ASX Small Caps Lunch Wrap: Who’s missing about 80 beautiful new mink coats this week?

"Boom! Headshot..." Pic via Getty Images.

Local markets have fallen this morning, after Wall Street took a beating overnight that left US investors battered and bruised, and their local indices looking decidedly second-hand.

That’s after the US Fed spent two days deciding not to do anything with interest rates, keeping things ticking along in a range of 5.25 to 5.5%, with one eye on getting the rate down to 5.1% at the end of 2024.

It wasn’t quite the interest rate escape that Wall Street was hoping for, so investors there (and local shareswappers here, too) will have to take solace in the news that there’s been a mass breakout (of sorts) in Rockefeller Township, 60 miles north of Harrisburg, Pennsylvania.

The escapees are likely going to be pretty difficult to round up, for a couple of reasons – firstly, they’re cunning little bastards and quite adept at hiding from large, lumbering predators (such as bears and thin-lipped old women), and because there’s 8,000 of them on the loose.

Local officials say that an “unknown actor” – my guess it’s someone like Mark Ruffalo or one of those other “Imagine video” dweebs – has broken into a mink farm and released thousands of animals that were destined to be turned into luxurious coats for people with poor judgement and a sub-standard moral compass.

It caused quite the sensation, as you’d imagine, because aside from being worth a lot of money and looking fabulous once you take their bodies out, mink are vicious animals.

But don’t take my word for it – because Joseph Carter the Mink Man has all the video evidence you need to see that these little bastards can, and will be, maniacs at the drop of a hat.

Part of the animalian branch as otters (which are lovely), weasels (which are not) and ferrets (which are inexplicably popular pets among people who like to stink of stale urine), mink are semi-aquatic beasties who live on a diet of meat, and fresh US dollars.

They’re wily, and will happily sink their billions of tiny needle-like teeth into anything they perceive as a threat – which is fine if there’s one of them, but very much not fine when there’s thousands of them gambolling their way to freedom.

Luckily for the people of Rockefeller Township, a large portion of the missing mink have been recovered, accoring to Challis Hobbs, executive director of Fur Commission USA, America’s peak representative body for mink farmers.

Hobbs told local media that “many remained close to the farm and were rounded up”, because LOL minks R dumb.

(I’m paraphrasing, of course).

However, hundreds of the critters remain at large, roaming the countryside in search of fresh meat – but before you go racing off to see if you can bag yourself a lovely new coat so you can be the belle of the ball, bear in mind that it takes about 100 mink to make a full-length coat.

Because they’re lazy and have small hands.

TO MARKETS

The benchmark has fallen more than 1.0% this morning, after Wall Street took a bath in the wake of the US Fed’s decision to ‘hurry up and wait’ on interest rates overnight.

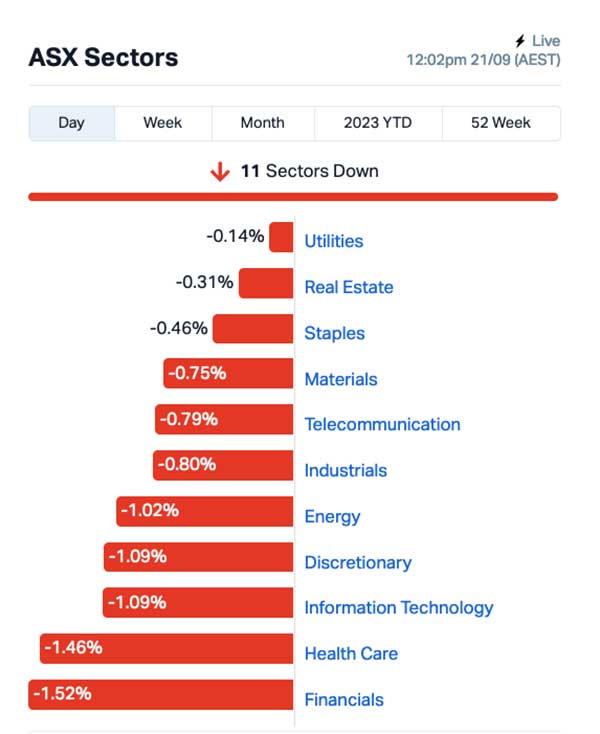

That flowed on to cause some upset tummies when the ASX opened this morning, and by lunchtime there wasn’t a positive sector in sight, with five sectors down more than 1.0% and Utilities sitting at the top as “best-worst” on -0.14%, but Real Estate was looking like it might take a positive turn.

