China’s 2022 ended in an abrupt fast-track reopening, can 2023 end in an economic miracle?

Via Getty

Minxin Pei is a political scientist and expert on Chinese governance. His stuff in Bloomberg is always great.

Most recently, the professor of government at Claremont McKenna, says all the signs and portents running into the Chinese Lunar New Year suggest that China’s strongman President Xi Jinping is leaving the failures of zero-COVID and putting the save of economic growth to distract from the mess it’s left behind.

In just a month, Xi has canned his signature Covid-restrictions, vowed to support the floundering property juggernaut and tinkered with pro-growth policies and earlier this week appeared to call off his attack dogs after 2 years of dismembering China’s powerhouse tech platforms.

If this is all going to work, Pei says Xi will be forced to do all of the things that don’t make Xi, President Xi.

“Costly sacrifices” are in the post he warns.

Not just for China, or the Chinese people, of course: They’re sacrifices are evident in daily life in almost every way.

What she means is that Xi himself will need to cash in a lot of his own chips to come good on resurrecting the modern world’s economic miracle.

We need an economic miracle, stat

He’ll need to “delegate more to technocrats” and send out the message to himself and all of his ridiculous Wolf Warrior proxies to ease right off the ideological war talk to try and win back friends and their investors.

He’ll need to do things anathema to his rule – using words like “relax restrictions” (for the private sector), stop favouring State-owned enterprises and “deescalate tensions with the West.”

“Such changes would represent an implicit repudiation of virtually all of Xi’s major policies.”

We won’t be weeping here if that stings the president.

A good beginning

And, according to the Amundi Institute’s Senior EM Macro Strategist Claire Huang, the Chinese economy just might well end up being independently insulated during a 2023 likely to be mired in stagnant growth, political turmoil and recessionary forces.

“We expect China to be separated from the global slowdown in 2023, accelerating from a low base,” Ms Huang says.

That low base is largely of Xi’s own obsessive and compulsive making. But the signs are good, Huang says, now the unwinding has begun.

Accelerating from a low base as fast as humanly possible

According to Claire, China’s tried to get out front and have it both ways when it released a “refined zero-Covid policy (with 20 measures) back in November.

She said the initial purpose envisioned by the leadership was to create an effective tool to balance growth and the Covid outbreak.

“However, with the highly infectious Omicron variants, the virus quickly spread and cases continued to rise across the country despite these measures,” Claire says.

The rollout confused China’s intricate system of local government and the ability to prioritise and then implement the 20 new and often contradictory policies was a mug’s game at best.

“Most of them opted to tighten the restrictions, in order to flatten the infection curve. Economic activity stayed depressed, and social unrest increased amid poorly executed Covid policies,” she says.

After the refined zero-Covid policy proved to be ineffective in containing the outbreak, Xi’s plan B was to just drop the whole thing and jump on the nearest high-speed, fast-track reopening instead because reverting to hard-core lockdowns was likely to be as effective as a large cat-less bag.

“Since late November, the country has removed testing requirements for most travel, allowed home quarantines for positive cases, and introduced the second booster for the senior population. The faster and earlier reopening caught the Chinese public as well as the market by surprise, given that the medical system is far from being prepared.

“In this regard, the initial stage of reopening will be chaotic, accompanied by a surge in hospitalisations and depressed mobility. Medicine shortages are already in place. However, going forward, we do not expect the Chinese government to back track,” Ms Huang said.

China has passed the point of no return

BEIJING, CHINA -NOVEMBER 27: Police form a cordon during a protest against Chinas strict zero COVID measures on November 27, 2022 in Beijing, China. Protesters took to the streets in multiple Chinese cities after a deadly apartment fire in Xinjiang province sparked a national outcry as many blamed COVID restrictions for the deaths. (Photo by Kevin Frayer/Getty Images)

When it comes to COVID-19 now, the official priority is to be clever with its scarce medical resources for those most in need, and to get past the fear of a jab and accelerate booster injections for the elderly.

