China’s housing market recovery boosts demand for commodities: Commbank

Chinese housing construction continues to recover and fuels demand for commodities. Getty Images

- Housing prices in Chinese cities have bounced back from COVID downturn

- Australian coal and iron ore to benefit from stronger Chinese housing sector

- Shares in some ASX coal companies could gain from upturn in Chinese demand

China’s new-build housing market is basking in some sunny economic weather with prices in the Asian country’s largest cities returning to levels seen in late 2019 before the COVID-related slowdown.

Property construction accounts for 25-30 per cent of China’s steel consumption and stronger housing demand typically flows into demand for steel-related commodities.

“China’s demand for metals, iron ore and coking coal are particularly set to benefit from a resilient property sector,” Commonwealth Bank of Australia (CBA) economists said in a report.

Market prices for Australian coking coal used in steelmaking have touched a five-month high of $US132 ($181) per tonne free-on-board Australia basis and are up 24 per cent from their August low.

China has been steadily stocking up on a range of commodities in recent weeks.

ASX coking coal companies gain from stronger market prices

There are several ASX coking coal stocks, including Bowen Coking Coal (ASX:BCB) which recently received positive washability and clean coal results for its new Hillalong project in Queensland’s Bowen coalfield.

Another coking coal company is Stanmore Coal (ASX:SMR), which operates the Isaac Plains mine in Queensland.

Tigers Realm Coal (ASX:TIG) ships coking coal from its Russian mine through Beringovsky port in Russia’s Far Eastern region.

BCB, SMR and TIG share price charts

Rebound in housing prices down to looser Chinese bank lending

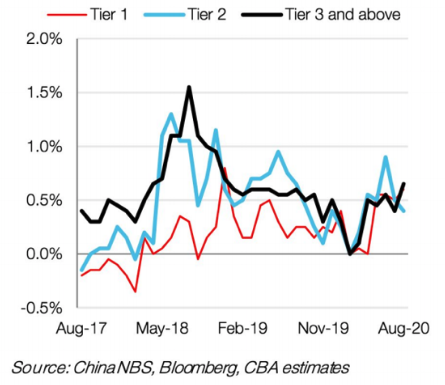

Price growth for housing in China’s cities accelerated 0.5 per cent in August, representing an annualised growth rate of 6 per cent, CBA said.

“The rebound in China’s new home prices this year is likely the result of easing measures taken by China’s central bank.”

Looser bank lending to customers has led to lower mortgage costs and increased activity in China’s property sector, the bank said.

“We still believe the ongoing credit expansion will keep demand for new properties strong in 2020.”

Credit growth in China’s economy has expanded despite measures taken by local governments and the People’s Bank of China to curb the rapid increase in new home prices this year.

Property market momentum to carry through 2020

Policymakers in China are keen to keep the housing sector growing at a stable pace, the CBA report said.

“Unless local governments apply immediate and harsh restrictions on new home purchases, we think the underlying momentum behind China’s property sales and construction volumes will remain for the remainder of 2020.”

China’s central bank took measures to slow the country’s housing market in late August, announcing restrictions on funding for property developers.

Property including housing is seen by Chinese as a safe place to store wealth, a trend that has been fostered by buyers’ fear of missing out on price increases for new homes.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.