ASX Small Caps Lunch Wrap: Who’s losing the ride-sharing war to a snake this week?

Despite having a 5-star passenger rating on Uber, Trevor often had difficulty getting the driver's attention when he needed picking up. Pic via Getty Images.

Local markets have opened lower this morning, because it’s Budget Week and no one seems even remotely confident in trying to pick which way Jim “Supernintendo” Chalmers is going to try to steer the nation when he unveils the mother of all spreadsheets at 7:30pm tomorrow night.

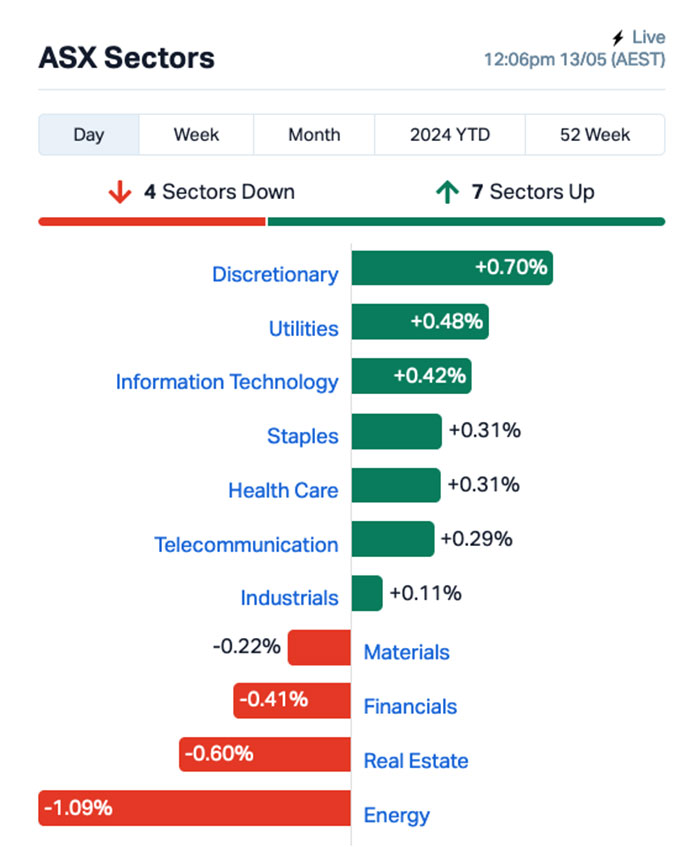

The sectors are mixed, but it’s the losers that are winning the battle for control of the market’s sentiment this morning, with losses in Financial, Industrial and Energy proving too strong for the gains in InfoTech and Utilities.

I’ll get into the details of that shortly, but first, we’re off to the city of Newcastle in New South Wales, where one woman’s battle for ownership of her work ute has reached something of a stalemate.

According to the ABC News team, Lisa Kournelis has been forced to wear “protective clothing” whenever she drives her ute, after four attempts to remove a red-bellied black snake from inside it have failed.

I’ll let you sit with that sentence for a moment, because there’s a bit to unpack there…

Let’s start with the obvious question: Why, pray tell, is anyone driving that vehicle at all when there’s clearly a highly-venomous danger noodle on the loose inside it?

It’s undeniably a sign of the times that an upstanding member of the Aussie workforce is compelled to keep driving their vehicle to work, even though there’s a bloody good chance that a swift and grisly death is lurking somewhere inside the cabin.

I’ll be honest… if there was a snake trapped in my car, there is precisely zero chance I’d be bothering to even get out of bed. I’d be calling work to say I can’t possibly be at work today, because “there’s a f#$%ing snake in my car” is a pretty compelling reason, despite the fact that I work from home and ride a motorcycle most of the time.

According to Ms Kournelis, no less than four snake catchers have had a crack at getting the snake out, but so far the reptile has eluded each and every one.

Local snake guru Matt Stopford told the ABC that there are a number of concerns, starting with the fact that the snake has most likely taken up residence somewhere inside the dashboard of the vehicle.

“The dash is a big one, it’s a big job,” he told the ABC. “Generally you want a technician to do that, especially in the newer cars, and the technicians don’t want to go in there while there is a snake in there, so it is a bit tricky.”

The point I suspect that he’s missing is that if – god forbid – Ms Kournelis is involved in an accident, the job of removing a full-grown black snake after it was fired at high speed into her forehead by the airbags is likely to be a lot trickier.

