Boom 2 Bust 2 Boom: Boyz Buy the ‘Hood in surprise Aussie house price sequel

Familyz in the hood. Via Getty

According to CoreLogic, Australian property prices rose for a third consecutive month in May.

No one saw that coming. Or perhaps someone did, but no one said they saw that coming.

The 1.4% increase in all of the country’s eight capital city benchmark indices throughout a surprise May buying spree comes hot off the 0.7% increase in April and the 0.8% lift in March.

Basically, there’s been something of a miracle recovery in the direction of Aussie property prices over the last quarter – CBA reckons it’s been ‘nothing short of remarkable’ given the Reserve Bank has continued to bump the cash rate like an advertising executive at a Sydney Christmas party.

The RBA has raised rates by 3.75 percentage points over the past year and while it might be talking up an intention to move cautiously, the punchy nature of recent inflation and now property price reads may engineer a soft landing in the economy

The national home price rebound accelerated into a bit of a sprint in May with the Australian average home price up 1.2% over the month. That kind of red hot run hasn’t been seen since November 2021 and it’s the third straight month wherein prices have started climbing.

In fact Aussie home prices are now up 2.3% from the February bottom.

Naturally, the greatest city in all of NSW, Sydney, took further command to lead the gains with a 1.8% increase. Average prices are now up 4.8% from their January low.

AMP Capital’s Shane Oliver says the building wave of post-COVID immigration, as well as really tight supply appear to be easily trumping any of the fears around ceaselessly higher interest rates.

“At least for now.”

CBA’s chief economist Gareth Aird says the sudden boom has caught the Aussie property predicterati entirely by surprise.

“Most forecasters will be frustrated at their home price models as the usual inputs didn’t pick this turning point. And the strength of the rebound in prices has caught almost everyone off guard.

