Want to rent property in Australia? Good luck. You’ll never get a less vacant look than right now

Via Getty

Here’s the latest on Australia’s post-pandemic rental crisis.

It’s very bad.

And getting worse.

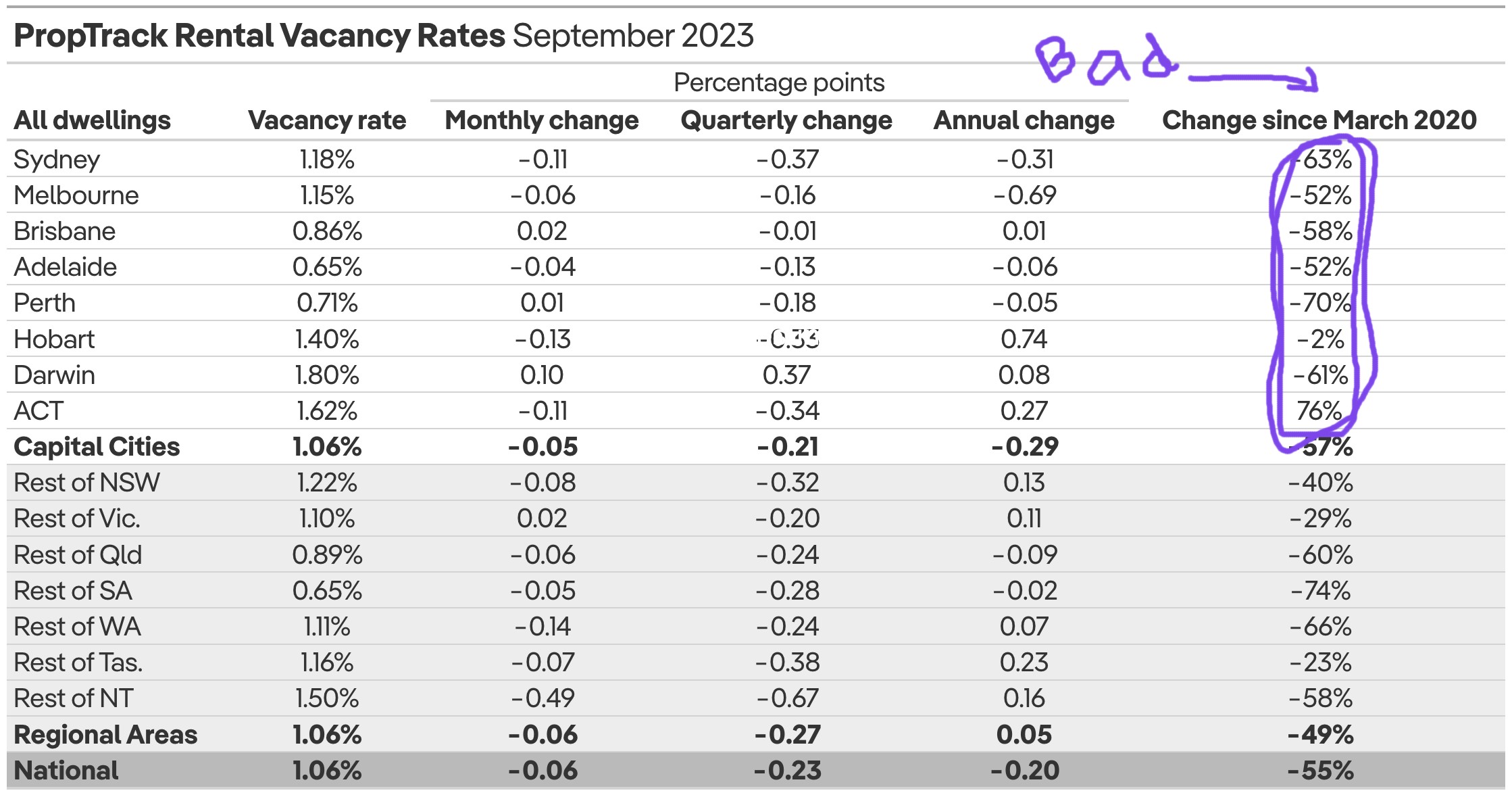

The national rental vacancy rate got squeezed even tighter last month according to numbers out of both leading Aussie property data firms, PropTrack and CoreLogic.

