ASX Small Caps Lunch Wrap: Who’s regretting going DIY with a poop transplant this week?

"... it goes in where?!?" Pic via Getty Images.

Local markets were surging this morning, rising sharply out of the gate after Wall Street had another “it’s a record high! Hooray for us!” party in New York overnight.

As we closed in on lunchtime, the ASX 200 was at +1.34% and trending slightly higher, but if the market’s feeling even remotely like I am at the moment, there’s a post-lunch slump coming that could very well mean we all have to take a couple of aspirin and go for a cheeky lie-down.

I’ll get into the details of all that shortly, but first there’s a bit of biomedical news out of California that caught my eye this morning, because nothing fires up the ol’ imagination glands better than a phrase like “DIY poop transplant”.

According to local media, college student Daniell Koepke was suffering from the debilitating effects of Irritable Bowel Syndrome (IBS), which is exactly like having an easily irritated neighbour, except they live up your bum.

The symptoms of IBS are horrible… bloating, cramps, huge quantities of gas, horrible sharp pains and faeces that seems to have signed onto something of a ‘two state solution’ in sufferer’s bellies.

That means that whatever poop is in there is generally in one of two extreme states – and will camp in there for days on end, and then suddenly decide that everything needs to be ejected at once, with little warning and precisely zero mercy.

When you’ve gotta go, you’ve already gone.

After years of getting nowhere with doctor visits and drug treatments, Koepke decided it was time to literally take matters into her own hands, after reading up on the “benefits” of Fecal Microbiota Transplants.

The idea there is that IBS is being caused by an unhappy combo of flora (ie, gut bacteria) in the bowel, and the best way to deal with that is to evict the bacteria that are there, and introduce new ones to take their place.

As most bacteria don’t survive the journey through the entire digestive system, the transplant recipient is required to open up the tradesman’s entrance to welcome the new bacteria, a practice normally done by trained medical professionals in an appropriate medical environment.

But not in Koepke’s case – she opted for the far less expensive option of doing it herself, at home, using poop harvested from her brother and her boyfriend and I cannot begin to imagine how that conversation went.

Sadly for Keopke, while the mechanical aspect was successful, it’s been of limited benefit in dealing with the underlying IBS.

Even worse, it appears that the change in gut bacteria means that she has inadvertently absorbed more than she bargained for, and is now complaining of having acne (like her brother) and depression (like her partner).

However, it’s unclear from the report whether the latter of those is the transference of a genuine mental health issue, or if they’re both just bummed out about going through the harvesting, prep and introduction of his poop, thanks to a little post-poo clarity.

Either way, it’s a pretty solid warning to anyone that has been considering approaching friends or family members with a takeaway container in one hand and turkey baster in the other, that there’s probably a very good reason why it’s best to leave that sort of sport to the medical professionals.

Or at least stick it on OnlyFans – if it’s going to ruin your skin and send you spiralling into a mental health crisis, at least you’ll be able to spend a couple hundred dollars on something to cheer you up, courtesy of the army of basement dwelling weirdos that are probably yet to realise that this untapped kink is even a thing.

TO MARKETS

The ASX was bolting like someone left the gate open this morning, and by lunchtime the benchmark was pointing more than +1.7% into the greener part of the pasture.