The unofficial priority will be go dark on data and obfuscate what’s happening on the ground so any disaster ona. human scale doesn’t upset the economic cart.

Officials announced to drop quarantine rules for overseas visitors on 8 January, just ahead of the Chinese New Year holidays (22 January),

“(That’s) much earlier than we expected month ago. A full reopening now looks likely by end-Q1.” Claire forecasts.

“There will be a sequencing of peak infections in different regions. For instance, Beijing is on a first-in, first-out basis. Nevertheless, most cities in China will see the peak of the first wave by mid-January and the end of first wave by March.

“We expect most restrictions to be removed after the Chinese New Year holidays (in late January). Returning to work is expected to start in February, and full production is likely in March.”

Winter recession, strong rebound in spring

However for now, the reality is bleak, according to Claire.

“Economic growth plunged again in November, due to the additional tightening that local governments put in place right after the Party Congress. Consumption and the services sector bore the most pain.”

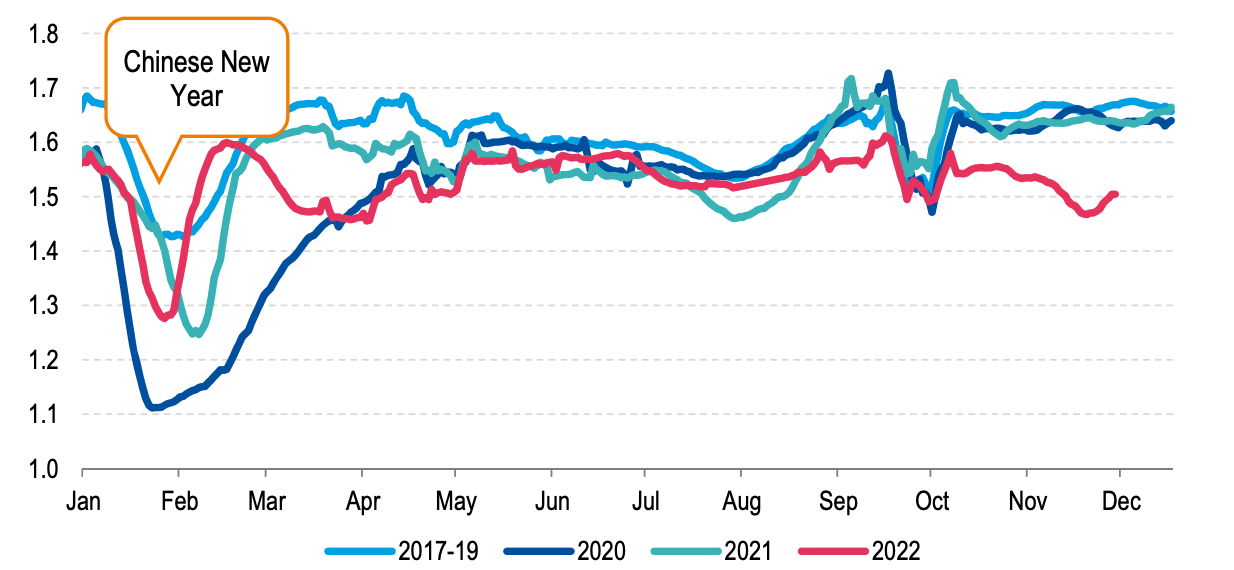

Mobility of Chinese households

A meaningful recovery for around Easter

The mobility data (above) shows signs of a late November recovery. But Claire warns that the improvement has slowed as COVID- zero is dropped and that looking ahead there’s a solid pause ahead to describe the surge of infections.

“Lessons from other Asian economies suggest the whole reopening process takes two to three months before activities recover meaningfully. Also considering the quiet activity around Chinese New Year holiday period, we expect weak growth throughout February 2023,” Ms Huang says.

Amundi has pegged something of a “meaningful recovery” to follow the traditional break sometime during March and through Q2 2023.

