ASX Small Caps Lunch Wrap: Who’s trying to make it harder to get really stoned in the US today?

"Put the bong down, Dave – the computer says your card's been declined, man." Pic via Getty Images.

After a minor stumble at open, local markets have delivered a solid morning of gains, driving the benchmark forward +0.77% by lunchtime today.

However, the mood has been tempered somewhat by an ABS report that the June quarter Export Price Index has fallen 8.5%, pushing Materials and Energy stocks lower.

But before I get into the details of that, there’s some bad news for marijuana enthusiasts in the United States, where Mastercard has decided to stop letting people pay for their dope using a debit card.

According to a Reuters report, the decision was made by the company on the basis that marijuana – while legalised/decriminalised to varying degrees in many US states – remains illegal according to US federal law.

“As we were made aware of this matter, we quickly investigated it. In accordance with our policies, we instructed the financial institutions that offer payment services to cannabis merchants and connects them to Mastercard to terminate the activity,” a spokesperson for the company said.

“The federal government considers cannabis sales illegal, so these purchases are not allowed on our systems.”

On the surface, it sounds like a major issue for cannabis suppliers in the US, which have been operating freely under state law in many areas for quite some time, as marijuana usage – even for recreational purposes – rapidly becomes normalised.

However, a push by left-leaning Democrats in Congress to overturn the often draconian marijuana laws in the US is facing significant headwinds, thanks to Republicans like Senator John Cornyn, who remains steadfastly opposed to letting people get monstrously high and giggle at cartoons for a few hours.

The upshot is that most cannabis users in the US who use Mastercard products will simply have to go back to how things were done in the Dark Ages of enjoying jazz cigarettes – making the whole thing a cash-only transaction.

Thankfully, given that there are now brick-and-mortar shopfronts where those purchases can be made, the issue of having to sit in their dealer’s foul-smelling bedroom and play Xbox for at least an hour “so my mom doesn’t get suspicious about why you’re here” can be avoided.

What’s left unsaid is the fact that Mastercard really only wants their debit and credit cards used for their intended purposes, including cutting up fat lines of cocaine on glass-topped coffee tables, or being left behind the bar at strip clubs by forgetful magazine editors.

TO MARKETS

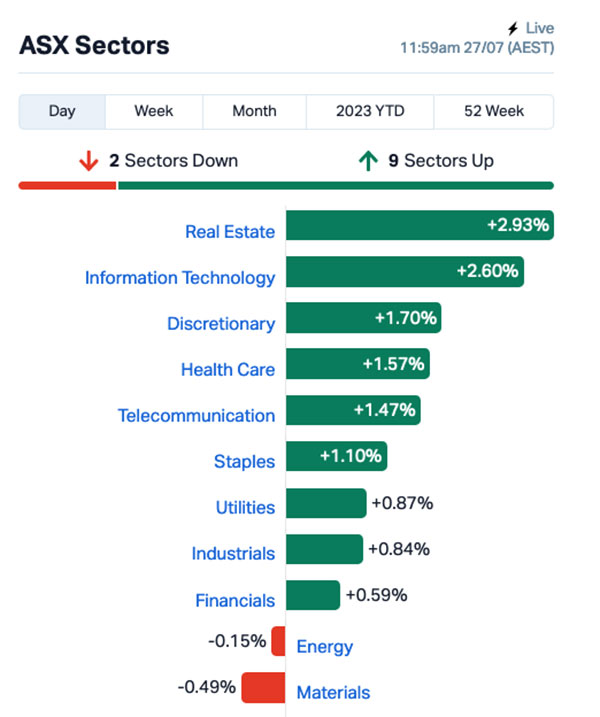

The ASX 200 benchmark is sitting pretty on +0.77% at lunchtime today, following a surge in tech stocks (again), with a big burst of energy out of the Real Estate sector as well.

The latter sector is leading the charge on +2.9% this morning, InfoTech is up 2.6%, Consumer Discretionary is up 1.7% … it’s looking like a pretty solid day for just about everyone.

That’s everyone except Material and Energy stocks – both of those sectors are looking a little gloomy this morning – which is hardly surprising considering the Champions of the Calculators at the ABS dropped the Export Price Index for the June quarter, and it’s decidedly not great.

According to the ABS, the June quarter Export Price Index has fallen 8.5%, and is down 11.2% on an annual basis.

