ASX Small Caps Lunch Wrap: Who’s given up trying to turn themselves into an alien this week?

Pic via Getty Images.

Local markets are down this morning, after overseas markets made an absolute meal of their first day of trading. There are, of course, reasons for that which I will get to shortly.

But first, to the story of Frenchman Anthony Loffredo, who rounded out 2023 with the stunning revelation that he was abandoning an art project that had made him quite famous on Instagram, and among the more extreme end of the world’s body modification scene.

It’s a scene that is rife with all manner of oddballs, and it’s one that takes an extraordinary level of commitment – or an obvious catastrophic head injury – to be ranked among the world’s most extreme.

Which is what makes Loffredo’s story so compelling, because he’s spent nine brutally painful years getting – by his own count – 65% of the way through his physical transformation before pulling the pin on the whole thing.

Loffredo, who is more widely known as The Black Alien, has told his fans – and the rest of us who have been watching on in abject horror – that his transformation “had lost all meaning to him”.

Which would be fine, except that he’s been so far out on the extreme end of the scene for so long, that he’s done a number of clearly irreversible things to his body.

That includes having his tongue split into two independently-moving parts, and having a number of his fingers removed so that they look like three-fingered alien hands.

His head’s taken a battering as well, after he had parts of his nose and lips sliced off, and both of his ears are gone as well, giving the late great Chopper Read a real run for his money.

He’s also pretty much completely covered in black tattoo ink, had a large part of his scalp removed, sports a number of super-weird sub-dermal implants put in to make his head into a highly unusual shape … and he’s had his eyeballs tattooed black as well.

The result is, as you’d expect, a stomach-churning horror show, and it’s left him looking like this.

The wildest part of all this is that he’s stopped just short of the most major part of his planned transformation – having one of his legs amputated and replaced with a biomechanical prosthetic.

It’s quite possible that the project is fizzling out because The Black Alien is, by all accounts, pretty unhappy that he’s not being accepted for who he is.

He can’t find a proper job, Uber drivers refuse to pick him up – presumably because they’re too busy sh-tting themselves whenever he looms out of the darkness and tries to get into the back of their Prius.

Which, frankly, is entirely understandable because he’s turned himself into a walking, ghoulish nightmare.

If you’ve got the stomach for it, there’s a great mini-documentary about him on YouTube here – which is, objectively, a total horror show, but it does offer some insight into whatever ol’ mate was thinking.

But in one sense, his decision to pull the pin on his transformation proves one thing – while his passion for changing his body might have waned, his ability to change his mind has remained intact.

Godspeed, you freaky bastard…

TO MARKETS

The New Year cheer on the ASX has lasted all of about 24 hours, and local markets are spending the morning in the doldrums, down 0.98% at the time of writing – and here’s why.

If you were watching telly on New Years Eve, you would have seen the Sydney Fireworks Spectacular – the annual sacrificial burning of literally millions of taxpayer dollars to ensure a bountiful harvest and ongoing abundant fertility for all the womanfolk of old Sydney town… or something along those lines.

Anyway, it’s quite a show, and – thanks to the arbitrary placement of the International Date Line, Sydney is one of the first cities in the world to ring in the New Year with a proper, high-quality ear-splitting, dog-panicking fireworks display.

Over the course of the following 24 hours, many cities around the world do their best to compete, but almost all of them routinely turn out to be cheap imitations that leave locals depressed and unhappy, spiteful towards Australia for having the audacity to do something in a crowd-pleasing manner.

That’s what happened when the markets opened for 2024 – the ASX fireworks were in full swing, our benchmark knocked a very welcome +0.5% dent into the bonnet of the new year, and yea verily, the locals were pleased with what they had done.

Then, New York and most of the major Euro indices had their turn to put on a New Year show, and it was predictably just a crap and derivative knock-off, which made their locals miserable out of shame.

There’s more to it, of course – and I’ll explain it better in a minute.

But the thing about a miserable overseas market performance is that Aussie markets tend to follow those trends – which meant that when the ASX threw open the doors this morning, we were all pumped and primed to shed value from the moment the clock struck 10.

