ASX Small Caps Lunch Wrap: Who’s taking the magic out of miracles this week?

"Don't drink The Lord's tears!! It's just a leak coming out of the Cardinal's dunny upstairs!!" Pic via Getty Images.

Local markets have fallen this morning, after a broad rattling of the commodities cage knocked the will to live out of the Materials sector and made pretty much everyone else sad in the process.

I’ll get into the details of all that shortly, but first there’s news from the Vatican this week that will send shivers down the spine of anyone planning on going public with claims of a heavenly-sponsored “supernatural event”.

The era of “fake news” has finally caught up with church doctrine, so the Pope’s working group on the topic, with the catchy title of Dicastery for the Doctrine of the Faith – has put together a memo for priests and other faithful to have a look over before the next time they call (I assume) the Vatican Hotline to report that there’s a statue crying somewhere.

The report, titled Norms for Proceeding in the Discernment of Alleged Supernatural Phenomena, is alarmingly long for something that really could have been handled in an email.

In essence, it says “if someone reckons there are strange things afoot in your local parish, have a poke around and – if absolutely necessary – call your local Bishop and he’ll swing by and figure out what to do”.

The document sets out six possible conclusions the Bishop can then choose from, which are unhelpfully delivered in Latin, long considered a dead language because it’s only really spoken by dead people.

The options start with a process called Nihil obstat – and under such a ruling, “the Diocesan Bishop will pay the utmost attention to the correct appreciation of the fruits resulting from the examined phenomenon, while also continuing to exercise vigilance over it with prudent attention”.

Which (I think) means that the Church isn’t going 100% all-in on it being a genuine, bona fide miracle, but it’s happy for people to come and worship it all the same, provided that “the correct appreciation of the fruits resulting from the examined phenomenon” occurs.

Translation: if anyone’s charging money to get in to see the miracle, make sure the church is getting a decent cut.

The document is very heavy on having church reps make damn sure that any weird phenomena aren’t just a ruse, or other fraudulent activity set up in an attempt to make money.

Because making money by telling wild stories about impossible things is not what the church is all about. No sir, not even a little bit.

This freshly issued Norms replaces the previous version of the Norms for Proceeding in the Discernment of Alleged Supernatural Phenomena which came out in 1978 and featured a much longer section on the evils of disco music and banned the sale of flared trousers on church grounds.

At least I think that’s what it said – it’s mostly in Latin, and my Latin is a little rusty these days, as it’s been nearly 40 years since I was last brutalised by my high school Latin teacher into rote-learning the unending horrors of declensions, while trying to figure out why Caecilius was in the atrium in the first place. #IYKYK

But in the end, it’s important for the church to make sure that it’s not going to end up in a similar situation to one of its recent high-profile blunders – when people from around the world made the pilgrimage to Mumbai to gather and drink the tears of Jesus Christ emanating from a weeping crucifix.

That one turned out to be caused by a clogged toilet upstairs.

