ASX Small Caps Weekly Wrap: Okay, so that’s what a week of losses looks like. Let’s move on

Do you think we should tell them? Pic via Getty Images.

- The ASX 200 fell nearly 4.5pc this week after Monday’s shock collapse

- Every market sector finished in the red, Utilities was best at -0.3pc

- Who won the Small Caps race? Read on to find out…

It’s been a week that’s best characterised by the keening lamentations of everyone who got caught up in the events of Monday when – in case you’ve blanked it from your memory – the ASX 200 fell more than 3.0%, wiping about $100 billion off the market’s bottom line.

Since then, the overall market’s response has been less volatile, but by the close of play on Friday the writing was on the wall.

The ASX 200 benchmark is set to finish the week well below where it started, and – at the time of writing – that’s 4.45% lower than this time last week. Which is a lot.

The reason for the massive slump on Monday has been picked apart ad nauseum, but the Reader’s Digest version of events effectively lays the blame for the collapse squarely at the feet of US jobs data, which told a story of impending recession that spooked investors badly.

Since then, there’s been a concerted effort from some quarters to start rebuilding, now the the shockwaves from that epic tumble on Monday have dissipated – and that, alongside the usual market seagulls that have pounced on recently brutalised stocks in order to bag some bargains, has undone some of the damage.

Not all of it, though – not by a very long shot.

And that has set pundits’ tongues wagging, with a growing number of armchair US Fed experts pricing in a rate cut when the Fed meets again in September.

The size of the rate cut is currently what’s up for debate – and the chorus of voices claiming that the Fed is gearing up to cut rates by a full 50 basis points (0.5%) has some quarters feeling relieved, while for others it’s a portent of more doom and gloom.

A cut that size is an indication that the US Fed acknowledges that there is, in fact, a bit of a crisis on the horizon, and that there could still be a recession unless things are brought under control, and quickly.

Despite decent US jobs data that landed last night and propelling the mercurial US indices up faster than they’ve moved since November 2022, the talk of a 50 basis point carve-out is lingering.

Which way it falls remains to be seen – and until mid-September, there’s a lot of data to digest before that call gets made.

US CPI and retail trade figures are coming next week, and the week after that we’ ll see the FOMC minutes from the most recent meeting – just in time for Fed chair Jerome Powell to stand up and deliver his annual address at Jackson Hole.

Then there’s US payrolls, another CPI result and then retail sales figures on the eve of the next Fed gathering – that’s a lot of moving parts, so it really is anyone’s guess which way the Fed will jump.

One thing is certain – and that’s whichever way the US cards fall, Australians are pretty much guaranteed a lengthy wait before there’s rate relief here.

RBA Governor Michele Bullock has done everything except draw a huge red circle around the first Tuesday in February 2025 – which means it’s still “hurry up and wait” for us locals.

Anyway – here’s what else happened this week:

WHAT THE SECTORS DID

The market sectors had a week, and this was it:

Everything lost ground. All of it – from Utilities (which emerged relatively unscathed) to Energy (which had 7.7% of the stuffing kicked out of it) – the market went backwards this week.

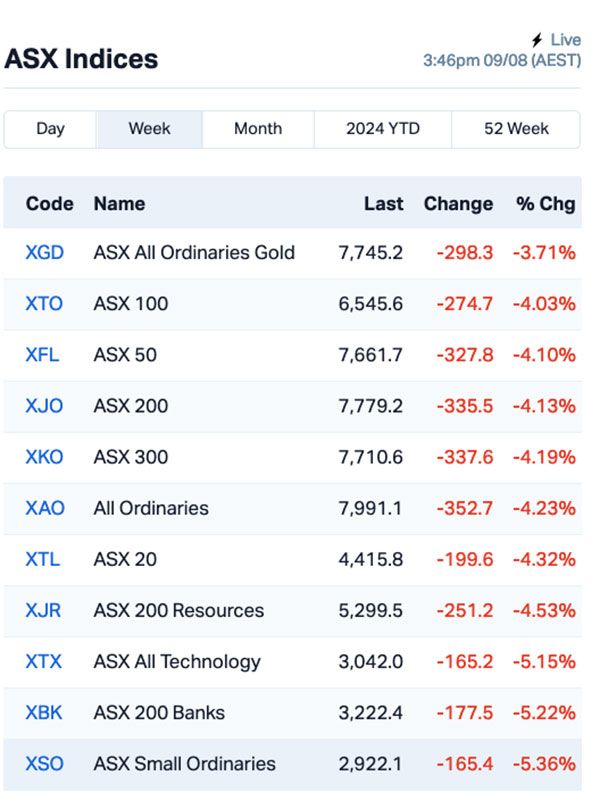

The ASX indices tell a similar story, as well – albeit one that looks even worse.

