ASX Small Caps Lunch Wrap: Who’s figured out a bold new way to mooch off their parents today?

Despite everything that's happened, Ivy and Bill are still proud of their son's new career as a stay-at-home moron. Pic via Getty Images.

Local markets opened higher this morning, after Wall Street put in a decent performance ahead of an expected 25bp rate rise announcement by the US Fed, and a slew of earnings reports as well.

At open, the ASX 200 benchmark jumped 0.4%, and after a morning of indecisive wavering, it landed at +0.3% at lunchtime, which – all things considered – is a pretty good outcome for anyone with skin in the game.

That includes, of course, most people who hold a superannuation account – the financial backstop introduced to take pressure off the finances of ageing Aussies who plan to be able to both eat and have a single lightbulb glowing in their homes for the duration of their post-work twilight years.

A simple, comfortable retirement is something many people aspire to – but it’s a concept that’s under considerable pressure in China, thanks to a new social phenomenon that has clearly been invented to stop young people from feeling like utter failures, while draining their parents’ bank account.

After the Covid-19 pandemic took an enormous government-wielded hammer to the employment prospects of young people in China, many have been forced to get creative with how they’re making a living.

That, in turn, has led to a rise in the number of young people going public with their new careers as “professional children”, which is a polite way of saying that “I’m mooching off my parents”, without admitting that they are doing precisely that.

According to NBC News, young people have started hanging around with their parents, looking after the household and taking them on shopping trips or to appointments, in exchange for a monthly payment that’s roughly equivalent to the average working wage in China.

For example, Jia Zhang – a young mother of two whose small business collapsed when China put everyone in Covid Jail – is now “working for her parents” and collecting the princely sum of 8,000 yuan (about $1,650) a month.

“My job is to spend time with my parents — for example, taking them to grocery stores — and do some household chores,” Zhang said. “Also, if my parents want to go out, I would make plans in advance, taking them to various stores.”

It is clearly a pretty good way to keep the wolves from the door, provided there’s enough cash tucked away in the old “Bank of Mum and Dad” – the kids don’t starve, while the oldies get someone to do all the things that young folks (unless they’re ungrateful little monsters) are probably meant to be doing anyway,

It comes with the added leverage for parents of being able to add “We’re paying you good money for this” whenever the not-so-subtle eye-rolling and huffing over being asked to perform a menial task around the house.

I’m not entirely sure what happens if the Professional Child starts to underperform in their job, or what sort of HR systems might be in place in the event of a dispute or – god forbid – a sexual harassment claim.

The increase in full-time children around China is not without its detractors, often garnering the outstandingly awful accusation that the young ‘uns are “chewing the old”, the kind of bluntly horrifying slang that China’s well known for.

But with youth unemployment for people aged 16-24 hitting 21.3% in June, and the Chinese national economy slowing like a sloth trapped in a tub of molasses, there’s probably never been a better time for those youngsters to really sink their teeth into the wholesale destruction of their family’s life savings.

TO MARKETS

Local markets opened higher this morning, enjoying a 0.4% leap at open, before settling into the now-familiar “sag quietly until lunch time” routine that the ASX clearly enjoys.

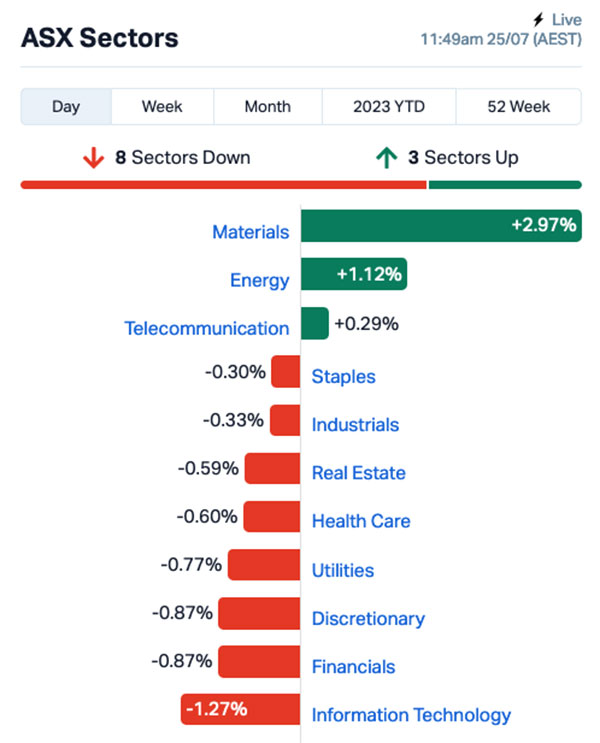

This morning, it’s the Materials and Energy sectors having their turn in the sun, pumping out +3.0% and +1.2% gains since open, with a tasty-looking rump of solid gains among the market’s heavy hitters, including BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) which have all seen rises better than 3.0%.