We’re all pro-growth here

On top of reopening news, Claire says that the headline Central Economic Work Conference (CEWC) held on 15-16 December reflects what most experts agree is a broader policy pivot towards supporting growth.

Coming out of the meet, top economic officials emphasized China’s fundamental job ahead was to revive expectations and confidence.

“More specifically, we note a sharp turn in policies for platform companies, by recognising their role in creating jobs and supporting them to compete globally.

“As for macro policy, the conference called for stepped-up spending from the fiscal pocket, while vowing to maintain an accommodative monetary policy, albeit in a more precise way by directing funding to small and micro enterprises, technology innovation, and green transition.

“Consumption is highlighted as a priority to expand domestic demand, including support for housing upgrading demand, electric vehicles, and elderly care services. This means a declining role of infrastructure investment, which is no longer required as a buffer to ease downward pressures on growth.

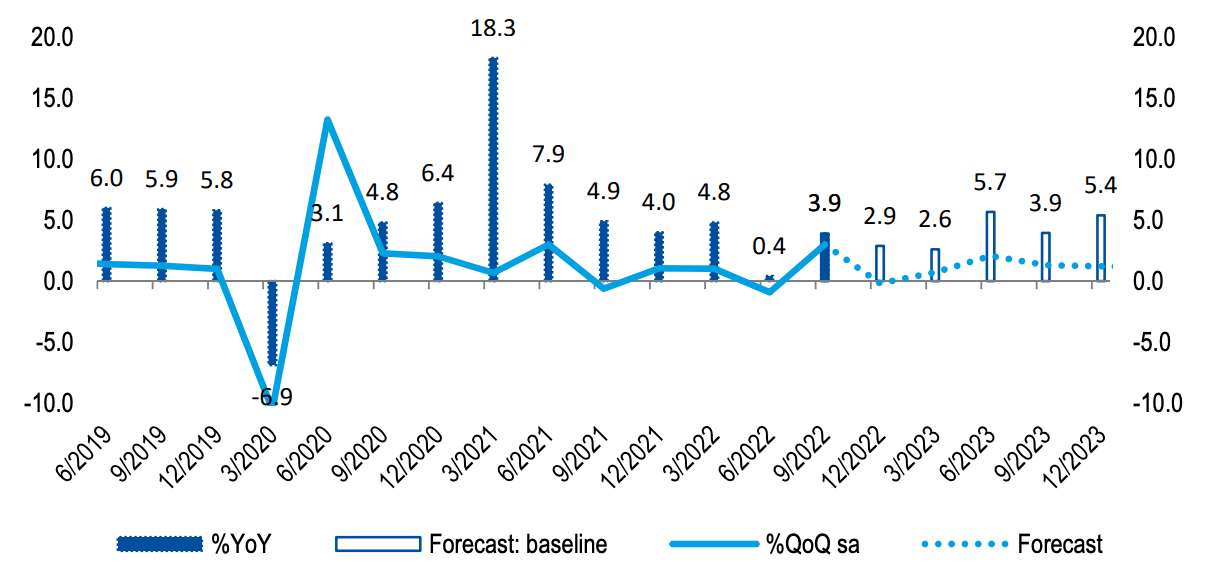

China GDP growth forecasts

Safe as houses

On the same note, China’s tightening grip on the gargantuan housing market is officially over.

Claire says the tougher policy stance helped stabilise a crackpot market and restore confidence, home sales, construction and land transactions from a grindingly sharp slowdown.

“By recognising that the housing crisis is systemic and that real estate’s role in the economy is crucial, officials plan to promote project deliveries, encourage M&A, meet developer financing demand, and resolve the risks hanging over high-quality names. With housing market returning to stability and economic reopening, we expect China’s growth to accelerate from a low base in 2022.

“The recovery trajectory will be choppy, hinging on how policymakers manage the reopening,” Ms Huang concludes.

“Evidence on hand indicates a preference for brief and sharp short-term pains and a smoother path in most of 2023.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.