Think Big: Here’s when every major central bank will raise interest rates, CBA says

US Fed chair Jerome Powell. (Pic: Getty)

For the importance of interest rate forecasts to stock markets, one need look no further than last Monday’s selloff on the ASX.

The falls followed a key update on US markets last Friday, when US Fed committee member Jim Bullard indicated the central bank may start raising rates as early as 2022.

Just two days earlier, the markets had digested the Fed’s revised forecast which indicated rate hikes would start in 2023 – a notable shift from its oft-stated position of ‘2024 at the earliest’.

Bullard’s comments set off a round of jitters, and while markets have since steadied, it’s perhaps evidence of the delicate tightrope policymakers will have to walk amid the post-COVID economic rebound.

In that context, CBA’s economics team has provided its own set of forecasts about when central banks globally will start raising rates.

Analyst forecasts provide a useful benchmark, in the sense that rate rises in line with the consensus view may not rattle markets as much.

But if timelines get pulled forward, that could put pressure on stock valuations. Here’s when CBA expects to see the first move by the RBA and the US Fed:

Australia – November 2022

On the home-front, the RBA has so far moved in lockstep with the US Fed as it maintains the consistent mantra of ‘2024 at the earliest’.

But CBA’s head of Australian economics Gareth Aird says we can nix that idea.

Instead, he’s pencilled in November 2022 as his central scenario for the first rate-hike, in response to strength in the domestic labour market and higher wages.

That will be followed by four more increases of 0.25%, bringing the official cash rate to 1.25% by the end of Q3, 2023.

Detailing his view, Aird said the speed at which Australia’s jobs market has rebounded from the pandemic has been “phenomenal”.

May data showed the unemployment rate has fallen to pre-COVID levels around 5%.

Just as importantly, underemployment levels – which include people in jobs who would like to work more hours – have also slumped sharply.

In May, Australia’s underutilisation rate “declined to its lowest level since February 2013”, Aird said.

The relationship between unemployment and wage growth used to be strong, although that hasn’t been the case in recent years.

However, there is still a “strong historical relationship” between underutilisation and wage growth”, Aird said.

Along with the strength of Australia’s economic rebound, another factor creating tightness in the labour market is the decline in immigration stemming from Australia’s border closures, which are expected to remain in place through to the middle of next year.

Unprecedented levels of fiscal stimulus are also part of the story, Aird said.

As a result, he expects the underutilisation rate to keep falling to 10% by the end of next year – a level it hasn’t reached since 2008.

That will flow through to higher wages, Aird says. And according to the RBA, higher wages will act as a central catalyst for sustainable increases in inflation.

In turn, investors should prepare for rate rises to kick off well before the RBA’s current stated timeline, CBA said.

USA – March 2023

The US Federal Reserve will always be central to the outlook for global interest rate policy, given that it manages the world’s reserve currency.

The USA’s post-COVID economic growth metrics remain strong, although previous CBA research flagged the idea that fears of a US inflation blowout may be overblown.

However, the US Fed’s June meeting “suggests its tolerance for an inflation overshoot may be less than previously thought”, CBA’s international economics team said this week.

In terms of timelines, CBA reckons the Fed will start tapering its asset purchase program this October — a gradual process that will conclude in September 2022.

The bank has pencilled in the first rate hike six months after that, in March 2023.

“We have pencilled in further increases in the Funds rate until it reaches 1.50% in 2024,” the CBA team said, noting their forecast is “more aggressive than current market pricing”.

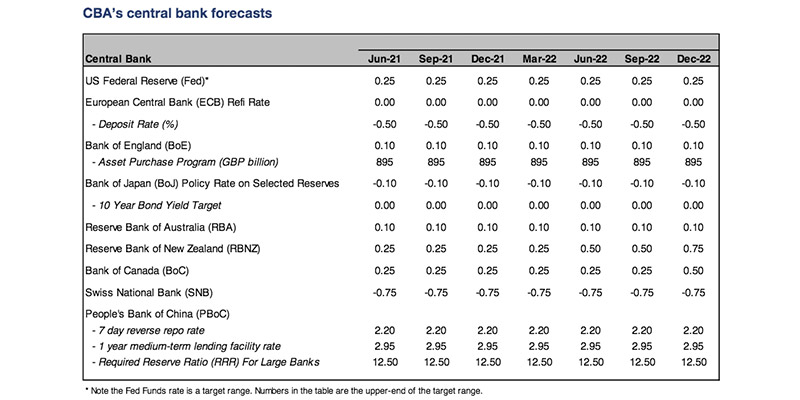

Here’s a table of CBA’s interest rate forecasts for central banks globally, through to the end of next year:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.