ASX Small Caps Lunch Wrap: Wisetech’s broad shoulders have helped mitigate a sharp ASX fall

Pic via Getty Images

Local markets have opened lower this morning, after Wall Street ran out of puff and banked its first negative session in more than a week, leading local shares down.

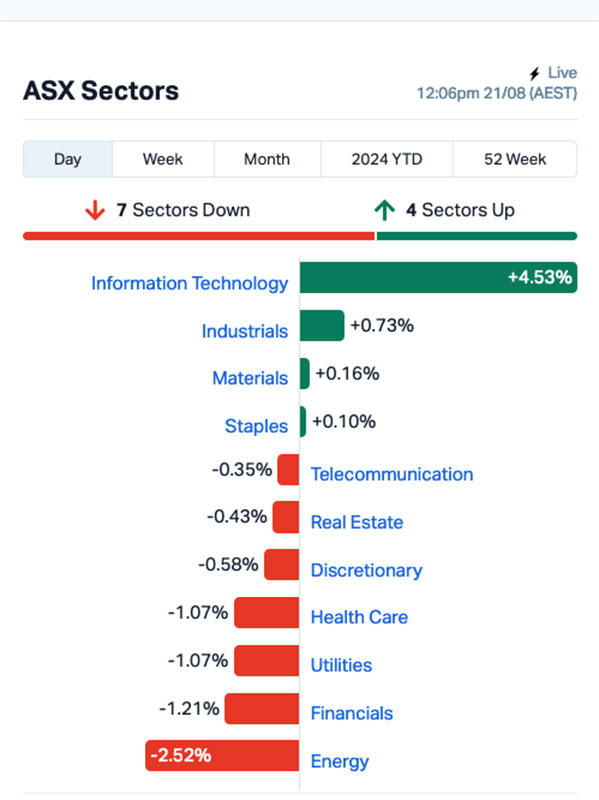

Both InfoTech and Industrials took off at a brisk clip when the 10:00am bell rang to start the day, however it’s the techies that have gone into overdrive on the way into lunch, outpacing the rest of the market by a significant margin, while the Energy sector is taking another battering.

As I sit down to write this, the ASX 200 is down 0.48% or 38 points, I’ve somehow got two large coffees going cold on my desk, and Tool’s Lateralus is playing loud enough to rattle the windows and scare the neighbours.

Let’s do this.

TO MARKETS

With the ASX Futures index pointing to a modest dip before the market opened this morning, it was always going to be a little murky on the bourse today.

However, the expected shortfall has been mitigated somewhat by a massive surge in the InfoTech sector, which is up a very handy 4.2% and providing excellent damage control as the market wobbles through the session.

Here’s how the sectors were looking two hours into the trading day.

So the wins are coming from Tech, and the losses are piling up in the Energy sector.

We’ll start with the good news, and that’s a gangbuster performance from Tech heavyweight WiseTech Global (ASX:WTC), which has been up as much as 21% to $114.99 per share after the company dropped a cracker of an earnings report.

The headlines from that are that Wisetech revenue broke through the billion dollar mark, hitting $1,041.7 million – a 28% climb on FY23 results.

That’s delivered Wisetech an EBITDA of $495.6 million, up 28% on FY23; 48% EBITDA margin ahead of expectations and 4QFY24 EBITDA margin run rate at 50%.

While Wisetech isn’t the only big player to post bumper results, what sets it apart from a number of companies that have suffered at the hands of investors in recent days is that the company says its outlook is looking rosy as well.

“CargoWise customer penetration momentum continues,” the company says, adding that it has “three breakthrough product releases announced for FY25 – CargoWise Next, Container Transport Optimization and ComplianceWise, with planned releases commencing 1H25”.

On the flip side of InfoTech’s win is a flailing Energy sector, which has been dragged lower by sharp falls at the top end of the sector, particularly by Santos (ASX:STO) , which was down 3.9% after it whiffed on earnings this morning, coming in well under expectations with an 18% drop in half-year underlying profit to $US654 million.

Woodside (ASX:WDS) was also down, shedding 1.73% and Yancoal’s (ASX:YAL) inglorious slide has continued, with the company adding a further 4.87% fall this morning to yesterday’s savage 14.5% freefall in the wake of its earnings call on Monday.