ABS head of prices statistics Michelle Marquardt said it is “the largest quarterly fall since the September quarter 2009, largely due to a strong drop in global energy demand”.

NOT THE ASX

In the US overnight, all eyes were on the US Fed decision that played out precisely as market watchers expected, with Jerome “Pow Pow” Powell stepping up to the microphone and droning out the news of a 25bp rate rise, taking it to a range of 5.25-5.50%, the highest level in 22 years.

While the market had fully anticipated the decision, chair Powell gave nothing away regarding future decisions, Earlybird Eddy wrote this morning.

Instead, he repeatedly reiterated the data dependency of the Fed’s next few meetings, simply noting that the FOMC is prepared to tighten policy further, if appropriate.

Treasury yields dropped after the announcement, suggesting that traders expect the Fed to stop hiking rates, at least for the rest of the year.

Following the news, US Senate Majority Leader Mitch McConnell fronted the media pack to talk about the news of the day, and had this to say.

It remains unclear whether McConnell had a stroke, stopped talking to soil his $3,000 suit, or suddenly realised he’s an extremely well-dressed and surprisingly upright turtle – but word on the street is that “he’s fine” and will be back to destroying what’s left of the American Dream tomorrow.

The far more exciting news is that the Dow is now on Day 13 of its winning streak, equalling the all-time record set in 1987.

The Dow’s +0.23% result was very much the highlight of the Index Results day, as the S&P 500 ended flat, and tech heavy Nasdaq fell -0.12%.

In US stock news, Google parent Alphabet climbed 6% to a 15-month high as quarterly revenue beat expectations, while Microsoft fell 4%, its steepest loss since January, on softening sales growth.

Meta rose 1.5% after beating expectations, while Boeing surged 9% after generating $2.58 billion in free cash flow in Q2 amid solid jet deliveries.

In Japan, the Nikkei is running flat on news that Japan is becoming less Japanese, according to government data released yesterday.

The numbers reveal that the population of Japanese nationals fell 801,000 in 2022 from a year earlier, to a total of 122,423,038 – the largest single drop since the annual survey began.

It’s also the first time all 47 of Japan’s prefectures have seen a decline since the survey began in 1968.

It remains unclear where all of Japan’s citizens are going, with officials forming investigative panels to determine whether they are moving overseas, or – more likely – falling victim to kamigakushi, the practice of ancient Japanese gods who enjoy a spot of kidnapping from time to time.

Police are also investigating prominent documentary maker Hayao Miyazaki, whose 2001 film Spirited Away revealed the extent of the issue, after one young girl’s parent were turned into pigs, forcing her to work in a bathhouse/brothel until she fell in love with a dragon, or something.

I don’t know… it’s been a while since I watched it.

Meanwhile in China, former Foreign Minister Qin Gang is still missing, and Shanghai markets are up 0.53%, while in Hong Kong the Hang Seng is up 1.44% because of reasons.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap G50 Gold50 Limited 0.34 79% 1,722,951 $10,819,170 XTC Xantippe Resources 0.0015 50% 3,047,500 $11,480,100 R3D R3D Resources Ltd 0.037 48% 90,448 $2,950,759 DDT DataDot Technology 0.004 33% 1,351,192 $3,632,858 ROG Red Sky Energy 0.004 33% 372,130 $15,906,682 PAC Pacific Grp Ltd 10.33 32% 397,183 $402,275,125 AJQ Armour Energy Ltd 0.0025 25% 64 $9,842,684 RBL Redbubble Limited 0.5925 22% 1,103,784 $134,694,308 TMB Tambourah Metals 0.285 19% 1,066,958 $10,144,609 BMO Bastion Minerals 0.032 19% 938,087 $4,679,754 BCC Beam Communications 0.18 18% 960,861 $13,179,343 AUQ Alara Resources Ltd 0.033 18% 222,049 $20,106,451 AUR Auris Minerals Ltd 0.014 17% 1,754 $5,719,511 CXU Cauldron Energy Ltd 0.007 17% 1,044,582 $5,589,412 OPN Oppenneg 0.007 17% 640,000 $6,700,078 TTT Titomic Limited 0.014 17% 3,692,403 $10,363,373 YPB YPB Group Ltd 0.0035 17% 812,000 $2,230,384 VBS Vectus Biosystems 0.5 16% 4,600 $22,871,493 PEC Perpetual Res Ltd 0.022 16% 4,676,698 $10,364,195 MEM Memphasys Ltd 0.015 15% 814,845 $12,473,765 RLF RLF AgTech 0.195 15% 216,661 $15,583,372 LSR Lodestar Minerals 0.008 14% 1,485,942 $12,903,781 ODE Odessa Minerals Ltd 0.008 14% 21,021,882 $6,629,783 PPL Pureprofile Ltd 0.032 14% 786,559 $31,733,026 C1X Cosmos Exploration 0.42 14% 293,653 $16,455,750