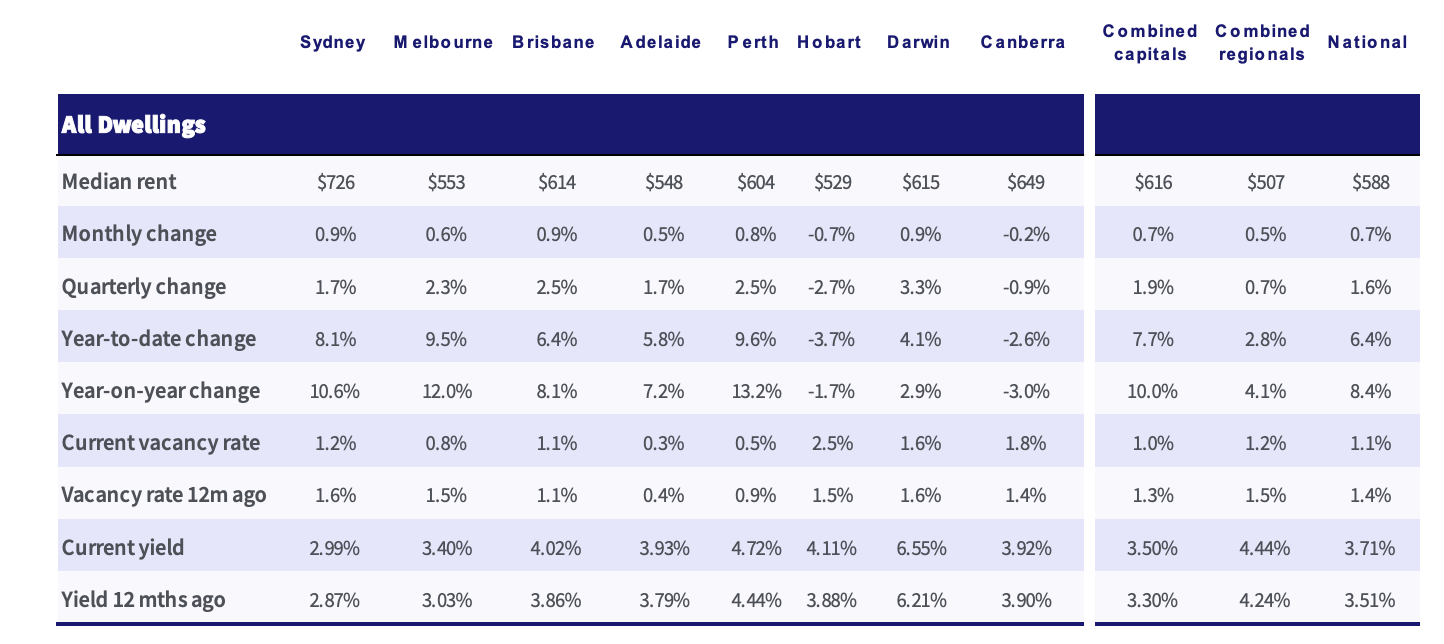

According to CoreLogic’s Kaytlin Ezzy, for the third quarter – July to September 2023 – Australia’s vacancy rate fell to a record low 1.1% in September, with Adelaide (0.3%), Perth (0.5%) and Melbourne (0.8%) all offering available rentals at under -1%.

Meanwhile, PropTrack economist Anne Flaherty told Stockhead that cross the country in September, the “available places to rent” list also somehow managed to inch even lower – down 0.06 percentage points (ppt) – to start October at a terrible new, new low of just 1.06%.

Anne’s latest work in derelict-looking house bullet form:

️ The proportion of rental properties sitting vacant is now 55% below March 2020 levels.

️ Sydney’s vacancy rate slid 0.11 ppt to reach 1.18% in September, reflecting a quarterly drop of 0.37 ppt. Rental conditions also deteriorated in Melbourne over the month, with vacancy dropping 0.06 ppt to 1.15%.