InfoTech is leading the losses, however, slumping again this morning to be down 1.2% since the session began, with the rest of the market turning in sub-par performances as well.

Up the top end of town, one gainer worthy of mention this morning is Monadelphous Group (ASX:MND) – up 6.5% on news that the engineering and construction firm has inked a major new contract with Albemarle, valued at approximately $200 million, associated with the expansion of the Kemerton lithium hydroxide plant in the southwest region of Western Australia.

NOT THE ASX

In the US overnight, the Dow Jones extended its winning streak to 11 straight days, rising by 0.52%. The S&P 500 was up +0.4%, and tech heavy Nasdaq climbed 0.19%.

Earlybird Eddy reports that former meme stock AMC Entertainment jumped 33% after a judge ruled against its stock conversion plan which would have diluted investors’ stakes.

Meanwhile, the release of the Barbie movie – which set a record for the biggest US debut of 2023 so far – has helped toymaker Mattel add 2% as investors saw an opportunity to leverage a probable massive boost to the company’s flagship silent spokesmodel.

There’s a lot of ‘wait and see’ for the US market over the next few days. Weighing heaviest are expectations that the US Fed is widely tipped to drop a 25bp rate hike on borrowers, while the next week or so will see a slew of earnings coming in from more than 150 companies.

The earnings stakes are high for the “big seven” — Apple, Amazon, Nvidia Corp, Meta, Alphabet, Tesla and Microsoft — which are trading at a record premium to the bottom 493 stocks in the S&P 500, Eddy says.

In Japan, the Nikkei is 0.25% lower this morning, as the nation braces for a prolonged period of culinary instability in the wake of major new tensions in the so-called Instant Noodle War.

Obviously, “instant” is something of a misnomer, as all hot noodle dishes require some time to prepare – however, since the launch decades ago of the “two minute noodles” that most people are familiar with, something of an arms race has been underway.

The latest escalation has come via manufacturer Myojo Foods, which has applied all manner of science and – I assume – witchcraft to bring 55-second noodles to market.

I know, right? How on earth is that possible without fracturing the laws of physics (specifically, thermodynamics) and collapsing the universe entirely?

In the meantime, Australia remains doomed to spend at least two minutes waiting on our own noodles to cook – a difference that will mean that over the space of a year, (at an assumed rate of one packet of noodles per day), the population of Japan will have an extra 6.5 hours per person to further its plans of world noodle domination.

In China, Shanghai markets are up 1.5% this morning on news of an impending, all-out noodle war with Japan which Beijing is widely tipped to win, while in Hong Kong the Hang Seng is up 2.9% because it heard a happy song on the radio just now, which put market there in a really good mood.

In crypto world, BTC has slumped ahead of the US Fed’s rate decision. However, meme coin Doge – a long time favourite of Elon Musk – is enjoying a solid boost in the wake of the aforementioned billionaire beachball’s decision to re-brand the social media disaster he owns.

I’m not going to bother re-telling the story of How Twitter Became X, but the backlash against the change (and a few of the random ramblings from its owner) is very loud, and hugely funny.

I present to you Exhibit A:

That is the dumbest shit I’ve ever heard, and I own NFTs.

