$3 trillion.

Next door ASML Holding added 8% to become Europe’s second-biggest listed company, overtaking LVMH, with a market cap of EUR380 billion.

Not to be beaten by either is Microsoft, whose US$3.15 trillion, is enough to remain the world’s most valuable company after its shares climbed 2% overnight.

Discount retailer Dollar Tree fell after 5% after announcing that it was deciding what to do with its struggling Family Dollar division.

Closer to home, India’s BSE Sensex was up 1% at around 3pm in Sydney, extending gains from the previous session, tracking Wall Street.

The Nifty 50 climbed above 22.800 as traders came to terms that the Narendra Modi-led alliance would share power to form the next Indian government.

Shares around the region tracked US gains. The Shanghai Composite rose 0.3% and in Shenzhen the tech heavy component index added slightly less.

The Hang Seng at lunchtime in Hong Kong was up 1%, tracking US tech and chip stocks.

Tencent Hlds. jumped almost 1% while Meituan added 0.3%. Semicon Manufacturing surged over 5%, while Techtronic Industries found 4%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FTL | Firetail Resources | 0.11 | 139% | 24,832,182 | $6,849,656 |

| MRD | Mount Ridley Mines | 0.0015 | 50% | 4,340,493 | $7,784,883 |

| BEO | Beonic Ltd | 0.03 | 36% | 265,990 | $9,338,889 |

| OSX | Osteopore Limited | 0.073 | 35% | 33,393,814 | $6,134,562 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 1,588,243 | $1,172,474 |

| GCM | Green Critical Min | 0.004 | 33% | 608,675 | $3,409,755 |

| VPR | Volt Power Group | 0.002 | 33% | 2,460,155 | $16,074,312 |

| MPP | Metro Perf.Glass Ltd | 0.083 | 26% | 94,812 | $12,234,954 |

| ADD | Adavale Resource Ltd | 0.005 | 25% | 976,000 | $4,161,061 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 2,335,116 | $20,980,461 |

| BLZ | Blaze Minerals Ltd | 0.005 | 25% | 1,039,761 | $2,514,233 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,380,527 | $7,356,542 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 812,000 | $7,037,487 |

| LRL | Labyrinth Resources | 0.005 | 25% | 308,000 | $4,750,175 |

| PUR | Pursuit Minerals | 0.005 | 25% | 2,020,313 | $11,775,886 |

| GED | Golden Deeps | 0.049 | 23% | 450,000 | $4,620,894 |

| IDT | IDT Australia Ltd | 0.125 | 22% | 1,681,253 | $35,945,805 |

| SMN | Structural Monitor. | 0.415 | 22% | 491,153 | $46,513,770 |

| NC6 | Nanollose Limited | 0.023 | 21% | 901,466 | $3,268,121 |

| CMP | Compumedics Limited | 0.295 | 20% | 97,604 | $43,404,922 |

| 1MC | Morella Corporation | 0.003 | 20% | 2,057,169 | $15,446,999 |

| AHN | Athena Resources | 0.003 | 20% | 167,600 | $2,676,169 |

| AOA | Ausmon Resorces | 0.003 | 20% | 8,374,285 | $2,647,498 |

| BKG | Booktopia Group | 0.048 | 20% | 41,239 | $9,128,204 |

| NRZ | Neurizer Ltd | 0.006 | 20% | 20,775,310 | $9,512,153 |

Back in the headlines on Thursday with a near 140% explosion in share price is Firetail Resources (ASX:FTL).

FTL announced it’s set to acquire up to 80% of the York Harbour copper-zinc-silver project in Newfoundland, Canada via a staged earn-in agreement.

York Harbour is here:

The company describes it as a Cyprus-style volcanogenic massive sulphide (VMS) exploration project, located 180km west-south-west of FireFly Metals Ltd (ASX:FFM) Green Bay Copper Project.

Only it’s much colder than Cyprus with only limited historical exploration.

The best of those results are below.

Osteopore (ASX:OSX) was back in the news after revealing that its $18.7 million partnership with Singapore’s NDCS and A*STAR to develop next-generation dental implants has reached “significant milestones”.

The milestones include the successful development of a 3D-printed technology, which the company says “can combine patented biological additives and polymer compounds for dental implants that have the potential to accelerate bone healing”.

Structural Monitoring Systems (ASX:SMN) rose quickly after lifting its revenue forecast for the full year ahead of a likely maiden quarterly profit.

The avionics specialist says increased sales are expected to see the Group record a quarterly profit for the first time in the June quarter.

The stronger-than-anticipated results bolstered by the strong performance of the Group’s Contract Manufacturing segment.

By the end of this current financial year, SMN forecasts that annual gross revenue will have grown by 27% building on revenue growth of 43% in FY2023 with a figure of 28% revenue growth budgeted for in FY2025.

SMN have also forecasted Group EBITDA of $3.38 million for the current financial year which represents a significant turnaround on LBITDA of $0.27 million for FY2023.

And Top End Energy (ASX:TEE) made moves through the morning session, after announcing that it has been given a formal Ministerial grant of Exploration Permit, which the company says is the culmination of a multiple year application and approval process encompassing native title holder agreement and NT Ministerial approvals.

