Aussie real estate horror: 28 Days Later

Via Getty

A big month (well, 28 days) in Aussie property has left Australian mortgage holders and renters alike all washed up and girt by these tremendously large numbers…

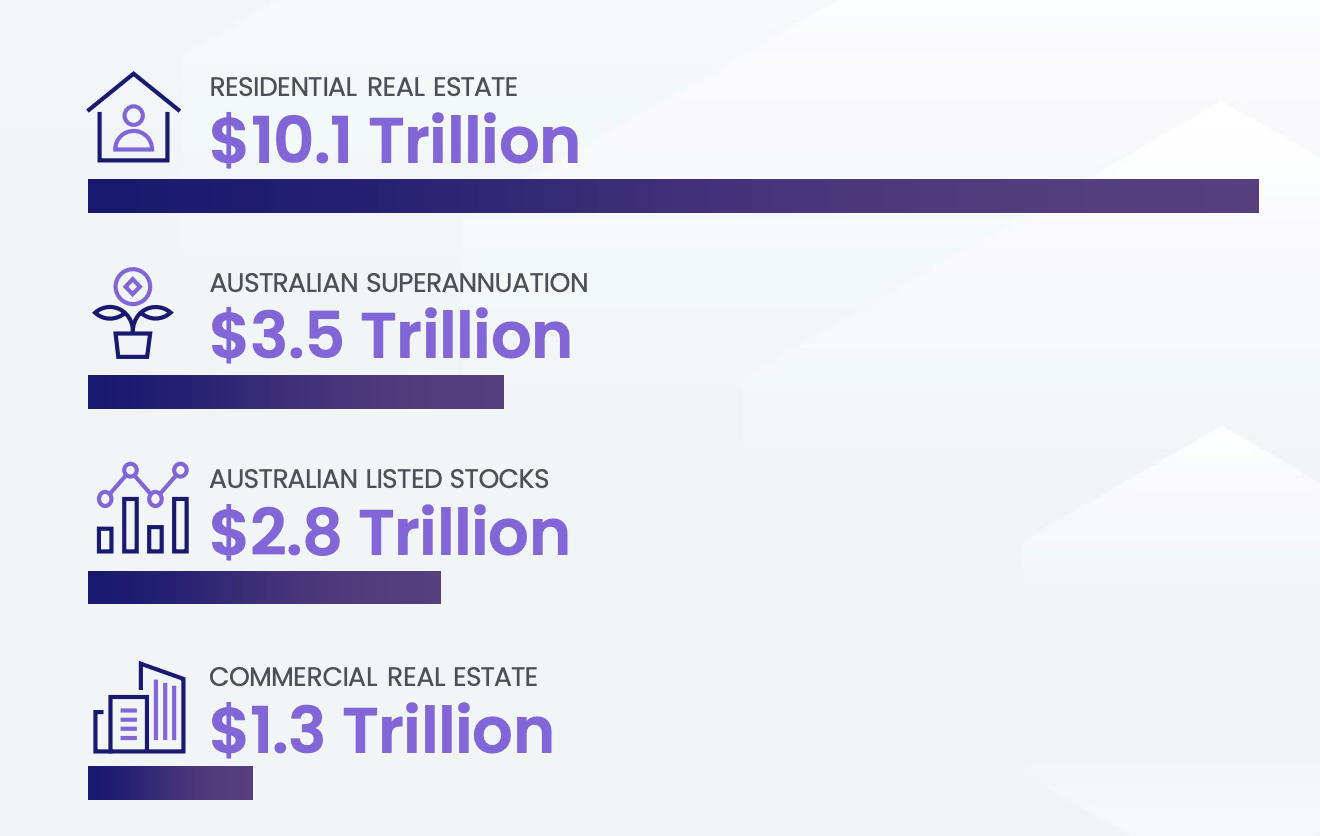

According to CoreLogic, what got the data in the first place, it’s residential real estate which basically girts the wealth in this island country, surrounded as it is by girtedness.

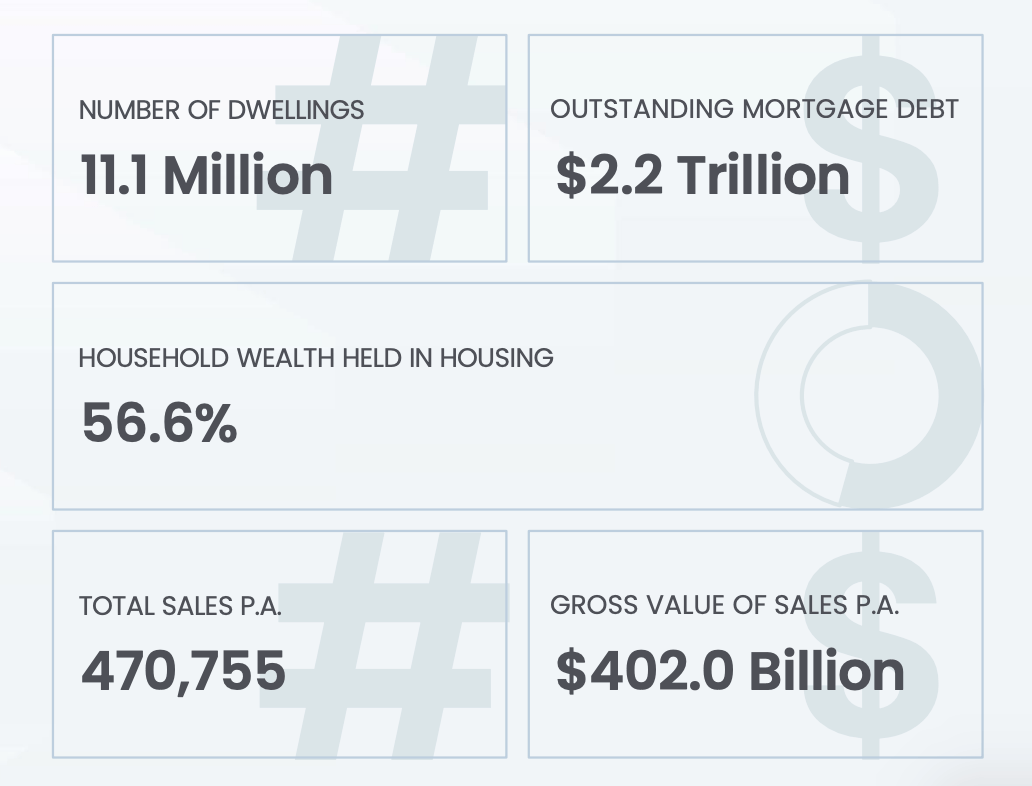

We’ve some $2.2 trillion in outstanding mortgage debt across the country (as of Monday) with loan refinancing activity remaining close to record highs, according to new data released last week by PEXA.