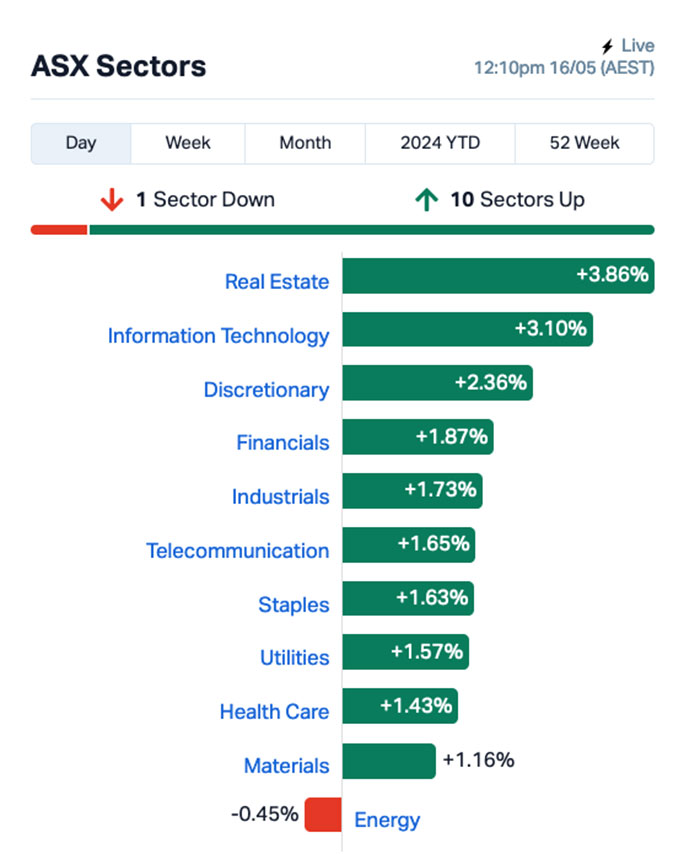

A quick look over the sectors shows that everyone except Energy was chugging along quite nicely pre-lunch, with the remaining sectors all at least +1.0% ahead of the curve after the morning session.

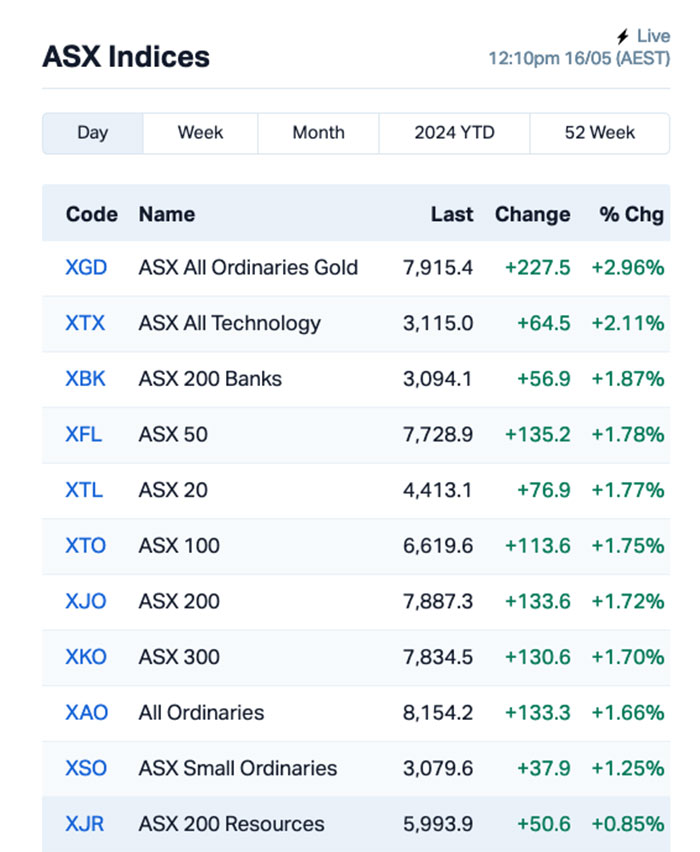

The ASX indices look like this:

The goldies are proving to be as popular as ever, way out in front of the market on +2.96%, with Tech and the Banks in hot pursuit, close either side of +2.0%.

Up the fat end of town, Aristocrat Leisure (ASX:ALL) was enjoying a mini jackpot prior to lunch, with the gaming giant up more than +10% in morning trade on the back of a hugely positive half-year report showing 16% growth in normalised NPATA to $764 million and a 6% revenue surge thanks to its operations in North America, so shareholders are in line for a $0.36 divvy.

It’s probably just a coincidence, but Aristocrat’s share price performance over the past three months does look an awful lot like the payout patterns of the pension-suckers they build for your local pubs and clubs.