TO MARKETS

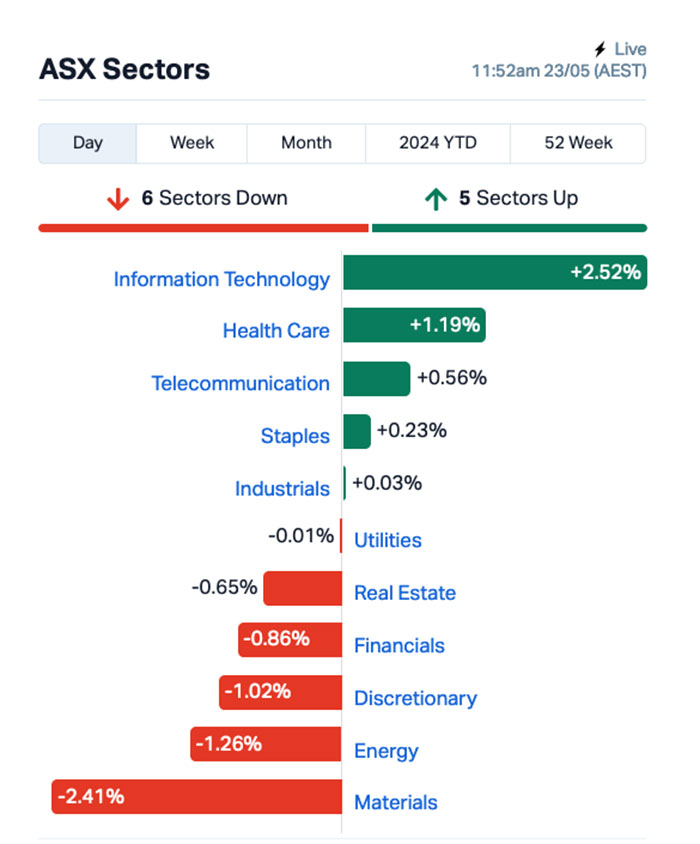

Local markets are down this morning, after the front fell off the Material sector thanks to a nasty patch of volatility among key commodities.

At around 10:00am, copper was off by -3.02%, nickel was down -4.44%, tin shed -2.29%, and even zinc – poor, hard-working zinc, for crying out loud – was off by -1.85%.

Copper’s probably the easiest example to use to explain what’s happening – but it’s complicated, so buckle in.

Ready? Good… because according to Reuters analyst Andy Home, there’s a one-two punch happening on the copper market that’s driving the volatility.

Firstly, there’s a “vicious short squeeze” underway in the US, where CME Group (which operates the US commodity exchange, or COMEX) is scrambling to ensure that there’s sufficient real-world copper on hand to cover a number of large short positions.

But the thing is that while US cupboards are looking a little bare, the pantries in London and China are anything but.

“Inventory registered with the Shanghai Futures Exchange (ShFE) stood at 291,020 metric tons at the end of last week, compared with London Metal Exchange (LME) stocks of 105,900 tons and CME stocks of just 18,244 tons,” Home says.

That’s largely due to a sharp increase over the past couple of years of copper imports into China, and that increased demand has led to two things: sky-rocketing copper prices and an overstocked warehouse.

The combination of those two things, Reuters says, has triggered a collapse in the Yangshan premium, which is “a closely-tracked indicator of China’s copper import appetite” – which, in turn, has effectively turned off the tap for Chinese interest in copper outside of existing annual import deals.

“The spot import door has just firmly closed,” Home says. “Metal will still flow into China under annual supply deals, which tend to be favoured by larger buyers, but arrivals will likely drop a couple of gears relative to the last few months.”

So… yeah. That’s a thing.

Also, BHP (ASX:BHP) had another crack at swiping right on Anglo American overnight, sending off a love letter, a bunch of roses and a cheque for $74 billion – more than enough to sweep any girl off her feet.

But while that offer was met with a third emasculating brush-off, Anglo’s more than likely just playing coy, as the deadline for talks has been extended by a week… whether BHP can finally crack the code and get a bid under Anglo’s nose that it’s happy with remains to be seen.