And lose value we did, for we are nothing if not extra-diligent when it comes to doing precisely that, because – as an unrequited love interest of mine told me when I was a teenager – “trends aren’t for bucking”.

At least, I think that’s what she said – it certainly rhymed with that, anyway.

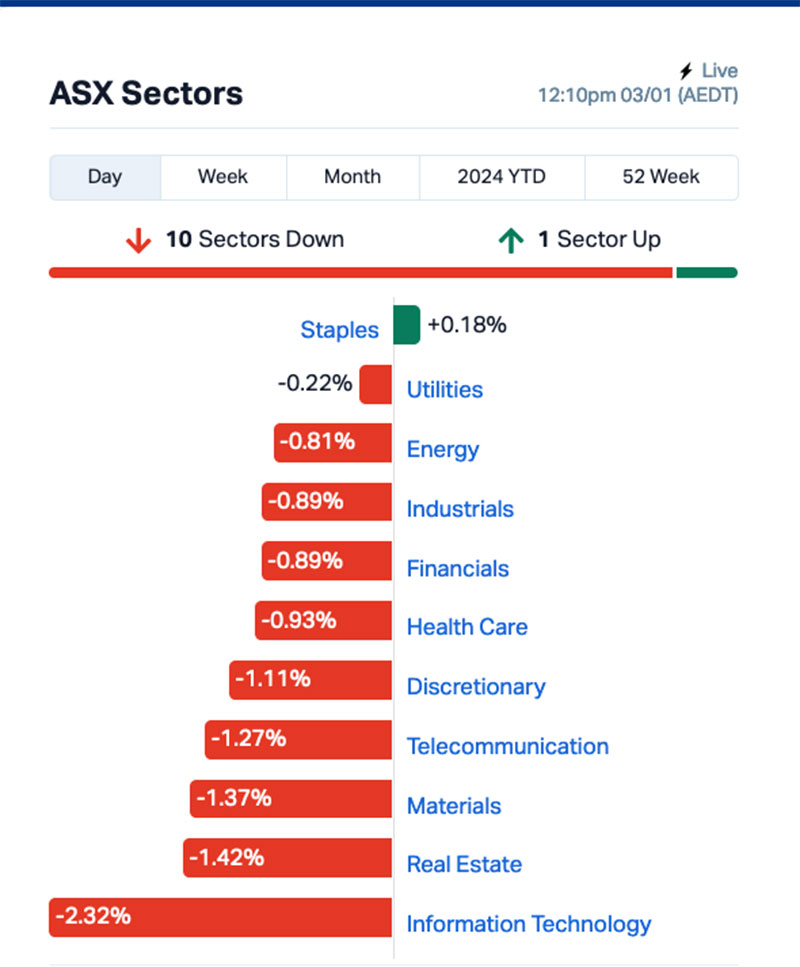

The morning’s losses have been led by a flagging InfoTech sector, which fell more than 2.3% before lunchtime – a sizeable chunk of that happening in very short order just before midday, when the XTX All Technology Index shed 0.5% in a matter of minutes.

In fact, at Meat Pie time today, the only sector doing anything worth a damn is Consumer Staples, which is a paltry 0.18% above zero – everything else is having a bad day.

Even the goldies are down this morning, with the XGD All Ords Gold Index falling 2.3%, despite gold prices remaining fairly stable, and still above the US$2,000/oz mark today.

That said, coal prices have been absolutely poleaxed this morning, down nearly 10% so far alongside plunging gas prices in Europe, which were down 5.5% the last time I dared to look.

Among the big names this morning, there’s not much to crow about – the best of the Big Money movers are Amcor (ASX:AMC) (+1.48%), and Endeavour Group (ASX:EDV), which is up 2.3% after the market was told that chairman Peter Hearl has resigned, and will be replaced by former Myer/McPherson’s/Accolade Wines supremo, Ari Mervis.

