ASX Small Caps Lunch Wrap: Whose not-so-strategic sock put them in prison this week?

One whiff of Socky Sockmonster's breath, and Sarah knew that he'd been up to no good the night before. Pic via Getty Images.

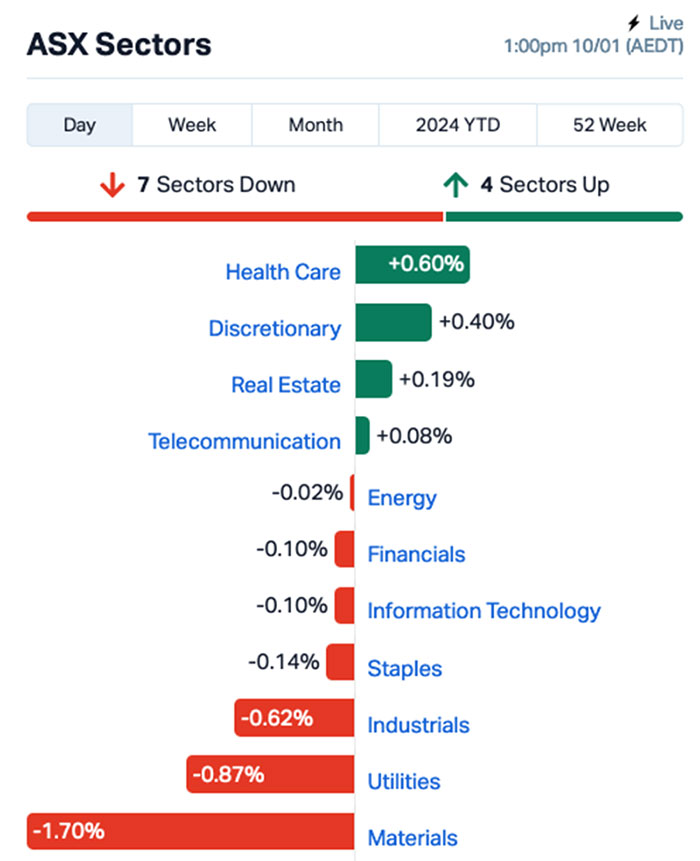

Local markets are higher, but one feels not heaps happier on Thursday in Sydney. It could be a general sense of apathy, or it could be that Sydney’s decided to dial the humidity up to 40,000% in a bid to drown us all where we stand, but something’s holding the market at +0.4% so far for today.

I’ll dig into that shortly, but first – we’re off to Russia, where the number of performers doing prison time for appearing on stage wearing aught but a strategically-placed sock has risen to two.

Maxim Tesli, front man of a band called Shchenki – which translates to The Puppies – was handed a 10-day sentence for “petty hooliganism”, after he accidentally gave punters an eyeful of dong during a show.

Footage of the incident went viral in Russia, but – in the interests of decency (and on the understanding that you’re probably eating your lunch right now) – I won’t share it here.

However, it’s worth noting that it was quite a brave stunt to pull, given that another Russian performer, a rapper called Nikolai Vasilyev who says things in very rapid Russian while a drum machine has a seizure behind him, landed a 15-day sentence for essentially the same ‘crime’.

Vasilyev, whose stage name is Vacio, was also fined 200,000 roubles (AUD$3,313 or thereabouts) for promoting “non-traditional sexual relations” – which is, arguably, a category that includes sticking your todger in a sock.

Maxim Tesli, meanwhile, has apologised for his actions, calling his sock malfunction “absolutely chaotic and stupid” – which, again, is right on the money.

Besides the risk of being tossed in jail for a few weeks, it’s worth remembering that Russia can be brutally cold at this time of year, and gallivanting about town with just your cock in a sock is a recipe for frostbite disaster.

Social media users also suggested that Tesli was in very real danger of giving himself a nasty skin condition – but I don’t think he needs to worry… I’ve seen the video, and he’s at least six inches away from being in any danger of giving himself Athlete’s Foot.

TO MARKETS

In morning trade, local markets have made a belated hoisting of the We Kinda Happy banner after the Australian Bureau of Counting Things on Wednesday, reported monthly CPI read for November came in at 4.3% YoY – below most forecasts and significantly lower than the 4.9% print of October.

That should’ve given the punters something to cheer about, but Wednesday on the ASX was surprisingly uninspired.

We asked Dr Shane Oliver for clarification, since it is our understanding the famed Elvis adherent and chief economist has broken with tradition and is not currently running up and down the streets of Parkes this year:

“I was a bit surprised too – initially the ASX rose slightly then fell. Up again today though,” Dr Shane told Stockhead from an undisclosed locale.