Right up the top of the tree – and waaaaay out in front of everyone else – is Gold 50 (ASX:G50), sailing up 84% by lunchtime today after revealing that it’s hit a very tasty patch of gallium mineralisation at its flagship Golconda project in Arizona.

It’s not a mineral that many are familiar with, but it is extremely useful in a bunch of applications, including the creation of low melting point alloys, as a silicon substitute in semiconductors and, in the right compound, can produce laser light directly from electricity.

Anyway – Gold 50 is reporting assays that look like this…

- 109m at 40.5g/t gallium from 129m in hole GDD02

- 241m at 20g/t gallium from surface in hole GRC01

- 308m at 28.6g/t gallium from surface in hole GRC02

- 271m at 23.8g/t gallium from surface in hole GRC05

… which is lovely and thick, like my mate Robbie – beaut bloke, dumb as a box of rocks, but he’s suspiciously muscular and really good at moving heavy things around.

Elsewhere, Bastion Minerals (ASX:BMO) is up 25.9% this morning on news that it has elected to exercise its option to acquire the three highly prospective lithium property packages located in Ontario, Canada.

“Following the commencement of exploration activities on the portfolio of assets Bastion elected to exercise the option early, after Bastion management was able to negotiate significantly more favourable acquisition terms on the company’s behalf,” BMO said in a statement.

And Redbubble (ASX:RBL) is climbing steadily this morning, following news yesterday that the company has had a couple of wins in the United States Court of Appeals for the Ninth Circuit, stemming from two different court cases.

There is way too much to unpack from that announcement here – but the upshot is that Redbubble is up 21.6% this morning, taking its running totals to +53% for the week, and +96.2% for the past month.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PAN Panoramic Resources 0.056 -39% 38,765,276 $188,684,088 MEB Medibio Limited 0.001 -33% 1,206,111 $7,725,891 CLE Cyclone Metals 0.0015 -25% 253,354 $20,529,010 NSB Neuroscientific 0.089 -23% 150,000 $16,499,239 CTO Citigold Corp Ltd 0.004 -20% 3,491,993 $14,368,295 VAL Valor Resources Ltd 0.004 -20% 100,609 $19,015,174 IS3 I Synergy Group Ltd 0.01 -17% 26,023 $3,468,964 TSL Titanium Sands Ltd 0.005 -17% 442,000 $9,704,145 WIA WIA Gold Limited 0.031 -16% 895,802 $21,290,836 EDE Eden Inv Ltd 0.003 -14% 198,000 $10,489,305 SKY SKY Metals Ltd 0.043 -14% 74,852 $22,727,840 BUB Bubs Aust Ltd 0.2 -13% 8,905,246 $172,812,204 ATH Alterity Therap Ltd 0.007 -13% 85,491 $19,519,181 CCA Change Financial Ltd 0.05 -12% 49,977 $35,776,699 MX1 Micro-X Limited 0.11 -12% 468,604 $64,553,124 A8G Australasian Metals 0.15 -12% 54,633 $8,860,484 WSR Westar Resources 0.025 -11% 2,272,343 $5,190,010 BCB Bowen Coal Limited 0.13 -10% 10,873,883 $309,717,952 RRL Regis Resources 1.8775 -10% 12,425,576 $1,578,125,267 XPN Xpon Technologies 0.045 -10% 329,866 $7,926,376 SP8 Streamplay Studio 0.009 -10% 270,903 $11,381,238 LNR Lanthanein Resources 0.019 -10% 4,362,952 $23,553,087 ODA Orcoda Limited 0.29 -9% 280,422 $54,130,262 NET Netlinkz Limited 0.01 -9% 2,611,483 $38,835,812 TAL Talius Group Limited 0.01 -9% 200,000 $25,065,033

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.