Beyond that, given the time of year, there’s a very real possibility that the snake is getting set to go into Winter Mode, or “brumation” as those scientific boffin types like to call it.

That means it’ll be semi-asleep somewhere in the ute for months, giving it time to learn how to operate the vehicle, at which point there’s a good chance it’ll emerge with the skills to pass a driving test.

I’d recommend Ms Kournelis, at the very least, makes sure she doesn’t leave the rego papers in the car – if the snake gets its shit together, it’ll be straight down to Service NSW to swap the rego over and then the car will legally belong to the reptile.

According to The Australian Museum, red-bellied black snakes were one of the most frequently encountered snakes on the east coast of Australia, and were responsible for a number of bites every year.

“They are a shy snake and will generally only deliver a serious bite under severe molestation”, a spokesperson for the museum said – and now I want to know who found that out, and what they were doing at the time.

TO MARKETS

Local markets are down this morning because, as I already mentioned, the losses stemming from the Financial, Real Estate and Energy sectors were outpacing gains from InfoTech, Consumer Discretionary and Utilities for most of the early part of the session.

By midday, the sectors looked like this:

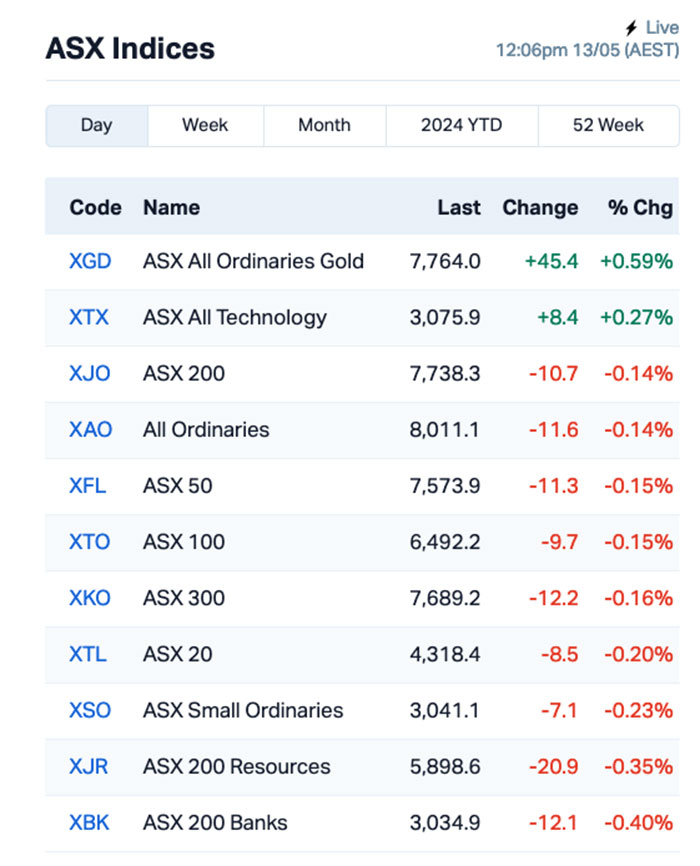

But, there’s some good news for investors. As is often the case when the ASX has a case of the Monday Morning Shakes, the goldies are doing okay out in front of the rest of the market by +0.6% or thereabouts.

It’s likely to be a pretty lumpy week on the ASX, as tomorrow night is Federal Budget Night, which means that it’s going to be about 30 hours or so before Australia gets to lay eyes on the latest round of ineffectual measures that the government’s going to say it will put in place five years from now to deal with the nation’s already-out-of-control cost of living crisis.

But even though the federal budget has turned into the modern fiscal equivalent of kicking a can of tea leaves down the road, it’s still likely to give local investors some jitters because the government is rapidly running out of minerals to add to its “critical list”.

It’s like the government learned nothing from watching The Incredibles… because if we’re all critical minerals, it means that none of us are.

NOT THE ASX

On Friday, the S&P 500 rose by +0.16% to reach its highest level since early April. The blue chips Dow Jones index was up by +0.32%, but the tech-heavy Nasdaq slipped by -0.03%.

Earlybird Eddy Sunarto reports that Fed Reserve Governor Michelle Bowman expressed her view that interest rates should remain unchanged “for a bit longer,” echoing sentiments shared by other Fed Reserve officials in recent weeks.

“I’ve sort of had an even expectation of staying where we are for longer. And that continues to be my base case,” she told Bloomberg News.

