ASX Small Caps Lunch Wrap: Whose AI turned the drive-thru into a bun fight this week?

Robert was very surprised to learn that if you hold a greasy hamburger up to your ear, you can hear the sound of lots of people laughing at you for being dumb. Pic via Getty Images.

Local markets opened slightly higher this morning, but managed to offload any hint of advancement within about 35 minutes of business getting underway on the bourse today.

By lunchtime, the market was back where it started, so that seemed like a good enough point to rule a line underneath it all for the morning and actually start doing the thing that I get paid for: trying to make sense of it all, while struggling to rein in an increasingly concerning sense of humour.

I’ll get into the details of all that market goodness in a minute, but first to some news from the intersection of high tech wizardry, and fast food – a hot topic for Aussie investors as the market deals with the greasy aftertaste of Guzman y Gomez’s gangbusters IPO yesterday.

Reports have emerged from the US that fast food giant McDonald’s has learnt a hard lesson about adopting emerging technology too early in its lifecycle.

The company has evidently been caught up in the AI hype train, and has been experimenting with its own implementation of an AI-driven system to take customer orders since it bought AI startup Apprente in 2019.

But, so far at least, in the race to shoehorn the technology into the customer end of the burger-flinger’s supply chain, it seems Old McDonald night have made a costly mistake when he put Grimace and the Hamburglar in as Junior VPs to lead the dev team on the project.

Apparently training an AI using only the phrase “robble robble robble” didn’t elicit the desired results.

The premise was simple enough – McDonald’s saw an opportunity to remove awkward pimply teenagers from customers’ drive-thru experience, replacing them with an AI-powered gizmo to take and process orders from Americans who are too lazy, large or – highly unlikely – too busy to waddle inside for their pre-diabetic second lunch snack.

The fact that I’m writing about it here should tell you that it has, of course, gone hilariously wrong, with customers posting the results of the AI-driven tech’s interpretation of their orders online for the whole world to laugh at.

So far, the mistakes have mostly been pretty benign – random food items being added to orders for no apparent reason, that sort of thing. But at least one customer and her friend were amused when the computer went waaaaay off the reservation, piling on orders for 10-packs of McNuggets meals.

@typical_redhead_ I thought TikTok would appreciate this #fyp #foryou #foryoupage #comedy #fail ♬ Monkeys Spinning Monkeys – Kevin MacLeod & Kevin The Monkey

The video, sadly, cuts the experience short – but it’s a fair guess the driver and her passenger probably had zero intention of spending more than US$313 on 22 separate meals of Macca’s nuggety goodness.

Other AI-driven foul-ups included one women who said “and one hash brown” to the machine, which it interpreted by adding 9 iced teas to her order.

So US McDonald’s has decided to pull the tech from its stores until such time as it’s been properly de-bugged – but far too late from stopping customers from wondering if McDonald’s actually is run by a bunch of clowns.

TO MARKETS

Local markets started Friday morning excellently, but the fun lasted about 10 minutes before investors realised that yes, they were at work, and just because it’s Friday doesn’t mean they can why away from their job today, which – by the looks of things – is to deprive the ASX 200 of as much forward momentum as possible.

The early morning fervour may have come from a boost overnight for a few of the major commodities – Eddy reported this morning that gold prices enjoyed a +1.30% rally to US$2,359.86 an ounce, and silver, platinum and copper have all had pretty big, positive swings for the week so far.

I guess the banner headline stuff from the ASX today is the red-hot question on everybody’s lips: Will the bourse’s new burrito buddies Guzman y Gomez (ASX:GYG) be strong enough to weather an important session this morning?

The company listed yesterday, the ~15 million shares on offer were snapped up quickly, and GYG finished the day at a well-supported $30 per share.

However, it seems that at least some investors are experiencing first-hand the “morning after remorse” that typically follows a GYG binge, and in a couple of hours this morning, its price had retreated more than -5.0%.