“It was very good news but I suspect the 12% or so rebound since the October low had already priced in a lot of good news. Same story with the S&P. Which leaves shares a bit vulnerable short term to a pullback as we come into the US CPI and central bank meetings later this month/early Feb.”

This morning, the local Tech Sector and a few growth-related stocks surged out of the blocks at 10am after US equities closed higher ahead of their own CPI release tomorrow at 12.30am AEST.

NOT THE ASX

Wall Street got game overnight.

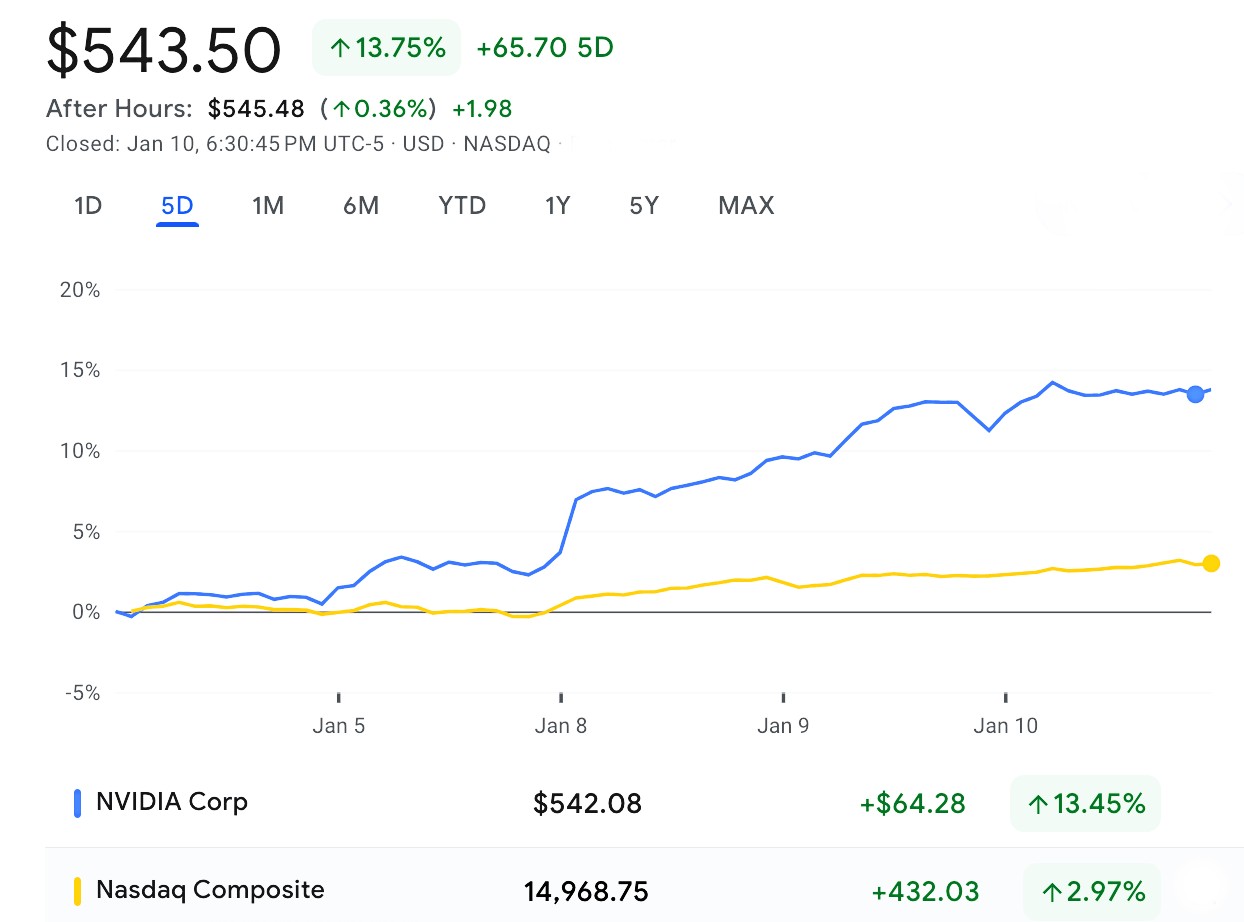

The tech sector was once again the leader, boosted by renewed vigour for Mega Tech.

Namely Mega Meta (3.7%), Mega Nvidia (2.3% and at more record highs) and Mega Microsoft (1.85%).

So far this year, it appears NVDA is off in a universe of its own making.

