ASX Small Caps Lunch Wrap: Who’s talking big about a brand-new crack this week?

Pic via Getty Images.

Local markets were up this morning, partly because Wall Street did okay on Friday night, and partly because the ASX spent the weekend with its nose in the corner, thinking about the past two weeks and what it could have done better.

The result of that introspective burst of institutional navel gazing was a solid morning for the ASX 200 benchmark, which spent the bulk of Monday morning hovering around +0.8%, despite InfoTech’s failure to launch with the rest of the group.

I’ll get into that shortly, but first to some really exciting news for anyone who’s a fan of cigarettes and cocaine, after scientists in China revealed that they had managed to genetically engineer a tobacco plant to produce cocaine.

The research team, led by Sheng-Xiong Huang, a plant chemist at the Chinese Academy of Sciences’ Kunming Institute of Botany, made it very clear that this wasn’t done in order to produce the world’s most amazing and incredibly addictive cigarettes – much to the dismay of the fashion industry, which has long depended on the slimming properties of cocaine, vertical stripes and tobacco to make models look excellent in weird clothes.

Huang said that cocaine has other uses, and once everyone was finished laughing at him, he explained that the compound is used in all sorts of medical applications, such as pain-killers and driving California’s plastic surgery community.

In order to make the breakthrough, Huang and the team needed to reverse engineer existing cocaine – which I imagine would have been pretty difficult, if not for the team’s willingness to ‘stay up all night working on this if we have to’.

Interestingly, it turns out that one of the easiest plants to manipulate into producing cocaine is Nicotiana benthamiana – known to Aussie gardening buffs as “Benthi” and to health professionals as “Bush Tobacco” – a native Australian species that has been bullied by scientists for years into making all sorts of funky stuff, including influenza vaccines.

And it’s been used for ages as a traditional medicine and all-round pick-me-up by Australia’s first nations people for generations, too – usually by chewing the leaves, or by crushing it up, mixing it with ash and spit, which turns it into a rudimentary version of nicotine chewing gum.

But, before you race out and buy 20 ‘spare acres’ down the back of your buddy’s apple farm, there are a few things you should know.

First of all, Huang’s team hosed down speculation of a new cash crop appearing across Australia any time soon.

“This reconstruction of cocaine in tobacco means nothing because cocaine production [via this method] is quite low,” Huang says.

And even if it did create fuel for some kind of super-smoke, the ability to produce cocaine “is not retained in the next generation of tobacco”.

But – and this is where things are going to get ‘interesting’ down the track – now that the code has been *ahem* cracked, the door is open for other self-replicating organisms to be genetically engineered, so that the compound production carries over from one generation to the next.

Huang says that in future, it would probably make more sense to bioengineer the ability to make cocaine into something like a yeast strain… so you might want to ditch your plans on buying some land to go farming, and make friends with your local craft brewer instead.

TO MARKETS

Local markets were up on Monday morning, as the market moved to retake some of the ground it lost during the back half of May, when the benchmark ASX 200 dropped from a mid-month high of 7,881 points to 7,701 on the last day of the month.