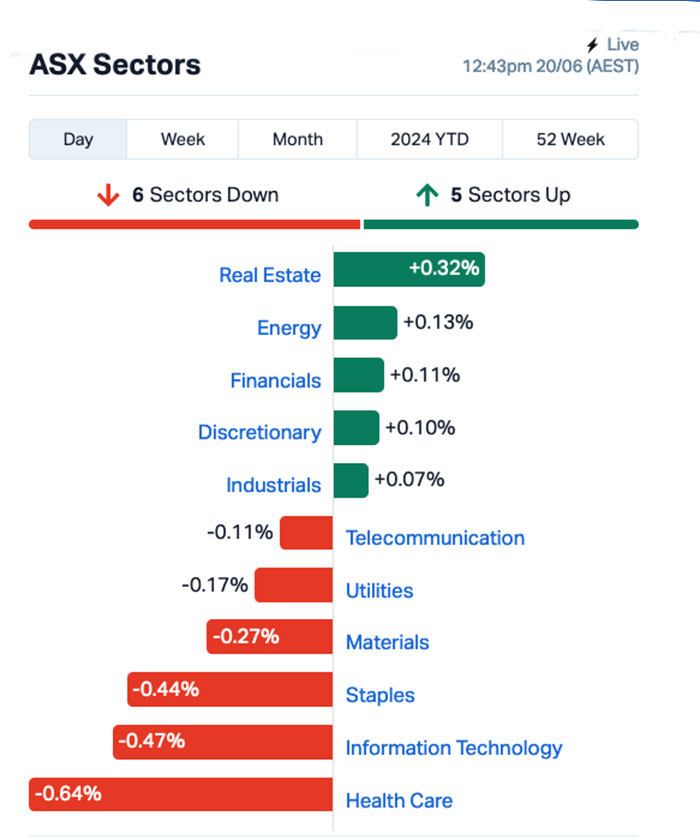

The morning’s sector charts looked like this:

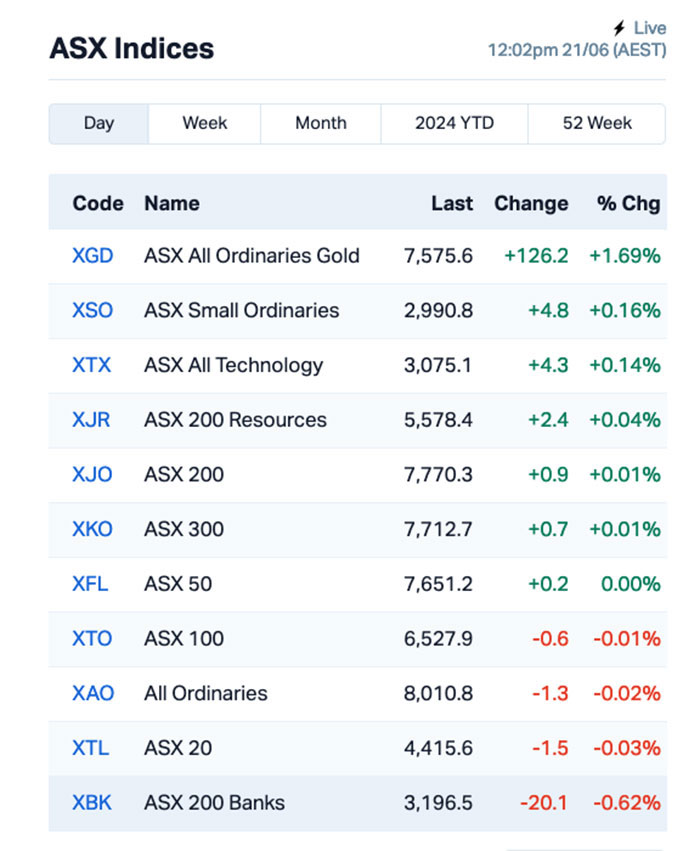

The ASX indices looked like that:

… and there’s nary a surprise result in there, so I say we stick a pin in this, so we can circle back later to bring you a freshly-made batch of market news at the end of the day.

