NVIDIA is not having the same 2024 the rest of us are

Via Getty

Overnight, analysts at Oppenheimer reaffirmed their Outperform rating for the US chipmaker Nvidia (NVDA) – which was up again – this time by more than 3.5% (at 6.15am in Sydney), despite a broader market pullback in New York.

Nvidia just hasn’t had the kind of 2024 that its six fellow gunslingers in the so-called Magnificent 7 have had.

It’s easy-as 8.9% gain thus far in ’24 is probably unlike what anyone else has seen of this year, either.

Before bench-pressing a shiny new all time high on Monday, the microchip maker revealed that no less than four major Chinese electric vehicle (EV) brands will be incorporating NVDA tech into the thinking parts which create China’s leading automated driving systems.

It was around this time last year that Nvidia joined Apple et al as the latest Wall Street company with a market capitalisation of over $US1tn.

It’s now regarded – by a long shot – as the go-to designer and supplier of microchip processors for anyone who wants to use or abuse the very best AI computing can offer.

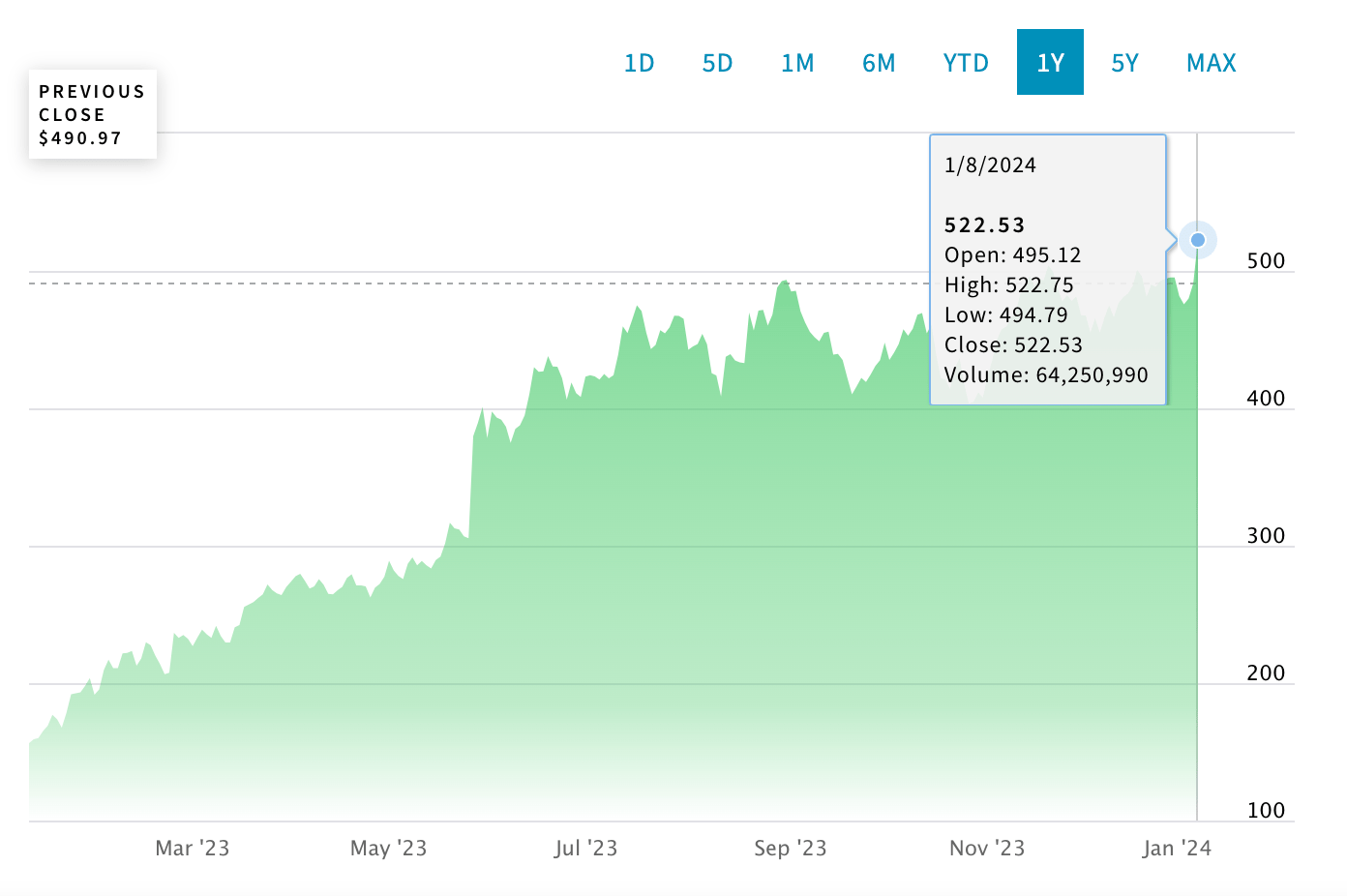

And so, in 2023 it was Nvidia which set alight the Nasdaq-led obsession with AI, the share price more than tripled before Christmas.

On Monday in New York, traders exchanged over US$32 billion worth of NVDA stock, according to LSEG data.

According to Oppenheimer’s tally, Nvidia’s order backlog is more than six months deep.

At an all time high circa US$533 on Wednesday morning in Sydney, the stock’s average target price is closer to circa US$640, making the tech firm’s market cap, at $1.3tn, look eminently pumpable

“Nvidia,” Oppenheimer says, “is leveraging a dominant hardware/software installed base, (and) remains the top AI play.”