Up the fancy end of town, there’s not a Large Cap in sight in the winners’ circle – the best of them is currently toll road operator Atlas Arteria (ASX:ALX), up 1.6%.

Losing ground were Genesis Energy (ASX:GNE), down 5.1%, and maintenance services company Mader Group (ASX:MAD), which has dropped 6.4% this morning, for reasons that are probably very important, but I don’t want to talk about right now.

NOT THE ASX

In New York, the S&P 500 fell by -0.94%, the blue chips Dow Jones index was down by -0.22%, and the tech-heavy Nasdaq fell by -1.53%, after the US Fed faffed about for a couple of days before letting everyone know that they’re not gonna budge on interest rates for the moment.

Earlybird Eddy reported this morning that In the post meeting statement, the Fed’s Summary Economic Projections (SEP) and dot plot suggests “an additional 25 basis point rate hike this year, peaking in the 5.5 to 5.75% range”.

Fed officials also saw its “overnight lending rate to be 5.1% at the end of 2024 (5.25% – 5.5% currently)”.

“They’re talking about higher rates for longer, but it’s really the economy that matters,” said Gennadiy Goldberg of TD Securities.

“And if the economy starts to soften, I don’t think these dot plot projections will actually hold up.”

Bond yields in the US and Europe jumped after the statement, with the US Treasury 3-year yields climbing to the highest level since 2006.

To stock news, marketing automation firm Klaviyo made its public debut overnight with a valuation of US$11.3 billion. The shares closed the day more than 30% higher.

IBM rose more than 2% after RBC Capital Markets initiated coverage on the stock with an ‘Outperform’ rating and a price target of US$188 (vs current price of US$150).

Meanwhile in Japan, the Nikkei is down as the country braces for the onslaught that is the Tokyo Game Show, which – disappointingly – is not synonymous with the phrase “Japanese Game Show”, so it will involve a lot fewer hapless salarymen being hit in the nuts than one might ordinarily expect.

The Tokyo Game Show kicks off today, but the first couple of days are for industry people and journos – then, on Saturday, the gamers will emerge… slowly at first… before descending on the Makuhari Messe convention centre in Chiba to stink the place up and whinge about stuff like “pathetic frame rates” and “microtransactional grifting” until police turn up with high-powered hoses to disperse them.

In China, Shanghai markets are down 0.5% because Japan found a buoy floating in the East China Sea near a smattering of tiny, uninhabited rocks called either the Senkaku islands, or the Diaoyu islands, depending on who you barrack for.

Japan wants the buoy removed, China says “those islands are ours, so you can go root your boots, mate” and it’s a whole big thing now.

In Hong Kong, the Hang Seng is down 1.24% despite a pick-up in local buoy manufacturing.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PKD Parkd Ltd 0.028 33% 152,750 $2,138,185 PLG Pearl Gull Iron 0.033 27% 1,016,054 $4,066,822 AGC AGC Ltd 0.072 26% 24,967,102 $5,700,000 BTC BTC Health Ltd 0.045 25% 128,007 $11,668,439 CTN Catalina Resources 0.005 25% 800,000 $4,953,948 MXC MGC Pharmaceuticals 0.0025 25% 327,172 $8,855,936 AGD Austral Gold 0.03 20% 96,482 $15,307,784 BGE Bridge SaaS 0.025 19% 212,955 $609,756 AVM Advance Metals Ltd 0.007 17% 72,857 $3,531,352 LRL Labyrinth Resources 0.007 17% 14,285 $7,125,262 OZZ OZZ Resources 0.075 15% 252,999 $6,014,458 KGD Kula Gold Limited 0.015 15% 141,333 $4,851,755 SPX Spenda Limited 0.008 14% 1,403,878 $25,699,955 MEG Megado Minerals Ltd 0.049 14% 874,351 $10,941,589 NZK NZK Salmon Ltd 0.205 14% 37,798 $97,461,848 CWX Carawine Resources 0.13 13% 697 $22,634,009 EMT Emetals Limited 0.009 13% 550,000 $6,800,000 GTR GTI Energy 0.009 13% 501,309 $16,359,577 ICN Icon Energy Limited 0.009 13% 1,100,100 $6,144,109 ZEU Zeus Resources Ltd 0.018 13% 492,068 $7,348,496 PCK Painchek Ltd 0.037 12% 1,128,877 $46,297,163 AAR Astral Resources NL 0.079 11% 2,567,175 $56,083,661 MKG Mako Gold 0.02 11% 166,181 $10,368,147 TAR Taruga Minerals 0.01 11% 188,000 $6,354,241 ASP Aspermont Limited 0.011 10% 441,139 $24,387,637

