China property update: Well, there’s been some bad developments

Picture: Getty Images

Bad property developments, a broad market sell-off in Chinese equities and reactionary moves to prop up the Chinese currency continue to make this, the third week of August in 2023, a real unhappy one for the beleaguered Chinese economy.

Literally everything from stocks, domestic spend, foreign investment and the official currency, the RMB, appear to be heading down a dark hole for a place to hide.

With the renminbi (RMB or the yuan) seeking cover in its own deflationary hole – back to somewhere circa 2007 – China’s central bank on Thursday did promise/pledge to get intervening in any mass currency exits to prevent an “over-adjustment” in the yuan. Or what might be called an exodus.

In contrast to the US$6 billion in FX inflows seen in June, Goldman Sachs on Wednesday said net FX outflows totalled roughly US$26 billion in July.

“While we saw net buying of equities in July, goods trade FX conversion ratio declined, related inflows slowed in July, and services trade deficit widened. In addition, cross-border renminbi transfers showed net outflows in the month,” GS said in a Wednesday note.

The People’s Bank of China’s surprise cut in interest rates this week was the biggest swing of the PBoC’s axe since since the COVID pandemic kicked off.

Those moves followed an awful 48 hours of economic news and were released just as China’s increasingly unreliable National Bureau of Stats unloaded official data describing a July wasteland.

Investor sentiment is a mess. The hit on Wednesday of falling home prices reminded everyone just how critical, and lingering, the Chinese real estate sector’s problems are. Property distress has been the crux of China’s economic successes and now its troubles.

And now the widening interest-rate directions add a new layer of divergence between the US and China.

That’s started to weigh heavily on the currency Beijing’s been pumping all year. According to Bloomberg, ‘people familiar with the matter’ say that officials have gone and also told state-owned banks to step up their own methods of intervention as fears of a run on the currency market grow this week.

The Hang Seng lost more than 1% and ended Wednesday back below where it was before policy vows at the key July Politburo meeting sparked a bit of a cow rally that’s now fizzled out and returned all its gains.

As the Year of the Rabbit began, investors shot out of the blocks to cash in on what they saw as bargain prices for neglected Chinese stocks. Few considered the Hang Seng would be within a breath of a technical bear market in August.

But here we are and investors foreign and domestic are withdrawing funds from Chinese stocks due to growing concern about the prospects for the world’s second largest economy.

From around the Chinese New Year in January, both Hong Kong and mainland Chinese markets from Shanghai to Shenzhen attracted investors betting on China’s glorious economic return in the wake of some very dark policy moves during the COVID-pandemic.

Now, in the ghastly clear light of horrible developments by horribly big developers in the property market, those big bets are getting pulled off the table as China’s slumbering economy refuses to wake up.

If what looks like a cyclical downturn is in fact something more of a mismanaged structural sh*tstorm, then the merry flight of funds from Chinese markets could but be the first scene of a five act tragi-comic opera.

Not so comic for countries like ours well within China’s sphere of influence, at both economic dependence and competition. An economically injured China could steer the region into recession. A domestically wrought China could do all kinds of unexpected tricks. As Australia’s largest trading partner, a further downturn in China alone could mean trouble ahead for the engines of the local economy.

And if equity markets don’t get permission and/or help from Beijing, a serious slump might begin in Hong Kong, but it would spread far, wide and quickly.

According to the Institute of International Finance, circa US$3.7 billion worth of Chinese stocks were ditched in the first 14 days of August.

That’s bigger than it looks. And it already looks significant.

Bloomberg says this exodus of cash was the very largest of its kind, but for the nigh-withdrawal of US$8 billion from back in October 2022, when China’s pandemic stricken economy was then whacked with Beijing’s zero-COVID policy.

Perhaps more worrying for Beijing, Taiwanese money poured into in South and Southeast Asia during 1H, eclisping investments coming into China, a new first.

Taiwan’s ASEAN investments (across Australia and New Zealand, Bangladesh, India, Pakistan, Thailand and the nine or so other associate states of Southeast Asia) reached a combined US$2.125 billion in the first six months of the year.

Taiwanese money moving into China came to just US$1.9 billion over the same period, according to Taipei.