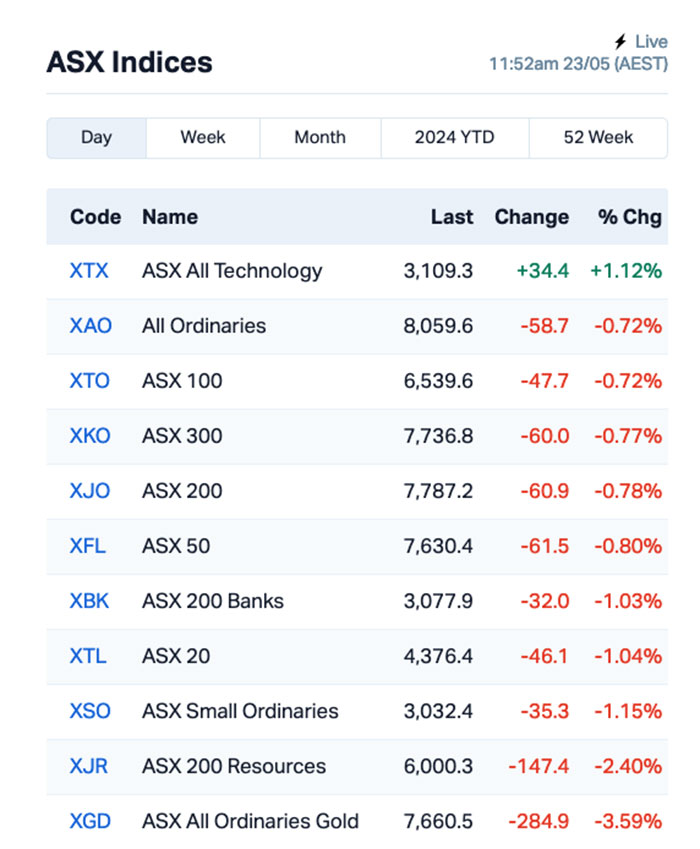

Anyway – the Materials sector is taking a battering today, by far the worst off among the sectors, while InfoTech is headed in the opposite direction and is way out in front of the rest of the market.

A look at the ASX indices shows that the goldies are taking even more of a pasting today, down -3.6% as we bumble our way to the lunch break.

A large chunk of the good fortune for InfoTech is because Xero (ASX:XRO) dropped its FY24 earnings report this morning, and it’s a belter – so good that it’s pushed the megacap more than +8.5% higher so far today.

The company has delivered operating revenue growth of $1.7 billion, up +22% – which puts the company comfortably on the correct side of the Rule of 40 principle, which states that a software company’s combined revenue growth rate and profit margin should be at least +40% in order for it to be generating sustainable profit.

NOT THE ASX

Overnight, the S&P 500 fell by -0.27%, the blue chips Dow Jones index was down by -0.51%, and the tech-heavy Nasdaq slipped by -0.18%.

Nvidia hogged the headlines after hours, blowing past Wall Street estimates as its Q1 profit soared, with its stock price popping +7% in post-market trading.

Nvidia’s Q1 EPS (earnings per share) skyrocketed by 628% to US$5.98, on the back of a 268% increase in revenue to US$26 billion.

As Earlybird Eddy Sunarto reported this morning, Nvidia also announced a 10-for-1 stock split and bumped up its dividend from US4c to US10c, keeping up with the trend of other big tech companies upping their quarterly payouts to shareholders.

Sentiment at Nvidia HQ is – understandably – pretty buoyant, with plenty of corporate hubris on display.

“The next industrial revolution has begun,” Nvidia’s CEO and founder, Jensen Huang, humbly intoned. “Companies and countries are partnering with Nvidia … to produce a new commodity: artificial intelligence.”

In Asian markets, things are mixed. The Nikkei is up +0.71%, but the Hang Seng is down 1.65% and Shanghai markets are dropping as well, down -0.92 in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SER Strategic Energy 0.018 50% 39,090,962 $5,829,782 MRD Mount Ridley Mines 0.0015 50% 10,454,057 $7,784,883 CAZ Cazaly Resources 0.032 33% 12,720,777 $10,911,272 ECT Environmental Clean Technologies 0.004 33% 307,078 $9,515,431 JAV Javelin Minerals Ltd 0.002 33% 250,491 $3,264,346 PKO Peako Limited 0.004 33% 125,000 $1,581,254 KAL Kalgoorlie Gold Mining 0.036 33% 10,076,056 $4,279,519 REE Rarex Limited 0.019 31% 14,864,256 $9,909,105 IEC Intra Energy Corp 0.0025 25% 1,002,133 $3,381,563 MHC Manhattan Corp Ltd 0.0025 25% 3,093,028 $5,873,960 BEX Bikeexchange Ltd 0.38 25% 50,901 $6,154,839 E33 East 33 Ltd 0.017 21% 142,600 $10,852,575 AEV Avenira Ltd 0.006 20% 1,463,482 $11,745,170 MOM Moab Minerals Ltd 0.006 20% 200,000 $3,559,815 PEC Perpetual Resources 0.02 18% 7,385,994 $10,880,500 RNE Renu Energy Ltd 0.007 17% 204,257 $4,356,804 SHP South Harz Potash 0.014 17% 4,360,383 $9,926,220 EQN Equinox Resources 0.37 16% 200,948 $39,520,001 FFG Fatfish Group 0.015 15% 1,133,631 $18,285,449 NPM Newpeak Metals 0.031 15% 530,237 $3,337,697 CTO Citigold Corp Ltd 0.008 14% 192,868 $21,000,000 VML Vital Metals Limited 0.004 14% 806,908 $20,632,734 WML Woomera Mining Ltd 0.004 14% 36,250 $4,263,486 CHW Chilwa Minerals 0.53 14% 44,180 $21,331,875 X2M X2M Connect Limited 0.041 14% 282,418 $9,601,824

