Australian house price slump has piqued buyer interest

CBA said its home buying sentiment index rose to the highest level since July 2019 last month. (Pic: Getty)

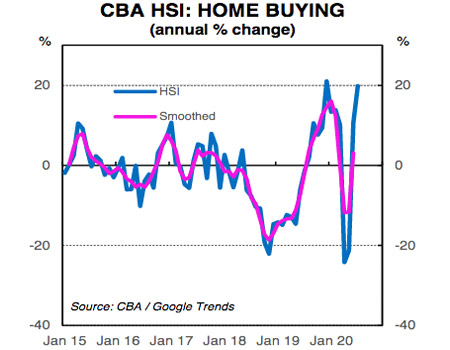

Spending intentions around buying a home increased again in July, according to monthly data presented by Commonwealth Bank.

CBA chief economist Stephen Halmarick also flagged improvements in spending intentions around retail, travel (from a low base) and education.

And the improved sentiment around home buying makes for an interesting data point in the current environment, where house prices remain subdued in the wake of the COVID-19 pandemic.

Monthly data from CoreLogic at the start of August showed home prices fell nationally for the third straight month in July, led by steeper declines in Sydney and Melbourne.

But at the same time, CBA’s home-buying intentions index continued to bounce back from the COVID-19 shock:

Australian property’s pre-COVID highs

Sentiment around buying a new home has now climbed back to the same level it was in July 2019, which was just after the RBA announced the first of a three-round rate cutting cycle which saw the official cash rates reduced from 1.5 per cent to 0.75 per cent.

Halmarick said gains in the index were driven largely by two key inputs: an increase in the number of home loan applications received by the bank, and a corresponding increase in the number of Google searches about buying a house.

He highlighted the RBA’s policy response to the pandemic, which saw rates slashed from 0.75 per cent to just 0.25 per cent. That in turn has flowed through to new record lows in the mortgage rates offered by banks — particularly for fixed rate mortgages.

“CBA data shows a rise in new mortgage applications taking advantage of low fixed rates, and this should help provide support to home buying in the future,” Halmarick said.

However, he added that downside risks to the positive trends need to be taken into account in the wake of stage-four lockdown restrictions for greater Melbourne introduced at the end of last month.

“Stage four lockdown in Victoria, border closures and the resulting drop in the population growth rate are a clear source of downside risk to home buying,” Halmarick said.

ASX flow-on effect from property prices

With one of the highest ratios of household debt to disposable income in the world, the direction of house prices is often cited as an important indicator of broader Australian economic activity.

Last week, UBS researchers selected a cohort of ASX stocks with either direct or indirect exposure to the housing market, with a corresponding view on their near-term performance outlook.

Among the companies with direct exposure — such as construction companies and real estate websites — the analysts’ top pick was building company CSR Ltd (ASX:CSR).

For the ‘indirect exposure’ group, they picked stocks in industries with exposure to a negative wealth effect from falling house prices, such as discretionary retailers and management.

Potential winners in that category included Corporate Travel Management (ASX:CTD), Webjet (ASX:WEB) and industrials company AMA Group (ASX:AMA).

Across the broader property market, analysis from Stockhead this week showed the ASX cohort of ASX-listed Real Estate Investment Trusts (REITs) and property investment stocks have also struggled for traction this year, with an average loss in 2020 of almost 20 per cent.

But a handful, including Rural Funds (ASX:RFF) and Vitalharvest (ASX:VTH), have bucked the trend.

The insights from CBA form part of the bank’s real-time analysis of domestic economic activity, leveraging data gleaned from more than 16 million customer accounts.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.