ASX Small Caps Lunch Wrap: Whose invasive home tech saved a baby from a monkey this week?

"It's okay, Johnno... really... you weren't to know it wasn't a real dog. Besides, I bet that baby was all gristle anyway." Pic via Getty Images.

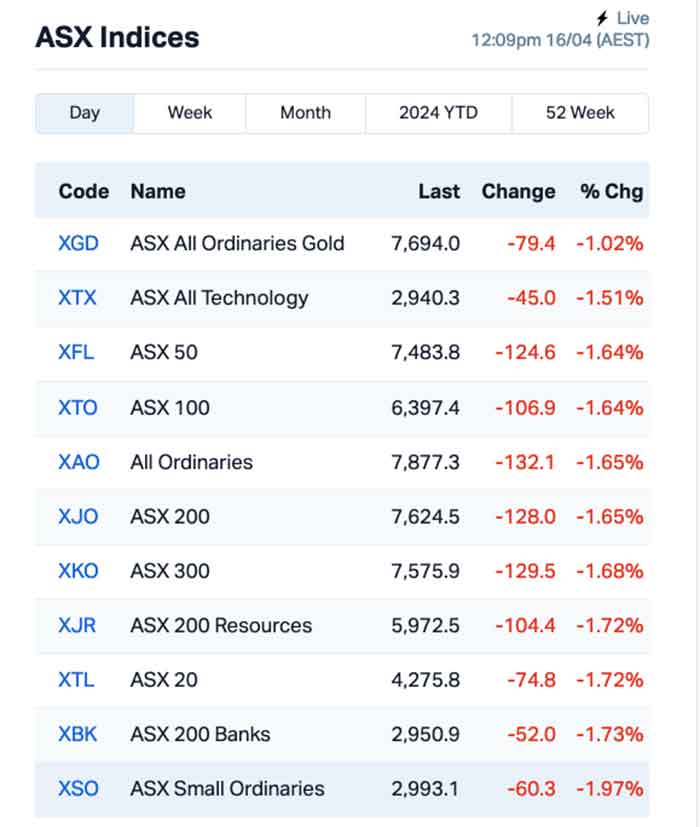

Local markets are melting like a wet wicked witch this morning, with the ASX 200 benchmark down 1.46% in the first hour of trade today, following a similar effort on Wall Street overnight.

It’s not all grim news, though – there’s a couple of Small Caps ignoring the trends and performing quite well, given the circumstances. I’ll get into the details of that shortly, but first we’re off to India where a baby and some unlikely technology have teamed up to thwart a monkey attack.

The story comes from Uttar Pradesh, where a local man – identified by local media as Pankaj Ojha – left his home briefly to run an errand, but failed to secure the door to his home, leaving his 13-year-old sister-in-law Nikita and 15-month-old daughter Vamika inside.

The trouble began when a large monkey entered the home, presumably in search of food, because the report says it ransacked the kitchen and made a hell of a mess.

However, evidently still hungry, the monkey then began to explore the home in search of further sustenance – and that’s when it entered the room where Nikita and Vamika were playing.

Thinking fast, and in the absence of a grown-up, the 13-year-old girl sought help from the only place it was available; the Amazon Alexa unit that was installed in the house.

The young girl asked Alexa to “bark like a dog” – a command the always-listening-and-not-even-a-tiny-bit-creepy home tech obeyed, making enough of a ruckus to fool the monkey into thinking there was a carnivorous protector in the home.

The monkey fled, because monkeys are dumb, leaving the child and infant unharmed, much to the delight of Pankaj Ojha, whose only complaint is that he’s having a dreadful time cancelling a recurring order for explosive bananas and other cheaply-made anti-monkey armanents that Amazon is now delivering to his home without his consent. Possibly.

TO MARKETS

It’s hard yakka on the ASX this morning, after Wall Street took a beating because everyone’s quietly crapping their pants about the escalating tensions in the Middle East.

I have neither the time nor the patience to try to unpack that particular mess, except to say that it’s shaping up pretty poorly at the moment, and if it gets much worse, we’re all in for a very bumpy ride.