The US will release its CPI report for April on Wednesday (US time).

Analysts anticipate that US inflation will maintain the trend of elevated inflation seen this year, and should that materialise, the CPI report is poised to bolster the argument for the Fed to delay any rate cuts until July or beyond.

Translation: All speculation is pointless, and the outlook at the US will see a rate cut towards the end of the year remains unchanged, despite whatever unhinged headlines Jim “The 1,000-year-old Baby” Cramer is spoon-feeding his cronies at CNBC.

In US stock news, Chipmaker TSMC rose almost +1% after reporting a sales jump of 60% in April, citing sustained AI demand and a revival in smartphones demand.

Tesla was down -2% as Elon Musk said the company intends to invest over US$500 million in expanding its charging network, just days after significant layoffs within the EV maker’s Supercharger division.

If someone’s available to explain to me how Musk can still have his nose out of joint about not getting paid $54 billion a year while he’s laying off hundreds and hundreds of workers, I’m all ears.

Shares of US-listed Chinese electric vehicle manufacturers such as Nio, Li Auto, and Xpeng experienced declines on Friday after reports emerged that President Biden is preparing to introduce new tariffs on China this week – including electric vehicles, batteries, and solar cells.

The best gainer on Wall Street was pharmaceutical stock Novavax, which rose +98% after the company signed a US$1.4 billion deal with French company Sanofi to co-commercialise its current COVID-19 vaccine worldwide.

In Asia this morning, the markets are all open for once. Hong Kong’s Hang Seng is up 0.40%, Japan’s Nikkei is trading flat and Shanghai markets are down -0.23%.

There’s a slim possibility that Chinese markets are floundering because the ABC’s Four Corners program is set to blow the lid off Beijing’s surveillance of dissidents in Australia, featuring an interview with a fella called “Eric” who is, I suspect, feeling pretty glum about being a whistleblower, judging by that lump in his throat.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 13 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap ERW Errawarra Resources 0.12 100% 13,636,588 $5,755,240 FAU First Au Ltd 0.005 67% 58,457,386 $4,985,980 EXL Elixinol Wellness 0.006 50% 3,211,786 $5,204,296 LPD Lepidico Ltd 0.003 50% 5,174,802 $17,178,239 BUR Burley Minerals 0.12 40% 974,083 $12,931,901 MGU Magnum Mining & Exploration 0.019 36% 16,492,511 $11,331,060 ANX Anax Metals Ltd 0.059 34% 18,987,450 $26,017,952 PUA Peak Minerals Ltd 0.004 33% 14,411,010 $3,124,130 PNN Power Minerals Ltd 0.14 33% 850,482 $9,723,529 LV1 Live Verdure Ltd 0.55 31% 592,175 $52,381,684 MTL Mantle Minerals Ltd 0.0025 25% 3,593,129 $12,394,892 PUR Pursuit Minerals 0.005 25% 1,106,598 $11,775,886 RML Resolution Minerals 0.0025 25% 400,000 $3,220,044 E25 Element 25 Ltd 0.36 24% 676,276 $63,083,797 IND Industrial Minerals 0.215 23% 318,641 $12,033,000 FZR Fitzroy River Corp 0.145 21% 40,879 $12,954,510 M4M Macro Metals Limited 0.047 21% 47,575,484 $126,050,603 TON Triton Min Ltd 0.015 20% 2,751,714 $19,517,408 AYT Austin Metals Ltd 0.006 20% 75,000 $6,425,957 CCO The Calmer Co International 0.006 20% 5,810,997 $6,804,398 IVX Invion Ltd 0.006 20% 850,056 $32,122,661 ME1 Melodiol Glb Health 0.003 20% 13,712,492 $1,783,718 PRX Prodigy Gold NL 0.003 20% 813,645 $5,034,435 HRZ Horizon 0.05 19% 1,183,883 $29,441,314 NPM Newpeak Metals 0.025 19% 2,349 $2,385,986

Leading the ladder on Monday morning was Errawarra Resources (ASX:ERW), after the market reacted to the company blaming “nearology” for an unexplained share price jump by piling on and pushing it to a +100% gain in early trading, after ERW’s response to an ASX speeding ticket suggested Artemis Resources’ (ASX:ARV) lithium-rich rock chip samples from up the road were to blame.

Elixinol Wellness (ASX:EXL) was up this morning on news that it has received $2.3m from divesting its minority stake in Altmed Pets.

