ASX Small Caps Lunch Wrap: Who’s ready to embark on a furry new adventure this week?

Everybody warned Pete about the massive cock who owned the farm next door, but he was still quite surprised the first time they met. Pic via Getty Images.

What a difference a day makes… local markets were up this morning, a positive turnaround following three days of sour fortunes, with the benchmark pointing +0.63% higher at the end of the first hour of play.

The rise this morning has defied a clearly less than excellent lead-in from Wall Street overnight, but the morning session was shaping up nicely on a day that is destined to be overshadowed by news from the US about former US President, Donald Trump.

Trump was found guilty this morning of 34 felony counts of falsifying business records, after he was busted trying to cover up payments he made to porn actress Stormy Daniels, in order to cover up the fact that he’d had sex with her at a celebrity golf tournament in 2006.

Which, of course, everybody now knows – even though most rational people neither cared, nor wanted to hear about, whatever went on between two consenting adults, regardless of who they are.

But, given the media saturation about the case, I have little doubt that 50,000 years from now, alien anthropologists will be sifting through the ashes of our once-proud civilisation, and wondering just who was this “angry orange beast” with the insatiable sexual appetite that has shown up in every rudimentary cave drawing they uncover from every corner of the globe.

But, anyway… there are far more important things to talk about this morning, which means we’ve only just got time to stop in with an old friend in Japan, with some “breaking news”.

Toco, the Japanese chap who has spent a horrifying large amount of money on his efforts to become a dog, has revealed that he’s come to the realisation that his goal of morphing into a Collie hasn’t quite scratched the itch that drove him to start the process in the first place.

Here he is, dressed in the costume that has – so far – set him back about US$14,000, and made him an international laughing stock internet sensation.

It’s a lot of money to spend, and it could be argued that some of that cash could probably have been better spent on learning how to move like a dog that hasn’t recently been shot full of muscle relaxants and ketamine.

Toco has been chatting to Japanese media outlet WanQol (pronounced just how it’s spelled), and says that after becoming famous for his Collie suit, he’s ready for a change.

“I might realistically be able to become another dog, a panda or a bear,” Toco told WanQol.

“A fox or a cat would also be nice, but they are too small for humans to try. I’d like to fulfil my dream of becoming another animal someday.”

So, I’m offering this warning for you know – the unrelenting creepiness of a man in a not-quite-a-dog suit is about to get a whole new chapter… and the countdown to Toco turning up against his will in a Chinese zoo has begun.

TO MARKETS

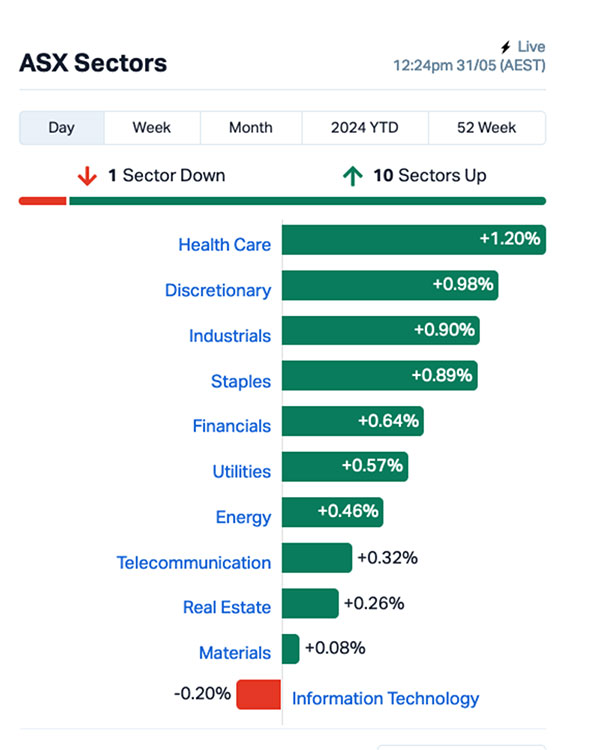

Local markets were performing well on Friday morning, with the benchmark wending and winding its way to +0.48% around lunchtime, following a burst of uncharacteristic defiance of Wall Street’s dishonourable lead-in overnight.

The local charge has a lot to do with a surge by the local goldies, after gold prices bedded in at $US2,343 an ounce.

That was supported by solid positive moves by the Health Care, Staples and Consumer Discretionary sectors, which all moved around +1.0% over the course of the morning session.

As mentioned, it’s the goldies well out in front of the market, with a charge by the Small Ordinaries backing that slice of the market up very nicely indeed.

A few bits of local news to touch on briefly, including great news for anyone who’s a fan of buying shares, and eating thoroughly mediocre Mexican food.

Fast-food chain Guzman y Gomez has announced to the market that it plans to IPO next month, with a plan in place to raise roughly $242.5 million through the sale of 11.1 million shares at a surprisingly steep $22 a pop.

Existing shareholders in the company include Aware Super, Cooper Investors, Hyperion Asset Management, Firetrail Investments and QVG Capital.

