Ausbil: Slowing demand, a bit of war and a lot of inflation behind largely forgettable ASX reporting season

News

News

Australian companies reported a “slightly disappointing” reporting season relative to expectations, says top Aussie investment firm Ausbil.

It’s not an excuse, hey, but seems the past 12 months of rising rates, inflation, war and falling commodity prices came home to roost in the end.

Earnings dropped away -2.2% in nominal terms in HY23 compared to HY22, due to a combination of factors including lower commodity prices, higher interest rates and inflationary pressures impacting cost growth,” Ausbil said in a note on Monday morning.

From hereon, they believe, getting some quality earnings growth into your portfolio’s going to be “harder to come by” than in the last few years.

Which were pretty good, too, let’s not deny it.

Ausbil says earnings per share (EPS) revisions for the market have turned negative for FY23 and FY24, and the growth outlook – while positive – has softened.

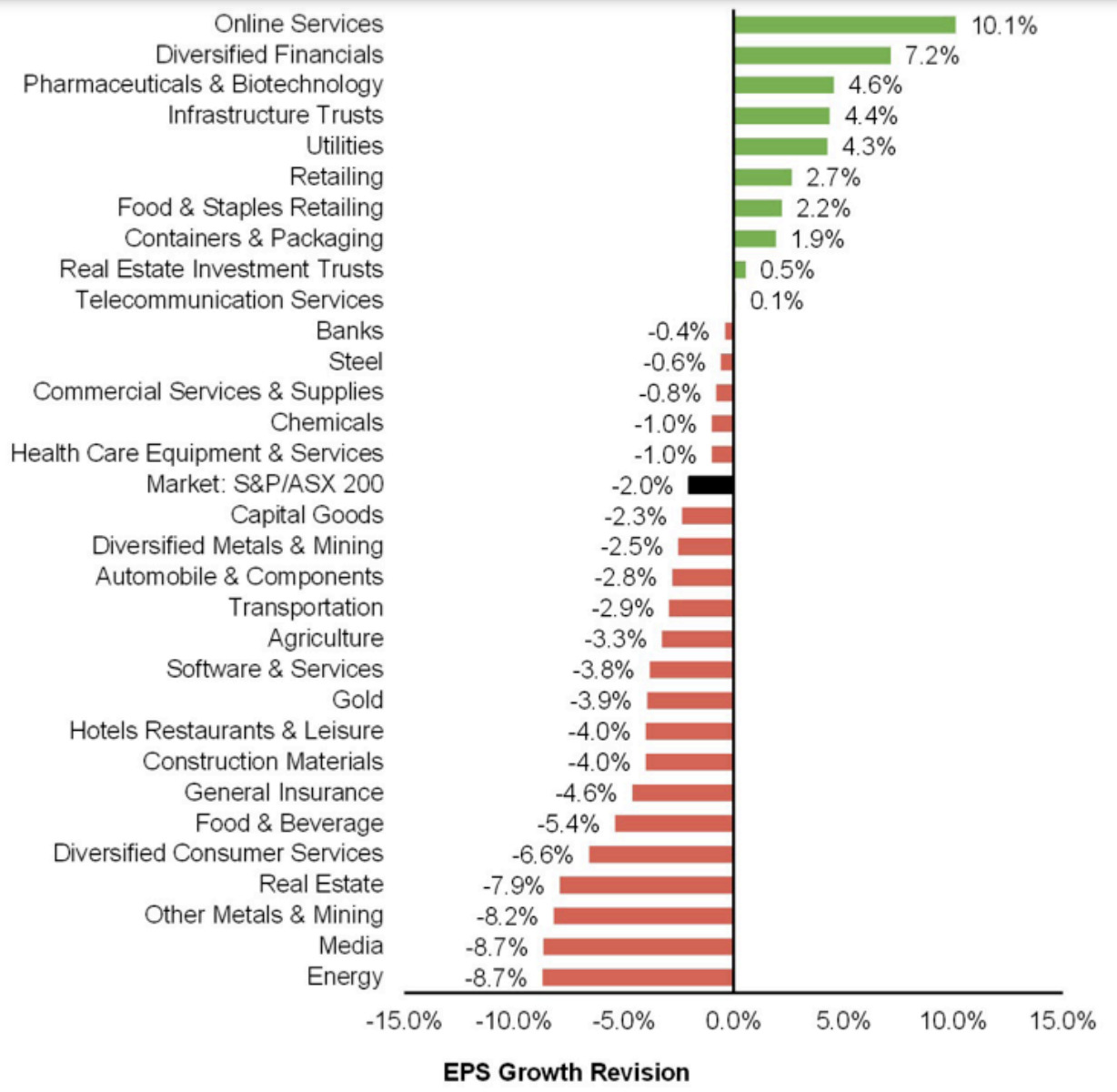

There were positive EPS revisions for 10 sectors, and 21 sectors experiencing negative EPS revisions for FY23 for the S&P/ASX 200.

Here’s a handy visual summary. I’ll go and get a cup of tea.

Consensus expectations for earnings growth were +5.0% for FY23 and +3.0% for FY24 (S&P/ASX 200).

According to Ausbil data, the greatest upward revisions were for:

- Online services

- Diversified financials

- Biotech

- Infrastructure, and

- Utilities

The half-year reporting season follows a pretty wild run for markets where hoisting interest rates have been used to combat equally buoyant inflation.

Ausbil puts this down to reflux of sorts after we all happily scoffed down some huge stimulation during the pandemic.

This was, OFC, compounded by a commodity shock as Russia took to its neighbour Ukraine.

“The economy has been resilient, operating near full employment, but with the cash rate rising from 0.10% in April 2022 to 3.35% in February 2023, it is slowing down as expected.”

While Ausbil’s view is that Australia will avoid recession, there has still been some derating in market earnings with slowing demand.

Ausbil believes we’re entering a period of stabilisation where we expect rates to peak and hold for some time while the economy adjusts to the recent tightening cycle.