️ Vacancy held relatively steady in Brisbane over the month, rising just 0.02 ppt to 0.86%. Brisbane, along with Perth, Darwin and regional Victoria were the only markets to see vacancies hold steady.

️ South Australia now has the lowest vacancy rate in the country, sitting at just 0.65% in both Adelaide and regional SA. Perth recorded the second lowest vacancy in September at just 0.71%.

️ Hobart saw the sharpest drop of the capitals in vacancy over the month, falling 0.13 ppt to 1.4%.

Home prices spotting is a national pastime here in Aussie, but By The Power of Greyskull! – forecasters, homeowners, rent-seekers, economists and politicians alike have been flabbergasted by the wild ride property prices and rental vacancies have taken us on so far in 2023.

Home values jumped for an eighth straight month in September, heedless – apparently – of the Reserve Bank’s historic pumping of the interest rate cycle.

CoreLogic is now predicting national housing values to reach a new high by November.

It’s been carnage out there ever since COVID-19 infected local property markets just as ferociously as it did everyone else, leaving us with a more than 21.5% spike in national home values during a freaky 12 months to Easter last year.

Then rate rises began, and the market backpedalled, the central bank doshing out 12 straight interest rate hikes, kicking over 9% off the national residential property market between May 2022 and February this year.

In March, pretty unexpectedly, prices began to rise…

So my math tells me that according to CoreLogic’s data, we’re still circa 13% higher than the pre-pandemic days, one of the impacts being it’s incredibly hard for everyone – but especially younger people to get themselves onto the property ladder.

Ask your mates. 90% of aspiring first-home buyers are unable to purchase a property, and that’s according to May research out of the Australian Housing and Urban Research Institute (AHURI). It’d be a fair bit less now, you’d reckon.

That in turn, places further pressure on rental markets.

“Rental conditions deteriorated further in September, with the proportion of rental properties sitting vacant hitting a new low,” Anne Flaherty says.

Rental opportunities dropped lower in both capital city and regional areas, Flaherty says, with renters feeling the squeeze everywhere across the country.

“Vacancy is now sitting well under 1% in three of Australia’s capital cities. More markets are expected to fall below 1% over the coming year as demand continues to grow.

“Across Australia’s regional areas, every state has seen vacancy fall by at least 20 percentage points over the quarter. Regional SA and Queensland are seeing the lowest vacancy, at 0.65% and 0.89% respectively.

“Declining vacancy rates are increasing competition for rentals and placing growing pressure on rents.”