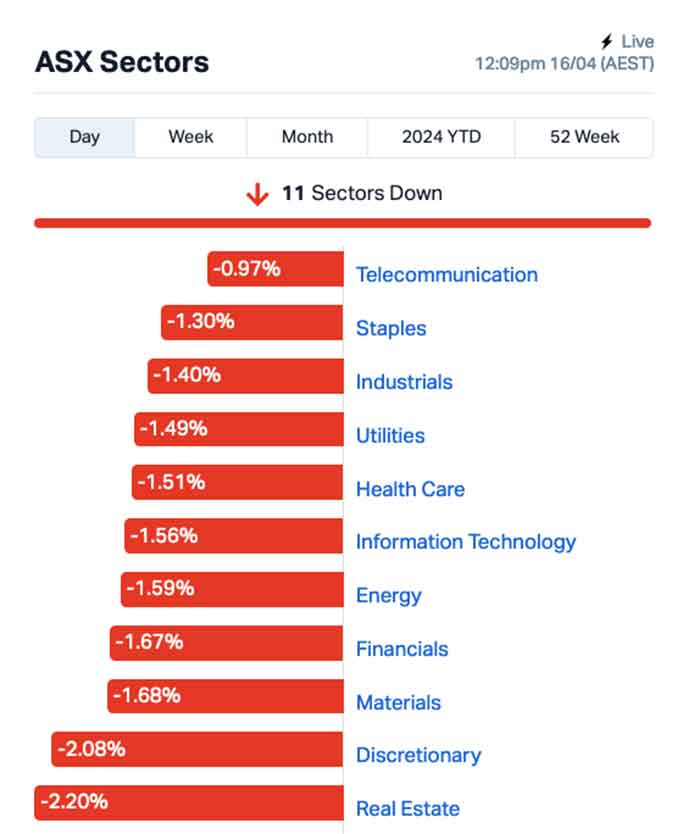

The sentiment locally is negative right across the board. The best performing sector this morning is the Telcos, and that sector’s down -0.88% in the first hour and a bit of trading today.

Update: by midday, the Telcos had fallen even further to -0.88%. Blergh.

Real Estate is being hit hardest, down -2.37% with the most significant loss in that sector apparently coming from sector giant Charter Hall (ASX:CHC), on the back of an announcement that the company has taken a a 14.8% strategic stake in Hotel Property Investments (ASX:HPI) at $3.35 per share – which equates to a $97 million spend to become the company’s largest stakeholder.

A look at the more granular indices shows that even safe haven gold is under attack this morning – it’s the best performer, but it’s down more than -1.0% despite the spot price of gold continuing to rise overnight. It was up 2.0% to US$2,390 an ounce.

NOT THE ASX

Wall Street stumbled badly overnight as the grim reality of an escalation of hostilities in the Middle East weighed heavily on the market.

If that wasn’t enough of a wet blanket, anyone in the US who was still holding out hope for two rate cuts this year was dealt yet another blow, as much stronger than expected US retail sales data landed, showing a +0.7% rise in March.

That’s on the heels of an increase of 0.9% in February, and significantly ahead of analysts’ expectations of +0.4%.

In US stock news, Tesla slipped over -5.5% after two top execs quit the company in the midst of the carmaker’s largest-ever round of job cuts.

The most recognisable EV maker on the planet is likely to be left almost unrecognisable, with the company’s top brass deciding that 14,000 workers – more than 10% of its global workforce – need to go.

Among the list of Tesla casualties were two senior leaders, namely battery development chief Drew Baglino and vice president for public policy Rohan Patel. Elon Musk thanked them on Twitter for their service.

Musk also explained the job cuts as “business as usual” for the EV maker, saying: “About every five years, we need to reorganize and streamline the company for the next phase of growth.”

Translation: I really should spend less time playing Culture Wars on X, and start being a CEO again. Possibly.

American Airlines dropped -1.6% after its workers’ union told members to be vigilant following a “significant spike” in safety related problems at the carrier.

And, rather alarmingly, Wall Street’s “fear gauge” — the VIX — has spiked by +11% after jumping +14% on Friday. The index, which essentially predicts how volatile S&P 500 stock prices could be in the next 30 days, is at levels unseen this year, reports Earlybird Eddy Sunarto.