Earnings growth will be harder to come by than in FY21 and FY22. Cost pressures have seen a number of companies miss on expectations across sectors, and there remains some caution in outlook statements given the unknown path for interest rates and inflation.

“Looking ahead, we like critical metals and commodities for the long rotation from fossil fuels to renewables in the great decarbonisation and the electrification-of-things.”

Ausbil reckons inflation “is in a peaking phase” in response to the massive central bank tightening program.

“Whilst we expect some further small upward adjustments to interest rates, our view is that we are fast approaching the terminal rate for this cycle, where it will hold for an extended period as the RBA assesses the economic impact.

“The economy is slowing, and we see economic growth below trend in 2023 and into 2024. In this environment, we believe earnings growth will be harder to find.”

After FY22’s pandemic-stimulated earnings growth of 22% (and let us not forget the 30% of FY21) the Ausbil fundies see “positive but more muted growth” for FY23.

“There is room for some upward surprise in certain sectors as Australia’s economy remains relatively resilient and is operating near full employment.”

“We remain focused on the key thematics that are driving the long-term earnings growth, particularly where imbalances see demand exceeding supply on a fundamental basis for some time.

“We like critical metals and commodities for the long rotation from fossil fuels to renewables in the great decarbonisation, and the electrification-of-things, with the steady switch from combustion and fossil fuel power to renewable electricity generation. Service companies associated with the cap-ex investment needed for this energy transition are also attractive. With China re-emerging from its intense COVID issues, we see upside in commodity prices as demand returns across calendar 2023.”

The money manger says beneficiaries of elevated inflation are expected to perform in 2023.

“But the emphasis on those that perform well in a rising rate environment is starting to shift towards those that will benefit with stabilisation and peaking rates. Quality REITs, some quality leaders in technology, and some exposures in building products are helping to bridge the shift from the inflation beneficiaries that outperformed in 2022.”

Dividends this half year were slightly below expectations.

The dividend yield outlook for FY23 is 4.3% (S&P/ASX 200).

“We are also seeing some of the difference in dividends from expectations being reinvested into capex.”