ASX Small Caps Lunch Wrap: Who’s just dying to make a bit of spare cash this week?

Please, lie still... this is going to hurt you a lot more than it's going to hurt me. Pic via Getty Images.

Local markets have fallen pretty hard this morning, because of what’s happening on the US 10yr Bond scene.

Yields are climbing, fast, to a 16-year high of 4.7% – which, for the newbies who might be just joining us, is terrible news for stocks and other securities.

The reason for it is simple: Think of stocks as Coca-Cola, a clear market dominator in terms of “fun places to invest your money”.

But then, Pepsi – the second-fiddle competitor – comes along with a beverage that doesn’t taste like arse, and suddenly there’s a competition for where investors are going to park their money.

Now, the yields are going up because the US Fed keeps raising interest rates (or at least threatening to), and the higher the yields go, the more attractive bonds become for investors, so they start ditching their shares, which sends share prices lower.

And so, here we are, with an ASX that is headed for the basement and down 1.22%, and nothing else to show for it other than a can of fizzy drink that tastes less of rectum than it used to.

I’ll get into the finer details of what’s happening locally shortly, but first there’s an alarming tale that emerged from Pakistan overnight, following the arrest of a doctor and seven other people involved in an organ trafficking ring.

According to the BBC, a medico by the name of Fawad Mukhta is accused of harvesting kidneys from more than 300 people in order to transplant them into wealthy patients willing to pay enormous sums of money to skip the transplant queue.

Local officials say that at least three people have died as a result of having one of their kidneys “borrowed” throughout Pakistan’s eastern Punjab province, as well as in Pakistan-administered Kashmir.

Fawad Mukhta doesn’t exactly have a squeaky clean record. He’s been arrested for medical malpractice no less than five times, but in the grand Far Eastern tradition, he was able to walk free after securing bail, which is a polite way of saying “hand police and the judiciary massive sums of cash so he could get back to stealing people’s inside bits”.

If you’re not already appalled, it gets worse. The transplants were performed in private homes throughout the region, which you’d expect would be anything but the sterile surgical operating theatres this sort of surgery would require.

And Fawad Mukhta’s surgical assistant is 100% not a doctor – he’s actually a mechanic, which goes some way towards explaining why some patients were complaining of idling rough because of fouled plugs following their operation.

Dr Mukhta was allegedly pocketing 10 million rupees – around $55,000 Aussie – per transplant, despite the threat of a 10-year stretch, which as you might imagine is a horrifying experience when you’re banged up in Pakistan.

If he does get prison time, at least he won’t be alone… because this is the second organ harvesting operation busted in Pakistan this year alone – in a country where the commercial harvesting and selling of human body parts has been illegal since 2010.

(A quick aside: Everyone who’s reading this who isn’t already an organ donor please visit this website and sign up. I’d be dead without the donated liver I received in late 2020 – so if you’re enjoying your daily Lunch Wrap from us, you can thank the stranger who donated their liver to save my life.)

(Promise it was actually donated.)

TO MARKETS

As previously mentioned, the ASX isn’t doing so well today, down 1.2% at lunchtime after being hit repeatedly over the head with a cricket bat that has the words “US 10-year Bond Yields” stencilled on the fat end.

All that’s been happening against the backdrop of the RBA Board’s monthly Fat Cats & Interest Rates Luncheon today, which has investors on edge and fretting over what’s going to happen to local interest rates this afternoon.

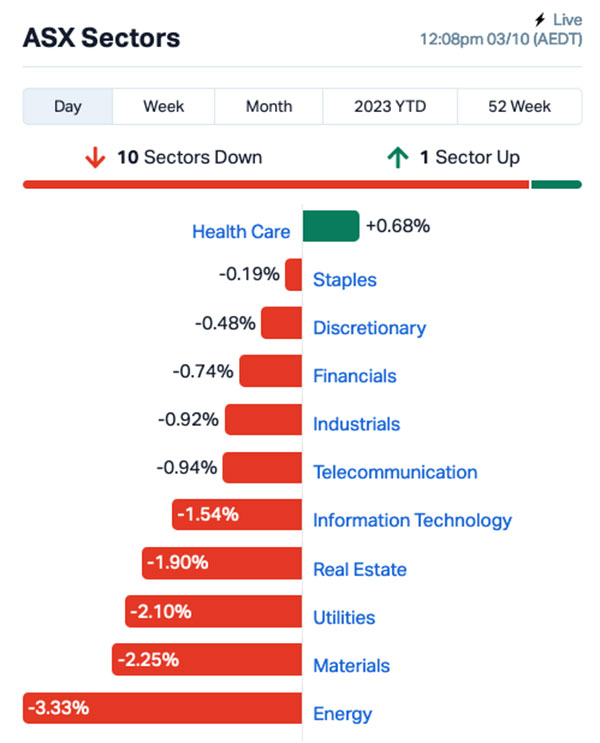

A quick look at the sectors shows that everything is deep in the red, with the exception of Health Care which is proving to be more stubbornly buoyant than an ill-timed turd in a packed backyard spa.