In Asian market news, the doldrums appear to have spread eastward as well, leaving Shanghai markets down -1.01% and Hong Kong’s Hang Seng off by -1.28%.

Japan’s Nikkei is also struggling today, dropping -1.67% on news that a 32-year-old man had stolen a gold bowl worth 10 million yen (AUD$101,000).

The alleged thief, identified as Tokyo resident Masaru Horie, has been arrested, and the ridiculously expensive bowl has been recovered at a local pawn shop, where I can only assume that the best the shop’s operator could do was 50,000 yen.

He could probably have gone higher, since he knows a guy who knows all about expensive gold bowls, but no doubt the thief didn’t want to hang around for three hours waiting for the expert to arrive.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP DAL Dalaroo Metals 0.029 81% 17,933,904 $1,324,000 DCG Decmil Group Limited 0.28 65% 6,247,000 $26,449,647 GTI Gratifii 0.007 56% 12,686,084 $7,254,202 HIO Hawsons Iron Ltd 0.052 53% 9,305,911 $31,248,416 RMX Red Mount Mining 0.0015 50% 798,913 $2,673,576 WMG Western Mines 0.325 48% 685,276 $16,518,300 LPE Locality Planning 0.075 39% 1,221,173 $9,731,038 AS1 Asara Resources Ltd 0.01 25% 13,614,883 $7,057,403 TIG Tigers Realm Coal 0.005 25% 4,562,415 $52,266,809 ALV Alvo Minerals 0.18 20% 138,226 $13,969,547 CAV Carnavale Resources 0.006 20% 3,620,075 $17,117,759 CTO Citigold Corp Ltd 0.006 20% 3,059,900 $15,000,000 LSA Lachlan Star Ltd 0.06 18% 90,814 $10,586,233 LYN Lycaon Resources 0.24 17% 945,488 $9,031,531 NNG Nexion Group 0.014 17% 2,130,815 $2,427,694 TAR Taruga Minerals 0.007 17% 600,000 $4,236,161 AXN Alliance Nickel Ltd 0.036 16% 40,004 $22,501,028 APS Allup Silica Ltd 0.052 16% 615,933 $1,731,470 OLY Olympio Metals Ltd 0.06 15% 81,192 $3,653,610 TAL Talius Group Limited 0.008 14% 188,071 $18,073,420 EMC Everest Metals Corp 0.125 14% 773,983 $18,071,142 CR9 Corellares 0.017 13% 5,000 $6,976,363 PNT Panther Metals 0.034 13% 50,000 $2,614,985 1TT Thrive Tribe Tech 0.018 13% 88,811 $4,745,944

In the lead on Tuesday morning was explorer Dalaroo (ASX:DAL), rising sharply in the morning on the back of a tasty +200m long gold find at Goodbody West, part of the Lyons River project in the Gascoyne region of WA.

The best of the results include 5m @ 0.85g/t Au from 9m, including 1m @ 1.83g/t Au from 9m and 1m @ 1.23g/t Au from 12m – a happy amount of gold and not far from the surface.

Hawsons Iron (ASX:HIO) was on the move this morning, after revealing to the market that seven potential strategic investors had been handed a 350-page Information Memorandum, containing a comprehensive review of results from activity undertaken in line with the company’s strategic review, issued in February last year.

Western Mines Group (ASX:WMG) was also celebrating some assay results revealing the company is onto broad zones of nickel sulphide mineralisation – elevated Ni and S coincident with highly anomalous Cu and PGE, including a cumulative assay from one drill hole that totalled 184m at 0.27% Ni, 126ppm Co, 82ppm Cu, 18ppb Pt+Pd with S:Ni 0.9.

Locality Planning Energy (ASX:LPE) was rising on news of an unsolicited and “opportunistic” off-market takeover offer from River Capital, which the company has directed shareholders to ignore.