Guzman y Gomez has been operating since 2006, and has expanded its operations since then to include 185 stores Australia-wide, and a further 25 outlets in three other international markets.

To put that into perspective, the former go-to for sub-standard burritos delivered at a sedate pace by bored teenagers, Taco Bell, boasts just 89 outlets around Australia.

Meanwhile, Qantas (ASX:QAN) has taken a break from disappointing the nation to announce that it has struck a deal with Perth Airport for the development of a new second runway, and the relocation of the airline to a new terminal at the site.

The new runway is set to run parallel to the existing north-south runway at Perth airport, and is slated to be complete and operational by the end of 2028, with Qantas saying its new terminal should be complete about three years later in 2031.

And hardware giant Bunnings is celebrating the announcement that it is the “most trusted brand in Australia”, according to the research from Roy Morgan.

The result is hardly surprising given the implied threat that comes from any company known for its massive warehouses full of dangerously persuasive implements.

I should note that I can’t personally comment on how Australians are vibing with Bunnings, as it’s been quite some time since I’ve been there myself, after I witnessed a young child using one of the display toilets – with a level of enthusiasm I can only describe as “disturbing” – which cleared the store from aisles 8 through 15 for a solid 30 minutes in 2021.

NOT THE ASX

Overnight, Wall Street slumped again as the S&P 500 fell by -0.64%, the blue chips Dow Jones index was down -0.86%, and the tech-heavy Nasdaq retreated by -1.08%.

It was, as they say in the classics, an observably bad day, driven largely by investors’ profit-taking which continued to bring down shares in the energy and metal markets, while tech stocks bore the brunt of the worst of the sell-off.

However, a weaker US dollar helped lift the prices of precious metals – and that, in turn, helped our local markets out this morning quite nicely indeed.

In US stock news, Dell’s stock dropped 5% during the trading session and an additional 15% after hours, even though the company met Wall Street’s earnings expectations for Q1 and reported higher-than-expected sales.

Nvidia saw its stock price drop almost -4% after US officials have reportedly delayed issuing licences for exporting large-scale AI accelerators to the Middle East.

US investors not distracted by the Trump verdict circus will have noticed that new data revealed that US GDP grew by 1.3% in the first quarter of the year, which is lower than the earlier estimate of 1.6%.

“Sum it all up and you have an economy that has come off the boil – and needed to – but remains on track for continued growth,” Jim Baird at Plante Moran Financial Advisors told Bloomberg.

Bond yields finally retreated on the back of the GDP report, and after Fed Bank of New York President John Williams expressed optimism that US inflation will keep decreasing in the second half of this year.

In Asian market news, things are looking up across the region. Japan’s Nikkei is up 0.19%, Hong Kong’s Hang Seng has jumped +1.43%, Shanghai markets are better off by 0.35%, and those lucky buggers in Malaysia are all set to knock off early at 12:30pm for Harvest Festival celebrations.

I don’t know what that means, but I’m assuming there’s a massive, national tractor ride involved.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 31 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ME1 Melodiol Glb Health 0.002 100% 6,835,970 $823,137 HCD Hydrocarbon Dynamic 0.004 33% 209,942 $2,425,747 LPD Lepidico Ltd 0.004 33% 3,724,558 $25,767,358 LSR Lodestar Minerals 0.002 33% 367,500 $3,035,096 KGD Kula Gold Limited 0.013 30% 16,198,155 $4,864,619 MGA Metalsgrovemining 0.075 25% 729,775 $5,394,630 VRC Volt Resources Ltd 0.005 25% 425,046 $16,634,713 FRS Forrestaniaresources 0.062 24% 12,604,621 $8,089,287 TM1 Terra Metals Limited 0.053 23% 273,183 $12,718,484 ZMM Zimi Ltd 0.022 22% 2,000 $2,220,265 1MC Morella Corporation 0.003 20% 1,535,878 $15,446,999 TTI Traffic Technologies 0.006 20% 1,396,474 $4,622,490 BCA Black Canyon Limited 0.125 19% 3,709 $7,364,854 FAL Falconmetalsltd 0.32 19% 2,497,880 $47,790,000 AON Apollo Minerals Ltd 0.027 17% 101,000 $16,015,887 PPY Papyrus Australia 0.014 17% 248,252 $5,912,311 ASV Assetvisonco 0.016 14% 37,750 $10,161,712 LML Lincoln Minerals 0.008 14% 191,334 $11,928,317 TX3 Trinex Minerals Ltd 0.004 14% 265,281 $6,400,283 PAA Pharmaust Limited 0.21 14% 2,214,768 $73,243,578 WMG Western Mines 0.43 13% 193,247 $28,772,909 SVM Sovereign Metals 0.655 13% 1,314,121 $326,541,973 AVH Avita Medical 3 13% 1,173,906 $165,407,631 SNS Sensen Networks Ltd 0.027 13% 15,203 $18,617,625 FLC Fluence Corporation 0.135 13% 646,870 $129,142,166

The Small Caps winner on Friday morning was Kula Gold (ASX:KGD), which gained nicely through the morning on news that the company has decided to acquire the historic Mt Palmer Gold Mine, last commercially mined in 1944 down to only the 6th Level (~160m) at 15.9g/t Au.