A goodly chunk of Health Care’s performance today can be attributed to the utterly enormous CSL (ASX:CSL) , which has added a little over 1.2% to its fat-bottomed $120 billion market cap today.

Plus, there’s been a huge deal for ECS Botanics (ASX:ECS), which has pushed its price up 27%, alongside Noxopharm (ASX:NOX) which has broken through 28% today. I’ll explain why later.

Lagging badly are Energy and Materials, the former due to crashing oil prices over the past week or so, which saw crude back below US$90 a barrel again – and coal is down more than 3.0% today as well.

Meanwhile, prices for shiny stuff like gold and silver (and copper, and platinum) have been sliding in recent days as well. Oh, and lead is down, iron ore is down for the week, and tin is pllummeting, down 5.5%.

Uranium is on the up and up, though – so there’s that.

On the Top 50 Gainers list, the biggest company making an appearance today is the $238 million market cap Galan Lithium (ASX:GLN), which has posted an 8.7% gain this morning.

But there are some bigger names losing ground today, including Westgold Resources (ASX:WGX) – down 6.4% – and Latin Resources (ASX:LRS) which has dropped 7.9%.

NOT THE ASX

It was a little bit chaotic in the US overnight, leaving the Dow Jones down -0.2%, while the S&P 500 managed a +0.01% win, and the tech heavy Nasdaq Composite added 0.7%, rising for the fourth straight session into the new month.

The Delightful Christian Edwards reports that the US 10-year Treasury yield topped out overnight at 4.7% – a fresh 16-year high.

In company news, Tesla shares added 0.5% rebounding from early losses as deliveries for Q3 missed market estimates.

Apple gained 1.5% and Nvidia found some of its old form, jumping 3% thanks to Goldman Sachs adding the chipmaker’s stock to its conviction list.

And in another sign of ongoing uncertainty, the US Utilities Sector has now lost circa 20% this year, the single worst-performing sector on Wall Street.

And in political news, former president Donald Trump appeared for Day One of his fraud trial, and promptly had a strop because the civil case is being heard in front of a judge, rather than a civilian jury.

The strop came to a sudden halt when the judge revealed that there’s no jury, because Trump’s legal team “didn’t ask for one”.

You can expect those lawyers to be added to the shuddering pile of “former legal representatives” in a deep hole down the back of Mar a Lago.

In Asia, there ain’t nothing happening on Chinese markets as the National Day holiday enters Day 2, but in Hong Kong the Hang Seng is wide awake and losing money like the rest of the region, down around 3.0% before lunch.

Japan’s Nikkei is also down, falling 1.31% this morning despite news that Japanese baseball sensation Shohei Ohtani has become the first player from that nation to lead the US Major League in home runs at the end of the regular season.

Ohtani, who plays for the Los Angeles Angels, has hit the ball over the fence 44 times this season, but would probably stop doing it quite as much if he had to climb over and retrieve it himself.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.002 100% 279,855 $15,642,574 TOY Toys R Us 0.014 56% 19,698,428 $8,306,262 NOX Noxopharm Limited 0.058 38% 1,870,093 $12,273,994 AL8 Alderan Resource Ltd 0.014 27% 8,539,596 $6,783,641 ECS ECS Botanics Holding 0.028 27% 21,633,770 $24,348,075 HVY Heavy Minerals 0.12 26% 1,086,523 $5,474,239 NIM Nimy Resources 0.24 26% 1,245,490 $14,718,854 BPP Babylon Pump & Power 0.005 25% 2,000,000 $9,848,308 GTG Genetic Technologies 0.0025 25% 173,083 $23,083,316 PXS Pharmaxis Ltd 0.04 21% 488,200 $23,828,348 FBR FBR Ltd 0.033 20% 3,609,745 $102,325,872 DEL Delorean Corporation 0.027 17% 18,518 $4,961,581 RIM Rimfire Pacific 0.007 17% 500,000 $12,631,468 MOH Moho Resources 0.008 14% 1,319,500 $1,904,249 RMX Red Mount Min Ltd 0.004 14% 500,000 $9,357,516 XTE Xtek Limited 0.365 14% 410,820 $32,563,745 AGR Aguia Res Ltd 0.017 13% 1,510,705 $6,507,814 MRL Mayur Resources Ltd 0.175 13% 112,500 $50,748,989 MGA Metals Grove Mining 0.135 13% 73,000 $4,464,060 HLX Helix Resources 0.0045 13% 287,743 $9,292,583 OPN Oppenneg 0.009 13% 440,000 $8,933,437 BBX BBX Minerals Ltd 0.029 12% 383,238 $13,461,099 VMM Viridis Mining 0.93 11% 95,390 $34,694,805 EFE Eastern Resources 0.01 11% 85,136 $11,177,518 LVT Livetiles Limited 0.01 11% 249,000 $10,593,996

