Bitcoin and Palladium ETFs steal the show, while a new ethical bond ETF hits the market

Bitcoin and Palladium ETFs steal the show. Picture via Getty Images

- Australian ETF industry hits $233 billion in funds

- International equity leads inflows, with VGS, QUAL, and IVV topping ASX list

- Betashares launches ethical Australian bond ETF with ESG focus

The Australian ETF industry continues to reach new heights, with the latest VanEck ETF Industry Pulse for October 2024 reporting a record $233 billion in funds under management.

This marks a 2.7% increase from September, and a huge 54.5% jump from October 2023.

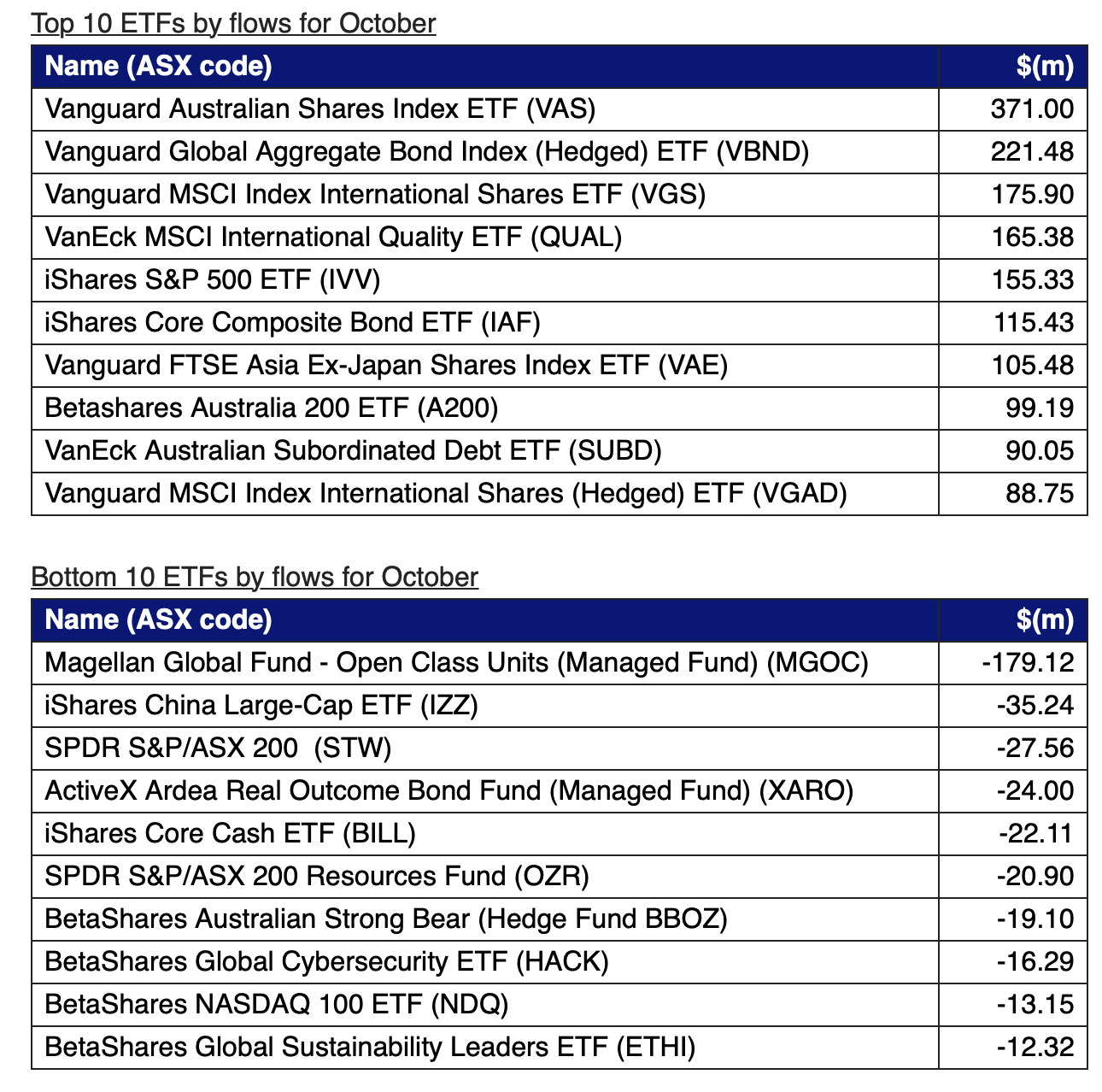

International equity funds led the way in October, with three key funds – Vanguard MSCI Index International Shares ETF (ASX:VGS), VanEck MSCI International Quality ETF (ASX:QUAL) and iShares S&P 500 ETF (ASX:IVV) – capturing the majority of inflows.