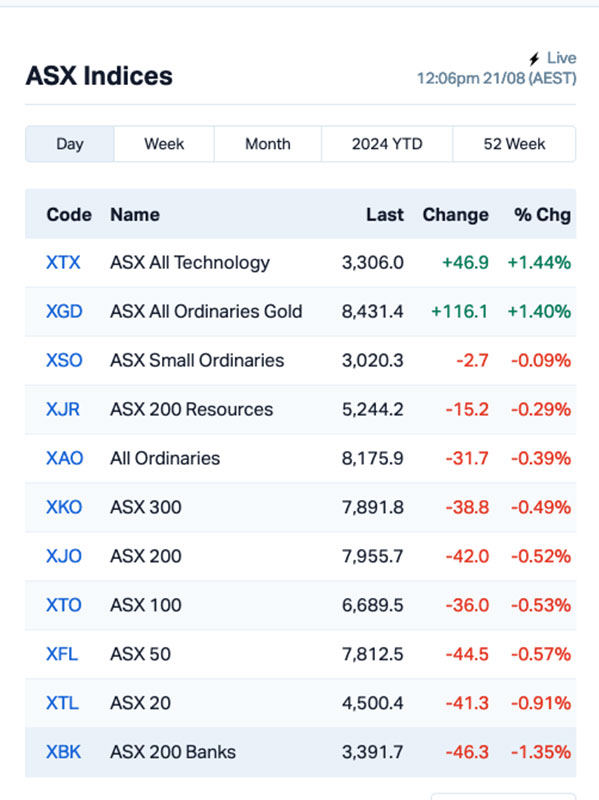

The ASX Indices are telling a familiar tale: aside from tech stocks, it’s the goldies once again making headway as the morning progresses.

Elsewhere, Bluescope Steel (ASX:BSL) has sounded an alarm bell and set the cat among the pigeons by accusing China of flooding the global steel market.

Bluescope chief executive Mark Vassella told the ABC that large volumes of steel are “flying out of China into the South-East Asian markets” as China’s construction market continues to ossify, leading to “pressure on price, which then comes back to our domestic market here in Australia”.

That, in combination with a projected $4 billion hit to the Australian economy as iron ore prices continue to crater, is painting a grim picture for the coming months, unless there’s radical change in China.

NOT THE ASX

Overnight, the S&P 500 was down by 0.2% to end its eight-day winning streak, the blue chips Dow Jones slipped by 0.15%, while the tech heavy Nasdaq edged lower by 0.33%, Earlybird Eddy Sunarto reported this morning.

Wall Street, however, is still anticipating that Jerome Powell will hint at a possible rate cut in September during his remarks on Friday. The focus has shifted from when to cut rates, to whether a 0.5% reduction might be possible.

In US stock news, Netflix climbed 1.5% to a record high after announcing a 150% year-over-year increase in upfront advertising commitments, signalling strong growth for its new ad-supported subscription tier.

Microchip Technology Inc dropped 2% and fell an additional 2% in after-hours trading after revealing that a breach by an unauthorised party led to the shutdown of some of its systems.

Eli Lilly & Co. surged 3% after a study revealed that patients using its blockbuster weight-loss shot, Zepbound, were 94% less likely to develop diabetes over three years.

In Asian markets this morning, the news is similar to what’s happening on the ASX. Japan’s Nikkei is down 0.74%, the Hang Seng is lower by 0.75%, Shanghai markets are off by 0.31% and markets in The Philippines are closed today as the nation takes a holiday to remember Benigno ‘Ninoy’ Aquino, a prominent politician who was assassinated in 1983.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap DUN Dundasminerals 0.061 154.2 19,314,095 $2,031,073 RGT Argent Biopharma Ltd 0.385 51.0 31,831 $12,343,429 EDE Eden Inv Ltd 0.002 33.3 77,539 $6,162,314 HLX Helix Resources 0.004 33.3 55,688,650 $9,792,581 MEL Metgasco Ltd 0.004 33.3 130,000 $4,342,760 GTE Great Western Exp. 0.033 32.0 469,174 $10,875,332 KME Kip McGrath Edu.Cntr 0.44 31.3 233,272 $19,042,243 MTM MTM Critical Metals 0.048 29.7 11,568,900 $10,400,953 RR1 Reach Resources Ltd 0.015 25.0 2,518,409 $10,493,176 HUM Humm Group Limited 0.65 25.0 4,555,380 $255,513,099 88E 88 Energy Ltd 0.0025 25.0 192,445,940 $57,867,624 CZN Corazon Ltd 0.005 25.0 350,000 $2,671,622 EEL Enrg Elements Ltd 0.0025 25.0 1,433,333 $2,019,930 MKL Mighty Kingdom Ltd 0.005 25.0 1,370,931 $12,863,772 PUR Pursuit Minerals 0.0025 25.0 110,000 $7,270,800 TAS Tasman Resources Ltd 0.005 25.0 479,839 $3,220,998 NAG Nagambie Resources 0.017 21.4 10,522,634 $11,152,899 CCG Comms Group Ltd 0.063 21.2 1,755,626 $20,094,874 IMI Infinitymining 0.018 20.0 46,667 $1,781,301 BXN Bioxyne Ltd 0.006 20.0 3,488,000 $10,233,227

Dundas Minerals (ASX:DUN) went flying on Wednesday morning, up 125% in a matter of minutes on news that it has drilled into high grade gold while exploring at the Windanya and Baden-Powell projects, located adjacent the Goldfields Highway ~60km north of Kalgoorlie, Western Australia, with the highlight being an assay of 9.5 g/t Au between 146m and 147m, with drilling to be extended to further test the depth of mineralisation.