Over the last month (28 days) – even as the Reserve Bank (RBA) held the cash rate steady at 4.10% for the fourth straight month, Aussie mortgage-holders were adjusting to the ‘new normal’ of higher interest rates with no signs yet of a precipitous tilt over a ‘mortgage cliff’.

“Australia’s housing markets stabilised in early 2023 and have been recovering since around March, with a gentle lift in prices and sales volumes across most city locations. This recovery is gaining momentum, with prices, listings and sales all gathering pace through September,” says PEXA chief economist, Julie Toth.

“(The) extended pause in monetary policy tightening will foster greater confidence in the housing outlook, particularly among the majority of buyers who rely on mortgages to finance their homes.”

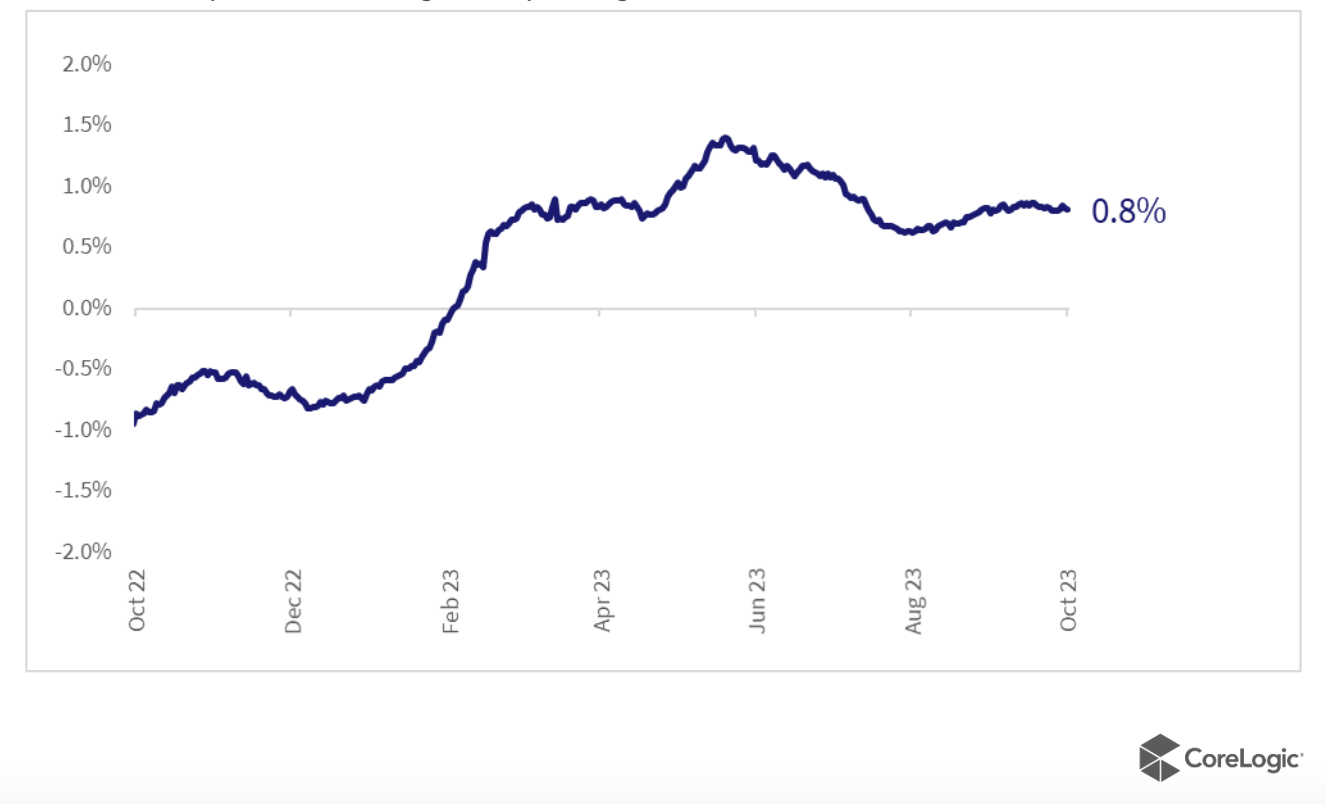

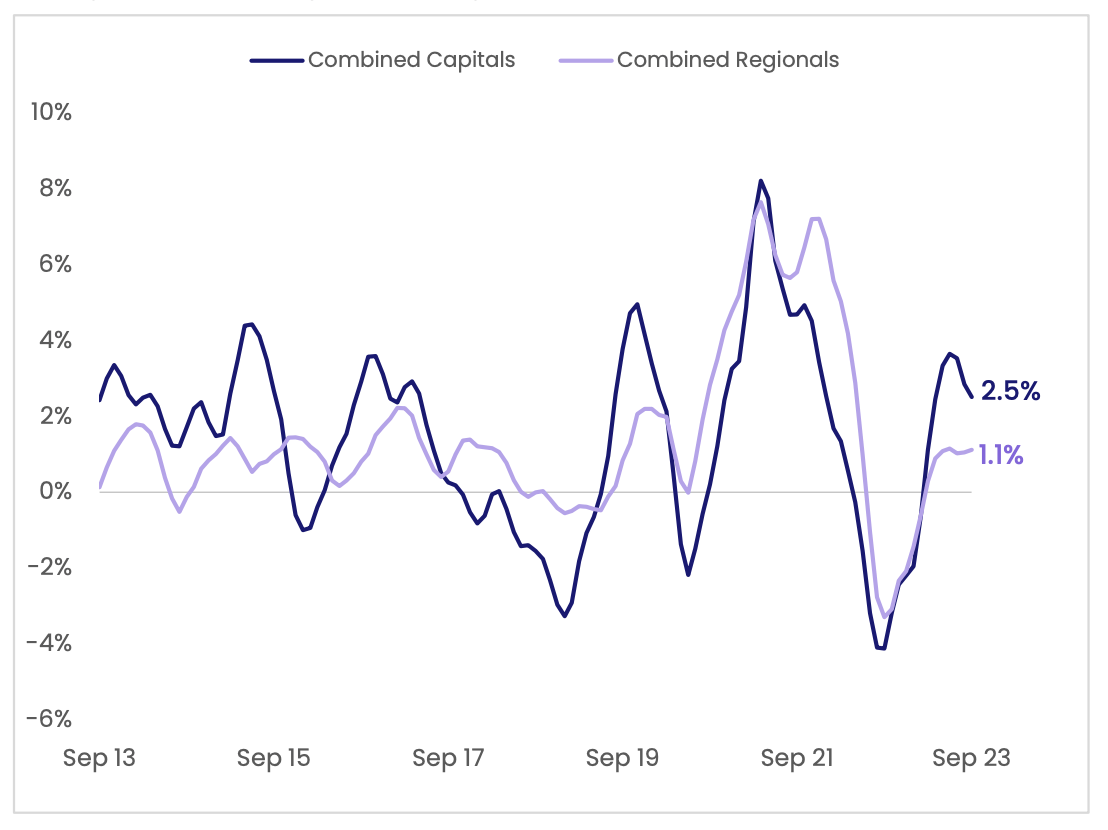

CoreLogic’s rolling 28-day change in the combined capitals home value index was 0.8% in the 28 days ending October 8.

CoreLogic’s Eliza Owen told Stockhead that although the growth trajectory across Aussie’s combined capitals has eased from the recent June peak of 1.3%, growth has still ‘trended steadily across the combined capitals for the past few weeks.’

Combined capital cities, rolling 28-day change

PEXA data shows that the diabolical threat of a “mortgage cliff” for up to 800,000 fixed-rate lemmings borrowers – has so far failed to materialise in 2023, with judicious refinancing helping to cushion mortgage holders from the spiky rate rises… ‘and gives them time to adjust their spending to accommodate higher repayments.’

“PEXA’s Refinance Index shows loan refinancing volumes hit a record high in the first week of September, with the Index reaching 212.3 points in the week ending 3 September (seasonally adjusted),” Toth said last week.

The Index has receded only marginally since that peak.

As of 3 October, weekly refinancing volumes had fallen only 1.7% from the month earlier and remained 16.7% higher than the same week in 2022.

This is more than double the volume of refinancing mortgage-holders, compared to the lowest periods of Australia’s COVID-19 years in April-May 2020 and Feb-March 2021.