The safe haven of gold was evident, but only in the fact that the goldies fell by 3.7% – which is a lot better than the Small Caps, which bore the brunt of the sell-off, retreating 5.3% since last Friday.

Anyway… take it all in, because it’s time to hit “reset” and hope that things go better next week.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MHI | Merchant House | 0.15 | 275% | $15,082,639 |

| TGH | Terragen | 0.026 | 100% | $9,596,109 |

| HCT | Holista CollTech Ltd | 0.013 | 86% | $3,624,401 |

| MHK | Metalhawk | 0.095 | 79% | $9,563,650 |

| E33 | East 33 Limited | 0.021 | 75% | $16,278,863 |

| AME | Alto Metals Limited | 0.055 | 67% | $38,962,251 |

| HCL | Highcom Ltd | 0.22 | 63% | $21,563,361 |

| AUK | Aumake Limited | 0.009 | 50% | $15,315,254 |

| LSR | Lodestar Minerals | 0.0015 | 50% | $2,600,780 |

| TKL | Traka Resources | 0.0015 | 50% | $2,918,488 |

| ZLD | Zelira Therapeutics | 0.8 | 45% | $9,020,988 |

| PIL | Peppermint Inv Ltd | 0.0115 | 44% | $23,334,942 |

| RRR | Revolver Resources | 0.071 | 42% | $16,615,953 |

| CND | Condor Energy Ltd | 0.035 | 40% | $16,184,010 |

| GES | Genesis Resources | 0.007 | 40% | $4,697,048 |

| ATX | Amplia Therapeutics | 0.135 | 35% | $37,018,619 |

| AUH | Austchina Holdings | 0.004 | 33% | $8,401,535 |

| DDT | DataDot Technology | 0.004 | 33% | $4,843,811 |

| IEC | Intra Energy Corp | 0.002 | 33% | $3,381,563 |

| INP | Incentiapay Ltd | 0.004 | 33% | $4,975,720 |

| OAR | OAR Resources Ltd | 0.002 | 33% | $6,444,200 |

| PKO | Peako Limited | 0.004 | 33% | $2,108,339 |

| SHO | Sportshero Ltd | 0.004 | 33% | $1,853,499 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | $1,929,431 |

| BNZ | Benz Mining | 0.145 | 32% | $11,764,052 |

| FFF | Forbidden Foods | 0.013 | 30% | $2,953,905 |

| HVY | Heavy Minerals | 0.125 | 29% | $9,277,238 |

| IXU | Ixup Limited | 0.029 | 26% | $38,693,815 |

| CSX | Cleanspace Holdings | 0.49 | 26% | $41,784,386 |

| BUY | Bounty Oil & Gas NL | 0.005 | 25% | $5,994,004 |

| RML | Resolution Minerals | 0.0025 | 25% | $3,220,044 |

| AQC | Auspaccoal Ltd | 0.12 | 25% | $64,056,111 |

| BMT | Beamtree Holdings | 0.275 | 25% | $76,595,255 |

| RLT | Renergen Limited | 0.885 | 25% | $21,834,703 |

| BPH | BPH Energy Ltd | 0.022 | 22% | $25,246,060 |

| DCL | Domacom Limited | 0.011 | 22% | $4,790,520 |

| VGL | Vista Group Int Ltd | 2.57 | 22% | $563,292,599 |

| AW1 | American West Metals | 0.14 | 22% | $62,121,236 |

| CAG | Caperange Ltd | 0.17 | 21% | $15,659,870 |

| ST1 | Spirit Technology | 0.063 | 21% | $87,463,629 |

| CRR | Critical Resources | 0.006 | 20% | $12,462,452 |

| DTR | Dateline Resources | 0.006 | 20% | $13,305,079 |

| PHL | Propell Holdings Ltd | 0.012 | 20% | $3,340,057 |

| SFG | Seafarms Group Ltd | 0.003 | 20% | $14,509,798 |

| SPA | Spacetalk Ltd | 0.024 | 20% | $10,441,042 |

| TML | Timah Resources Ltd | 0.036 | 20% | $3,195,351 |

| CPN | Caspin Resources | 0.063 | 19% | $5,938,737 |

| DES | Desoto Resources | 0.13 | 18% | $9,216,563 |

| SOC | Soco Corporation | 0.13 | 18% | $17,997,156 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