NOT THE ASX

In the US overnight, it was all a bit rubbish, really – the S&P 500 and the tech-heavy Nasdaq Composite started in the red and, like a pair of well-smacked arses, turned redder as the day wore on to finish down 0.7% and 1.8% respectively.

The Dow, however, stubbornly refused to budge, shipping a curmudgeonly -0.07% while harumphing in obvious discomfort while rattling the pages of the Wall Street Journal and pretending that everything was fine.

The dual-edged sword that hit US investors last night were weakening oil prices on the way into the session, and – you’re not going to believe this – it looks like all the investors that went bananas before the Christmas break about rate cuts might have realised that their celebratory big spend on the market might have been a tad premature… just like everyone (ie, me) said when it was all unfolding in late December.

As our very own Christian “Chedward” Edwards put it this morning, “a growing number of previously bullish punters suddenly appear worried they’ve gotten well ahead of themselves already in 2024”.

“With doubts emerging that equity markets look over-ripe, US stocks overnight compounded last Friday’s losses on the final trading day of 2023, with a Barclays downgrade of Apple helping undermine confidence in some of the euphoric bets made on the so-called Magnificent Seven tech stocks which were behind so much of 2023’s gains,” Cheds continued.

It goes on like that for quite some time – you can read it all for yourself here.

In US stock news, Apple shares were down -4% after the Barclays downgrade.

Tesla delivered a record number of vehicles for Q4, helping the company hit its 2023 target of 1.8 million. That was good, but the mood is worse after BYD on Monday said it produced more than 3 million new energy vehicles in 2023, outpacing Elon for a second straight year.

Also souring Musk’s mood was news that his beloved Twitter, which I stubbornly refuse to call X because it’s a stupid name, has decreased in value somewhat since he bought it.

Musk famously boasted his way into being forced to buy the social media platform for an utterly ridiculous US$44 billion in October 2022 – and one of his company X Holdings’ major shareholders, Fidelity, has gone public with its own analysis of how that ‘investment’ is tracking.

The news is terrible – Fidelity reckons the company’s lost 71.5% of that value since Musk took it over, with an appreciable 10.7% chunk of that value disappearing out the door when Elon told advertisers to “go f..k yourself”, because he’s clearly a Biznus Genius.

In Asia, Japanese markets are closed today for a National Holiday, which is probably just as well because that country is having a shocking start to 2024, dealing with a massive earthquake that has so far claimed more than 55 lives, and an airport disaster that has left at least five people dead when two planes collided on a runway.

Tokyo is meant to open for business tomorrow, so hopefully things will be back on track by then.

In China, Shanghai markets are basically flat at +0.03%, while in Hong Kong the Hang Seng is falling, losing 1.15% so far this morning.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ME1 Melodiol Global Health 0.002 100% 1,676,495 4,728,824 CHK Cohiba Minerals 0.003 50% 1,806,830 5,060,460 AVE Avecho Biotech Ltd 0.004 33% 92,151 9,507,891 PXX Polarx Limited 0.008 33% 2,328,471 9,837,701 PAM Pan Asia Metals 0.2 29% 521,354 26,011,601 NWF Newfield Resources 0.125 25% 120,000 90,322,242 VMM Viridis Mining 1.62 21% 831,278 59,957,115 CRB Carbine Resources 0.006 20% 1,000,000 2,758,689 IVX Invion Ltd 0.006 20% 629,240 32,108,161 GTG Genetic Technologies 0.155 19% 244,519 15,004,242 NKL Nickelxltd 0.044 19% 105,737 3,249,161 TAR Taruga Minerals 0.013 18% 28,502 7,766,295 CLU Cluey Ltd 0.083 17% 45,597 14,314,563 MGT Magnetite Mines 0.35 17% 328,068 29,530,358 ENR Encounter Resources 0.355 16% 1,013,881 122,686,488 MBH Maggie Beer Holdings 0.115 16% 290,491 34,891,552 M2M Mt Malcolm Mines NL 0.03 15% 236,833 3,050,931 A1G African Gold Ltd 0.031 15% 46,350 4,571,403 CUF Cufe Ltd 0.016 14% 6,252,137 16,045,573 LPD Lepidico Ltd 0.008 14% 757,800 53,468,156 VMS Venture Minerals 0.008 14% 699,266 15,470,091 WZR Wisr Ltd 0.048 14% 2,322,814 57,313,812 5EA 5E Advanced 0.255 13% 1,076,971 69,223,538 CRS Caprice Resources 0.034 13% 1,640,582 6,702,608 AS2 Askari Metals 0.175 13% 87,006 12,051,283