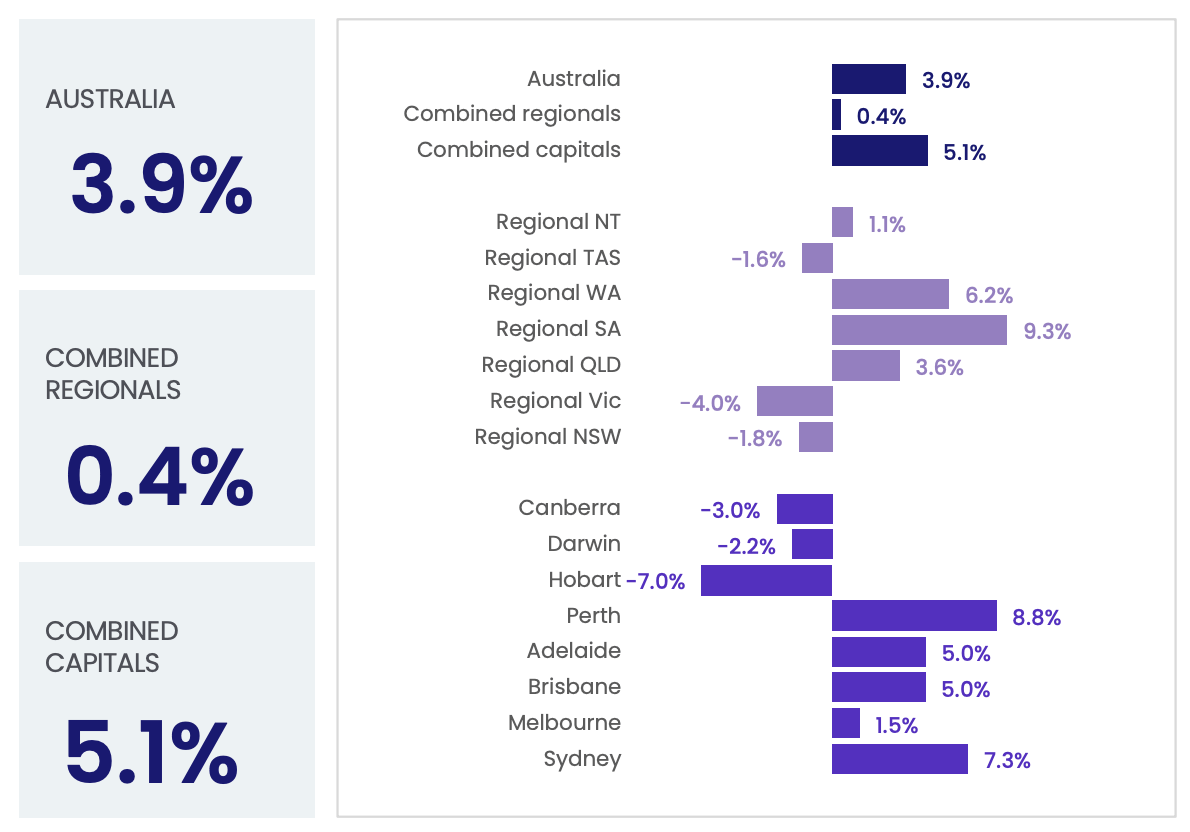

Three months of houses

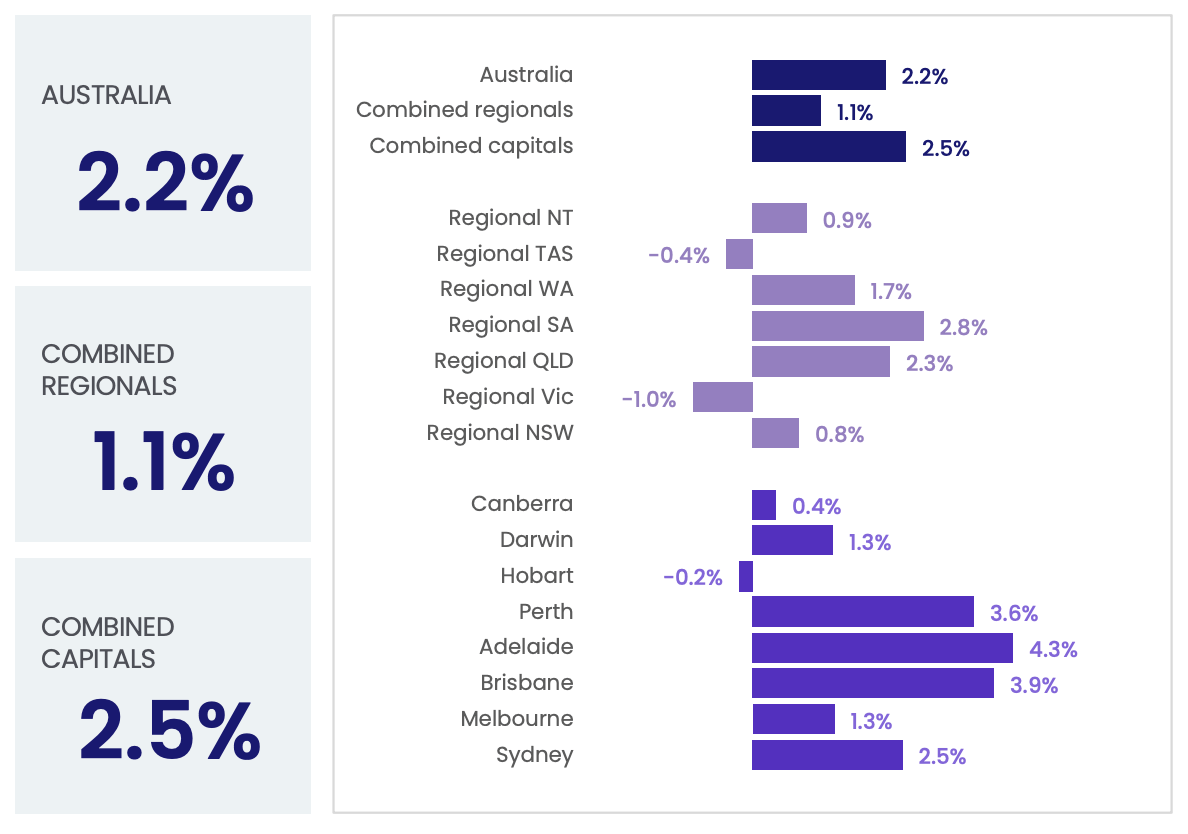

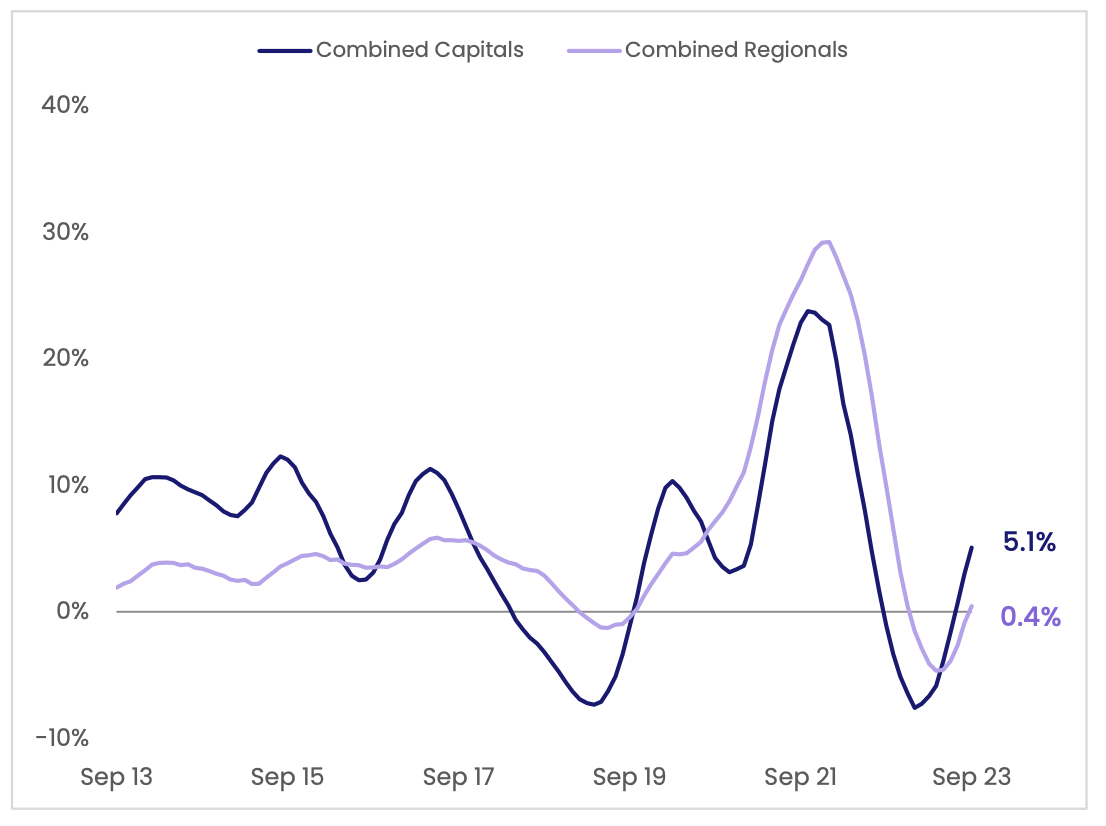

National home values rose 2.2% in the three months to September, Eliza says, which is down slightly from the 2.4% growth over the three months to August.

Change in dwelling values, three months to September 2023

Rolling quarterly change in dwelling values

12 Months of Houses

“Our upgraded Home Value Index model shows national dwelling values increased 3.9% in the year to September,” Eliza says. “The annual change in home values moved into positive territory in August.”