Australian Gold and Copper (ASX:AGC) is top of the pops at lunchtime, putting on more than 26% after a ‘transformational’ $10.1 million strategic capital investment by Delin Mining Group.

The company says the funds are coming via a placement of 122,222,222 new shares at $0.082636 per share, which is well above yesterday’s closing price of $0.057 – and still well above its current price at lunchtime of $0.072.

In second place(s), there’s a laundry list of decent gains on slim volume, ranging from BTC Health (ASX:BTC) adding 25% through to Kula Gold (ASX:KGD) adding 15.3%.

Also worth a mention is a stock we don’t hear from very much, but it’s come sailing out of the ocean mist like a haunted galleon for the first time in ages – Pearl Gull Iron (ASX:PLG) is up 15.3% after dropping its annual report after hours last night.

In summary: PGL still has an Inferred Mineral Resource estimate of 24.5Mt at 34.3% Fe, but it still has to find an economic way of getting it off the ultra-remote Cockatoo Island. There’s talk of a barge, though, which is nice.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CYM Cyprium Metals Ltd 0.034 -66% 49,547,645 $152,120,549 INP Incentiapay Ltd 0.006 -25% 13,000 $10,120,509 HAL Halo Technologies 0.06 -23% 17,400 $10,100,627 PPY Papyrus Australia 0.024 -20% 297,564 $14,777,028 TMG Trigg Minerals Ltd 0.012 -20% 3,221,628 $3,020,769 BP8 Bph Global Ltd 0.002 -20% 84,217 $3,336,824 ME1 Melodiol Glb Health 0.005 -17% 559,450 $17,683,922 MRI My Rwards International 0.01 -17% 739,907 $5,119,606 CZN Corazon Ltd 0.011 -15% 8,590 $8,002,773 AKM Aspire Mining Ltd 0.084 -15% 822,869 $50,256,062 IVZ Invictus Energy Ltd 0.17 -15% 15,294,403 $237,999,508 ELE Elmore Ltd 0.006 -14% 2,970,214 $9,795,687 EXL Elixinol Wellness 0.006 -14% 114 $4,385,379 ODE Odessa Minerals Ltd 0.012 -14% 12,265,645 $13,259,566 SKN Skin Elements Ltd 0.006 -14% 250,000 $3,986,403 TAS Tasman Resources Ltd 0.006 -14% 27,969 $4,988,685 DAF Discovery Alaska Ltd 0.019 -14% 750 $5,153,163 CMX ChemX Materials 0.1 -13% 28,026 $6,103,842 OSM Osmond Resources 0.11 -12% 71,565 $5,862,005 SHN Sunshine Metals Ltd 0.015 -12% 1,898,513 $17,165,286 SYA Sayona Mining Ltd 0.093 -11% 65,749,185 $1,080,796,081 MM1 Midas Minerals 0.195 -11% 70,487 $19,040,394 PHO Phosco Ltd 0.056 -11% 10,000 $17,288,041 BRN Brainchip Ltd 0.2 -11% 15,720,911 $399,388,083 IVX Invion Ltd 0.004 -11% 560,000 $28,897,345

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.