Can Elsight crack open the US drone market like an over-ripe melon dropped from a UAV?

Via Getty

One of the more interesting ASX defence tech makers is the Israeli-based Elsight (ASX:ELS). With the share price up and gunning for it on Thursday – ahead by 20% in morning trade and holding onto the gains – we though it’d be a fine time to look under the hood.

Why is ELS flying?

The company describes itself as a drone connectivity specialist. ELS says its flagship Halo delivers “absolute connection confidence” for drones and other unmanned systems.

A connected drone is a good drone.

The big news on Thursday in Sydney was the granting of Type Certification by the US Federal Aviation Administration (FAA) to the Halo-enabled Airobotics Optimus-1EX drone.

In historic news from @ExpoUAV the @FAA has granted @Elsight’s (#ASX: $ELS) #Halo enabled the @AiroboticsUAV Optimus-1EX system a Type Certificate to allow operations over people and infrastructure without case-by-case waivers: https://t.co/kDf7q7bt2x#BVLOS #DesignWin #drones pic.twitter.com/qq53bcg3mq

— Elsight (@elsight) September 7, 2023

The Optimus-1EX has now become the first and only non-air carrier drone in the world to have been granted the FAA Type Certification.

The grant will allow the drone to fly over people and infrastructure without the need for case-by-case waivers.

The certification also verifies compliance of the drone system’s design with the FAA airworthiness and noise standards, ensuring safe operation within the National Airspace System (NAS).

Why’s that so terrific?

What makes the win particularly epic for the Israeli-originated drone tech maker is, firstly, just how much of a beast the addressable market is in the US, now Elsight is tight and in the clear sight of the FAA.

The second is how the broader drone industry itself faces complex and evolving regulatory frameworks worldwide.

Governments and aviation authorities are grappling with the need to strike a balance between fostering innovation and ensuring safety and privacy. And the goalposts move almost as quickly as the technology and its applications.

Since drones were first legalised in the US for commercial use in 2016, the capabilities of the technologies have quickly outpaced the regulatory framework.

Elsight says this certification will significantly broaden the range of operational scenarios and scale up operations for automated Uncrewed Aircrafts (UAs).

Out of (flight beyond visual line of) sight

ELS has already secured recent high-profile clients across US, Europe, South America, the Middle East and Asia.

These include delivery service provider DroneUp, used by US retail giant Walmart, Brazil’s SpeedBird Aero and Spright, the drone division of US medical services company Air Methods.

But while global regulatory bodies appear to have made progress on simplifying airspace access, one of the missing links in the sector is rule-making on flight beyond visual line of sight (BVLOS) which remains elusive in the US.

BVLOS flight is widely recognised as a necessary step to deploying industrial drones at scale, due to the additional use cases that BVLOS flight opens and the additional value that an increased radius of operation offers for existing use cases like drone delivery. In scary ways, we’ve seen what these drones-at-scale can do across Ukraine.

Without a shared rule, drone makers and stakeholders are stuck for years at a time, forced to engage in lengthy and complex processes for waivers and exceptions.

This latest certification for ELS was only achieved after four years hard work by Elsight and the US-based Airobotics.

This was on top of the intensive engineering and operational review processes conducted by the FAA.

“After a long profound process done with the FAA and many of our partners, we are thrilled to announce that our OPTIMUS 1-EX drone has met all of the specific airworthiness and noise standards set by the FAA,” Meir Kliner, CEO of Airobotics said.