Change in dwelling values, 12 months to September 2023

Rolling annual change in dwelling values

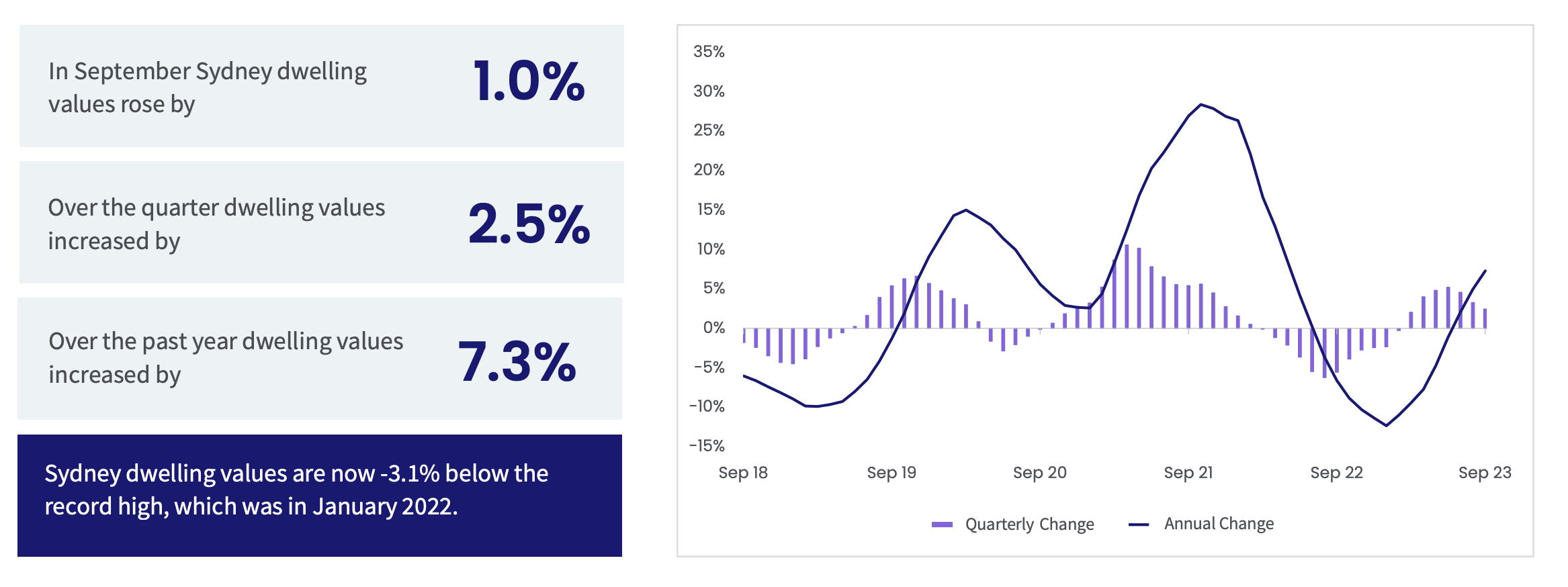

28 Days: Capital City Housing

The combined capital cities dwelling market value rose 0.9% in September, up from a 0.8% lift in August. Monthly increases across the combined capitals surpassed a 0.4% lift in the combined regional market over the month.