NOT THE ASX

Us investors came back from the Juneteenth holiday with mixed emotions, which saw only the Dow Jones index making gains – up +0.77% – while the other two majors were apparently on the wrong side of a tech sector profit-taking spree that saw the S&P 500 fall by -0.25% and the Nasdaq drop -0.79%.

Nvidia and Apple led the Nasdaq losses, falling by -3.54% and -2.15% respectively, and the sell-off prompted Craig Johnson at Piper Sandler to opine that the market had clearly been overbought recently.

“Bullish momentum remains intact for the S&P 500 and Nasdaq, but near-term overbought conditions coupled with deteriorating breadth make equities vulnerable to a pullback or correction,” Johnson told Bloomberg.

In other US stock news, Dell Technologies fell -0.65% despite CEO Michael Dell announcing plans to establish a “Dell AI factory” in collaboration with Elon Musk’s startup xAI, alongside Nvidia Corp. xAI will utilise Dell’s XE 9680 servers.

United Airlines ticked modestly lower after one of its planes returned to a Connecticut airport due to a dislodged piece of the liner inside the engine cover. This incident adds to the airline’s difficulties this year, as it continues to be scrutinised for various flight issues.

And shares of MGM Resorts surged by nearly 3% after the company revealed cunning plans to introduce a novel online betting experience. This initiative will feature live dealers stationed at two of its prestigious Las Vegas resorts, marking a pioneering move among casino operators on the renowned Las Vegas Strip.

In Asian market news, Shanghai markets are down (-0.25%), Hong Kong’s Hang Seng is downer (-1.27%) and Japan’s Nikkei is ultra-flat – a calming yin to the rest of Asia’s seething yang.

The Nikkei is most likely flat today because investors in Tokyo have spent the morning watching this incredible news story of a young Japanese boy being rescued from the water by a poorly-animated chap from the Philippines.

Word around Hollywood is that there’s already a sequel in the works, with legendary animator Hayao Miyazaki – who made such classics as Spirited Away, Howl’s Moving Castle and Don’t Be So Gross, Mr Tentacles! – already announcing that the 45-second follow-up news report should be ready for audiences in 8 or 9 years.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap K2F K2Fly Ltd 0.185 85% 1,321,651 $18,692,719 PPY Papyrus Australia 0.018 64% 681,678 $5,419,619 MTB Mount Burgess Mining 0.0015 50% 5,384 $1,298,147 VML Vital Metals Limited 0.003 50% 2,379,640 $11,790,134 TSL Titanium Sands Ltd 0.007 40% 963,271 $11,058,736 LNU Linius Tech Limited 0.002 33% 355,000 $8,320,111 FNR Far Northern Res 0.2 29% 42,144 $5,540,603 DAL Dalaroometalsltd 0.024 26% 2,217,382 $1,572,250 BLZ Blaze Minerals Ltd 0.005 25% 850,000 $2,514,233 ESR Estrella Res Ltd 0.005 25% 106,250 $7,037,487 MCT Metalicity Limited 0.0025 25% 500,000 $8,971,705 PKO Peako Limited 0.005 25% 100,000 $2,108,339 AQI Alicanto Min Ltd 0.023 21% 4,190,709 $11,696,149 JRV Jervois Global Ltd 0.023 21% 26,551,293 $51,352,512 CYP Cynata Therapeutics 0.29 21% 335,400 $43,111,629 PVE Po Valley Energy Ltd 0.036 20% 217,556 $34,768,849 PVT Pivotal Metals Ltd 0.018 20% 460,280 $10,561,774 EEL Enrg Elements Ltd 0.003 20% 6,333 $2,524,913 BCM Brazilian Critical 0.019 19% 99,317 $13,291,831 CHW Chilwaminerals 0.735 19% 7,591 $28,442,501 FTZ Fertoz Ltd 0.032 19% 34,750 $6,756,720 ARV Artemis Resources 0.013 18% 1,249,891 $19,406,158 ZMM Zimi Ltd 0.013 18% 495,266 $1,356,829 KNI Kunikolimited 0.23 18% 329,156 $16,895,632 PIL Peppermint Inv Ltd 0.01 18% 3,462,506 $18,031,546

Friday morning’s winner’s list was dominated by K2Fly (ASX:K2F), after the asset management consulting services company revealed that it has entered into a Scheme Implementation Deed with Argyle Bidco that will see the latter acquire 100% of K2Fly for $0.19 per share.