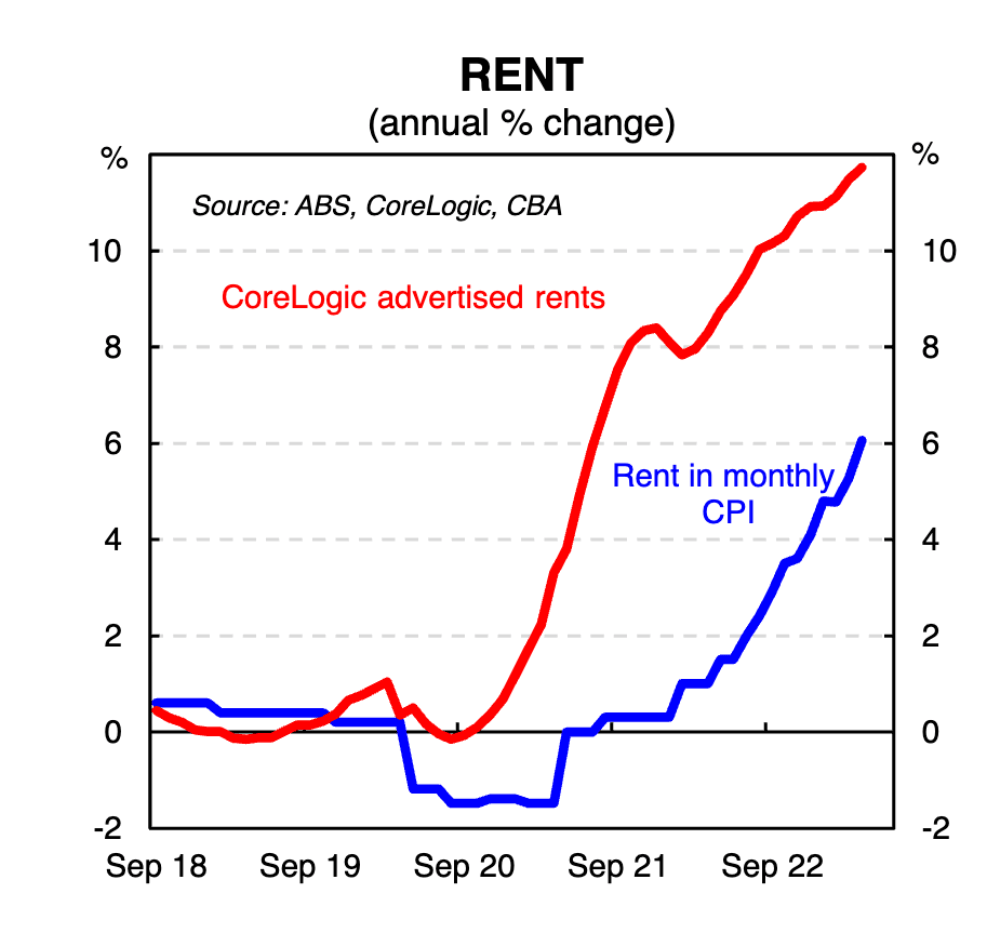

“Historically rents and vacancy rates have a strong inverse relationship. But home prices have generally been impacted by changes in mortgage rates rather than rents.

“The old adage ‘this time is different’ has rung true,” Aird says.

More Aussies, less Aussie homes

Population growth has massively exceeded expectations, says the CBA.

According to Gareth Aird, the government’s new net overseas migration target is now forecast to be 400k in 2022/23 and 315k in 2023/24.

“Such outcomes would be much bigger than the pre‑pandemic average of ~250k per year.

“Given the size of Australia’s population (26 million) the upgrades in the Budget are very significant from a levels sense, and – by extension – the impact these upgrades have on the underlying demand for housing,” Aird says.

Moreover, the steady flow of new Aussies looking for a place to be a new Aussie has coincided with a near total collapse in building approvals.

For context, last month, the green light for new builds was at its lowest monthly ebb in well over a decade – since April 2012 to be exact.

That’s adding to property values, but making life miserable for renters in particular. It’s a great data set for explaining why the cost of renting is now almost in human blood.

AMP Capital revised average home price forecasts a month ago from ‘flat’ to ‘slightly up’ this year ahead of a 5% gain next year.

However, the risk of ‘another down leg in prices remains high’ as interest rate hikes continue to impact and the economy slows – with a now very high risk of a hard landing.

Bust 2 Boom

CoreLogic’s national average home price data shows that after falling 9.1% (that’s from their high in April 2022 to their low in February), the gains are not only accelerating, but now all Aussie capital cities are seeing increases.

The upswing in prices is consistent with an upswing in auction clearance rates and housing finance commitments.

Auction markets are also flouting a material improvement, with heaps of punters ensuring clearance rates in both Sydney and Melbourne are back to above average levels. That’s above the circa 70% range, according to Westpac, which has typically been associated with sustained rising prices.

Pre–auction withdrawals have also returned to more normal after being super high through much of 2022.

Surging demand, weak supply vs rate hikes

The rebound is being driven by a worsening underlying demand/supply imbalance for homes. Immigration has surged and is likely to reach a record 400,000 this year driving the fastest population growth in 14 years at the same time that the supply of new dwellings is slowing.

This in turn is accentuating very tight rental markets, forcing rents up and driving renters to consider buying earlier than they otherwise would have. At the same time foreign demand is returning.

“So buyer demand is strong but supply remains weak with listings remaining below normal,” Dr Oliver says.

Talk of rising prices and shortages is in turn further boosting demand with an element of FOMOOAM (fear of missing out on a mortgage). Doc Oliver says the “sticker shock” of rate hikes also appears to have worn off for less interest rate constrained buyers.

This all appears to be dominating the impact of higher mortgage rates (at least for now). As such, last month AMP revised its national home price forecasts from flat to up slightly for this year (so far prices are up 1% this year) ahead of a 5% gain next year.

Westpac, meanwhile, says its forecasts have likewise been revised – prices now expected to hold broadly flat over calendar 2023 rather than make a ‘second-leg’ lower.

“A sustained upturn expected to gain traction once the RBA starts easing rates in 2024. Key risks continue to centre on the path for inflation and interest rates,” the bank said in its monthly analysis released this week.

All wrong: The housing market correction is now over

As far as Westpac is concerned ‘Australia’s housing market correction is now over,’ with the combo of surging migration, higher construction costs and low on-market supply, leaving us with the stabilisation in property values over 2023.

“The shift has come despite a further rise in interest rates and expectations that rates will remain high near term. The full impact of policy tightening has also yet to flow through to the wider economy.”

While this cautions against expecting a sustained upturn near term, the stabilisation is looking firmly entrenched, Westpac notes.

“It would take a large shock to knock market back into correction mode from here.”