Kula says that the mine’s location, just 15km from the Marvel Loch gold processing plant and infrastructure, aligns with its strategy of exploring near to existing operations to fast track any discovery to monetary success.

Graphite producer and natural graphite anode developer Volt Resources (ASX:VRC) was also on the move Friday morning, after providing an update on a shipment of high purity graphite product.

Volt says its subsidiary, Zavalievsky Graphite, has commenced production of high purity micronized graphite for the 40-tonne customer order received in April 2024 and is targeting completion by July 2024. To-date, about 26 tonnes have been produced and shipped to the customer.

Papyrus Australia (ASX:PPY) continued to enjoy investor support on Friday morning, after the company clarified some of the structural elements of the contracts it recently signed with the Egyptian government, which – in a mildly convoluted way that I have run out of time trying to comprehend – “represents potential revenue of up to $2.7m USD per year from moulded product sales by Papyrus”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 31 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 1AG Alterra Limited 0.004 -33% 8,674,069 $5,172,879 AUH Austchina Holdings 0.002 -33% 5,288,803 $6,301,151 SIH Sihayo Gold Limited 0.002 -33% 520,830 $36,612,769 AVE Avecho Biotech Ltd 0.003 -25% 406,243 $12,677,188 ECT Env Clean Tech Ltd. 0.003 -25% 3,000,105 $12,687,242 RBX Resource B 0.03 -21% 774,357 $3,142,010 KP2 Kore Potash PLC 0.034 -21% 8,262,023 $28,305,374 BEL Bentley Capital Ltd 0.023 -21% 4,829 $2,207,710 EDE Eden Inv Ltd 0.002 -20% 100,000 $9,195,678 OSL Oncosil Medical 0.004 -20% 5,100,000 $16,660,548 ROG Red Sky Energy. 0.004 -20% 1,225,869 $27,111,136 YAR Yari Minerals Ltd 0.004 -20% 100,000 $2,411,789 RSH Respiri Limited 0.027 -18% 69,482 $34,975,674 BCT Bluechiip Limited 0.005 -17% 547,200 $6,604,601 LRL Labyrinth Resources 0.005 -17% 2,056,147 $7,125,262 NAG Nagambie Resources 0.01 -17% 2,261,708 $9,559,628 STM Sunstone Metals Ltd 0.011 -15% 1,702,926 $47,720,834 FCT Firstwave Cloud Tech 0.017 -15% 1,366,908 $34,200,387 GCM Green Critical Min 0.003 -14% 650,000 $3,978,048 RKT Rocketdna Ltd. 0.006 -14% 633,369 $4,592,804 IXU Ixup Limited 0.013 -13% 174,812 $22,566,289 OKJ Oakajee Corp Ltd 0.013 -13% 100,000 $1,371,690 AHL Adrad Hldings 0.81 -13% 130,960 $75,597,243 BFC Beston Global Ltd 0.0035 -13% 1,100,000 $7,988,188 EXT Excite Technology 0.007 -13% 352,900 $11,633,934

ICYMI – AM EDITION

Anson Resources (ASX:ASN) drilling has uncovered high grades of critical minerals such as gallium, indium, germanium and barium at its Ajana project in WA, providing an additional avenue for economic value to the current zinc resource.

CuFe (ASX:CUF) is another step closer to receiving additional revenue from its 2% net smelter royalty over M24/462, which hosts Northern Star Resources (ASX:NST) Crossroads gold project.

This follows Western Australia’s Department of Energy, Mines, Industry Regulation and Safety approving the Mining Proposal for Crossroads, which mining up to 2.67Mt of ore over a 36 month period commencing in the second half of 2024.

While CuFe will only know the grades involved as there were not stated in the mining proposal, the NSR nonetheless represents a potential valuable revenue source for the company in the near-future.

Meteoric Resources (ASX:MEI) has made a high-powered addition to its board with the appointment of economist and leading geopolitical financial expert Dr Nomi Prins as a non-executive director.

Dr Prins was formerly a managing director at Goldman Sachs, ran the international analytics group at Bear Stearns in London and held roles at Lehman Brothers and the Chase Manhattan Bank.

Prins is also the best-selling author of seven published books and testified to the US Senate, advised senior US leaders on matters ranging from banking to the energy transition to national defence-based critical mineral policies.

“This is another great appointment to our board with Dr Prins bringing vast real-world experience of banking, debt finance, macroeconomics and critical minerals initiatives,” executive chairman Dr Andrew Tunks said.

Strickland Metals’ (ASX:STK) drilling has returned significant gold intersections including a highlight of 10.6m at 7.5g/t gold from 161.4m from its Palomino prospect, which was previously thought to be devoid of mineralisation.

At Stockhead, we tell it like it is. While Anson Resources, CuFE, Meteoric Resources and Strickland Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.