Moreover, the turmoil in China’s property sector is worsening by the day.

The National Bureau of Statistics, having already ditched monthly consumer confidence reads (no confidence) and this week halting youth unemployment data (no jobs) says property prices fell last month in 49 cities, an increase of 11 from June.

Given its importance to China’s growth and the impact property has across Chinese households and the financial system itself, for the NBS to pull real estate price indices from its shrinking portfolio would be a concession of defeat from Beijing.

But for the moment the NBS says prices fell across 70% of 70 major cities the stats bureau said on Wednesday, leaving China analysts in fear of that indicator as well.

Previous anxiety over the tight finances of big gun property developers niow looks well-placed.

Country Garden’s missed coupon payments on offshore bonds, its own sales misses and the renewal of scrutiny on the sector is likely to scupper hollow hopes for price rises and lead to widespread investment property sell-offs.

From outside it looks hairy enough for the investment banks to hit pause on talking up the Chinese economic engine for 2023 and concede its central place in a global recovery is diminishing.

Goldman Sachs and JPMorgan have both slashed full-year projections for Chinese GDP to 4.8%. A few months ago JPMorgan was backing a 6.4% 2023 growth target.

But with overall investment in Chinese property YTD down some 9% y-o-y to US$944bn (circa 6.8 trillion yuan), and new home sales off by 20%, even JPMorgan, so bullish in this arena, admits the soft trade updates from last week (the worst read since February 2020) alongside awful private-sector lending, consumer and producer prices are now “outright negative.”

“China’s property sector is staying challenged, in a structural downtrend,” the bank said on Monday. “We stay cautious on Chinese equities, and keep advising to use any stimulus news-driven bounces to sell into.”