That said, I am running a significant fever so I’m chock full of competing medications today, so pretty much everything is looking a lot like other stuff at the moment. I really should go and lie down.

NOT THE ASX

Wall Street did pretty good overnight, leaving the S&P 500 up by +1.17%, the blue chips Dow Jones index up by +0.88%, and the tech-heavy Nasdaq higher by +1.40%, reaching yet another record high.

“Yay team” etc etc.

The reason for the excitement on Wall Street were softer than expected US CPI data for April drove another wave of hard-to–fathom optimism among investors betting on a rate cut by The Fed this year.

It comes despite the US Fed representatives devoting literally months this year frantically hosing down any suggestion that it’s even on the cards – and even if it was on the cards, it’ll maybe be here in time for Christmas, and definitely not any sooner.

The data showed that US inflation took a bit of a breather in April, marking the first cooldown in six months.

The core CPI, which excludes food and energy costs, went up by 0.3% from March, breaking a streak of three higher-than-expected increases, and the YoY rise of 3.4% was the lowest pace in three years, according to the Stats department.

In US stock news, Boeing was down -2% as the US government is reportedly thinking about throwing the book at the aircraft maker because it breached the terms of a US$2.5 billion deal linked to the crashes back in 2018 and 2019. Prosecutors will have no later than 7 July to file charges.

Both BHP and takeover target Anglo American shares were up +1% as shareholders anticipate that BHP will bounce back with a third and better offer before the regulatory deadline hits next week.

Burberry meanwhile tumbled by -6% in London after saying that it was bracing for a tough first half ahead. The British brand famous for its pricey trench coats and trillion-dollar gumboots said its disappointing sales numbers were caused by sluggish demand in both China and the US.

The sentiment is cheap’n’cheerful across Asian markets this morning as well, with Japan’s Nikkei ahead +0.69%, Hong Kong’s Hang Seng up +0.38% and Shanghai markets higher by +0.26% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 16 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap TD1 Tali Digital Limited 0.002 100% 927,969 $3,295,156 HLX Helix Resources 0.005 67% 10,174,267 $6,969,438 CT1 Constellation Tech 0.0015 50% 18,400 $1,474,734 ME1 Melodiol Global Health 0.003 50% 2,350,018 $1,426,974 ILT Iltani Resources 0.28 44% 379,069 $6,632,048 SER Strategic Energy 0.014 40% 11,038,828 $4,858,151 EMS Eastern Metals 0.05 39% 6,336,879 $2,967,345 ENT Enterprise Metals 0.004 33% 428,905 $2,654,163 TMK TMK Energy Limited 0.004 33% 2,127,571 $20,734,836 VPR Volt Power Group 0.002 33% 300,000 $16,074,312 NTL New Talisman Gold 0.02 33% 382,012 $6,622,943 RGL Rivers Gold 0.009 29% 13,144,599 $6,773,630 PGD Peregrine Gold 0.32 28% 173,913 $16,969,605 AGC AGC Ltd 0.31 27% 7,517,910 $54,444,444 SHO Sportshero Ltd 0.005 25% 6,455,115 $2,471,331 SIH Sihayo Gold Limited 0.0025 25% 56,100,298 $24,408,512 AT1 Atomo Diagnostics 0.033 22% 12,732,663 $17,258,462 BVR Bellavistaresources 0.25 22% 245,207 $10,170,249 PNM Pacific Nickel Mines 0.039 22% 243,079 $13,384,099 1CG One Click Group Ltd 0.009 20% 2,042,491 $5,161,341 SS1 Sun Silver Limited 0.51 20% 6,317,559 $29,613,575 TRU Truscreen 0.019 19% 200,000 $8,841,458 ODA Orcoda Limited 0.23 18% 49,939 $32,985,628 BFC Beston Global Ltd 0.0035 17% 6,840 $5,991,141 KP2 Kore Potash PLC 0.014 17% 610,668 $7,899,174

Market newbie Sun Silver (ASX:SS1) was continuing its run on the heels of Wednesday’s excellent debut, with investors continuing to pile on through Thursday morning, pushing its price higher by another +20%.