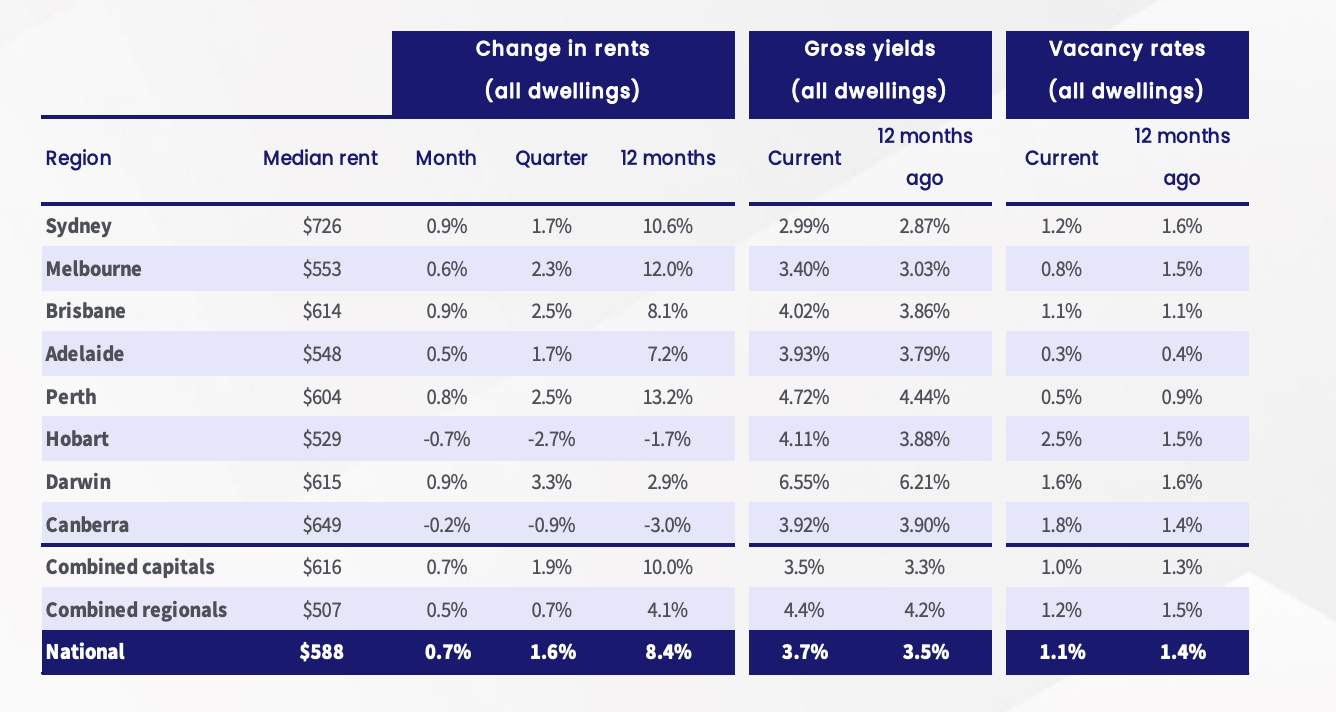

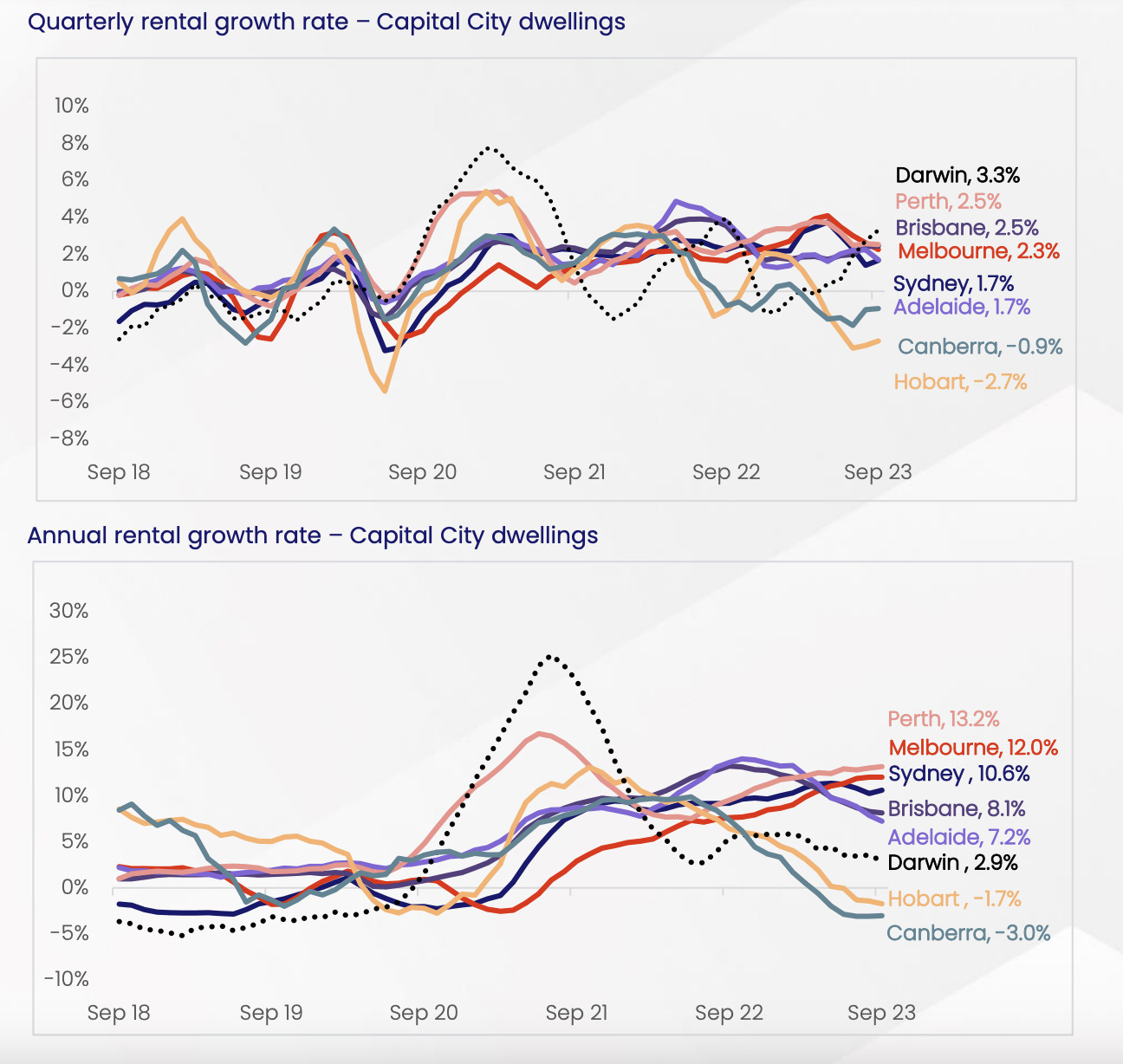

So what happens? That’s easy, says Ezzy from CoreLogic – rents will keep getting higher.

Flaherty says around the country weekly rents will continue accelerating – at above trend levels – over the coming months, particularly in the capitals.

Right now, the total count of national rental listings is at its lowest level since early November 2012, according to CoreLogic data.

The numbers describe a national structural housing shortage in freefall.

And now Ezzy says it’s a crisis on the move – nationally rents remain 30.4% higher than they were in mid-2020.

“After recording a small dip over the first few months of COVID, national rents have risen for 38 consecutive months.

“With the rising cost of living adding additional pressure on renter’s balance sheets, it is likely tenants have hit an affordability ceiling, seeking to grow their households to share the growing rental burden.

“The situation of low rental vacancy rates and insufficient housing supply is a broad issue impacting regions around the country to different extents,” Ezzy adds.

Record high net overseas migration, with net arrivals at record highs, has amplified the squeeze, while an uncertain pipeline of builds makes the future an equally murky prospect.

CoreLogic’s Cordell Construction Cost Index (CCCI) which tracks the cost to build of a typical new dwelling, returned a quarterly growth rate of 0.5% for the September quarter, the smallest lift since the three months to June 2019 and half the pre-COVID decade average of 1.0% per quarter.

So it’s still a bloody expensive, low-margin and largely thankless task to be in residential home building. Not good in terms of being incentivised to lift Australia’s vacancy rates anytime soon.

