Australian house prices rise again but post-COVID boom is looking ‘unsustainable’

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Australian house prices ripped higher again in June, but a bit of heat is coming out of the market.

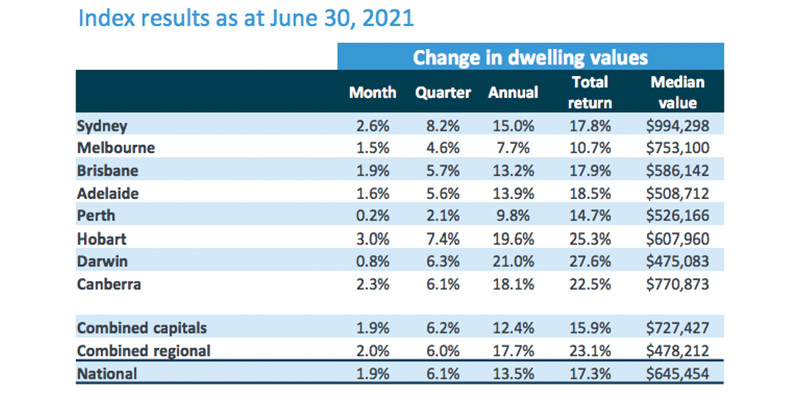

Data from CoreLogic showed home values across the country rose by another 1.9% in June which left the annual gain at 13.5% — still tracking at close to 20-year highs.

The market has been running hard and there are now signs the epic post-COVID housing rally is beginning to cool off in the wake of some stomping first-half returns.

For starters, results diverged more clearly across capital city markets last month. Sydney and Hobart still stormed ahead while Perth prices only just edged higher.

In addition, the rate of monthly change — 1.9% — was almost a full percentage point lower than the gains registered in March.

Here’s how capital cities and regional areas performed:

Australian house prices — the outlook

Fundamentally, the same conditions that supported this year’s historic rally are still in place.

The jobs market rebound has beaten expectations and there are signs the labour market is tightening — a key prerequisite for wage growth.

Consumer confidence is at decade highs and household savings rates are also historically high, while interest rates remain anchored.

On that front, the only change over the past month is that consensus seems to be forming that rates will rise faster than the RBA currently predicts — perhaps as soon as 2022.

In addition, CoreLogic noted recent correspondence from the bank regulator APRA to major lenders to “ensure proactive risk management in home lending”.

Since there, “there have been early signs of more conservative home loan assessments”.

When property values are rising as fast as they have been, a key component in the outlook is credit growth because house prices are partly a function of the loan-size buyers can get approved to pay for them.

As a sign of little changes taking place in the market, CBA last week raised the minimum rate buffer it uses to assess mortgage application by 15 basis points, to 5.25%.

APRA data for May (released this week) showed housing credit rose by another 0.6% in the month, largely driven by loans to owner-occupiers as loans to housing investors rose by just 0.1%.

Lending growth to owner-occupiers has been a defining feature of the post-COVID bull market which differentiates it from the previous growth cycle, particularly in the major east coast markets of Sydney and Melbourne.

Citing the effect of lockdowns currently in place across a number of Australian cities, CoreLogic said the housing market has largely shrugged off previous measures.

However, “outcomes for the housing market and industry will depend upon how long lockdown conditions last across parts of the country”, said Eliza Owens, the group’s Head of Australian research.

If they do become extended, the focus as it pertains to house prices will shift to what economic support measures are put in place.

More broadly, Owens said the booming growth seen through the first part of this year is proving “unsustainable”.

Similar sentiments were offered by CBA economists Kristina Clifton and Belinda Allen, although no one is predicting any kind of sharp reversal in the near future.

“New lending is growing at a fast pace and auction clearance rates remain high,” Clifton and Allen said.

“We expect prices to continue to lift but the pace of the monthly gains should slow.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.