— hotlneblng.eth (@hotlneblng_) July 23, 2023

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.0015 50% 750,000 $10,264,505 DXN DXN Limited 0.0015 50% 5,500,000 $1,721,315 BEZ Besra Gold 0.37 37% 4,224,673 $95,542,710 AUK Aumake Limited 0.004 33% 4,245,790 $4,461,778 MCT Metalicity Limited 0.002 33% 472,428 $5,604,129 SI6 SI6 Metals Limited 0.008 33% 16,893,133 $9,924,050 WLD Wellard Limited 0.06 30% 170,445 $24,437,514 CTO Citigold Corp Ltd 0.005 25% 519,628 $11,494,636 GFN Gefen Int 0.005 25% 420,609 $513,119 CVR Cavalier Resources 0.145 21% 28,780 $3,819,470 AMA AMA Group Limited 0.135 17% 1,560,509 $123,403,075 ATH Alterity Therap Ltd 0.007 17% 119,400 $14,639,386 DOU Douugh Limited 0.007 17% 157,888 $5,903,390 BOD BOD Science Ltd 0.115 15% 350,464 $15,312,149 CUS Copper Search 0.23 15% 4,000 $10,558,979 CHK Cohiba Min Ltd 0.004 14% 100,000 $7,746,355 VTM Victory Metals Ltd 0.4 14% 567,302 $23,494,232 TGH Terragen 0.034 13% 114,046 $7,276,163 ADG Adelong Gold Limited 0.009 13% 62,500 $4,770,578 CCO The Calmer Co Int 0.005 11% 16,929,174 $2,538,349 RR1 Reach Resources Ltd 0.01 11% 409,454 $24,795,456 SUV Suvo Strategic 0.03 11% 540,817 $21,877,328 SPQ Superior Resources 0.031 11% 1,223,774 $51,367,505 NGS NGS Ltd 0.011 10% 137,178 $1,683,075 WTN Winton Land 1.99 10% 1,320 $536,870,862

Leading the small cappers this morning is Besra Gold (ASX:BEZ), which has jumped 22.2% on news that shareholders have approved a US$300 million gold offtake drawdown facility to be provided by Quantum Metal Recovery.

Under the terms of the facility, Quantum – which has already provided an initial deposit of US$5,000,000 – may provide up to US$10,000,000 in funding per month, up to the amount of US$300,000,000, all of which is payable into a drawdown account controlled by Besra, with the first US$10,000,000 expected to be received on or before the end of September.

Next best is auto parts and repairs player AMA Group (ASX:AMA), which is up 17.4% on no news and average volume, while Victory Metals (ASX:VTM) is continuing its recent upward trajectory, adding another 14.2% this morning to take its climb for the past month past 81%.

And Surefire Resources (ASX:SRN) has retreated from its early gains today, prompted by production of high grade 4N (99.99%) high purity alumina (HPA) from the Victory Bore vanadium project; “a significant value addition” for any future development.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BNO Bionomics Limited 0.0115 -48% 20,678,749 32,312,179 MTL Mantle Minerals Ltd 0.001 -33% 1,000,000 9,221,169 ROG Red Sky Energy 0.003 -25% 8,312,463 21,208,909 AUR Auris Minerals Ltd 0.011 -21% 1,142,158 6,672,763 ONE Oneview Healthcare 0.19 -21% 1,056,505 128,032,121 OM1 Omnia Metals Group 0.18 -20% 2,399,538 10,253,457 CTN Catalina Resources 0.004 -20% 1,766,550 6,192,434 NAE New Age Exploration 0.004 -20% 2,585,299 7,179,495 BFC Beston Global Ltd 0.009 -18% 372,682 21,967,516 EPM Eclipse Metals 0.019 -17% 11,245,408 46,645,375 BEX Bikeexchange Ltd 0.005 -17% 2,187 7,134,901 MXC MGC Pharmaceuticals 0.0025 -17% 795,332 11,677,079 BGT Bio-Gene Technology 0.083 -16% 50,000 17,651,329 GPR Geopacific Resources 0.017 -15% 2,755,555 16,423,822 RVS Revasum 0.175 -15% 12,250 21,712,914 AVE Avecho Biotech Ltd 0.006 -14% 35,714 15,135,146 PRX Prodigy Gold NL 0.006 -14% 3,124,791 12,257,755 JPR Jupiter Energy 0.019 -14% 73,981 27,056,703 PFT Pure Foods Tas Ltd 0.1 -13% 332,288 12,620,090 1MC Morella Corporation 0.007 -13% 2,213,280 48,788,644 AWJ Auric Mining 0.051 -12% 161,354 7,589,856 MDR Medadvisor Limited 0.22 -12% 286,051 136,239,852 ICG Inca Minerals Ltd 0.031 -11% 160,677 16,975,349 M2R Miramar 0.039 -11% 196,410 4,880,779 AMD Arrow Minerals 0.004 -11% 1,251,100 13,606,943

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.