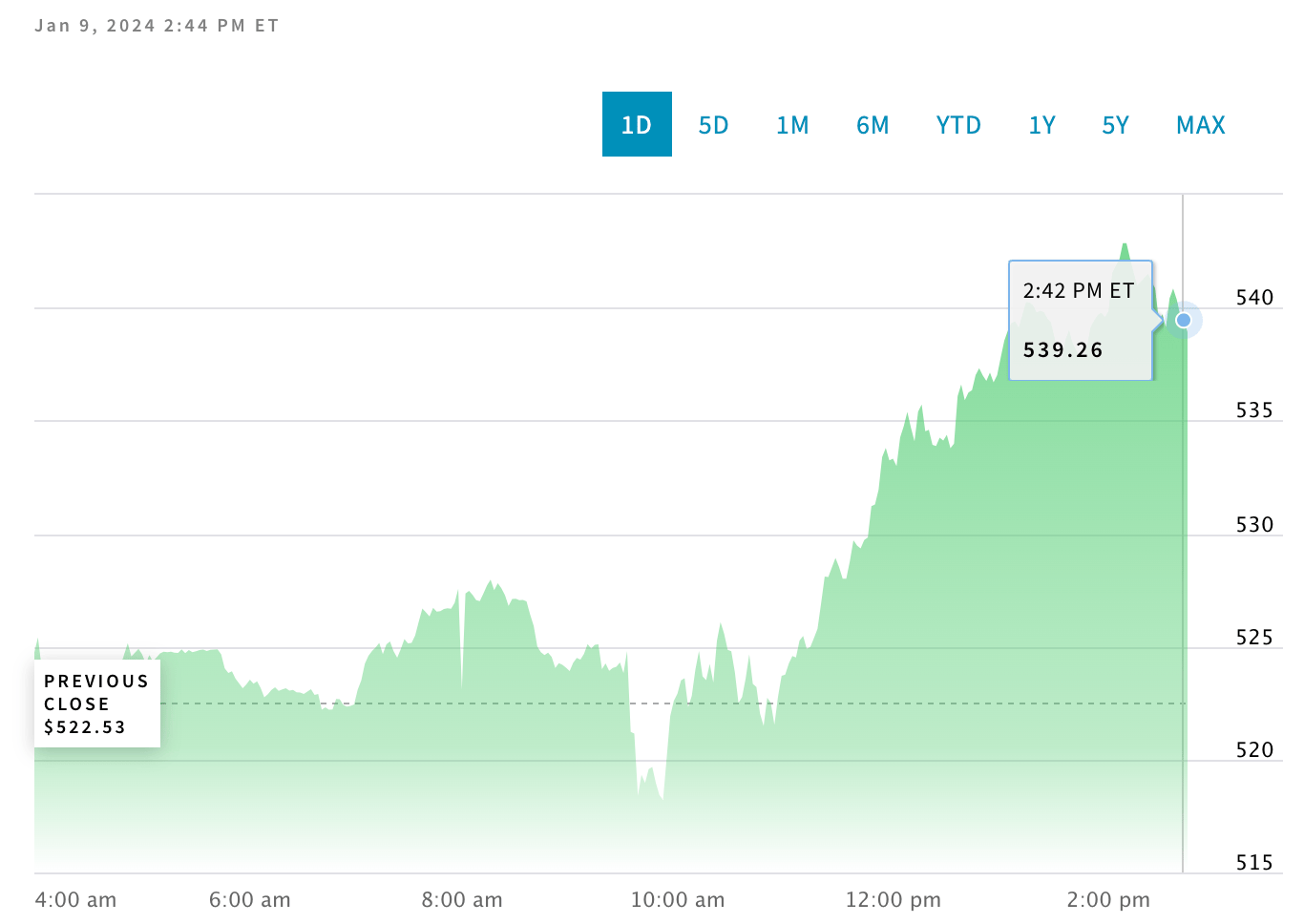

NVIDIA Corp NVDA (Tuesday, at circa 3pm NY)

NVIDIA Corp NVDA (YTD)

NVIDIA Corp NVDA (1 Yr)

Big in Beijing, Watched in Washington

The China news in particular is fascinatingly market-moving on so many fronts.

Lookit China’s free-wheeling foray into a driverless future, Nvidia’s multifaceted market traction and perhaps most perplexingly, the chipmaker’s casual success in winning over China in the face of Washington’s attempts to draw a tighter circle around Chinese access to US tech and the apparent gaps in President Joe Biden’s export bans.

Out front and welcoming any old tech NVDA might be flogging – no less than the Electric Vehicle unit of Chinese telecommunications giant and Huawei facsimile – Xiaomi. As well as the top tier Chinese automakers Li Auto, Great Wall Motor and… Zeekr?

According to a presso delivered to the big CES tech conference in Vegas, where nothing stays for long – all four will be using DRIVE technology to power the Chinese company’s variations on the same theme – automated driving.

The announcement followed the record high close for NVDA on Monday after the world’s most valuable chipmaker revealed all-new desktop graphics processors which apparently lean heavily on artificial intelligence.

The trillion USD company’s stock surged almost 6.5% on Monday to its highest close ever at US$522.53.

Videogame enthusiasts swooned over the new GeForce RTX 40 SUPER Series of graphics processors, while investors eyed moves across China’s burgeoning EV-making market.

China now boasts a handful of fast moving EV brands the scope and scale of which is surely a key growth market for Nvidia; after all, the chipmaker already has its own well-serviced automotive-tech business.

‘