Not so convinced is Dr Oliver, who says things can still go either bananas or pear-shaped yet

“While the shortage of property is dominating right now the risk of another leg down in prices remains high as mortgage rates are still rising and unemployment is likely to rise significantly over the next year, with the increasing risk of a hard landing for the economy.”

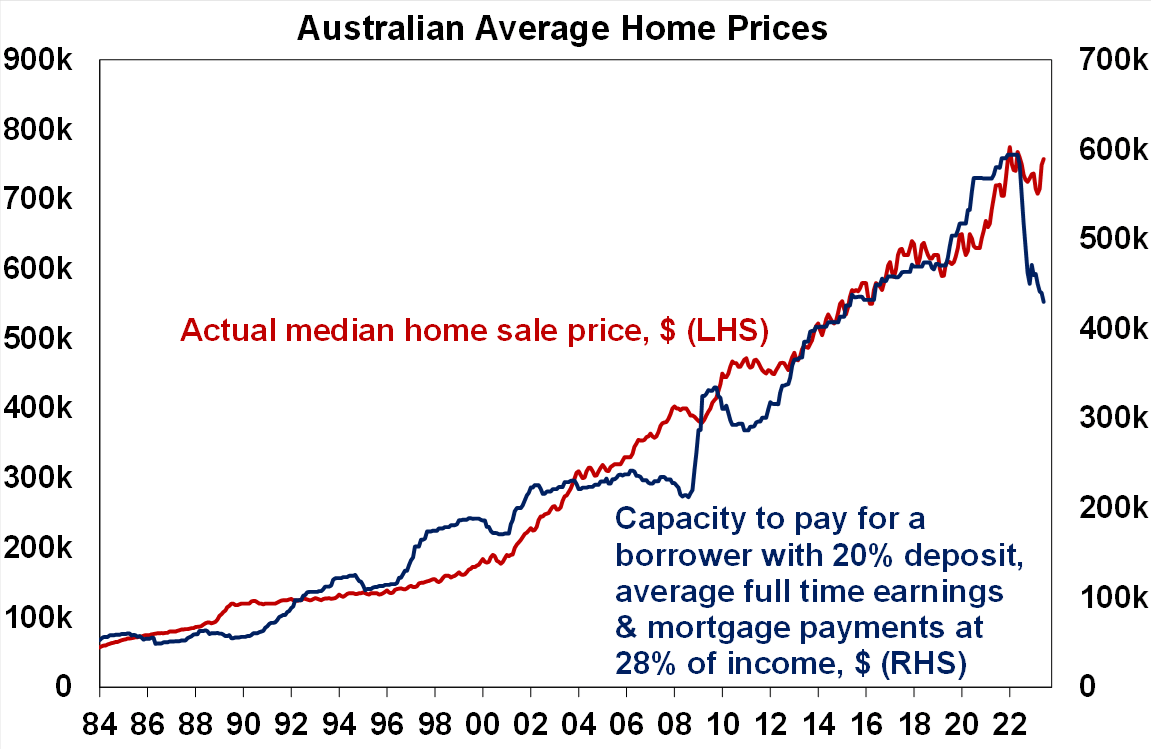

“The hit to home buyer capacity to pay from higher rates remains high – we estimate the capacity to pay for a borrower with a 20% deposit and on full time average earnings is around 28% lower than it was in April last year.”

Dr Oliver says that historically this has had a close relationship with home prices (see the chart below) and points to an adjustment later on which could come once less interest sensitive housing demand is exhausted.

In the meantime the RBA appears loaded for bear.

They’re seeing wages growth risk accelerating, fixed rate mortgages are now resetting to much higher interest rates and they reckon more than 15% of all Aussie variable rate borrowers (circa 1 million of us) will be sitting on negative cash flow by Xmas.

Westpac says all of this, combined with higher unemployment, could lead to a mini-flood of listings by distressed sellers.

“Low ‘on-market’ supply looks to be accentuating some of these drivers,” the bank says.

“The weak market has clearly discouraged many sellers with both new listings and total stock on market below average across the major capitals and extremely low when viewed as a share of the total dwelling stock.”

These ‘thin’ market conditions mean small shifts in demand can have a bigger than usual impact on prices.

Renting in Australia: It’s quite sh*t.