Merchant House (ASX:MHI) came out on top, but it’s with a tinge of sadness, as it was on news that the company is hunting for a buyer for about $12 million worth of textile factory in the US, and once that’s sold off, the company is planning to delist.

Australian biological company Terragen (ASX:TGH) cracked second place on the ladder without poking its nose all the way into the winner’s reports this week, on Monday’s news that its Mylo feed supplement has turned in some bonanza results during testing to see if it helped reduce methane production.

The research, done by the Dept of Energy, Environment and Climate Action found that lambs supplemented with dry Mylo had an average daily weight gain 24% higher than those that went without, and produced 9.9% less methane.

Bigger sheep that fart less? Sign me up, please.

And in third place was Holista CollTech (ASX:HCT), which climbed despite the only word from the company being a hand-written Change in Substantial Holding form that arrived at the ASX offices about 7-8 degrees askew, and made me chuckle, so… thank you.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TEG | Triangle Energy Ltd | 0.007 | -53% | $12,480,804 |

| CT1 | Constellation Tech | 0.001 | -50% | $2,949,467 |

| BCB | Bowen Coal Limited | 0.018 | -45% | $54,134,403 |

| AD1 | AD1 Holdings Limited | 0.005 | -44% | $4,493,242 |

| MOZ | Mosaic Brands Ltd | 0.032 | -44% | $6,247,725 |

| GAS | State GAS Limited | 0.045 | -43% | $15,892,671 |

| CDE | Codeifai Limited | 0.0015 | -40% | $2,307,961 |

| AD8 | Audinate Group Ltd | 8.74 | -39% | $727,202,315 |

| RPG | Raptis Group Limited | 0.008 | -38% | $507,891 |

| ATV | Active Port Group | 0.047 | -38% | $22,255,907 |

| ENT | Enterprise Metals | 0.0025 | -38% | $2,733,293 |

| BMM | Balkan Mining and Minerals | 0.042 | -35% | $3,613,702 |

| WEC | White Energy Company | 0.028 | -35% | $5,571,560 |

| CAZ | Cazaly Resources | 0.017 | -35% | $8,303,454 |

| CNJ | Conico Ltd | 0.001 | -33% | $3,302,291 |

| DXN | DXN Limited | 0.058 | -33% | $10,278,914 |

| EEL | Enrg Elements Ltd | 0.002 | -33% | $2,524,913 |

| GCM | Green Critical Min | 0.002 | -33% | $2,773,170 |

| PRX | Prodigy Gold NL | 0.002 | -33% | $4,235,549 |

| PUR | Pursuit Minerals | 0.002 | -33% | $10,906,200 |

| RIL | Redivium Limited | 0.002 | -33% | $6,827,137 |

| RMX | Red Mount Mining | 0.001 | -33% | $3,423,577 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| TX3 | Trinex Minerals Ltd | 0.002 | -33% | $4,571,631 |