28 Days: Sydney aggregate prices -3.1% below record high

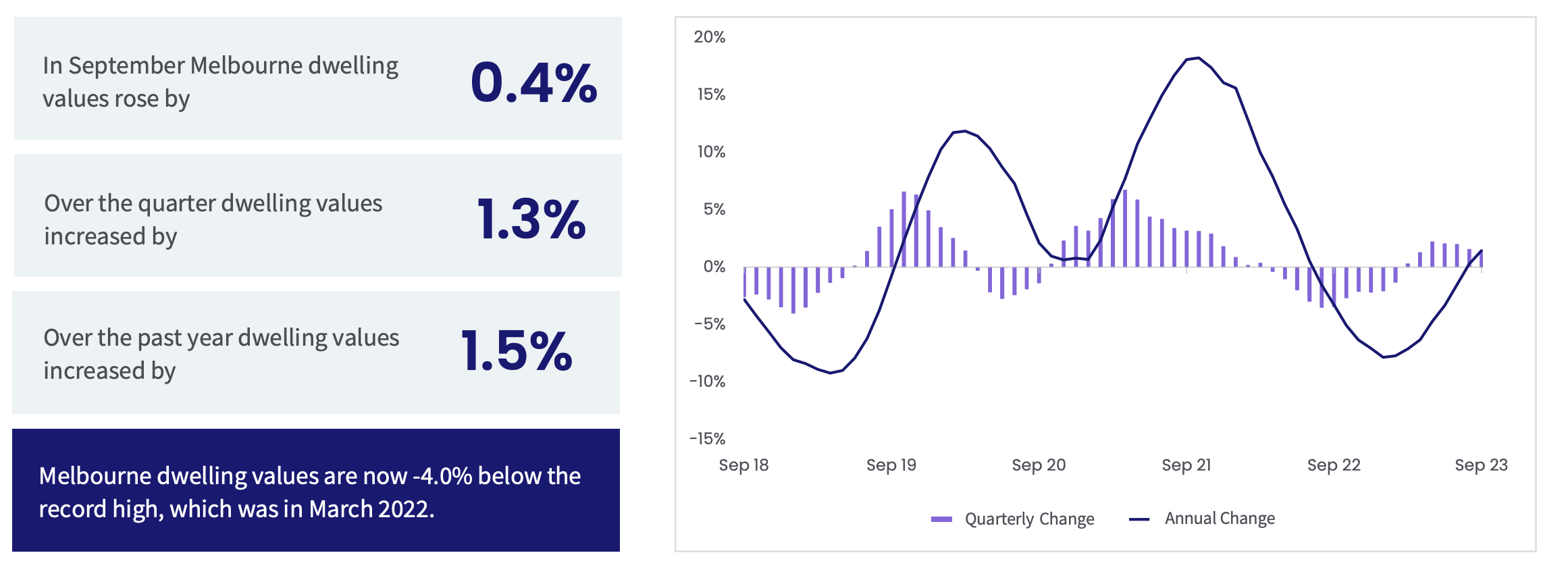

28 Days: Melbourne aggregate prices -4.0% below record high

28 Days: Brisbane aggregate prices -0.6% below record high

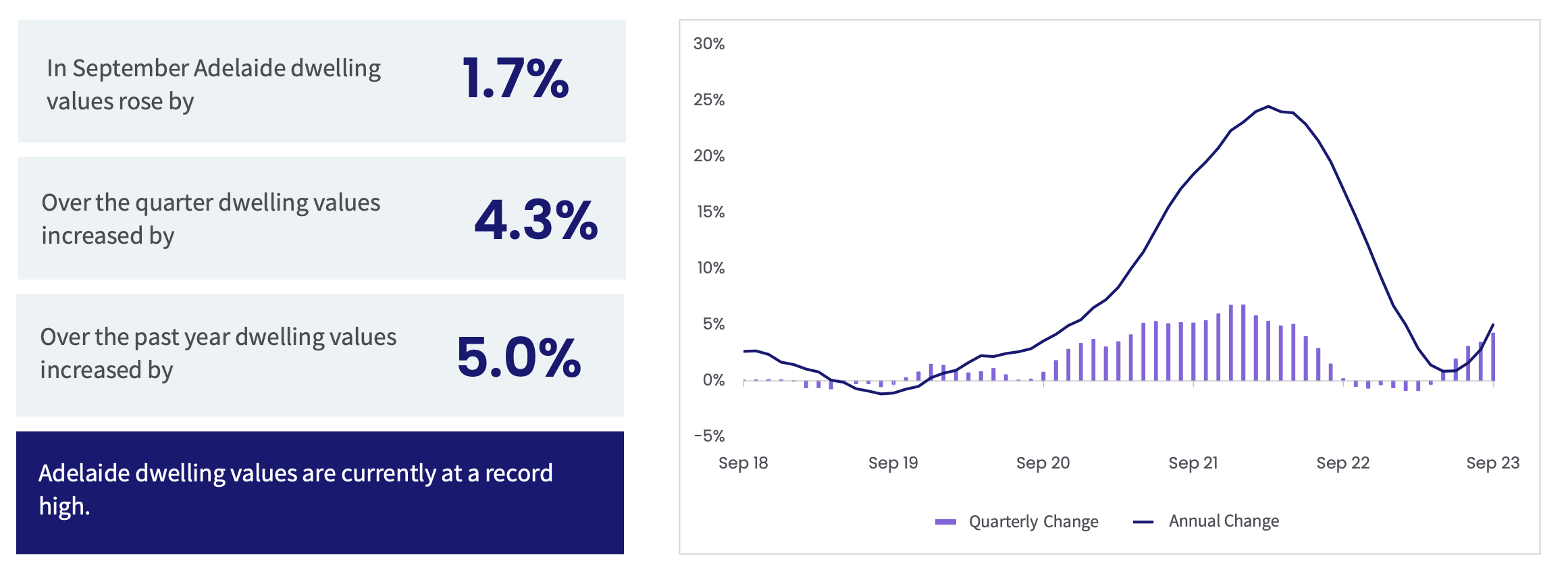

28 Days: Adelaide aggregate prices are at record highs

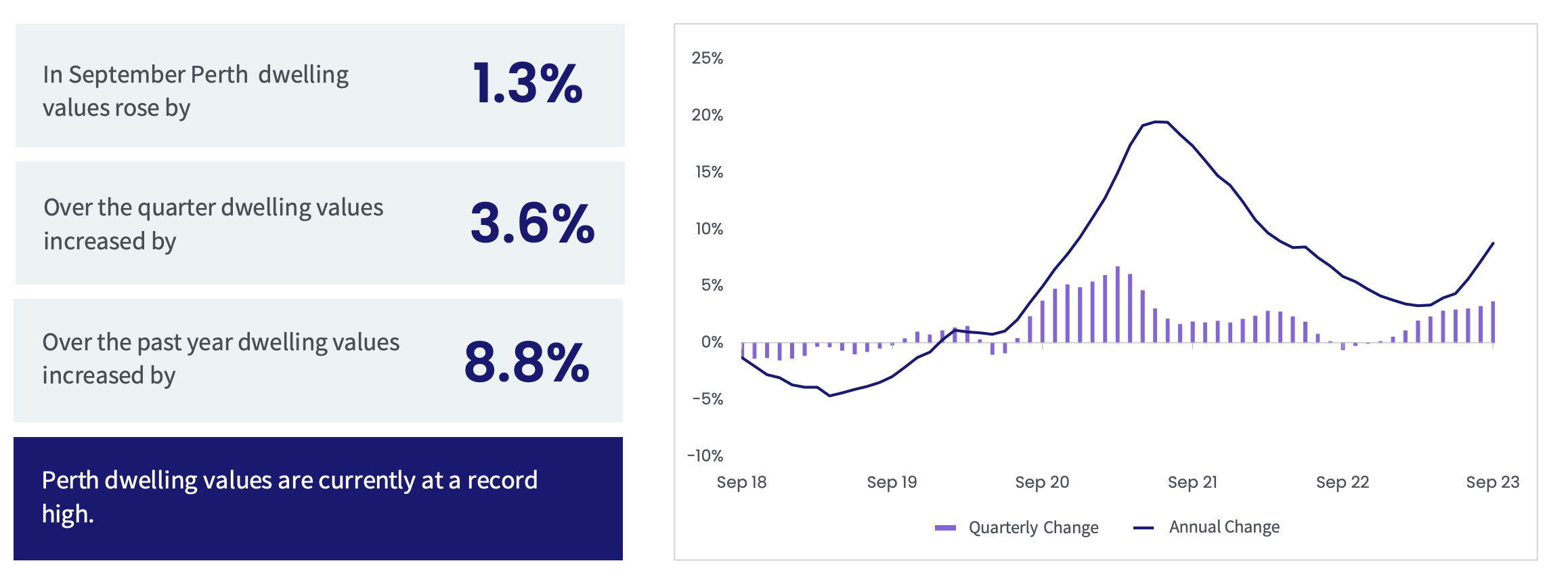

