Bitcoin punches back up above $US10k, but it’s a rollercoaster ride

Getty Images

Bitcoin (BTC) has taken traders on a lively mid-week rollercoaster.

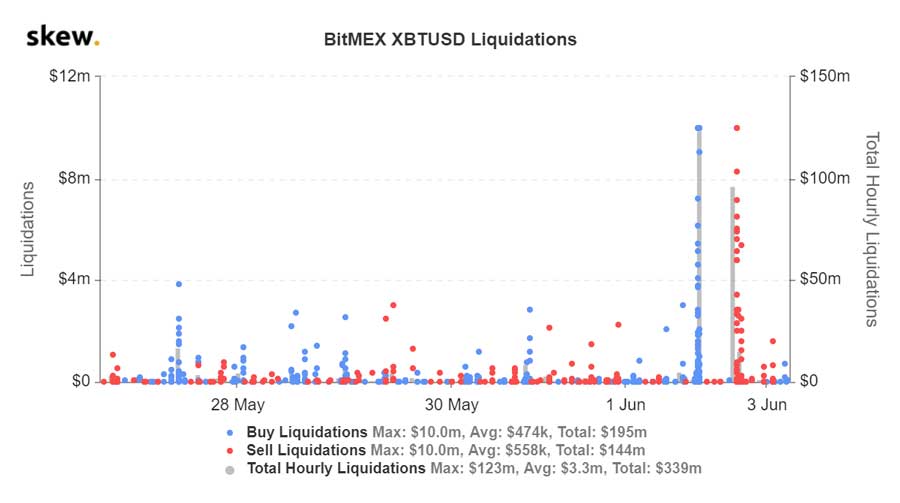

BTC surged $754 Tuesday morning, to a weekly high of $15,134 in just 35 minutes on BTC Markets. The rally was partly due to a cascade of short liquidations on Seychelle’s-based derivatives exchange BitMEX.

BitMEX, the world’s third-largest exchange, can influence BTC prices on spot exchange like BTC Markets.

As prices climbed on BitMEX, traders were squeezed from $US123m ($178.2m) worth of short positions, the largest such event since October 2019. This roused bullish sentiment and kicked off a price rally that took BTC from $US9,400 to just over $US10,000.

Four minutes later, prices on BTC Markets began to react to the move. BTC’s value shot up to $15,134, its weekly high. The asset’s price then consolidated between $14,400 and $15,000.

Market sentiment quickly reversed 16 hours later, as BTC plummeted 8 per cent to $13,592 early Wednesday morning.

The sudden crash can once again be attributed to further liquidations on BitMEX. This time, $96m worth of long positions were forced to close as prices dropped.

BitMEX allows its users to trade up to 100x margin, meaning they can borrow funds to add to their position.

Trading on margin can increase profits, but it also increases risk. If prices move too far in an unfavourable direction, the margin position is forced to close by the exchange in the form of liquidation.

At the height of this week’s rally, the total digital asset market capitalisation reached $412.85bn. It now sits at $396bn, with BTC dominance at 64.8 per cent.

BTC’s market value decreased 3.2 per cent overall this week because of the asset’s turbulent behaviour.

Investor activity continues to break records

The Chicago Mercantile Exchange (CME) BTC options market continues to break records.

Options volume and total open interest reached $US66m and $US259m respectively on May 28. This is a 65 and 48 per cent increase over previous respective records.

Ethereum markets

Ether (ETH), the native token to the Ethereum blockchain network, is the second largest digital asset by market capitalisation.

The token shares many fundamental properties with BTC. Both assets are purely digital blockchain-based assets that use a scarcity model to build value. Both can be used for payments, trade or store value.

Ethereum’s point of difference is that it’s a programmable network. Applications, such as digital asset wallets, financial applications or even games, can be built by anyone and run over the network.

Many tokens, such as Enjin Coin (ENJ), OmiseGo (OMG), Basic Attention Token (BAT) or Power Ledger (POWR) are all based on the Ethereum network.

Due to its functionality and versatility, Ethereum has the largest and most active blockchain community worldwide.

ETH has so far outperformed BTC this year with a 90 per cent year-to-date gain compared to BTC’s 37 per cent. ETH’s price moves with some correlation to BTC, and as a result, was affected by this week’s price fluctuations.

Despite taking on a 5.56 per cent price dive along with BTC on Wednesday, ETH still managed a gain of 6.5 per cent this week. The asset currently sits at $355.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.