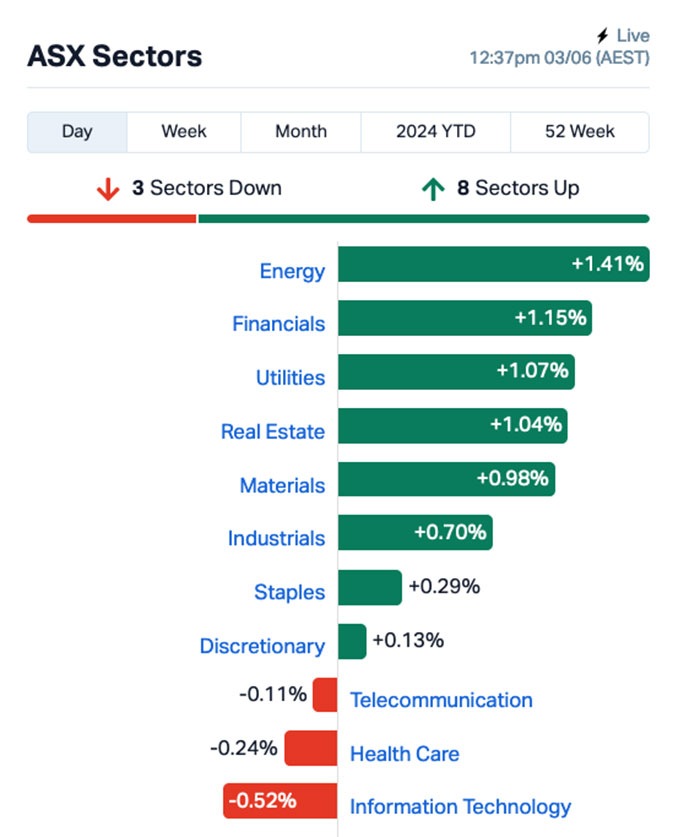

The sectors looked like this:

And the ASX indices were telling these stories:

Energy and Financials did particularly well throughout Monday morning’s session, with some big names banking solid results, including Woodside Energy Group (ASX:WDS) (+1.4%) and Santos (ASX:STO) (+1.25%), and Westpac (ASX:WBC) (+1.7%) and QBE Insurance (ASX:QBE) (+2.8%).

Cochlear (ASX:COH) +(+1.5%) and CSL (ASX:CSL) (+1.2%) also did well to boost gains in the Health sector.

However, the local tech sector followed the Nasdaq into a ditch this morning, losing -0.48% during the session as heavyweights WiseTech Global (ASX:WTC) (-1.22%) and SiteMinder (ASX:SDR) (-3,85%) were sold off.

The headline news for Business Folk was an announcement from The Fair Work Commission, which delivered a 3.5% increase in the Australian minimum wage this morning, boosting the pay packets of around 2.6 million workers by $33 a week to $915.91.

While putting it all together and crunching the numbers on where it should land with the increase, the Fair Work heard arguments from the ACTU gunning for a 5.0% increase, and business groups that wanted a 2.0% increase, before delivering a 3.75% increase.

The Council of Small Business Organisations Australia is – brace yourselves – unhappy with the decision, because of course it is.

CEO Luke Achterstraat fired off a media release, saying the increase of 3.75% to wage costs when annual productivity is at 1.2% “does not add up or bode well for jobs”.

“A $50 increase in wages means a $59 increase in total costs for small businesses,” Achterstraat says, adding “Owners will be forced to pass on these costs which means higher prices and inflation.”

However, J.P. Morgan economist Tom Kennedy – who apparently has a nifty computer that can figure out things like the effect a wage rise will have on inflation – has punched 3.75% into his laptop and figured out that it will have “next to no impact on aggregate wage growth”.

“Accordingly, we don’t think this outcome will move the needle on the Bank’s inflation/wage forecast or change its thinking on current monetary policy settings,” Kennedy said. “We retain the view for cash rate stability this year, with rate cuts likely from early 2025.”

And now I don’t know who to believe…

NOT THE ASX

On Friday, the S&P 500 rose by +0.5%, the blue chips Dow Jones index was up by +1.51%, and the tech-heavy Nasdaq closed flat.

Earlybird Eddy Sunarto – a man who knows these things – reported this morning that the month of May marked the sixth month out of the last seven where all three main US indexes finished higher, with all of them hitting new records during the month.

“The Dow had its best May since 2020, while both the S&P and Nasdaq had their best May performances since 2003,” Eddy wrote this morning.

To put that into perspective, gritty cop drama The Wire was still on free-to-air TV, Delta “Trailer Swift” Goodrem had the No. 2 single in the country with Lost Without You, and free-to-air TV was still a thing.

To US stock news, Trump Media & Technology fell -5% after Donald Trump was convicted on all 34 charges. oh dear, what a shame, how sad, etc.

Dell Technologies plunged -18% as its AI server sales fell short of estimates.

Hotel and casino company Caesars shot up over 11% after news broke on Bloomberg that the investor Carl Icahn has bought a big chunk of the company despite Caesars missing expectations for its Q1 earnings last month.

And retailer stock Gap surged over 28% after announcing impressive Q1 earnings and sales growth across all four of its brands.

In Asian markets this morning, things are also looking up – Japan’s Nikkei is higher by +0.94%, the Hang Seng is up +2.57% and Shanghai markets are flat.