CoreLogic’s Cool Head of Australian Research Eliza Owen says toppy construction costs are still very elevated, but the continuing level of increasing costs “has normalised.”

“This is the fourth consecutive slowdown in the quarterly pace of growth for residential construction costs. The slowdown in new dwelling approvals also points to mixed news for the construction industry next year.

“On the one hand, this will free up capacity for material and labour resources, but it will also mean greater competition for new jobs.

Over the four weeks to 1 October, the total count of national rental listings fell to its lowest level in nearly 11 years, with around 90,153 properties available for rent.

September Quarter: Key rental & yield stats:

By the numbers it’s the same as a rental shortfall of around 47,500, Ezzy says, with total listings down 15.1 per cent on the levels reported this time last year, and 34.5 per cent below the previous five-year average.

After recording the smallest monthly rise since September 2020 in August (0.4 per cent), national rents ticked up 0.7 per cent in the ninth month of the year, Ezzy revealed. Sydney, Brisbane and Darwin all reported 0.9 per cent increases in rent in September, followed by Perth (0.8 per cent), Melbourne (0.6 per cent) and Adelaide (0.5 per cent).

On the other end of the spectrum, rents dropped 0.7 per cent in Hobart and 0.2 per cent in Canberra.

But even that’s no cause for celebration – people at the coal face of rising prices are simply giving up looking.

“Worsening affordability continues to be a significant factor placing downward pressure on the pace of rental growth in recent months,” Ezzy adds.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.