| VPR | Volt Group | 0.001 | -33% | $10,716,208 |

| 88E | 88 Energy Ltd | 0.002 | -33% | $57,867,624 |

| PHX | Pharmx Technologies | 0.03 | -32% | $26,932,806 |

| BCT | Bluechiip Limited | 0.0035 | -30% | $4,728,158 |

| DTM | Dart Mining NL | 0.014 | -30% | $4,393,359 |

| NRZ | Neurizer Ltd | 0.0035 | -30% | $6,315,452 |

| T3D | 333D Limited | 0.007 | -30% | $836,115 |

| PFE | Pantera Minerals | 0.024 | -29% | $9,096,641 |

| BSN | Basin Energy | 0.039 | -29% | $3,242,847 |

| OSL | Oncosil Medical | 0.01 | -29% | $37,840,239 |

| RWL | Rubicon Water | 0.23 | -28% | $37,969,602 |

| ZNC | Zenith Minerals Ltd | 0.036 | -28% | $12,685,712 |

| PPY | Papyrus Australia | 0.008 | -27% | $3,941,541 |

| AGC | AGC Ltd | 0.22 | -27% | $53,885,417 |

| ASQ | Australian Silica | 0.022 | -27% | $6,200,928 |

| VMM | Viridis Mining | 0.595 | -27% | $38,653,180 |

| SGQ | St George Mining | 0.025 | -26% | $24,713,511 |

| ZMM | Zimi Ltd | 0.014 | -26% | $1,773,306 |

| FBR | FBR Ltd | 0.0355 | -26% | $151,706,299 |

| DYL | Deep Yellow Limited | 0.965 | -26% | $906,420,503 |

| HE8 | Helios Energy Ltd | 0.009 | -25% | $20,832,396 |

| JAY | Jayride Group | 0.009 | -25% | $2,126,782 |

| KOB | Koba Resources | 0.105 | -25% | $17,441,778 |

| KPO | Kalina Power Limited | 0.003 | -25% | $7,459,182 |

| LPD | Lepidico Ltd | 0.0015 | -25% | $8,589,125 |

| ME1 | Melodiol Global Health | 0.0015 | -25% | $789,420 |

HOW THE WEEK SHOOK OUT

Monday 05 August, 2024

East 33 (ASX:E33) was moving rapidly on Monday after news broke that the company, along with Yumbah Aquaculture, has entered a Bid Implementation Deed that would see an off-market takeover of 100% by Yumbah, for cash of $0.022 per East 33 share – a premium that is well above East 33’s previous close at $0.012 a pop.

Red Mountain Mining (ASX:RMX) was up on Monday morning on news that the company has acquired four exploration licences that are prospective for gold in the Yilgarn‘s Murchison Domain southeast of Mount Magnet. The Project covers 111km2 of the Kiabye Greenstone Belt, an underexplored gold belt adjacent to the Narndee Igneous Complex, where shallow historical exploration has found evidence of gold mineralisation before.

Carnavale Resources (ASX:CAV) was up on news that its ongoing metallurgical testwork for its headline Swiftsure Deposit within the Kookynie gold project in Western Australia has produced some great results, with high overall gold recovery rates ranging from 98.9% to 99.5%, with recovery of gravity gold averaging 87.1% and recovery from carbon in Leach (CIL) test 99.7%.

Metal Hawk (ASX:MHK) joined the growing list of goldies announcing discoveries today, revealing that it has rock chip and soil samples from the new Siberian Tiger prospect at Leinster South which have returned significant high grade gold assays over a broad area. MHK says the best of the results include 20.2 g/t Au with a total of 16 samples grading above 1.0 g/t Au.

Killi Resources (ASX:KLI) says that its hunt for gold at its 100% owned Mt Rawdon West project in Queensland, where pole-dipole Induced Polarisation (IP) geophysical survey showed a strong spatial association with gold-copper mineralisation that have helped the company identify new, discrete chargeable targets in line with earlier surface sampling that showed copper-gold mineralisation of 238g/t Au and 5.4% Cu.

Spirit Telecom (ASX:ST1) was one of a handful of tech companies doing well on Monday morning, after announcing that it is expecting to do better than expected for FY25, saying that the company is confident that its strategy of selling combined Cyber Security, Managed Services and Collaboration platforms will improve its profitability and deliver uEBITDA of between $9.5 million and $10.5 million and revenue of between $150 million and $160 million in FY25

Ardea Resources (ASX:ARL) has pushed the supply chain diversification narrative to sell its 50:50 4Mt KNP Goongarrie Nickel Hub JV. ARL warns of mounting concerns from OEM’s about buying product from the environmentally non-compliant and high-risk jurisdictions of China and Indonesia – two of the world’s largest nickel producers. ARL signed on Japanese majors Sumitomo and Mitsubishi, which will fully fund a DFS for up to $98.5m and jointly farm-in to a 50% share of the project.