The K2Fly board seems very keen that shareholders take up the offer, as it represents a 90% premium on the company’s 20 June 2024 closing price, and will give shareholders “certainty of value and the opportunity to realise their investment in full for cash”.

Alicanto Minerals (ASX:AQI) was also up on Friday morning, in the wake of the company announcing that it’s keen to undertake a 1 for 5 pro rata non-renounceable offer to raise up to approximately $1.6 million (before costs), at an offer price of 1.3c per new share – a 31.58% discount to yesterday’s closing share price of $0.019.

And that’s about it for winners with news this morning – I could write more, but I’d just be making things up, and we can’t have that now, can we?

… No. we definitely don’t want that.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 88E 88 Energy Ltd 0.002 -33% 4,680,791 $86,678,016 AMD Arrow Minerals 0.002 -33% 7,905,070 $31,618,095 CT1 Constellation Tech 0.002 -33% 50,019 $4,424,201 KOR Korab Resources 0.007 -30% 513,255 $3,670,500 AAU Antilles Gold Ltd 0.003 -25% 496,427 $3,986,140 AD1 AD1 Holdings Limited 0.006 -25% 398,750 $7,189,187 EDE Eden Inv Ltd 0.0015 -25% 48,000 $7,356,542 NAE New Age Exploration 0.003 -25% 10,889 $7,175,596 RIL Redivium Limited 0.003 -25% 5,214,430 $10,923,419 SGC Sacgasco Ltd 0.003 -25% 140,000 $3,118,748 AI1 Adisyn Ltd 0.02 -20% 427,398 $4,628,300 MOZ Mosaic Brands Ltd 0.08 -20% 2,416,124 $17,850,644 AUH Austchina Holdings 0.002 -20% 100,000 $5,250,959 NWF Newfield Resources 0.105 -19% 15,216 $122,291,379 HE8 Helios Energy Ltd 0.031 -18% 233,665 $98,953,879 AVE Avecho Biotech Ltd 0.0025 -17% 44,766 $9,507,891 BEL Bentley Capital Ltd 0.02 -17% 26,290 $1,827,070 OSL Oncosil Medical 0.005 -17% 510,932 $19,992,657 POS Poseidon Nick Ltd 0.005 -17% 483,790 $22,281,209 RNE Renu Energy Ltd 0.005 -17% 17,604 $4,356,804 SI6 SI6 Metals Limited 0.0025 -17% 4,283,334 $7,106,578 CGR Cgnresourceslimited 0.14 -15% 580,265 $14,978,402 AUA Audeara 0.029 -15% 238,978 $4,937,620 EVR Ev Resources Ltd 0.006 -14% 270,000 $9,248,900 EXT Excite Technology 0.006 -14% 31,000 $10,179,692

ICYMI – AM EDITION

Strickland Metals (ASX:STK) has made several executive and non-executive board changes to drive the next stage of exploration and resource growth at its Rogozna project in Serbia and Yandal project in Western Australia.

Additions include Paul L’Herpiniere as managing director, Richard Pugh as executive technical director (Western Australia), Jon Hronsky as non-executive director, and Peter Langworthy as non-executive director.

Resource Base (ASX:RBX) has commenced exploration at its Wali lithium project in Canada’s prolific James Bay region, with a soil sampling program expected to follow up anomalous targets defined in drilling last year across a highly prospective ~1.2 km² area which covers several mapped pegmatites.

Mt Malcolm Mines (ASX:M2M) ) has begun bulk sampling and an ore processing study at the Golden Crown prospect in WA, with a focus on resource estimation in the near-term.

At Stockhead, we tell it like it is. While Strickland Metals, Mt Malcolm Mines and Resource Base are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.