Leading the ladder this morning is a surprising surge for Toys R Us (ASX:TOY) which has jumped more than 50% at lunchtime despite the last message to the market being a morose letter about how dismal things have been for quite some time.

However, news from the overseas branch of the toy-seller is that it’s in new hands, and has plans to build 24 new retails spaces in some unconventional places – inside other major stores like Macy’s, and on cruise ships (the ultimate in captive audiences).

Next best is Noxopharm (ASX:NOX), which is up 35.7% at lunchtime, seemingly off the back of days-old news concerning encouraging data from its Chroma platform, as presented at the American Association of Cancer Research (AACR) Special Conference on Pancreatic Cancer.

The day’s climb has had the brakes yanked on it, though – at 1:21pm, NOX was suspended from trading for some reason – it’s not entirely clear. I’ll update you later once I’ve figured it out.

Mining minnow Alderan Resources (ASX:AL8) has spiked 27.2% on news of the execution of a binding share sale agreement to acquire 100% of the issued capital in Parabolic Lithium, which in turn has the right to acquire a 100% interest in seven lithium exploration projects in the mineral resource rich state of Minas Gerais, Brazil.

And the morning’s early winner, ECS Botanics (ASX:ECS), is hanging in there on 27.2% as well, after revealing this morning that it’s signed an offtake deal with Perth-based medicinal cannabis company MediCann Health, worth a staggering $24 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0.0015 -25% 564,116 $8,855,936 CPN Caspin Resources 0.12 -23% 45,112 $14,611,178 EWC Energy World Corporation 0.028 -20% 140,275 $107,762,244 WBEDC Whitebark Energy 0.02 -20% 8,002 $3,669,830 DCX Discovex Res Ltd 0.002 -20% 716,666 $8,256,420 KNO Knosys Limited 0.033 -20% 62,362 $8,861,687 AVH Avita Medical 3.605 -19% 1,118,838 $269,342,398 CRS Caprice Resources 0.03 -17% 4,800 $4,203,250 E33 East 33 Limited. 0.025 -17% 106,517 $15,572,661 AVM Advance Metals Ltd 0.005 -17% 2,797,790 $3,531,352 NES Nelson Resources. 0.005 -17% 1,000,000 $3,681,566 TIG Tigers Realm Coal 0.005 -17% 1,500,000 $78,400,214 CBR Carbon Revolution 0.135 -16% 996,426 $33,944,401 MEL Metgasco Ltd 0.011 -15% 760,303 $13,830,528 1MC Morella Corporation 0.006 -14% 3,051,961 $42,970,590 BUY Bounty Oil & Gas NL 0.006 -14% 25,387 $9,593,507 GMN Gold Mountain Ltd 0.006 -14% 4,841,386 $15,883,550 MOB Mobilicom Ltd 0.006 -14% 39,403 $9,286,737 RGS Regeneus Ltd 0.006 -14% 1,886,000 $2,145,058 YPB YPB Group Ltd 0.003 -14% 46,406 $2,602,115 PIL Peppermint Inv Ltd 0.0095 -14% 1,049,302 $22,416,425 ZMI Zinc of Ireland NL 0.019 -14% 120,000 $4,689,174 MKG Mako Gold 0.013 -13% 79,663 $8,640,123 OSM Osmondresources 0.1 -13% 150,000 $5,393,044 ETR Entyr Limited 0.007 -13% 3,067,983 $15,864,831

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.