And in case you’re trying to get hold of someone across the ditch in New Zealand this morning, it’s worth noting that the market there is closed for the King’s Birthday holiday, which means the phone’s been switched off for the day.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap APC Aust Potash Ltd 0.0015 50% 138,000 $4,020,189 CT1 Constellation Tech 0.003 50% 1,166,666 $2,949,467 WEL Winchester Energy 0.003 50% 41,130 $2,040,844 IIQ Inoviq Ltd 0.65 40% 3,920,293 $42,788,696 ECT Environmental Clean Technologies 0.004 33% 740,655 $9,515,431 MRQ MRG Metals Limited 0.002 33% 500,000 $3,787,678 RBR RBR Group Ltd 0.002 33% 2,000,000 $2,451,607 WML Woomera Mining Ltd 0.004 33% 1,397,483 $3,654,417 NYR Nyrada Inc 0.073 28% 717,650 $10,226,296 AUH Austchina Holdings 0.0025 25% 801,091 $4,200,767 LNR Lanthanein Resources 0.005 25% 478,008 $9,774,545 PUA Peak Minerals Ltd 0.005 25% 80,000 $4,165,506 TMR Tempus Resources Ltd 0.005 25% 50,000 $2,923,995 EMS Eastern Metals 0.041 24% 4,824,303 $3,261,266 LML Lincoln Minerals 0.009 20% 3,928,995 $12,780,339 GGE Grand Gulf Energy 0.006 20% 4,795,070 $10,476,235 PRX Prodigy Gold NL 0.003 20% 241,036 $5,294,436 SI6 SI6 Metals Limited 0.003 20% 173,000 $5,922,149 EOF Ecofibre Limited 0.08 18% 112,860 $25,763,425 KLI Killi Resources 0.047 18% 1,359,342 $4,008,950 EE1 Earths Energy Ltd 0.014 17% 2,487,500 $6,359,571 MCL Mighty Craft Ltd 0.007 17% 75,000 $2,213,456 RKT Rocketdna Ltd 0.007 17% 600,000 $3,936,689 GAL Galileo Mining Ltd 0.285 16% 1,734,253 $48,418,107 KCC Kincora Copper 0.065 16% 1,098,030 $11,478,291

Galileo Mining (ASX:GAL) was the best performing small cap on Monday morning, surging on news that the company has signed a farm-in and joint venture agreement with the excitingly-named ACN 654 242 690 Pty Ltd, which is a 100% owned subsidiary of Mineral Resources (ASX:MIN) .

Under the agreement, Galileo will initially sell off 30% of the lithium rights at its Norseman project to Minres for $7.5 million in cash, with Minres able to increase that to a 55% stake by sole funding an additional $15m of exploration over the next four years, and then up to 70% by sole funding expenditure through to a Decision to Mine.

Eastern Metals (ASX:EMS) performed well on Monday morning, jumping around +40% on news that the company has identified new zones of anomalous base metal mineralisation in the northern portion of its Browns Reef project in NSW’s southern Cobar Basin.

The company says that mapping and pXRF traverses along the Woorara Faul – a regional-scale structure related to known mineralisation at the high-grade Pineview and Evergreen zones – have identified new anomalous zones north and south of Evergreen, which the company has named ‘Kelpie Hill’ and ‘Windmill Dam’ respectively.

Big news from health tech playert Inoviq (ASX:IIQ) on Monday was the announcement that the company has successfully produced and isolated engineered exosomes (EEVs) that target and kill breast cancer cells in vitro.

In the study, a breast cancer targeting protein (a chimeric antigen receptor, CAR) was expressed in exosomes released by immune cells. The researchers isolated and concentrated those exosomes using Inoviq’s proprietary EXO-ACE technology, recovering more than 80% of exosomes from cell-conditioned media with over 95% purity.

When those exosomes were applied to breast cancer cells in vitro, the team reports that 75% of breast cancer cells underwent cell death within 72 hours.

Falcon Metals (ASX:FAL) continued its climb up the charts on Monday, still gaining on last week’s news of a high-grade mineral sands discovery over a ~1,200m x ~600m area at Falcon’s 100% owned Farrelly Prospect.