Housing recoveries typically only emerge once the RBA is actively cutting rates or is very clearly poised to do so. Price gains also tend to follow a sustained lift in turnover, not vice-versa.

Rising rents could reduce the tightness in the rental market by encouraging more young people to move into share accommodation thereby pushing household size gradually back to pre-pandemic levels, easing some of the tightness in the rental market.

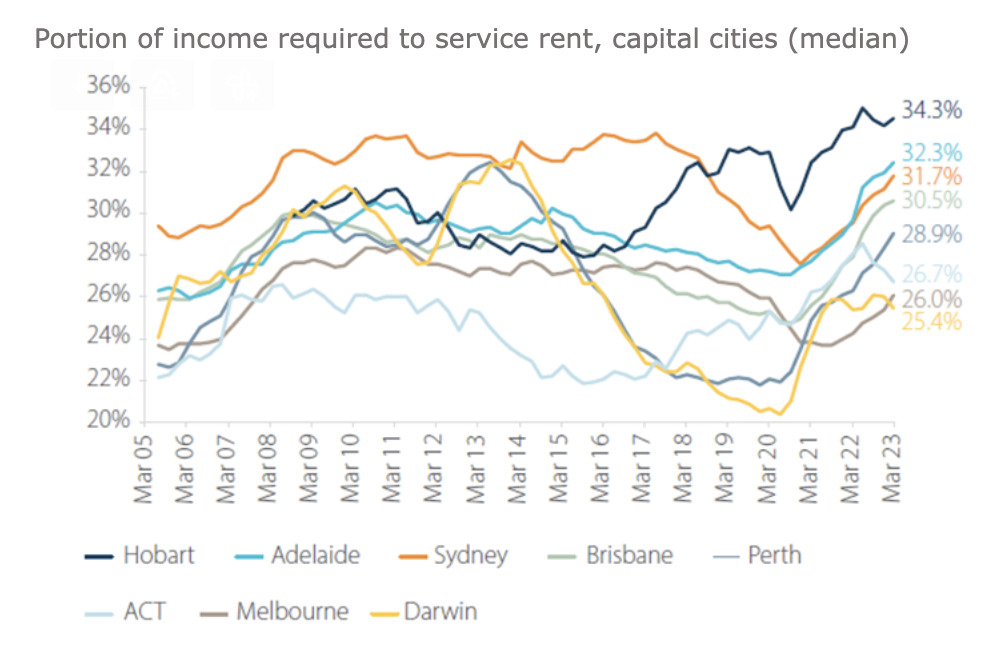

But ANZ/CoreLogic research released last week shows rental affordability – the portion of income required to service a new lease – is at the highest level since June 2014, with 30.8% of a renter’s income required to service a new lease nationally, for a median income household.

At the lower household income level, 51.6 per cent of income would be required, suggesting particular pressure for households at the 25th percentile income level.

Let’s not forget that Governor P. Lowe and his RBA goons have also been careful to add any rebound in property prices as being a potential reason for giving rates a further nudge.

Putting it plainly: the reboom itself ignites further RBA interest rate rises. Dr Oliver says rising home prices could drive a positive wealth effect offsetting its efforts to try and slow consumer spending down.

In past cycles lower interest rates have been required to drive a sustained rise in home prices (see the second chart below) and this, from Dr Oliver’s POV, is “unlikely until later this year or early next”.

“So, while our base case is that home prices have bottomed with stronger increases likely next year, the risk of another leg down as the full lagged impact of interest rate hikes on the property market and on unemployment materialises is high.

“A recession (which is now a high and still rising risk as rates keep rising) would add to the risk of another down leg in property prices.”

Interestingly, Dr Oliver says, Australia is not alone in seeing a stabilisation/rise in home prices. Something similar is being seen in the US, UK, Canada, Germany and Sweden.

“A number of factors appear to be at work including: the initial rate hike ‘sticker shock’ wearing off; talk that rates may be near the top; constrained supply and a rebound in immigration (Canada’s population is rising almost 3%); still strong jobs markets; savings built up through the pandemic; earlier than normal home price falls in response to rate hikes.

“If it continues it will worry central banks (with a positive wealth effect possibly boosting spending) but as in Australia, there is also the risk of another leg down in home prices if rates keep rising and economies go into recession with rising unemployment.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.