Horizon Minerals (ASX:HRZ) has geared itself to start production and gold sales from its 1.8Moz Goldfields assets, with the 428,000oz Boorara to kick off in the September quarter and 54,570oz Phillips Find during the following. It has a 1.24Mt ore sale agreement with Norton Gold Fields in place and a toll agreement through FMR Investments’ 1Mtpa Greenfields mill.

Trade on Killi Resources (ASX:KLI) was quite significant on Monday. The explorer is holding court on the ASX once again today, after confirming gold and copper drill targets from ground IP surveying across the Kaa prospect at Mt Rawdon West which intercepted some bonkers gold grades up to 238g/t gold and 5.2% copper. Those grades were found via IP line 3600N, a trend that’s sub-parallel to the recently mapped 1.8km-long high-grade copper-gold trend at surface.

Metal Hawk (ASX:MHK) says high-grade gold has been discovered from rock chip and soil samples across the Siberian Tiger prospect, part of MHK’s Leinster South gold project, also in the Goldfields. The prospect area is just 15km from the 4.5Moz Lawlers mining centre and assayed results showed up to 20.2g/t gold from 16 >1g/t samples.

PYC Therapeutics (ASX:PYC) has provided an update on its ongoing clinical trials for VP-001, an investigational drug candidate designed to treat Retinitis Pigmentosa type 11 (RP11). RP11 is a rare and severe eye disease that leads to blindness. The company has previously highlighted encouraging developments in its trials, showcasing the drug’s potential to significantly improve visual function in affected patients.

Metal Bank (ASX:MBK) has gained exploration rights for Area 47 in Jordan, a promising site for copper and molybdenum. The company is also applying for rights to Area 65, where nearby drilling has shown high copper levels. MBK plans to evaluate these areas along with its Malaqa Project, aiming for efficient drilling by combining efforts.

Magnetic Resources (ASX:MAU) has released a positive economic update for its Lady Julie Gold Project in WA. The project is expected to produce 817,470 ounces of gold over 8 years, averaging 104,000 ounces per year, with low costs and high profit margins. The project’s payback period is 12 months, and it boasts a 135% internal rate of return (IRR) and a total EBITDA of $1.49 billion. Operating costs are projected at $1,377 per ounce, with all-in sustaining costs at $1,386 per ounce.

And…. eNova Mining (ASX:ENV) has made notable progress with exploration drilling at its CODA project. The company has completed 6 diamond drill holes and 5 reverse circulation holes, with over 500 samples sent for analysis.

Tuesday 06 August, 2024

Javelin Minerals (ASX:JAV) was climbing on news that it has appointed highly experienced mining engineer and operations manager Andrew Rich to its board as non-executive director. Rich has been brought on as the company looks to update the resource and kick off a new exploration campaign at its Coogee gold mine in WA, which currently holds a 1.4Mt at 1.07 g/t indicated and inferred resource for a contained 49,000oz of gold.

Merchant House (ASX:MHI) was also up Tuesday morning after delivering a note to investors which is actually a bit of a bummer. The company has decided to jettison its American Merchant Inc textile factory in the US, because it’s currently losing around $3.7 million every year. Once the land and assets have been sold, Merchant House says it will explore options to delist from the ASX altogether.

Amplia Therapeutics (ASX: ATX) was up on some positive news, announcing that another patient in its Phase 2a ACCENT trial for advanced pancreatic cancer has shown a confirmed partial response. This brings the total number of responders in the first patient group to four. The ACCENT trial is investigating the effectiveness of narmafotinib, used in combination with standard chemotherapy, for treating advanced pancreatic cancer.

St George Mining (ASX:SGQ) was up on news that it is set to acquire the world-class Araxá niobium-REE-phosphate project in Brazil. Historical drilling at Araxá has already defined extensive high-grade niobium, REE and phosphate mineralisation with more than 500 intercepts of high-grade niobium, >1% Nb2O5, along with ultra-high grades up to 8% Nb2O5, 33% TREO and 32% P2O5; and mineralisation commencing from surface and open in all directions.

Grand Gulf Energy (ASX:GGE) was up on news that it has secured all necessary permits and paperwork from the Utah Division of Oil, Gas and Mining for its Jesse-3 well, which the company says will test deeper pay below the Leadville primary target by casing and perforating the entire basinal stratigraphic section.