Read More: NVIDIA is not having the same year the rest of us are

After a brief Tuesday balls-up, when the US Securities and Exchange Commission (SEC) got its X/Twitter account snatched to deliver a false dawn, the SEC has apparently really gone and approved a number of Bitcoin ETFs (exchange traded funds) as we call them down here..

The SEC’s been umming and ahhing for ages over whether the combo of these two new financial instruments really can make music as a duo.

Such a product, one might reckon, could open the floodgates for the cashed up masses to be exposed to the volatile movements in spot BTC via a stockmarket.

For five painful years the SEC backhanded more than 20 applications to approve spot Bitcoin ETFs, but overnight a US Court of Appeals decision in the District of Columbia vacated one of those rejections getting someone at the SEC to review the idea and greenlight a bunch of products.

SEC chair Gary Gensler added a few words of warning to cover the SEC’s tracks, saying approving the products doresn’t mean the SEC actually approves of the products.

He says the commission hasn’t fundamentally altered its general position and caution about cryptocurrencies.

“It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.”

And yet that’s exactly what it does signal.

Good work team. Take a knee.

Let’s talk about US CPI

Current expectations are for headline inflation to hit 3.2% YoY from 3.1% in November.

Core CPI is expected to ease to 3.8% YoY from 4.0%.

While the core measure is still above the Fed’s 2% target, Tony Sycamore at IG markets says disinflation over the back half of 2023 has the six-month rate at around 2%.

“A ‘good number’ is likely priced into the market, and an adverse reaction is expected if the numbers are hotter than expected,” Tony says.

What does a hot number look like, you ask?

“Core CPI has printed at 4.0% YoY for the past two months (October and November). If it were to print at 4.0% for a third straight month, prepare for headlines screaming stubborn inflation.

“The chances of a rate cut in March, currently at around 64%, would fall to about 20-25%. The S&P500 cash would likely experience a vaporising episode and dive to where it started this week, around 4700ish (-2%). On the other hand, a softer-than-expected Core CPI print of 3.7% YoY or less – fresh all-time highs beckon towards 4850 in the S&P500 cash and 17,100 in the Nasdaq cash.”

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JPR | Jupiter Energy | 0.038 | 111% | 860,444 | $22,865,945 |

| MXR | Maximus Resources | 0.047 | 27% | 9,475,452 | $11,862,413 |

| SHG | Singular Health | 0.049 | 26% | 861,986 | $5,511,100 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,541,461 | $7,334,027 |

| NGS | NGS Ltd | 0.016 | 23% | 1,769,455 | $3,265,956 |

| AKM | Aspire Mining Ltd | 0.175 | 21% | 440,136 | $73,607,363 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 830,000 | $1,999,884 |

| A1G | African Gold Ltd | 0.037 | 19% | 10,420 | $5,248,648 |

| LDX | Lumos Diagnostics | 0.096 | 17% | 41,531,386 | $39,466,604 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 388,747 | $6,059,790 |

| NET | Netlinkz Limited | 0.007 | 17% | 2,748,709 | $23,032,885 |

| RMX | Red Mount Mining | 0.0035 | 17% | 886,583 | $8,020,728 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 757,488 | $12,520,004 |

| PCL | Pancontinental Energy | 0.022 | 16% | 36,828,856 | $153,144,233 |

| SIX | Sprintex Ltd | 0.015 | 15% | 1,017,699 | $5,385,410 |

| PVT | Pivotal Metals Ltd | 0.023 | 15% | 858,603 | $13,601,116 |

| CMP | Compumedics Limited | 0.31 | 15% | 192,841 | $47,833,996 |

| FGL | Frugl Group Limited | 0.008 | 14% | 1,694,367 | $7,291,817 |

| LPD | Lepidico Ltd | 0.008 | 14% | 1,007,941 | $53,468,156 |

| NKL | Nickelx Ltd | 0.05 | 14% | 342,000 | $3,863,867 |

| SLM | Solis Minerals | 0.17 | 13% | 27,613 | $11,760,106 |

| LAM | Laramide Resources | 0.86 | 13% | 50,703 | $16,185,836 |

| AX8 | Accelerate Resources | 0.035 | 13% | 181,863 | $17,766,154 |

| ODE | Odessa Minerals Ltd | 0.009 | 13% | 340,000 | $7,576,895 |

| KAL | Kalgoorlie Gold Mining | 0.028 | 12% | 104,665 | $3,962,518 |

Top of the pops for the day so far is Jupiter Energy (ASX:JPR), hyped up harder than a toddler full of GI Cordial (the proper green stuff, not the rubbish red one) after the company brought in Sproule International to to evaluate the Proved, Probable and Possible reserves for Jupiter’s three oilfields in Kazakhstan and to prepare a Competent Person’s Report as to its findings.