While flows into Australian equity funds were more muted, the Vanguard Australian Shares Index ETF (ASX:VAS) ETF emerged as the top performer in terms of total flows for the month.

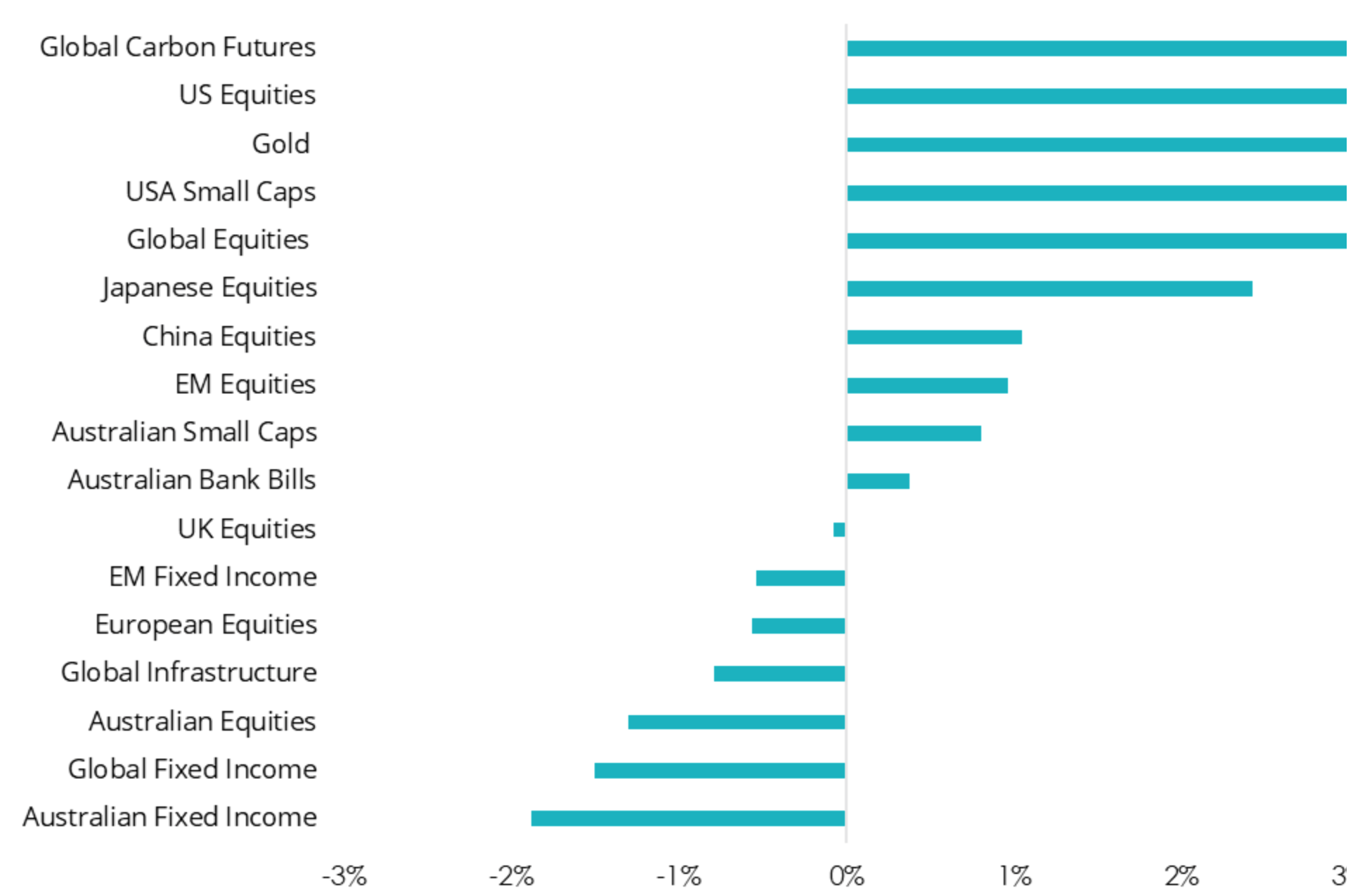

In terms of top level asset allocations, Carbon futures, US Equities, Gold and Small Caps had the most interest from investors, while investors were pulling out of Aussie fixed income.