ELS: A story of drone connectivity in numbers

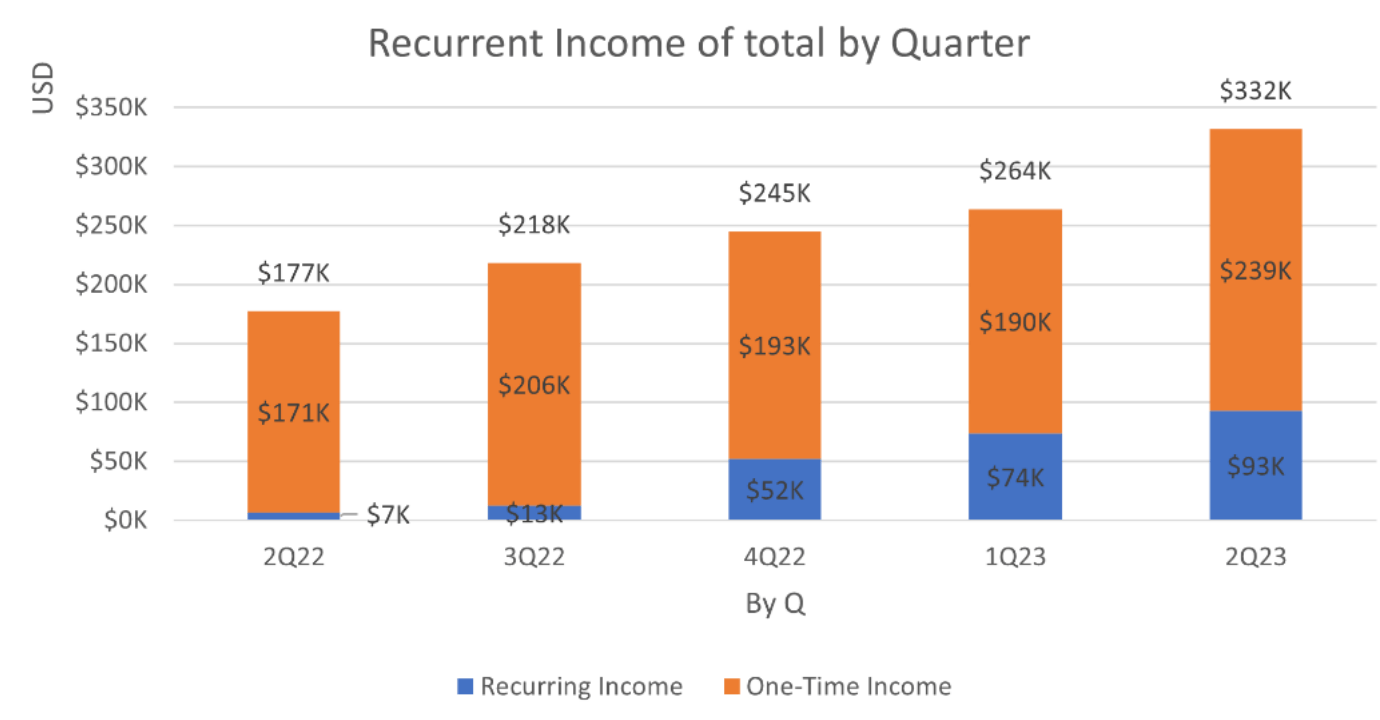

Last week, Elsight dropped underwhelming numbers for the half-year ended 30 June, copping a net loss of US$1,941,598, which was actually a decent beat on the same period in 2022 (which was a loss of US$2,246,917).

The improvement, the company says, is largely due to a renewed focus on reducing operational costs together with an increase in sales revenues.

Despite the early stage nature of the drone industry, the group continued to deliver some robust revenue growth, with the significant increase in recurring revenues a particularly promising metric.

A recurring dream

Elsight’s proprietary data and cloud services are being deployed, along with the Halo, to both new and existing customers, and as the drone market continues to move mainstream with the rate of commercial/industrial adaptation growing quickly, the impact of increasing recurring revenues are likely to become more and more material for ELS.

Earlier this year ELS won a strategic, multi-year public tender to supply Israeli Police and other Israeli government departments with solutions for its Communication On-The-Move (COTM) systems.

After testing, the Israeli Police ordered and implemented dozens of Halo units for force support in the field, with that number expected to grow significantly in the last quarter this year and into 2024, and beyond.

A month or so following, in June, ELS then received a follow-up order from the Israeli government which isn’t quite recurring, but obviously comes off the success of the Halo units described above.

Airobotics’ Optimus-1EX drone

Our Eddy Sunarto told me that the FAA Type Certificates (TC) hold significant importance and value in the aviation industry, being a mandatory prerequisite for all manned aircraft.

“Since the FAA began offering TC for Uncrewed Aerial Systems (UAS) in 2019, many drone companies have initiated this process… although Airobotics, focused on data capturing in urban environments, stands as the first to achieve it among numerous companies pursuing the TC.”

The company’s Optimus System is said to be among the most mature automated drone platforms in the market in terms of proven reliability and safety.

“We are proud that Airobotics has chosen the Elsight Halo as their connectivity solution,” says Elsight CEO, Yoav Amitai.

“Their completion of the Type Certification with the Halo onboard is a vote of confidence in Elsight and in the Halo, and we expect many more to come.”