The report came back with an upgrade to the recoverable reserves associated with Jupiter’s field, with the total Proved, Probable and Possible total now standing at 46,796,000 bbls, which the company says carries an after-tax Net Present Value of ~$US180 million.

Also out of bed early on Thursday was Maximus Resources (ASX:MXR) which says it’s just defined a number of ‘high-priority lithium targets’ at its $4.5mn Lefroy Lithium Project JV with the South Korean state mining corp KOMIR.

Maximus’ managing director, Tim Wither, says assay results returned from a completed soil-sampling program were “very encouraging.”

“These initial results from the first phase of the project-wide soil sampling campaign have defined a significant anomalous lithium trend over 5km in length, allowing us to set high-priority drill targets at the Lefroy Lithium project.

“The presence of a large 3km x 1.5km lithium-in-soil anomaly, extending from the recent discovery of spodumene-bearing pegmatites, provides more encouraging signs that the lithium-in-soil anomalies may be associated with a very large mineralised system.”

Maximus owns 100% of the Lefroy Lithium Project, with KOMIR able to farm into a stake of up to 30% by spending up to US$3 million, with Maximus retaining management of the project.

Coal from Aspire Mining’s (ASX:AKM) Ovoot project in Mongolia has been designated super high quality, or “fat”, making it ideal for coke making.

Coke is used in the smelting of iron ore, according to Stockhead’s diet coke expert, Reuben Adams.

“We are very excited by this confirmation which places our coal into the ‘fat coal’ market, which will attract a hard coking coal premium,” AKM’s Sam Bowles says. “In recognition of the distinctly unique qualities of this coal, the company will be branding the coal produced from the OCCP as Toson Coal.

“In Mongolian, ‘Toson’ is an adjective meaning ‘fat’ or ‘fatty’.”

Elsewhere, Singular Health (ASX:SHG) has received its first a binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

Details of the enterprise sale are “commercial-in-confidence”, but SHG says revenue generated from this order “exceeds the total direct-to-consumer sales of the 3Dicom software in 2023 of ~A$50,000 by more than 40%”.

So… $70,000?

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 011 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVW Avira Resources Ltd 0.001 -50% 295,714 $4,267,580 RR1 Reach Resources Ltd 0.003 -33% 34,424,349 $14,446,337 CAQ CAQ Holdings Ltd 0.007 -30% 5,000 $7,177,863 IEC Intra Energy Corp 0.003 -25% 5,979,640 $6,643,126 ME1 Melodiol GlobalHealth 0.0015 -25% 2,202,029 $9,457,648 IPB IPB Petroleum Ltd 0.008 -20% 2,580,718 $5,651,224 RLF RLF AgTech 0.098 -18% 2,400 $11,000,027 LLI Loyal Lithium Ltd 0.335 -17% 847,193 $33,731,364 1AE Aurora Energy Metals 0.125 -17% 350,823 $23,881,039 CCZ Castillo Copper Ltd 0.005 -17% 1,495,042 $7,797,032 HCT Holista CollTech Ltd 0.01 -17% 59,756 $3,345,601 HXG Hexagon Energy 0.01 -17% 10,000 $6,154,991 NWM Norwest Minerals 0.027 -16% 1,246,501 $9,202,224 AS1 Asara Resources Ltd 0.011 -15% 166,061 $10,305,502 PHL Propell Holdings Ltd 0.011 -15% 15,700 $1,564,622 RML Resolution Minerals 0.003 -14% 45,000 $4,409,989 STM Sunstone Metals Ltd 0.012 -14% 1,417,385 $48,828,288 MCM Mc Mining Ltd 0.13 -13% 488 $61,183,612 SRZ Stellar Resources 0.007 -13% 7,541,629 $9,192,212 VMS Venture Minerals 0.007 -13% 390,656 $17,680,104 WR1 Winsome Resources 0.745 -12% 3,102,885 $157,959,793 HAW Hawthorn Resources 0.088 -12% 13,563 $33,501,561 CPO Culpeo Minerals 0.115 -12% 5,722,237 $15,153,107 AHF Aust Dairy Limited 0.012 -11% 220,189 $8,854,202 PGY Pilot Energy Ltd 0.024 -11% 2,437,481 $31,398,505

Many thanks to my colleague Christian Edwards, who helped compile this edition of Lunch Wrap.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.