Argent Biopharma (ASX:RGT) was up on news that the company has sealed a strategic collaboration with SINTEF, one of Europe’s largest independent research organisations, to address the critical and unmet clinical challenge of chronic wound management, through nano-formulations as part of the Company’s ongoing expansion into new therapeutic areas.

Metgasco (ASX:MEL) was up on news that work at its 25% owned Odin and Vali gas field is set to recommence after bad weather in July hampered progress. The company says that two wells, Odin-1 and Vali-1 continue to perform steadily, averaging production rates of 1.4 MMscf/d and 1.1 MMscf/d respectively, and work is underway to bring Odin-2 to productivity.

Kip McGrath Education Centres (ASX:KME) was up on the heels of the company’s earnings report, which delivered happy-ish news to shareholders. The company says revenue was up 21.0% to $32.4 million, delivering an EBITDA of $6.5 million (down 2.7%) and an NPAT of $1.3 million, down 31.5% on pcp.

MTM Critical Metals (ASX:MTM) was moving higher on news that the company has achieved a significant breakthrough in the development of its Flash Joule Heating (FJH) technology, through which it was able to convert SC6 spodumene concentrate directly to lithium chloride (LiCl) in a single, acid-free unit operation.

Reach Resources (ASX:RR1) was up on news that the company has completed a heritage survey at its 100% owned Wabli Creek Project, in the Gascoyne region of WA with the Wajarri people and the Burringurrah Aboriginal Corporation, which has provided clearance for ground disturbing activities including a drilling program over the main target areas of the project.

Humm (ASX:HUM) released its results for FY24, and investors were happy. The company reported statutory net profit (after tax) of $7.1 million was up 145%, with the second half statutory net profit (after tax) of $13.1 million representing a turnaround of $19.1 million from the first half loss of $6.0 million. The company says it’s in good shape, with $125.1 million in unrestricted cash and $0.7 billion of warehouse headroom.

Comms Group (ASX:CCG) was up on news that the company’s revenue guidance exceeded for the year with total revenue of $55.5 million, an increase of 7% year-on-year. Importantly, the company says, that growth in revenue is all organic and over 90% of revenue is recurring. As a result, Comms Group has announced its inaugural dividend, declaring $0.0025 per share, fully franked.

Bioxyne (ASX:BXN) was flying high on Wednesday morning on news that the company has produced its first commercial run of edible cannabis products, namely THC gummies to fulfil an order that the company had taken a deposit for. The company says it is now scaling up its gummy manufacturing capabilities from 2 million single doses per month to 6 million to meet anticipated market demand.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ECT Env Clean Tech Ltd. 0.002 -33.3 884,159 $9,515,431 ADN Andromeda Metals Ltd 0.012 -25.0 19,815,228 $49,764,335 YAR Yari Minerals Ltd 0.003 -25.0 1,292,000 $1,929,431 PLG Pearlgullironlimited 0.011 -21.4 12,001 $2,863,585 PNX PNX Metals Limited 0.004 -20.0 125,000 $29,851,074 AQN Aquirianlimited 0.175 -16.7 31,229 $16,941,534 JPR Jupiter Energy 0.025 -16.7 81,370 $38,209,566 GGE Grand Gulf Energy 0.005 -16.7 2,000,000 $12,571,482 IPB IPB Petroleum Ltd 0.005 -16.7 28,768 $4,238,418 GBE Globe Metals &Mining 0.038 -15.6 268,724 $31,115,047 FME Future Metals NL 0.017 -15.0 17,636 $11,500,810 PFT Pure Foods Tas Ltd 0.023 -14.8 13,333 $3,296,492 LYL Lycopodium Limited 11.98 -14.6 235,583 $557,157,969 CDT Castle Minerals 0.003 -14.3 20,000 $4,647,392 EXL Elixinol Wellness 0.003 -14.3 17,647 $4,624,138 SHN Sunshine Metals Ltd 0.012 -14.3 838,998 $22,227,027 THB Thunderbird Resource 0.025 -13.8 262,119 $9,339,595 ADG Adelong Gold Limited 0.0035 -12.5 1,948,793 $4,471,956 BLZ Blaze Minerals Ltd 0.0035 -12.5 794 $2,514,233 VKA Viking Mines Ltd 0.007 -12.5 104,419 $8,202,067

ICYMI – AM EDITION

T’is all quiet on the Western front for today, so you can all have an early mark to enjoy your lunch.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.