Chinese automakers are racing each other to launch more advanced in-vehicle infotainment displays and automated driving functions. That’s created a growth opportunity for Nvidia, Intel, Qualcomm and other semiconductor manufacturers.

Still, Nvidia and its homegrown (formerly formidable but now recently rather lagging) rivals face a Devils Canyon gauntlet to satisfy the demands of the opposing superpowers facing off across the Pacific.

Firstly China and its state-backed tech firms are in desperado mode for really cracking chip technology. They’re not totally starved, but fresh fodder is thin on the ground.

That’s great for a company like Nvidia … unless meeting those demands and maintaining the trust of those Chinese customers is going to be incredibly difficult when taking into account wretched and reforming supply chains and – most importantly – not crossing the line with angsty US regulators and export laws – the compliance requirements of tightening regulations around the export of tricksy and highly advanced semiconductors into China.

But watching NVDA this week will be revealing for believers in its Magnificence as a stock.

2024 will want to be the year wherein the company convinces investors just how ubiquitous its tech could be.

Also in Vegas on Monday – Nvidia segued from games and geopolitics into online shopping.

Nvidia revealed it’s been cohabitating with the global advertising giant WPP, Lotus and no less than six other companies to come up with faster, clever and more advanced online shopping tools.

According to Danny Shapiro, Nvidia’s VP for automotive, Nvidia tech in the hands of car dealers and wheelers could soon delight online shopping sites with entirely 3D graphics bamboozling buyers with ultra lifelike – and ultra easy to buy – graphic representations of, one supposes, cars.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.