HighCom (ASX:HCL) was climbing on Tuesday, off the back of a double dose of good news for the company. Tuesday saw the announcement of a $2.5 million order for the company’s ballistic armour from an undisclosed military customer, which followed a similar announcement yesterday of an $8.9 million order from a similarly undisclosed buyer.

Wednesday 07 August, 2024

LBT Innovation (ASX:LBT) was one of the best performers on Wednesday. LBT says AstraZeneca purchased 5 APAS Independence instruments with the total contract valued between USD 2.2 million and 2.7 million, depending on the level of maintenance and support services chosen. In addition to the equipment, AstraZeneca will receive annual maintenance and support for the next seven years. There is also potential for additional orders from AstraZeneca in the future. APAS Independence is an advanced microbiology automation system designed to streamline the process of analysing culture plates used in laboratories.

Arrow Minerals (ASX:AMD) gained on Wednesday after releasing an exploration target estimate for its Niagara Bauxite Project, which the company says has come in at approximately 170 – 340Mt at a grade range of approximately 40-46% Al2O3, and 1-4% SiO2, which the company has reminded investors is a “conceptual” figure, not an official mineral resource estimate.

Centaurus Metals (ASX:CTM) was gaining nicely after delivering a presentation at the Diggers and Dealers conference in Kalgoorlie, which no doubt focussed heavily on its recent news of a major increase in its Mineral Resource Estimate for the Jaguar Nickel Project in Brazil, which puts the project on a whopping 138.2Mt @ 0.87% Ni for 1.20 million tonnes of contained nickel, which Centaurus says “cements its place as a Tier-1 project”.

Manhattan Corp (ASX:MHC) was up early after revealing that the entitlement offer announced by the company on Tuesday, 30 July 2024 is now open. The company is looking to raise up to $1.5 million, through a 1 for 2 non-renounceable pro-rata entitlement offer of 1,468,490,084 new Shares on a pre-Consolidation basis, at an issue price of $0.001 per New Share.

HighCom (ASX:HCL) was back in the winner’s circle on Wednesday, after providing fresh guidance for its FY24 results, revealing that revenue has come in at the lower end ($46 million) of the estimate given to the market in May. The company says that a delay in finalising a recent contract has pushed that revenue out to FY25, and that the company has seen an improvement in cash holdings from $1.6 million to $6.2 million, with new orders of ballistic products for US domestic and international customers valued at $13.7 million to be delivered soon.

First lithium carbonate from Arizona Lithium (ASX:AZL)’s pilot plant at its Prairie project in Canada has been produced using direct lithium extraction (DLE) tech and the first commercial production well at Pad #1 has been drilled. The milestones are sending the lithium-brine developer well on its way to becoming a fully-fledged producer, especially because Pad #1 has recveived a conditional $21.6m investment incentive by the Saskatchewan government. Full production is set to begin at the 6.3Mt LCE Prairie next year, pumping out battery-grade lithium carbonate. For now, the pilot plant material is being put up in the shop window for potential project partners to test.

Iceni Gold (ASX:ICL) was up on no news. The stock has been relatively quiet since a massive 300% gain on the back of its Christmas Gift gold discovery at 14 Mile Well in May. The junior exposed multiple “spectacular” gold-bearing quartz veins across a 20km-long strike length and produced a 9.5oz gold doré bar from a sample trench that had ridiculous grades in rock chips of up to 18,207g/t. A six-hole diamond drill program was completed in July to evaluate the gold-laden structure, with assays still pending.

Helix Resources (ASX:HLX) was also up on no news. But something’s a-rumblin’ around gold minnow HLX, which, last heard, has found prospective “Tritton-style copper-gold” at the Collerina copper trend, part of its Eastern Group Tenements near Nyngan in NSW.It’s got a whopping chunk of land that covers 1570km2 directly south and along strike of Aeris Resources’ (ASX:AIS) Tritton processing facility and several operating copper-gold mines.

Some 600 augur sample assays confirmed both copper and gold mineralisation and the explorer said it was continuing infill and extension augur sampling, AC drilling and detailed assessment of the anomaly to delineate future targets.

Thursday 08 August, 2024

Ovanti (ASX:OVT) was climbing in the morning after delivering an update on some allegedly embezzled funds, revealing that court action is looming to recover approximately $6.5 million that the company has identified as missing, with a further $15.9 million in transfers out of its Malaysian subsidiaries that are being investigated.