The permit the first EP to be granted in the NT since 2015, and sets TEE up for rapid deployment of a planned exploration program, looking for natural gas. The company is also in the process of finalising a deal for three additional granted permits from Hancock.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NVQDB | Noviqtech Limited | 0.005 | -88% | 4 | $5,949,229 |

| CCO | The Calmer Co Int | 0.008 | -38% | 28,625,555 | $17,949,372 |

| AUK | Aumake Limited | 0.002 | -33% | 35,083 | $5,743,220 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 17,819,750 | $8,737,021 |

| IEC | Intra Energy Corp | 0.002 | -33% | 719,995 | $5,072,345 |

| CUS | Coppersearchlimited | 0.1 | -31% | 1,400,033 | $13,381,384 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 1,032,540 | $12,677,188 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 585,741 | $12,687,242 |

| ICU | Investor Centre Ltd | 0.003 | -25% | 3,322,358 | $1,218,045 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | 1,587,778 | $5,873,960 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 341,633 | $2,357,944 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 725,000 | $52,266,809 |

| GTG | Genetic Technologies | 0.095 | -24% | 903,285 | $16,527,156 |

| TGH | Terragen | 0.013 | -24% | 401,280 | $6,274,379 |

| IXC | Invex Ther | 0.06 | -23% | 83,219 | $5,862,000 |

| EV1 | Evolutionenergy | 0.035 | -22% | 747,242 | $11,754,771 |

| JPR | Jupiter Energy | 0.02 | -20% | 124,335 | $31,841,305 |

| SHP | South Harz Potash | 0.008 | -20% | 8,279,766 | $8,271,850 |

| BCM | Brazilian Critical | 0.018 | -18% | 1,389,674 | $18,276,267 |

| WLD | Wellard Limited | 0.019 | -17% | 833,806 | $12,218,757 |

| 1TT | Thrive Tribe Tech | 0.01 | -17% | 2,210,437 | $4,519,458 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 18,056,840 | $6,707,934 |

| TTI | Traffic Technologies | 0.005 | -17% | 5,563,623 | $5,546,989 |

| DTR | Dateline Resources | 0.011 | -15% | 11,908,443 | $18,948,110 |

| HPC | Thehydration | 0.011 | -15% | 620,690 | $3,963,870 |

IN CASE YOU MISSED IT

Adavale Resources’ (ASX:ADD) maiden exploration has identified numerous targets including a priority uranium drill target at its Mundowdna licences in South Australia. The company intends to define further targets and finalise design for a drill program.

Blue Star Helium (ASX:BNL) has added a premium carbon dioxide product to its industrial gas products portfolio, complementing that expected production of high-grade helium with a CO2 by-product from its Galactica project in Colorado.

Dateline Resources (ASX:DTR) has upgraded resources at its Colosseum project in California by 35% to 1.1Moz of contained gold. The resource has also gained certainty with 67%, or 736,000oz, now in the measured and indicated categories.

Equinox Resources (ASX:EQN) has defined a 108.5Mt at 58% iron direct shipping ore (DSO) resource at its Hamersley iron ore project in WA’s Pilbara with significant upside exploration potential to grow the deposit.

Firetail Resources (ASX:FTL) has signed a binding farm-in agreement to acquire up to 80% of the York Harbour copper-zinc-silver project in Newfoundland, Canada, which contains VMS geology and is near Firefly Metals’ Green Bay copper project.

The selection of lithium-ion phosphate (LFP) batteries for Frontier Exploration’s (ASX:FHE) Waroona renewable energy project in WA will increase the battery duration by 2% to 4.5 hours, which will increase revenues, and reduce Capex.

Iltani Resources (ASX:ILT) has discovered silver-lead-zinc-indium mineralisation 650m southwest of known grades at the Orient West prospect, significantly expanding the Orient project’s potential ahead of a planned resource estimate.

Legacy Minerals (ASX:LGM) is on the hunt for high grade gold and silver via a new eight hole diamond drilling campaign at its Bauloora project in NSW. Geological mapping is also underway across the site’s primary vein field.

The trial of Neurotech’s (ASX:NTI) NTI164 for PANDAS/PANS has demonstrated continued symptom improvement in patients after a year of treatment, prompting caregivers to express appreciation for the positive impact on their children’s overall well-being and behaviour.

Pantera Minerals (ASX:PFE) has increased by 20% its landholding within the prolific Smackover Formation in Arkansas, where majors such as ExxonMobil and Albemarle are pouring in billions of dollars into developing a world-class lithium-brine mining jurisdiction.

TG Metals (ASX:TG6) has approved a program of works to drill pegmatite targets at its Jaegermeister and Burmeister deposits at the emerging Lake Johnston critical minerals district in southern WA.

TRADING HALTS

HeraMED (ASX:HMD) – pending an announcement by HeraMED regarding termination of a US Partnership.

Lodestar Minerals (ASX:LSR) – pending an announcement in relation to the pricing of a recently announced entitlements issue.

Prime Financial Group (ASX:PFG) – pending the expected release of an announcement relating to proposed non-renounceable entitlement offer and acquisition.

Life360 (ASX:360) – pending an announcement to the market in relation to a proposed US IPO.

Southern Hemisphere Mining (ASX:SUH) ) – pending an announcement regarding a capital raising.

Everest Metals Corporation (ASX:EMC) – pending an announcement by EMC in relation to a capital raising.

Jameson Resources (ASX:JAL) – pending an announcement of a two-tranche equity securities issue.

Viva Leisure (ASX:VVA) – pending an announcement about a proposed capital raising and acquisition.

Stavely Minerals (ASX:SVY) – pending an announcement regarding a capital raising.

Tivan (ASX:TVN) – pending the release of an announcement of a Strategic Alliance for the Speewah Fluorite Project.

At Stockhead, we tell it like it is. While Adavale Resources, Aura Energy, Blue Star Helium, BPM Minerals, Cosmo Metals, Dateline Resources, Equinox Resources, Firetail Resources, Green Technology Metals, Greenvale Energy, Iltani Resources, Legacy Minerals, Neurotech, New Age Exploration, Optiscan, Pantera Minerals, Peregrine Gold, Spartan Resources, Sunshine Metals, Terra Metals, TG Metals, Viridis Mining & Minerals and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.