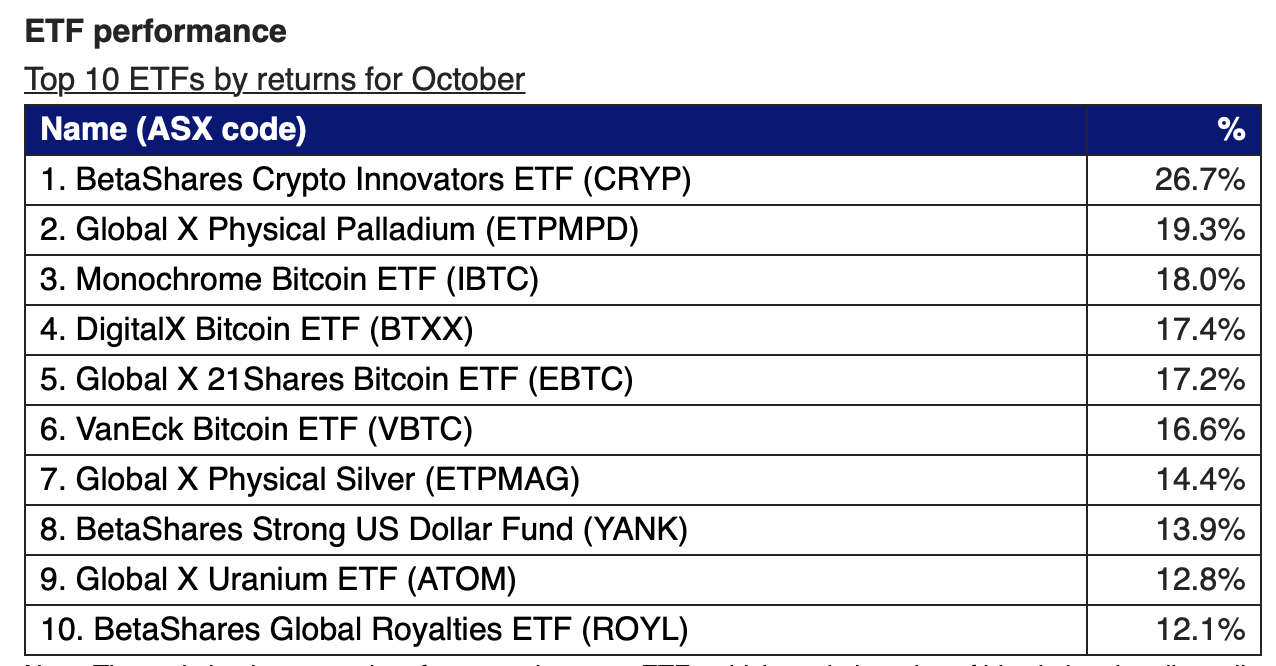

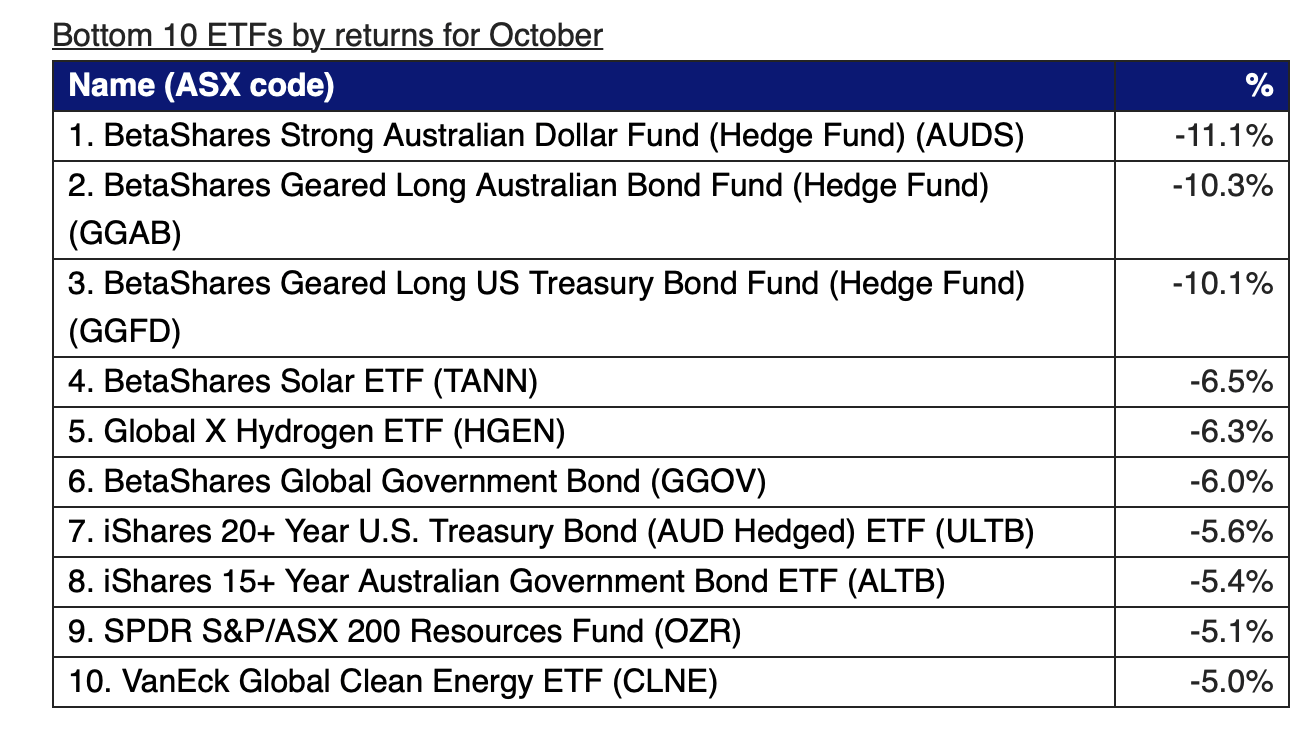

Best and worst ETF returns in October

In the fixed income sector, there was a noticeable risk-off sentiment, though investors appeared to focus more on broad exposure rather than a specific outlook on duration.

Bitcoin, often seen as a ‘Trump trade’, had an exceptional month, in line with the ‘Uptober’ trend, where cryptocurrency tends to rally as the year draws to a close.

Meanwhile, the Global X Physical Palladium (ASX:ETPMPD) ETF also had a big month.

ETPMPD gives investors easy access to palladium by backing its value with physical palladium bars.

This means the palladium is securely stored and individually identified, so there’s no risk of the company defaulting on the product. When you invest in ETPMPD, you’re essentially investing in physical palladium without the hassle of needing to store the metal yourself.

Palladium is a rare precious metal that’s most commonly used in the production of catalytic converters in cars. These converters help reduce harmful emissions by turning toxic gases from a vehicle’s exhaust into less harmful substances.

The worst-performing ETF in October was a fund that bets on the value of the Aussie dollar, the Betashares Strong Australian Dollar Fund (ASX:AUDS). This fund provides a leveraged exposure to fluctuations in the value of the Aussie dollar against the US dollar.

As we know, the US dollar has been climbing against major currencies in October, as US Treasury yields moved rapidly higher.

And, a new ETF listing on the ASX

Last week, Betashares launched a new ETF aimed at ethically conscious investors: the Betashares Ethical Australian Composite Bond ETF (ASX: AEBD).

This ETF provides exposure to a diversified portfolio of Aussie government and corporate bonds that meet strict ethical criteria.

The fund screens out issuers with involvement in fossil fuels or other activities deemed inconsistent with responsible investment practices.

AEBD not only tracks an index on environmental, social and governance (ESG), but also prioritises bonds with strong risk-adjusted income potential.

The launch comes at a time of growing interest in fixed income investments, with rates expected to fall across the world.

“We believe AEBD will become a foundational element in the portfolios of many ethically minded Australian investors,” said Betashares CEO, Alex Vynokur.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.