Likewise, investors were still pumped about Australian Gold and Copper’s (ASX:AGC) lab-breakingly dense silver discovery at its Achilles project, with intercepts in excess of 3,000g/t Ag that needed to be sent overseas because the local machines took one look and broke down crying.

Atomo Diagnostics (ASX:AT1) was making hay off the back of Tuesday night’s budget speech, which included news of the Australian Federal government’s commitment to fund expansion of HIV Self-Testing – which is right up Atomo’s alley.

Errawarra Resources (ASX:ERW) continues to be extremely buoyant despite repeated queries from the ASX asking for an explanation as to why the stock is so popular at the moment, in the absence of any market sensitive news.

And if you needed another indicator at just how hot copper is as a commodity right now, Helix Resources (ASX:HLX) was up quite a long way this morning after revealing to the market that a frill campaign has commenced to test a “highest priority” geophysics anomaly at the Canbelego copper project.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CGO CPT Global Limited 0.11 -35% 11,395 $7,122,552 AHN Athena Resources 0.002 -33% 10,000 $3,211,403 CNJ Conico Ltd 0.001 -33% 313,085 $2,707,643 EDE Eden Inv Ltd 0.0015 -25% 257,200 $7,356,542 NAC Naos Ex-50 0.55 -21% 222,467 $30,044,510 AL3 AML3D 0.055 -20% 638,996 $16,253,206 EXL Elixinol Wellness 0.004 -20% 5,116 $6,505,370 MEL Metgasco Ltd 0.004 -20% 133,333 $5,319,434 TMR Tempus Resources Ltd 0.004 -20% 728,700 $3,654,994 BGE Bridgesaaslimited 0.022 -19% 100,000 $3,223,721 SP8 Streamplay Studio 0.0075 -17% 298,750 $10,355,614 CAV Carnavale Resources 0.005 -17% 533,333 $20,541,310 HMG Hamelin Gold 0.06 -15% 25,980 $11,182,500 ODY Odyssey Gold Ltd 0.022 -15% 154,158 $23,370,649 WOA Wide Open Agriculture 0.022 -15% 9,935,445 $4,654,609 VBS Vectus Biosystems 0.2 -15% 50 $12,504,200 ADY Admiralty Resources. 0.012 -14% 212,073 $22,812,635 BXN Bioxyne Ltd 0.006 -14% 3,304,206 $14,326,518 TX3 Trinex Minerals Ltd 0.003 -14% 6,000,000 $6,347,783 RSH Respiri Limited 0.026 -13% 718,114 $31,796,068 1TT Thrive Tribe Tech 0.014 -13% 209,972 $6,025,944 CUL Cullen Resources 0.007 -13% 9,090 $4,561,386 ODE Odessa Minerals Ltd 0.0035 -13% 400,000 $4,173,130 PAB Patrys Limited 0.007 -13% 1,695,936 $16,459,579 NPM Newpeak Metals 0.021 -13% 4,798 $2,966,842

ICYMI – AM EDITION

Lithium Energy (ASX:LEL) and Novonix have completed their due diligence work and are proceeding with plans to spin off their Queensland graphite projects into an ASX listed company, Axon Graphite.

The prospectus for Axon, which seeks to raise between $15m and $25m is expected to be lodged within the next 4-6 weeks.

Axon will hold LEL’s Burke and Corella graphite projects and Novonix’s Mt Dromedary graphite deposit.

Provider of on-demand additive manufacturing services AML3D (ASX:AL3) has announced it has raised $6.9m in a capital raise. AL3 raised $3.9 million through applications from existing eligible shareholders and a well-supported shortfall placement.

The company says it raised a further $3 million in an additional placement to accommodate demand from institutional, professional, and sophisticated investors in the shortfall placement.

AL3 says it is now fully equipped to establish its US manufacturing hub, maintain its technological edge, and bolster its strategic position in the US defence sector.

At Stockhead, we tell it like it is. While Lithium Energy is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.