ASX Small Caps Lunch Wrap: Whose sinfully ugly Cybertruck is (maybe) ready to roll?

Lithium-powered brutalism at its absolute American finest. Pic via Twitter/Tesla.

Local markets – and around the region – have found some bounce on Monday morning, rising with grace and about half a per cent, following the positive juices Wall Street squeezed out of a hawkish Federal Reserve chair J Powell and his promises to be gentle and proceed carefully when it comes to whacking on new interest rates.

The Healthcare and Consumer Sectors led the ASX200 gains in early trade. By lunch, the benchmark was ahead almost 0.6% per cent, almost all corners of the market in the green, except for Tech and Telco.

But first, come with me quickly for a brief glance over the fence into the wild and wacky world of Tesla – partially because it’s been a while since I’ve had more than a surface skim of what the tech world’s famously Musky posterboy has been up to.

But mostly because the company had a torrid time on Wall Street recently, but finished last week on a high note on news that the rumoured 2 million drivers who have pre-ordered one of the company’s Cybertrucks might possibly not have wasted an hour or so filling in the application.

During last week, Tesla went public with information that it has finally produced at least one “production candidate” of the Cybertruck monstrosity – a factory-built example that rolled off the production line as something of a test case for the manufacturing process itself.

That’s caused more excitement and wonder than the original unveiling of the Cybertruck project, which (in case you’d forgotten) looked like this:

Last week, it was Musk himself who got behind the wheel of the Cybertruck’s development model. We know this, because this happened:

Just drove the production candidate Cybertruck at Tesla Giga Texas! pic.twitter.com/S0kCyGUBFD

— Elon Musk (@elonmusk) August 23, 2023

That’s an actual, off-the-proposed-production line Cybertruck… and fans of the beast will no doubt be feeling some sense of relief that even though its taken about four years to get to this stage, it still looks like a very fancy video game, where the skin of the car asset has failed to load.

Almost immediately, the gloves came off as the world was reminded just how profoundly, aggressively ugly it is, with its famous “Straight Outta Blade Runner” aesthetic.

How gloriously – dare I say it, Alanis Morrisette-esquely – ironic it is that Tesla’s take-home from the film was an offroad vehicle that’s uglier than a hatful of badly-burned arseholes.

Especially since the film is based on William Gibson’s vision of a horrifying dystopian future, where corporate greed and humanity’s decision to embrace technology at virtually any cost has made the entire planet an unendurable dumpster fire, populated by a blend of regular old meat-people and robots that look just like us, but do some wildly inappropriate things on a regular basis.

At least Japan got it right – where Tesla saw unforgivably ugly transportation, Japanese researchers saw immediately where the real future vision value lies: mechanical ladies for dudes to put their ding-dongs in.

Anyway… questions remain about the future of the Cybertruck, mostly because a lot of people looked at the image Musk posted and drew attention to the fact that the gaps between the panels of the car are not doing it any favours in the looks department.

And, of course, a post from 2022 surfaced to bite Musk in the arse, because in it he claimed that “Cybertruck will be waterproof enough to serve briefly as a boat.”

Key word in there being “briefly”, because just about anything will serve “briefly” as a boat, in the same sense that just about anything will serve briefly as a sex toy, depending on how brave (or conscious) you are.

Rough looks and questionable boat-a-bility prompted Musk to write to his employees with a demand to do something about the panel gaps.

“All parts for this vehicle, whether internal or from suppliers, need to be designed and built to sub 10 micron accuracy,” Musk emailed to his employees.

“That means all part dimensions need to be to the third decimal place in millimetres and tolerances need to be specified in single digit microns. If LEGO and soda cans, which are very low cost, can do this, so can we,” Musk wrote.

Given that the Cybertruck is made of out famously non-plastic bulletproof 3mm stainless steel, and that it’s not small enough to fit in the palm of a potential owners’ hand, are just two of the obvious red flags on this demand.

But there are only two outcomes that are within the realms of probability for Cybertruck now – the first of which is that the vehicle will now spend another decade in pre-production until the sub 10 micron accuracy is achieved.

The second is that Musk will realise his folly and back down from his widely-reported demand – and that’s about as likely as his four-wheeled briefly-a-boat floating long enough for even the most enthusiastic mariners among us to crush a bottle of bubbly on its bow, before it slides gracelessly to the bottom of the sea.

Local market news for local market people only

We’ve certainly seen worse Mondays throughout this angst-ridden August.

Punchy retail data has sales up 0.5% m-o-m for July, easily outstretching estimates of just 0.3% and reversing the -0.8% fall in June, according to the preliminary numbers. The Consumer Sector has led gains on the benchmark, but most sectors were in the green following a change into positive momentum on Wall Street during the final session.

Consumer Discretionary gained almost 1.5% the stronger than expected retail report not missed by Wesfarmers which put on another (circa) 2%.

Healthcare names were also among the early starters, jumping on the back of big names like Ramsay Healthcare (ASX:RHC) which is sitting nearer 4% at the break (there is no break).

The Big Banks have come out to play. CBA (ASX:CBA), ANZ (ASX:ANZ) and NAB (ASX:NAB) all up more than 1%. Westpac (ASX:WBC) finding only half the love (0.5%).

Finally, the goldies are also doing good. Northern Star (ASX:NST) gaining 2.5%.

On the other side of the ledger it is very hard to miss the Monday that Twiggy Forrest is having. Fortescue Metals group (ASX:FMG) is having a right hangover from its take-over-Perth self-party on the weekend.

The share price is getting whalloped, down some 4.5%, after the shock departure of now ex-CEO Fiona Hick.

She did good, making it through a whole six months in the job.

