You might be interested in

Mining

Bulk Buys: Goldman tips balanced iron ore market as seaborne demand plateaus

News

ASX Small Caps Lunch Wrap: Weak retail sales lift local market, choice Chinese data might even keep it there

Mining

News

It’s been challenging for a while now, but China’s Communist Party under Xi Jinping is staring down the first real test of a generation as an older form of centralised socialist politics tries to deal with a whole new set of free market challenges which no one in the Politburo knows anything about.

In ascending order these are:

An apparently impervious real estate crisis, the seed of deflation, rapidly declining population, an utterly unprecedented crisis in consumer confidence, and a bitterly disappointed youth where 1 in 4 has a job.

On Sunday another one found some dust and began to nibble.

Country Garden Holdings (2007.HK), right up there with China’s fattest and previously most stable real estate developers in the country, couldn’t scrounge together a debt payment, and now faces the risk of a default.

The company said it had “underestimated the market downturn.” Understandable in some ways, since there’s never been one since it was established in 1993.

Shares in Country Garden plunged more than 18% to HK$0.80 on Monday in Hong Kong. The HSMPI index which tracks mainland developers listed on the Hang Seng stuck another -5% boot into the -10% it gave away last week.

The Hang Seng Mainland Properties Index is now at its lowest level since November last year.

Reuters is reporting that Country Garden is seeking to delay the debt payment on a private onshore bond for the first time, according to a source, but this came after CG suspended trading in 11 onshore bonds, sending its shares diving to the new record low by the close on Monday.

A quick glance at the unChina-like stats and there’s pubescent predictions already afoot that China is headed for a catastrophic market blowout.

For now though, the Communist Party still has an immense pile of cash to buy its way out of imminent disaster, but the increasingly totalitarian state that China has become lacks expertise, if not the policy tools to deal with the long-term structural issues.

Anxiety spread through markets following the Country Garden blindside, and if Beijing wasn’t under the pump this time last week, then surely someone, somewhere is getting the hard word to start operating on the flatlining real estate sector with a short-term design of at least restoring some confidence in the cranky domestic consumer who just doesn’t feel like spending.

According to Caixin, China’s slapped together a doc to revive foreign capital inflows and improve the country’s business environment.

The 24-guideline document, issued by the State Council on Sunday, said China will “step up efforts to draw offshore investment to key sectors, such as tech and biomedicine.”

Eligible foreign investors “are encouraged” to establish investment vehicles and regional headquarters in China, as the country seeks to expand channels for foreign capital inflows, the Council declared.

“China’s appeal as a foreign investment destination has faded in recent years as the Sino-U.S. trade war intensifies and some Western nations de-risk ties with the country by reducing reliance on its supply chains. Many overseas firms are dialling back local operations or expansion plans, while some are relocating manufacturing and sourcing outside of the country,” Caixin wrote on Tuesday.