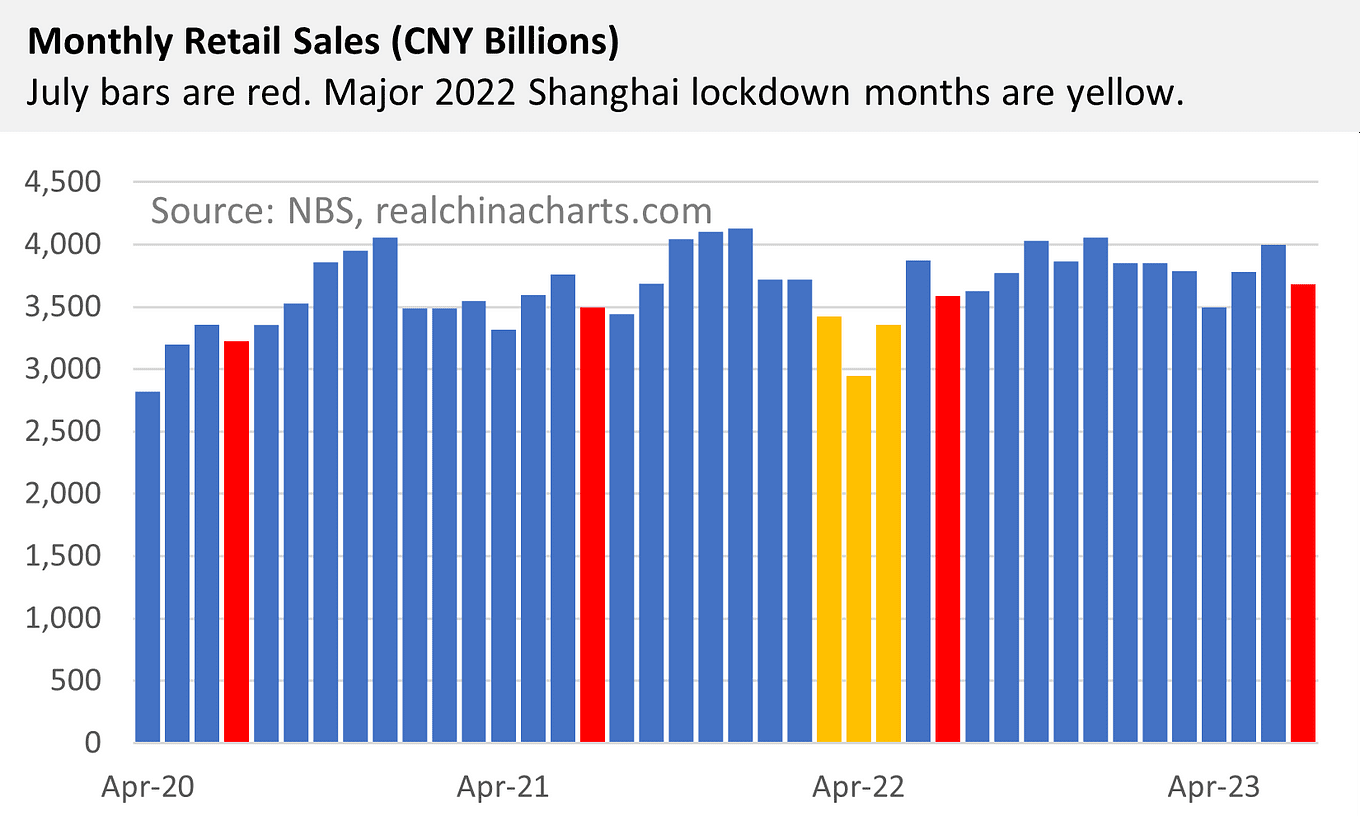

Finally July’s retail sales were grim at 3.6 trillion yuan, below 28 of the 29 surveyed estimates (4.0% mean) at around 2.5%. NBS data suggests non-seasonally adjusted MoM sales were down 8.0%.

Hong Kong’s Hang Seng Index has fallen 6% so far this year. Although the Shanghai Stock Exchange Composite Index is still nearly 3% higher, they’re a mile away from Wall Street and European markets which have recovered most of their 2022 losses. Even the S&P 500 is circa +16%.

The Chinese government has said this week, adding to other incremental pledges, that it’ll back its brutalised tech sector which somehow adds only further anxieties for management and stakeholders.

When Xi’s handpicked head of the State Council, Premier Li Qiang, pledged to deliver “new engines” of demand and innovation last month, it only began a hollow rally which has lost both money and faith.

China’s real economic administrator, The National Development and Reform Commission (NDRC), also revealed another long series of impenetrable measures to support tech companies. The 31 or so “provisions” to promote private sector growth lack grunt and smack of a double-speak not usually associated with the people ultimately responsible for generating China’s economic policies.

Where has Xi, the NDRC, Qiang’s State Council or a few lands from the Politburo been thinking as unemployment among 16- to 24-year-olds has slid in disastrous slo-mo to an all-time high of 21.5%.

Distressed developers have been distressed and have been spreading distress for well over 18 months now.

No wonder the share prices of top developers Country Garden and China Vanke have crashed since shamefully reporting news of their respective -60% and -36% y-o-y drop off on sales.

The shattershot splattering of quasi-stimulus has only drip fed markets uncertainty, disapointment and perhaps a little resentment, even rumours that officials might slash the onerous stamp duty on stock trades didn’t even register a blip on the MISC China index which looks increasingly numbed.

Willer Chen, a senior analyst at Forsyth Barr Asia, told Reuters on Wednesday simply that: “People are losing patience.”

“With just piecemeal policies, they are getting more and more concerned about the economy.”

China-focused exchange-traded funds (ETFs) listed in the States are getting whacked. The NASDAQ Golden Dragon China Index has lost circa 7% in five sessions.

Data from QUICK-FactSet as of Monday showed an outflow of US$115 million from the SPDR S&P China ETF (GXC) in the past week and US$152 million in the past month. The iShares MSCI China ETF (MCHI) lost some US$50 million.

“Negative China sentiment has been reverberating through markets and PBOC’s rate cut has again suggested that calls for a massive stimulus may be misplaced,” said Charu Chanana, market strategist at Saxo Capital Markets.

China-watching US hedge funds are suddenly rethinking their exposure to Chinese stocks for the first time in more than a decade. Louis Bacon’s Moore Capital divested itself of a US$200m stake in Alibaba.

Most recently Michael Burry’s Scion Asset Management offloded its holdings in Alibaba and JD.com.

And most notable, TigerGlobal slashed its JD.com and Kanzhun stakes by circa 12%, trimming US$1.1 billion to under US$720 million.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.