28 Days: Perth aggregate prices are at record highs

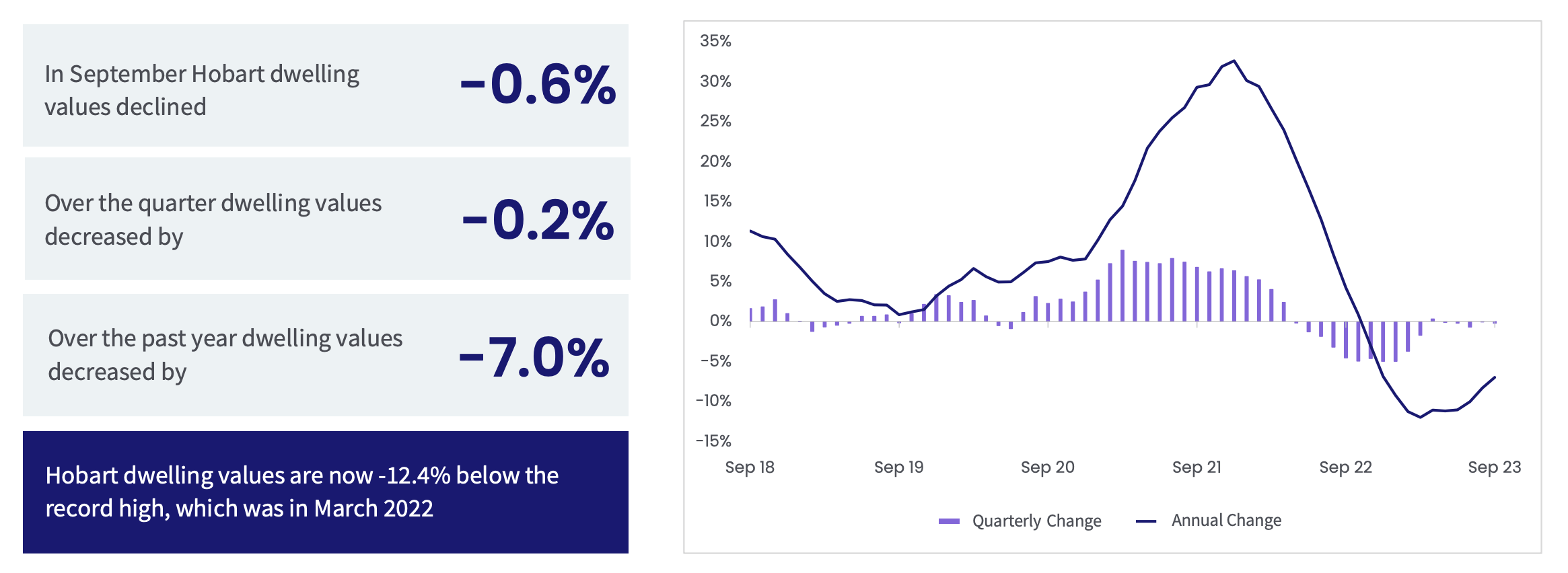

28 Days: Hobart aggregate prices are at -12.4% below record highs

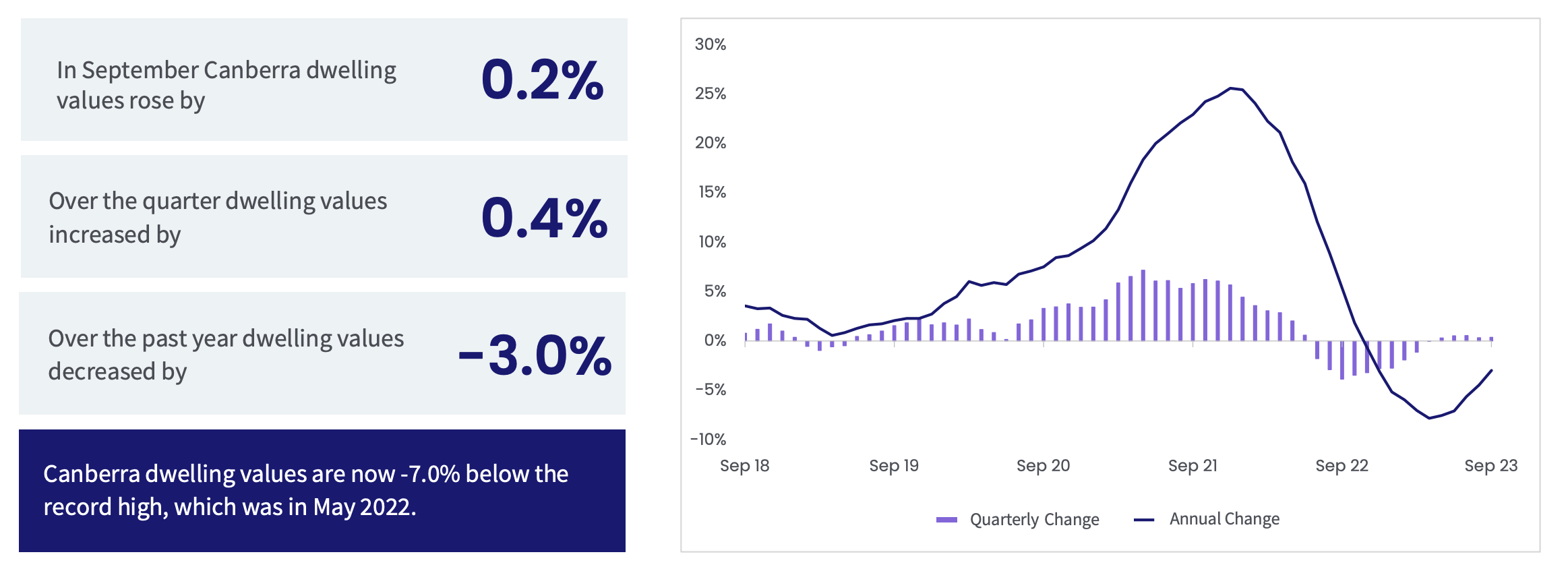

Housing Cycle: Canberra aggregate prices are now -7.0% below record highs

28 Days Later: Renting

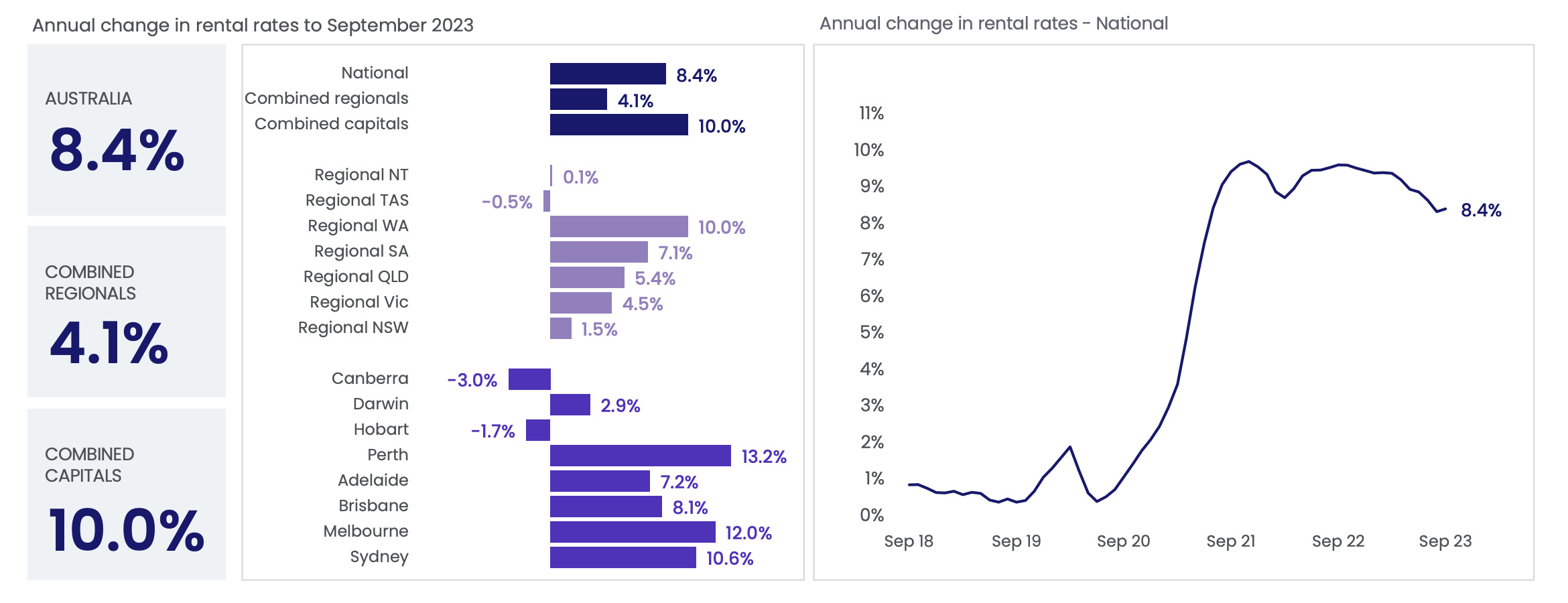