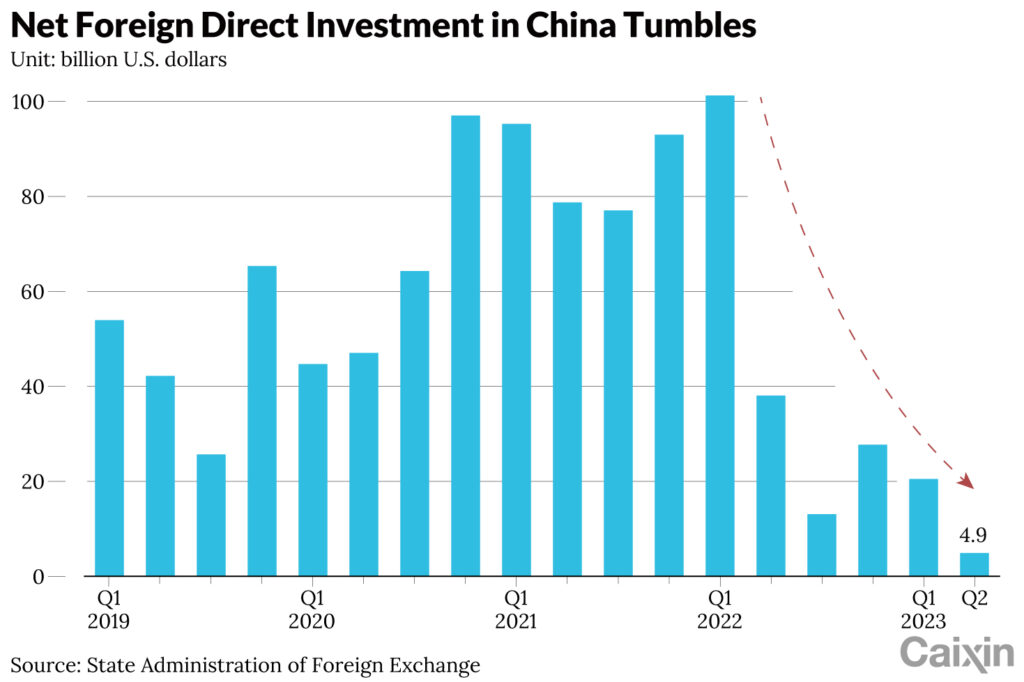

During Q2, net foreign direct investment (FDI) in the Chinese mainland crashed 87% year-on-year to US$4.9 billion, its lowest quarterly level on record, according to the State Administration of Foreign Exchange.

So such ad hoc measures like Sunday’s State Council release – without the scent of any real coordination – make the powers-that-be suddenly look like they’re a bunny in the headlights.

There’s no playbook for now. All the while its property market, the nation’s economic pillar, has been cruising headlong into a reckoning. And all it took was the inevitability that one of the country’s biggest developers, under the hammer for staggering debts, would become two.

China’s fattest developers have posted anaemic business numbers over the last four weeks, with contracted sales by the top 100 developers crashing by more than 33% last month to 350.5 billion yuan (US$48.5 billion), according to the property data firm CRIC.

The country’s deeply cancerous property problems first emerged back in 2021 after the Party had to go intervene in the market to handle the sector’s ballooning debt.

That move freaked out buyers and debtors, foreign and domestic, leading to the bloody near-death experience of Evergrande – which was really the crown jewel of China’s largest real estate developers.

It also led to a collapse in prices, breakdown in faith and the absurd bankruptcy of several other more disposable real estate developers.

As real estate prices fell, the economy went into a deflationary spiral, leading, in turn, to a prolonged crisis in consumer confidence, and an overall slump in economic growth.

In March for the first time I can remember, China’s National Bureau of Stats just stopped publishing its monthly consumer confidence numbers, not even bothering to fudge an index which obvs showed what everyone else could see – the failure of Chinese economic policies to re-engage, post-COVID.

Yet even if further real estate bankruptcies can be avoided, the damage to Chinese society and the Chinese economy is in the bag.

With skin in the game, at least JPMorgan said (before the CG crisis) the contagion is not comparable to the 2021 crisis begun by the Evergrande Group, “because 40% of the market has already defaulted” since then.

After Country Garden missed bond coupon payments worth US$22.5 million last week, raising the risk of default if it cannot make the repayment within a 30-day grace-period, the once largest Chinese developer said it is facing the “biggest challenges since establishment” in a statement on Friday night.

The author, the China legend and current Financial Times China editor James Kynge, wrote this weekend, “fragile consumer confidence is just one sign of a malaise that is not merely economic.”

“Under Xi Jinping, China’s leader, a concept of ‘comprehensive national security’ has come to dominate almost every aspect of life. The economy, culture, society, technology, ecology and others are officially classified as matters of national security deemed essential to the party-state’s survival.”

Sadder still for the millions of kids told to get rich quick and live “The Chinese Dream.” That particular reverie appears over already.

China’s population is shrinking. Chinese are older, and they don’t want kids.

The sudden birth rate vacuum has accelerated that population slide and means China is down about 850k people a year, and those are the numbers according to the same bunch at the national stats bureau.

It’s all rather grim, when seen against the geopolitical backdrop of the last couple of years.

It’s in these next few weeks when we’ll see the Party either put up a plan, or shut up the dissenters who’ve lost faith.