The drone industry has rapidly evolved, transforming a wide variety of sectors. Despite industry development, several challenges hinder the sector’s growth and potential.

The early-stage drone market is rapidly developing and providing an increasing number of commercial opportunities.

Specialising in drone connectivity solutions, ELS approaches the market via what it calls, a “Design-Win” strategy which management says ensures the company is “well positioned to grow organically with the market with minimal further sales effort and cost”.

By the end of June, Elsight reportedly has more than 90 Design-Win partners around the world at various stages of development, from the testing phase to implementation and service launch.

This strategy involves integrating ‘Halo’ with drone manufacturers’ products at an early stage and Elsight is well placed to grow organically alongside the rapidly expanding drone sector, with minimal further sales effort and cost.

ELS now has working “Design-Win” relationships across a range of industries and geographies including the US, Europe, and APAC. The list also includes some new partners from India following a successful trip to the Aero India trade show in February 2023.

“As the market matures, these current small orders, from many of these 100+ design win partners, are expected to expand along with the growth of these partners and the industry as a whole resulting in organic growth for the company with relatively minor sales effort and cost,” executive director David Furstenberg said last week.

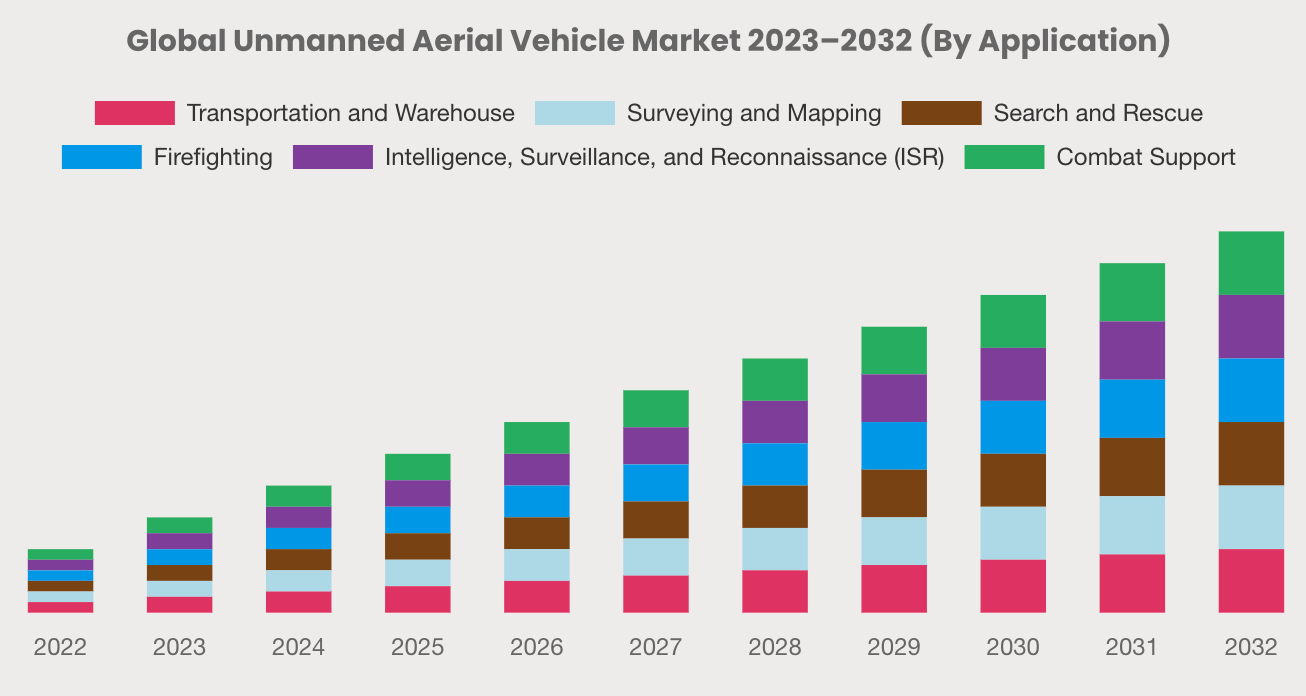

According to a market research firm Custom Market Insights, the global UAV market size & share revenue was valued at circa US$26.8bn last year and is expected to reach US$29.1 billion this year.

By 2032, that number is expected to hit US$50.4bn at a CAGR of 8.2% between 2023 and 2032.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.