Finally, the Pilbara Minerals (ASX:PLS) pendulum has swung back on Monday, shedding circa 3.5%. ‘Cos that’s how we roll, someone who sells the stock laughed to his colleague at some stage.

NOT THE ASX

Wall Street ended the week on an upbeat note, which saw the Nasdaq top out at 0.94%, the Dow up by 0.73% and the S&P 500 climb 0.67% – a much better performance than the bulk of the previous four days which has seen tech volatility and ongoing concerns over inflation, recession and a general “Oh sh-t… Jerome’s about to say something public”-related sense of impending doom.

Speaking of which, Jerome “Power Jaws” Powell did have something to say on Friday while headline the annual Jackson Hole Moneyfight Jamboree, saying that while The Fed “may need to raise interest rates further to cool still-too-high inflation”.

But Powell also said that he would move with (some might say “uncharacteristic”) care at upcoming Fed meetings, after noting that progress has been made on easing price pressures, and the fact that the US economy is showing “surprising strength”.

The latest available data from the US shows that 37.9 million people (11.6% of the population) is living in poverty – which is, I will admit, very “surprising” for such a strong economy… so maybe Ol’ Jerome’s on the right track, after all.

In US stock news, tabletop game company Hasbro – it owns stuff like Magic the Gathering, and Monopoly – climbed 5.7% despite missing EPS by 14.47%, which on paper looks bad but is actually not too shabby, since the March report showed the company missing EPS by 77.3%.

In Japan, the Nikkei is is up 1.6% which is a miracle considering that Fukushima Brand Radioactive Glowing Water™ is now – officially, with permits and everything this time – draining merrily into the ocean.

We all know the inevitable outcome… a heavily-mutated sunken Cybertruck is expected to be mowing down the citizens of Tokyo by Christmas next year, unless Toyota can develop an even more robust HiLux, setting the stage for the greatest automotive battle the world is ever likely to see.

In China, mainland markets are surging. The Shanghai and the Tech-Heavy Shenzhen indices both ahead by 2.7%.

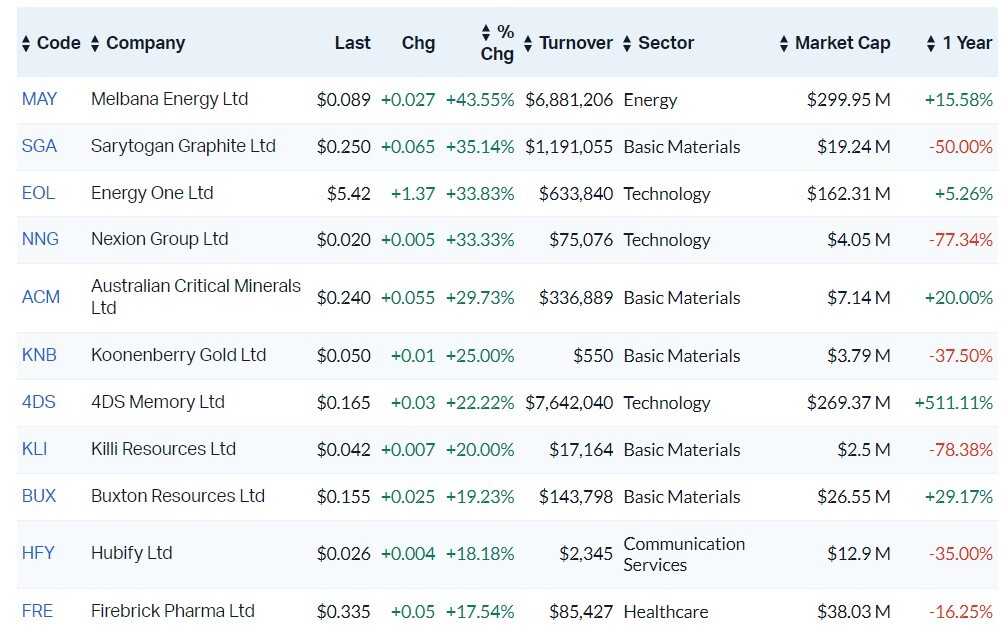

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 August [intraday]:

Thanks to Market Index for that one, because ours are broken today. (We owe you one.)

Sarytogan Graphite (ASX:SGA) is killing Monday, announcing that thermal purification has far exceeded battery anode material grade for its Kazakh graphite deposit.

SGA is knee deep which in its graphite project in Central Kazakhstan, reports that the thermal purification of its graphite has achieved a 99.99% Total Graphitic Carbon (TGC) result, with the sample being a “representative 50g sample of Sarytogan Graphite previously treated by flotation and alkaline roasting to 99.70% TGC”.

Still among the miners, Buxton Resources (ASX:BUX) has returned “exceptional” assay results from its maiden diamond drill hole at its Copper Wolf project in Arizona, USA, which kicked off in April this year.

It’s the first exploration in the project area since 1993, with drillhole CW0001DD targeting areas proximal to and beneath historical hole RC-UC-17 which ended in porphyry style copper-molybdenum mineralisation.

The specifics include: returns of 83.76 metres at 0.86% CuEq from 527.91 metres with assays up to 2.35% CuEq.

And Energy One (ASX:EOL) is cruising at altitude after receiving one of those always welcome confidential, indicative, incomplete, conditional and non-binding proposal from the global investment firm, STG.

STG has nearly US$10 billion of assets under management and a portfolio that includes software and software-enabled services companies.

The Indicative Proposal, EOS told the ASX, is to acquire all of the issued shares in Energy One at an indicative price of A$5.85 cash per share by way of a scheme of arrangement.

Energy One has also entered into an exclusivity deed granting STG with an expedited period of exclusivity to allow STG to complete confirmatory due diligence. Woohoo.

Up 34%.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks for 28 August [intraday]:

(Okay, we owe you two Market Index.)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.