And Earths Energy (ASX:EE1) was also showing a gain on Monday morning, with its news of a management restructure that saw Josh Puckridge sign on as the company’s Chief Executive Officer.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 63,703 $11,649,361 ME1 Melodiol Global Health 0.001 -50% 16,311,916 $1,646,275 AUK Aumake Limited 0.002 -33% 10,000 $5,743,220 JAV Javelin Minerals Ltd 0.001 -33% 15,000 $3,264,346 LSR Lodestar Minerals 0.001 -33% 62,500 $3,035,096 BP8DD BPH Global Ltd 0.003 -25% 13,637 $1,563,293 LPD Lepidico Ltd 0.003 -25% 820,600 $34,356,478 ODE Odessa Minerals Ltd 0.003 -25% 1,086,736 $4,173,130 RDS Redstone Resources 0.003 -25% 100,000 $3,701,514 KP2 Kore Potash PLC 0.029 -24% 1,756,926 $25,014,051 PAT Patriot Lithium 0.062 -21% 1,769,262 $7,234,952 VRX VRX Silica Ltd 0.035 -20% 686,513 $27,643,249 XPN Xpon Technologies 0.012 -20% 899,660 $5,136,622 MCT Metalicity Limited 0.002 -20% 665,376 $11,212,737 MSG MCS Services Limited 0.004 -20% 1,008,875 $990,498 ROG Red Sky Energy 0.004 -20% 199,605 $27,111,136 TAS Tasman Resources Ltd 0.004 -20% 113,888 $3,563,346 1MC Morella Corporation 0.0025 -17% 611,036 $18,536,398 BPP Babylon Pump & Power 0.005 -17% 121,428 $14,997,294 CDT Castle Minerals 0.005 -17% 130,333 $7,346,958 IEC Intra Energy Corp 0.0025 -17% 500,000 $5,072,345 UVA Uvrelimited 0.105 -16% 141,312 $5,315,403 ASQ Australian Silica 0.035 -15% 38,000 $11,556,275 AAU Antilles Gold Ltd 0.006 -14% 2,266,446 $6,975,745 CCO The Calmer Co Int 0.006 -14% 21,247,667 $9,665,047

ICYMI – AM EDITION

Brightstar Resources (ASX:BTR) has closed its takeover offer for Linden Gold Alliance after acquiring a relevant interest in 96.75% of Linden’s shares and 96.81% of its options.

It will now proceed with the compulsory acquisition of Linden shares and options which it has not already received acceptances for.

The acquisition of Linden Gold Alliance adds the operating Second Fortune mine and the 293,000oz Jasper Hills project to the company’s portfolio.

The Calmer Co (ASX:CCO) is looking to raise up to $2m through a one for three renounceable rights issue priced at 0.4c per share.

Eligible shareholders will also receive one free attaching option exercisable at 0.6c and expiring on 30 June 2026 for every two shares subscribed for.

Proceeds will be used to increase capacity for milling, drying, sieving and automate packaging and labelling processes at its Navua Fiji processing facility, ensuring that production keeps pace with growing demand.

Funds will also be used to further expand inventory and marketing activities in Australia and the US.

Lithium Energy (ASX:LEL) is a step closer towards completing the sale of its 90% interest in the Solaroz lithium brine project in Argentina to China’s CNGR Advanced Material for US$63m ($97m) in cash.

This comes after CNGR – a world leading producer of battery precursor materials – secured all necessary Chinese overseas direct investment and foreign exchange control regulatory approvals.

LEL expects to hold a general meeting to seek shareholder approval for the sale in late July 2024.

Clinical-stage biopharmaceutical development company Neurotech (ASX:NTI) has executed a strategic collaboration agreement with Melbourne-based contract research organisation Fenix Innovation Group.

Under the agreement, Fenix will work exclusively with the company in the medicinal cannabis field with the development of NTI’s broad spectrum cannabinoid drug therapy NTI164 for neurological disorders.

NTI164 has demonstrated significant clinical improvement in Rett Syndrome patients after 12 weeks of daily oral treatment.

At Stockhead, we tell it like it is. While Brightstar Resources, The Calmer Co, Lithium Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.