Heavy Minerals (ASX:HVY) was one of the day’s biggest market winners after completing Tranche 1 of non-dilutive royalty funding, raising a total of $2.1m. It’s executed a royalty agreement with Campbell Transport and raised $1.25m, adding to the previously raised $850,000 from investors so it can keep plugging away at its flagship Port Gregory garnet project near Geraldton, WA.

The royalty funding and cap raise clears the path for HVY to complete a PFS and kick off a bankable feasibility study for defined 166Mt at 4% total heavy minerals containing 5.9Mt of garnet.

Early doors findings from Kali Metals’ (ASX:KM1) review of historic drill core databases have revealed multiple spodumene occurrences at its Spargoville project in the Higginsville lithium district in WA, where Mineral Resources’ (ASX:MIN) 26.5Mt Bald Hill and 71.3Mt Mt Marion lithium operations are producing.

KM1 has pinpointed 170 pegmatite intervals that occur in 41 diamond drill holes and 37 RC holes, mainly west of Spargo’s Reward and says it will hit the ground to investigate the prospectivity further.

Meanwhile, four new copper and nickel targets have been sounded out at Asian Battery Metals’ (ASX: AZ9) Yambat project in Mongolia as the explorer has completed just over half of its 2500m drill campaign at the Oval prospect within the tenure. Meanwhile, while conducting regional exploration to the north of Oval, at a prospect now named Copper Ridge, gold mineralisation is showing up and has spurred the junior to get boots on the ground to investigate further.

Friday 09 August, 2024

Triangle Energy (ASX:TEG) was climbing on Friday, after the company released an investor presentation that outlined, among other things, the company’s progress in the Perth Basin, where a two-well farm-in is underway and proceeding nicely. The company has also revealed that the sale of Cliff Head oil field and facilities to Pilot for conversion to CCS is in its final stages, with Triangle expecting it to be finalised in October, pocketing $16 million.

Pointerra (ASX:3DP) was also gaining on Friday, after revealing that it has signed new contract awards with existing US energy utility customer Florida Power & Light. Pointerra will be paid $1.23 million to analyse lidar and imagery for FPL business cases, and expects to complete all contract deliverables during FY25.

EVZ (ASX:EVZ) was up early on news that it has been awarded a major contract in the mining and industrial sector through its wholly owned subsidiary, Brockman Engineering. The total value of this contract – to provide a bulk process water tanks package by Rio Tinto as part of the seawater desalination project at Parker Point, Dampier – is roughly $23 million.

Investors seemed to be going through the side door in trade Friday as BM8 topped the resources performers on the back of assay results out of Equinox Resources’ (ASX:EQN) Mata Da Corda REE project in Brazil – the world’s hottest emerging rare earths district.

While we can’t confirm why its share price soared here at Stockhead, BM8 does have a 36% stake in EQN – one of the best performers in the small cap market in FY24 and may have risen on the back of today’s announced results from its partner.

EQN is accelerating exploration at Mata de Corda, as well as the huge 1801km2 Campo Grande project – which straddles Gina Hancock’s Brazilian Rare Earths’ (ASX:BRE) own REE portfolio – in Brazil’s emerging world-class Rocha da Rocha REE district. Additional surface sample results have reaffirmed Mata da Corda’s exceptional district-scale targets, showing >2000ppm TREO across the 972 km2 project, and the junior is now primed for drilling, according to EQN MD Zac Komur.

Sarytogan Graphite (ASX:SGA) has received a cornerstone investment of $5m from the European Bank for Reconstruction and Development (EBRD), one of Europe’s sovereign wealth funds that has invested >€200 billion euros across 7100 projects to date. EBRD will purchase the shares at a premium of 16c and end up with a 17.36% stake in the company, yet will also need (and likely get) approval from the Australian Foreign Investment Board.

Green Critical Minerals (ASX:GCM) has consigned critical minerals specialist Wave International to complete the pre-feasibility study (PFS) of its McIntosh graphite project in northeast WA. Wave has worked with long list of resources companies such as Black Rock Mining (ASX:BKT), Graphinex, Lithium Energy (ASX:LEL), Renascor Resources (ASX:RNU), Syrah Resources (ASX:SYR) and Triton Minerals (ASX:TON).

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.