Australian rent values increased 0.7% in September, which means that over the last year of rising rates and rising rents, the weekly cost of renting has jumped 8.4%. Which is a lot, in just 12 months.

CoreLogic data shows that Australian annual growth in rent values remains elevated on the previous decade average, and accelerated slightly in September.

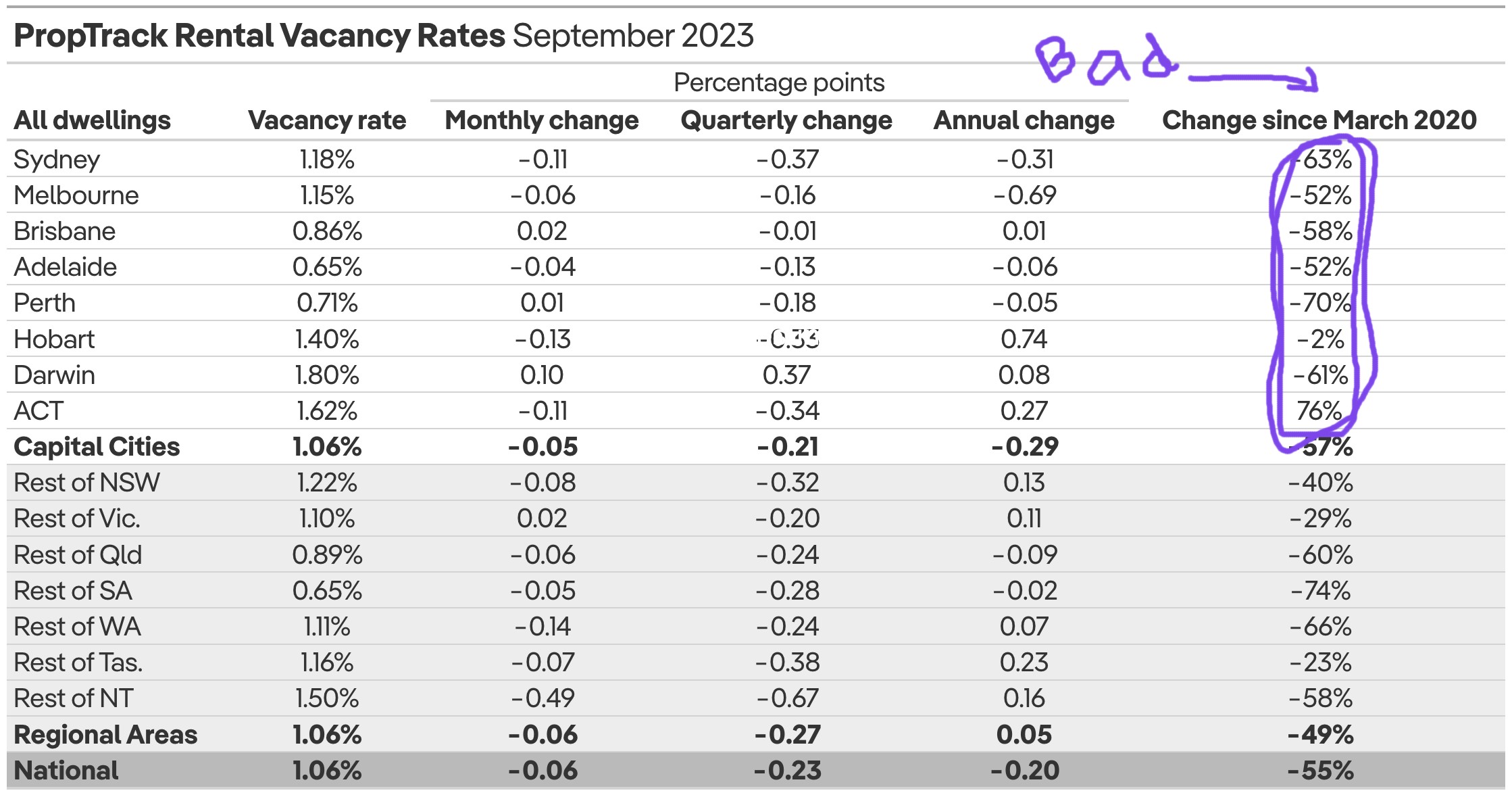

The national rental vacancy rate got squeezed even tighter last month according to both PropTrack and CoreLogic.

The national rental vacancy rate got squeezed even tighter last month according to numbers out of both leading Aussie property data firms, PropTrack and CoreLogic.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.