Strategic Energy Resources (ASX:SER) was leading the pack on Thursday morning, after announcing that it has raised $2m via placement to explore the Achilles 1 polymetallic prospect in the South Cobar Basin.

The placement, done at a small 8.3% discount to the last traded price, is cornerstoned by Datt Capital and Lowell Resources Fund (ASX:LRT).

Cazaly Resources (ASX:CAZ) was soaring early on Thursday, earning a speeding ticket and a please explain from the ASX, to which Cazaly dutifully replied “we have no idea, either.”

Kalgoorlie Gold Mining (ASX:KAL) posted a lovely gain on news that the company has pulled up thick, shallow gold in a first pass aircore drilling program at Wessex, near Hawthorn Resources’ (ASX:HAW) Anglo Saxon open pit mine. Highlights include 28m at 1.27g/t gold from 36m.

And RareX (ASX:REE) was making waves Thursday, after revealing that it is entering the niobium space, buying a large, early stage project in WA’s East Yilgarn region.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ME1 Melodiol Global Health 0.002 -33% 253,455 $2,140,461.72 EDE Eden Innovation 0.0015 -25% 6,001,943 $7,356,542.23 NAE New Age Exploration 0.003 -25% 4,000,000 $7,175,595.64 TSL Titanium Sands Ltd 0.0055 -21% 677,263 $15,482,230.33 EXL Elixinol Wellness 0.004 -20% 200,275 $6,505,370.28 1MC Morella Corporation 0.0025 -17% 2,699,168 $18,536,398.28 88E 88 Energy Ltd 0.0025 -17% 301,363,765 $86,678,015.86 ATH Alterity Therapeutics 0.005 -17% 109,000 $31,470,691.91 GBZ GBM Rsources Ltd 0.01 -17% 498,750 $13,880,266.67 MTL Mantle Minerals Ltd 0.0025 -17% 1,698,717 $18,592,337.50 LPD Lepidico Ltd 0.003 -14% 4,167,605 $30,061,917.84 KLI Killi Resources 0.039 -13% 1,255,876 $4,510,068.44 BGE Bridge SaaS 0.02 -13% 16,401 $2,746,132.29 MCL Mighty Craft Ltd 0.007 -13% 618,000 $2,951,274.15 NVQ Noviqtech Limited 0.0035 -13% 1,006,666 $5,949,229.18 SPX Spenda Limited 0.007 -13% 576,492 $34,595,662.39 GUE Global Uranium 0.105 -13% 516,257 $31,882,468.20 AGD Austral Gold 0.021 -13% 16,694 $14,695,472.47 IND Industrial Minerals 0.215 -12% 80,909 $16,846,200.00 GML Gateway Mining 0.022 -12% 500,000 $8,636,485.63 GLL Galilee Energy Ltd 0.03 -12% 682,880 $11,551,317.86 EXT Excite Technology 0.008 -11% 1,506,173 $13,088,175.59 JRV Jervois Global Ltd 0.016 -11% 4,997,095 $48,649,748.13 SP8 Streamplay Studio 0.008 -11% 529,186 $10,355,613.92 HE8 Helios Energy Ltd 0.041 -11% 103,561 $119,786,274.38

ICYMI – AM EDITION

You haven’t missed a thing today. Well done, you.

Unless it was my “tin shed” gag, in which case, there it is, again.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.