ASX small caps shake out creative strategies in troubled times

Handshake anyone? Pic: Getty

If Christmas is the time to break bad news, then January is the time for setting a plan of attack.

With more than handshakes at stake, the troubled times like those blazing through Australia need care and attention – and some smart strategies.

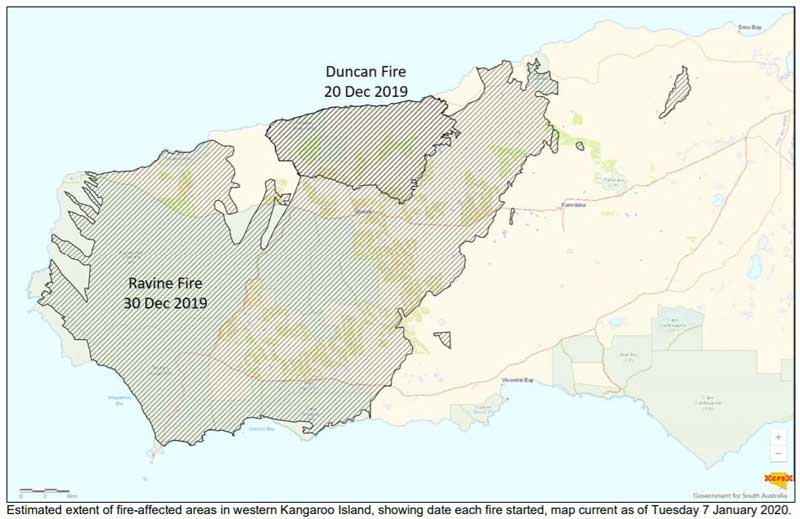

Companies like bushfire-affected Kangaroo Island Plantation Timbers (ASX:KPT) are taking on the challenge and working out what’s next.

Being a timber company, South Australian plantation owner Kangaroo Island Plantation is particularly vulnerable to the devastation of Australia’s wildfires.

Last week the company dropped the bad news that a further 971 hectares of its plantation had been lost, in addition to the 891 hectares lost initially.

The island where its ground is based experienced devastating fires this summer.

In an update to the market today, the voluntarily suspended company said it was actively assessing fire damage via air checks and on-ground assessment, when it was safe.

Kangaroo Island Plantation company secretary Victoria Allinson said in an ASX announcement today that the company was “determining which plantation areas are too damaged to have any commercial value, which fire-affected areas can be salvaged and which areas have relatively high survival rates and can be allowed to grow until harvest”.

The company is working on options for salvaging its fire-damaged timbers.

It’s also looking to contain residual hot spots in its landholding to keep its assets and neighbours safe.

Ninety per cent of plantations on the island have been affected by fires, leaving a big bill for insurers to foot.

Suspended dual-listed coal company Paringa Resources (ASX:PNL) is another company planning its next moves, although a bit creatively.

The Illinois coal basin producer has decided to let a bill due at the end of December go unpaid.

After speaking to a lender’s agent, Paringa subsidiary Hartshorne Mining Group opted to default on $US1.5m interest and fee invoice owed to Tribeca Global Resources Credit.

Paringa said its subsidiary was looking at options for new operational funding or a trade sale with the help of FTI Consulting.

The company said Hartshorne expected the decision would help it retain cash as it went through a ramp-up phase at the mine.

Mining started back up at Poplar Grove this month after a new-year break.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.