Magnum Mining and Exploration (ASX:MGU) rose sharply in early trade after telling the market that it – and its partners – will attempt to raise more than US$210m to advance their green pig iron project in Saudi Arabia, where early drilling has intercepted a shockingly large number of green pigs.

Anax Metals (ASX:ANX) was climbing on news that strengthened copper prices have enhanced the company’s Whim Creek project’s economics by 32% providing a Pre-Tax NPV7 of $357M and IRR of 74%, bumping the planned 8-year mine life out to a position that the company says will generate ~$520M in “free cash”.

And explorer Power Minerals (ASX:PNN) announced that it has a new niobium-rare earths project in WA’s West Arunta region, immediately adjacent to WA1 Resources’ (ASX:WA1) major niobium discovery, Luni.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 13 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JTL Jayex Technology Ltd 0.001 -80% 5,719,547 $1,406,393 AXP AXP Energy Ltd 0.001 -50% 1,119,999 $11,649,361 JAV Javelin Minerals Ltd 0.001 -50% 285,001 $4,352,462 CNJ Conico Ltd 0.001 -33% 220,000 $2,707,643 EDE Eden Inv Ltd 0.0015 -25% 202,350 $7,356,542 LSR Lodestar Minerals 0.0015 -25% 5,029,000 $4,046,795 TD1 Tali Digital Limited 0.0015 -25% 1,014,721 $6,590,311 BYE Byron Energy Ltd 0.046 -23% 9,959,882 $64,727,129 AVC Auctus Invest Grp 0.47 -20% 18,000 $44,563,727 HFY Hubify Ltd 0.012 -20% 500,000 $7,442,044 TM1 Terra Metals Limited 0.048 -20% 4,086,755 $17,746,722 PSL Paterson Resources 0.01 -20% 500,000 $5,700,473 MKL Mighty Kingdom Ltd 0.004 -20% 5,662,777 $12,487,999 PKO Peako Limited 0.004 -20% 125,000 $2,635,424 ROG Red Sky Energy. 0.004 -20% 213,615 $27,111,136 ICL Iceni Gold 0.073 -18% 7,091,473 $21,943,934 CAV Carnavale Resources 0.005 -17% 250,000 $20,541,310 KGD Kula Gold Limited 0.01 -17% 716,984 $5,837,543 MEL Metgasco Ltd 0.005 -17% 554,173 $6,383,320 NSX NSX Limited 0.02 -17% 117,000 $11,341,706 TGH Terragen 0.02 -17% 84,500 $8,857,947 CVC CVC Limited 1.605 -16% 10,618 $221,965,779 AXI Axiom Properties 0.055 -15% 297,237 $28,126,388 CHM Chimeric Therapeutics 0.023 -15% 6,291,619 $23,122,978 BCT Bluechiip Limited 0.006 -14% 223,872 $7,705,368

ICYMI – AM EDITION

Australian Mines (ASX:AUZ) has submitted patents for the use of its MH-Oct22 and MH-May24 metal hydrides to store hydrogen in a solid state, which could address the energy density issues as well as challenges involved with either compressing or liquefying the gas.

The company’s research program is aimed at reducing the metal hydride’s operating temperature and increase the absorption and desorption rates while maximising energy density.

While MH-Oct22 has proven to be capable of storing significant quantities of hydrogen, MH-May24 demonstrates significant improvement in the absorption and desorption rates of hydrogen at lower temperatures and may have higher energy density than compressed or liquefied hydrogen.

BPH Energy (ASX:BPH) has raised $1m through a placement of shares priced at 2c each to execute its next phase of hydrocarbon and Cortical Dynamics funding.

Placement participants will also receive one attaching option exercisable at 3c and expiring on 30 September 2024 for every two shares that they subscribe for.

Most of the funds will go towards gas exploration to help address the coming eastern Australia gas supply crunch.

Optiscan (ASX:OIL) has signed a 24-month know-how agreement with famed US academic medical centre Mayo Clinic to develop a new endomicroscopic imaging system for use in robotic surgery.

This will combine the company’s engineering expertise in digital endomicroscopic hardware and software development with Mayo Clinic’s know-how in robotic surgery and quality patient care.

Co-development and clinical testing will begin with an initial focus on robotic-assisted breast cancer surgery.

At Stockhead, we tell it like it is. While Australian Mines, BPH Energy and Optiscan Imaging are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.