And Alvo Minerals (ASX:ALV) was moving positively on news that it has secured firm commitment from Ore Investments to invest A$4.1 million at $0.175 per share, giving the latter pro-forma ownership of 19.9% in Alvo Minerals. That’s on top of existing substantial shareholder Strata Investment to invest $125,000 as well.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap YPB YPB Group Ltd 0.001 -50% 10,000 $1,580,923 88E 88 Energy Ltd 0.004 -33% 277,506,026 $150,744,375 MTL Mantle Minerals Ltd 0.001 -33% 300,000 $9,296,169 RR1 Reach Resources Ltd 0.002 -33% 333,333 $11,070,061 IEC Intra Energy Corp 0.0015 -25% 4,341,250 $3,381,563 LPD Lepidico Ltd 0.003 -25% 11,078,809 $30,553,232 TD1 Tali Digital Limited 0.0015 -25% 400,000 $6,590,311 PLL Piedmont Lithium Inc 0.22 -23% 13,000,572 $109,392,263 MCL Mighty Craft Ltd 0.014 -22% 107,000 $6,572,379 ATH Alterity Therap Ltd 0.0055 -21% 11,920,646 $36,666,125 FND Findi Limited 2.43 -21% 594,955 $150,307,761 ALM Alma Metals Ltd 0.008 -20% 5,616,812 $13,108,133 GMN Gold Mountain Ltd 0.004 -20% 13,538,685 $14,877,528 ME1 Melodiol Global Health 0.004 -20% 3,722,060 $2,690,966 PSL Paterson Resources 0.016 -20% 1,199,385 $9,120,758 RML Resolution Minerals 0.002 -20% 75,000 $4,024,992 TX3 Trinex Minerals Ltd 0.004 -20% 17,858 $8,724,546 ATX Amplia Therapeutics 0.07 -18% 691,642 $16,490,544 BM8 Battery Age Minerals 0.1 -17% 120,000 $11,011,238 W2V Way2Vatltd 0.015 -17% 8,055,638 $13,449,802 AYT Austin Metals Ltd 0.005 -17% 142,000 $7,711,148 RLG Roolife Group Ltd 0.006 -14% 100,000 $5,476,672 EE1 Earths Energy Ltd 0.013 -13% 1,264,642 $7,949,463 SVG Savannah Goldfields 0.026 -13% 1,563 $8,432,547

ICYMI – AM EDITION

Eagle Mountain Mining (ASX:EM2) has raised $1.1m through a placement of shares priced at 6c each to sophisticated and institutional investors.

Proceeds from the placement, which comprises the residual shortfall placement from the recently closed renounceable entitlement offer that raised $4.18m, will boost exploration at its Silver Mountain uranium project and studies at the Oracle Ridge project.

Each share includes one free attaching option exercisable at 20c and expiring on 31 March 2027.

New World Resources (ASX:NWC) is cashed up to accelerate exploration drilling, reserves definition drilling, project development and mine permitting at its high-grade Antler copper project in Arizona after raising $20m through a successful share placement.

The placement of shares priced at 3.6c each, which represents a 17.5% discount to the 15-day volume weighted average price, received strong stupport from domestic and international institutional investors.

“Funds raised from the placement will allow us to continue to advance our high-grade Antler copper project against the backdrop of a favourable outlook for the copper market,” managing director Mike Haynes said.

Raiden Resources (ASX:RDN) has completed heritage surveys over its Andover North and Andover South projects on scheduled and within budget.

It is now waiting on preliminary reports for both projects with final reports pending approval by the Ngarluma Aboriginal Corporation.

The company will outline the timetable for drilling once the final reports are received.

Titanium Sands (ASX:TSL) is raising up to $2.1m through a placement of shares priced at 0.75c each to sophisticated and professional investors.

It has received firm commitments for $1.5m worth of shares and is looking to finalise the issue of a further 80 million shares for another $600,000 in funding. The placement includes the issue of one option exercisable at 2.3c expiring 16 February 2026 for every two shares subscribed for.

Proceeds will be used to further the environmental and stage 2 & 3 EIA processes for the Mannar heavy mineral sands project in Sri Lanka.

At Stockhead, we tell it like it is. While Eagle Mountain, New World Resources, Raiden Resources and Titanium Sands are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.