The Small Caps winners for the morning include Pan Asia Metals (ASX:PAM) , which is continuing to surge on yesterday’s news that it has put pen to formal papers to acquire 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

PAM had been eyeing off full control of Tama Atacama for good reason – the project is one of the largest lithium brine projects in South America, representing roughly 13% of the highly prized Pampa del Tamarugal Basin in Chile’s Atacama Desert.

It also boasts super high-grade lithium in surface assays up to 2,200ppm Li, averaging 700ppm Li extending over 160km north to south – so, naturally, everyone’s a bit excited about the new deal.

Meanwhile, Viridis Mining and Minerals (ASX:VMM) is making waves this morning on news that a third set of assays from Viridis Mining and Minerals’ Colossus REE project in Brazil, have returned an average grade of 3,002ppm TREO across 113 drill holes.

Colossus is starting to stack up as a world-class REE project, and those assays make perfect sense when you consider that it lies within Brazil’s pro-mining state of Minas Gerais and directly adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project.

MEI’s Caldeira has a monster existing resource of 409Mt @ 2,626 parts per million (ppm) total rare earth oxides (TREO) – the highest grade for any Ionic Adsorption Clay (IAC) project known.

Aside from those two, the winner’s list this morning is dominated by a number of little companies moving sharply despite the absence of fresh news, including Genetic Technologies (ASX:GTG), NickelX (ASX:NKL) and Taruga Minerals (ASX:TAR).

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap M4M Macro Metals Limited 0.002 -33% 3,040,364 $7,401,233 MTM MTM Critical Metals 0.068 -26% 13,433,468 $9,148,212 AUH Austchina Holdings 0.003 -25% 25,000 $8,311,535 ZEU Zeus Resources Ltd 0.0075 -25% 13,536,302 $4,592,810 JAY Jayride Group 0.03 -23% 3,380 $9,141,956 88E 88 Energy Ltd 0.004 -20% 7,571,005 $123,204,013 EDE Eden Inv Ltd 0.002 -20% 3,001 $9,167,534 UVA Uvre Limited 0.115 -18% 508,059 $4,633,752 DEL Delorean Corporation 0.025 -17% 164,500 $6,471,627 AL8 Alderan Resource Ltd 0.005 -17% 1,536,592 $6,641,168 RIL Redivium Ltd 0.005 -17% 12,130,199 $16,385,129 SFG Seafarms Group Ltd 0.005 -17% 970,582 $29,019,595 LYN Lycaonresources 0.16 -16% 185,833 $8,370,688 ATH Alterity Therap Ltd 0.006 -14% 2,638,927 $19,616,523 HOR Horseshoe Metals Ltd 0.006 -14% 1,839,909 $4,525,351 TSL Titanium Sands Ltd 0.012 -14% 35,388 $27,912,223 VML Vital Metals Limited 0.006 -14% 2,014,496 $41,265,469 TX3 Trinex Minerals Ltd 0.007 -13% 500,323 $11,896,197 BMM Balkan Mining and Minerals 0.105 -13% 27,565 $8,524,862 PL3 Patagonia Lithium 0.11 -12% 1,001 $6,141,063 SSH SSH Group 0.15 -12% 70,000 $11,202,975 14D 1414 Degrees Limited 0.053 -12% 56,100 $14,290,111 GML Gateway Mining 0.023 -12% 303,000 $8,850,813 PSL Paterson Resources 0.023 -12% 50,000 $11,856,985 RCR Rincon 0.0275 -11% 1,393,228 $5,507,549

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.