ASX Small Caps Lunch Wrap: Who’s called in the fun police in Spain this week?

Larry and Sandra were shocked at how steep the fines were, just for leaving their hotel room. Pic via Getty Images.

Local markets opened flat on Tuesday morning, after a somewhat chaotic session on Wall Street overnight when a computer glitch sent the value of a couple of shares – including Warren Buffett’s legendary Berkshire Hathaway class A – plummeting to near 0%.

Between that hiccup and a duo of price slumps for iron ore and oil overnight, all the ingredients were ready for a thoroughly mediocre kick-off for the ASX this morning.

I’ll get into the details of that shortly, but first I fancy a brief sojourn in sunny Spain, where the locals have evidently had just about enough of tourists lobbing in and behaving like animals.

Authorities in the town of Platja d’Aro, on Spain’s Costa Brava – roughly 100km northeast of Barcelona – have been dealing with tourists from overseas for decades. It’s a popular spot to visit because it’s warm, by the sea, and for years has been awarded a coveted “Blue Flag” for its beaches.

The Blue Flag is a designation awarded only to seaside areas that meet a really stringent range of educational, safety, and accessibility criteria, and it guarantees that the area, unlike other beaches in the Mediterranean, is free of unsightly things that tend to upset tourists, such as oil spills, medical waste or hapless refugees.

It is also a favourite spot for a certain type of tourist… one which the locals have had a gutful of, and are finally taking serious steps to clamp down on. They are a scourge and a menace, and – at the risk of editorialising – I believe should have been outlawed by any rational government, democratically-elected or otherwise, decades ago.

They are the Bucks and Hens Night groups, which exist for the sole purpose of attempting to ruin the lives of those they are meant to be honouring, while ruining the nights of everyone around them with their boorish, sexualised antics.

And the 12,500 residents of Platja d’Aro have finally had enough, with authorities there putting would-be Bucks and Hens on notice that anyone caught wandering the streets behaving inappropriately will be slapped with a hefty fine, worth about $1,225 of our puny Australian dollars.

Offences that will attract said fines include, but are not limited to, “walking or standing on a street or public space without clothing, or only in underwear”, which is an entirely reasonable stance to take.

I consider myself pretty close to the “average person”, and I can promise you that the last thing in the world you’d want to see when you look out your window of an evening is me, lurking about outside, clad only in my undies.

(Please note, that’s not an actual thing you need to worry about – the court order made it very clear that I’m not allowed to do that anymore).

There are steeper fines on the table for more egregious tourist behaviour as well – and the wearing of costumes that “depict human genitals”, and “walking down the street clutching a blow up sex doll” are both activities that are likely to end up costing visitors to Platja d’Aro thousands in fines as well.

The incident that proved to be the tipping point for locals was a recent bucks night, where the groom-to-be’s friends taped him to a lamp post and blasted terrible music at him for hours in the dead of night.

I’d hate to see what they’d do to someone they don’t actually like.

TO MARKETS

Local markets have been effectively hamstrung this morning by a double-whammy slump in two key commodities – oil, and iron ore.

Oil prices leaked to their lowest point in months, after the OPEC+ goons decided to pursue a strategy that opens the door for a rapidly increasing supply starting later this year.

Under the plan, major producers – including Saudi Arabia, Iran and Iraq, and Russia – have agreed in principle to keep current production cuts in place through to 2025, with the seemingly incongruous caveat that each would be able to start winding back those cuts starting in October this year.

The oil market apparently saw straight through the ruse, and Brent crude futures fell sharply by 3.4% to $78.36 a barrel, which is as low as it’s been for ages.

And the news for iron ore wasn’t great overnight, either – China’s ongoing (to the point where it could almost be rechristned as “perpetual”) housing crisis has reared its fearsomely ugly head again, with the outlook for appetite for construction materials taking a serious blow overnight.

That immediately hit iron ore prices, which fell alarmingly by 4.2% to $US110.65/t – as sour as it’s been for about six weeks – and that’s knocked local producers about a bit.

But gold went up about 1%, and we’ve got loads of goldies on the ASX, so the safe havens are getting a workout today.

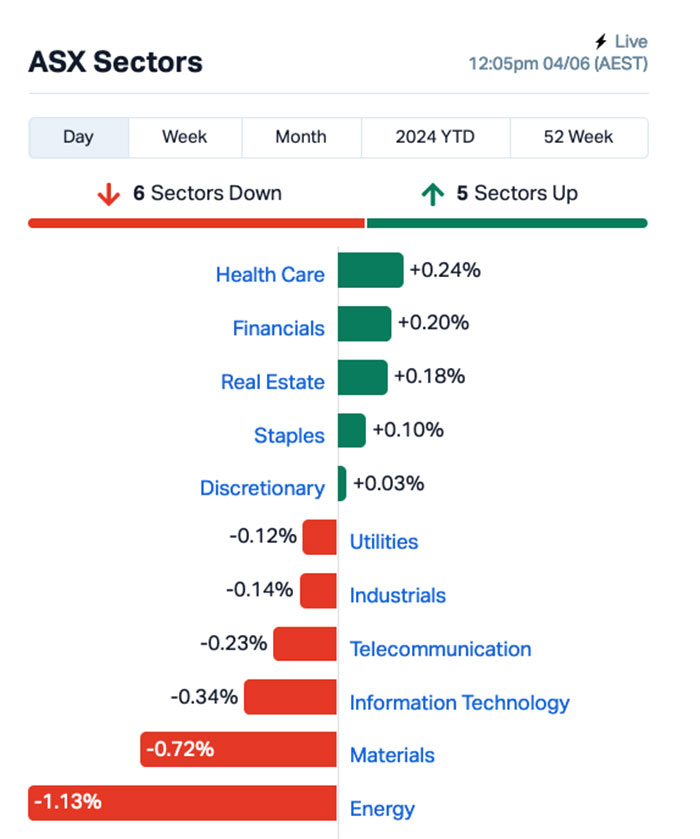

Here’s what the sectors looked like:

And here’s what the ASX indices are doing:

See? The goldies are belting out the gains. Everything’s gonna be fine. Go have some lunch, we’ll still have jobs when you get back.

NOT THE ASX

It was a wild and crazy night on Wall Street on Monday, after a computer glitch caused a couple of major stocks to tumble in a truly alarming fashion, and which no doubt had a number of well-to-do gentlemen of a certain age clutching their chests as they watched their “carefully amassed” fortunes vanish before their very eyes.

According to a Reuters report, a “glitch at the New York Stock Exchange (NYSE) triggered massive swings in the shares of Berkshire Hathaway and Barrick Gold, and trading halts in dozens of other companies on Monday, before the problem was fixed”.

Berkshire Hathaway at one point were shown to be down 99.97%, while Barrick Gold’s price appeared to fall a more modest 98.54%, and you can just imagine the panic that would have accompanied that data flitting across computer screens in the US, and around the world.

Luckily, the NYSE was able to step in, halt trading and figure the mess out and in the end, it has taken the steps of reversing a number of panic-sells – sorry, erroneous trades – that took place in all the confusion.

So, if you were up late last night, saw your portfolio tanking for no apparent reason and dumped all your Berkshire Hathaway stocks at a savage loss, fret not – all trades in that stock have been reversed, provided the sale took place at a price below … *checks notes* … $US603,718.30 a share.

Once the glitch had been sorted, it turned out that Wall Street had finished the session mixed. The S&P 500 rose by +0.11%, the blue chips Dow Jones index was down by -0.3%, and the tech-heavy Nasdaq was up by +0.56%.

Earlybird Eddy reclaimed his title as Stockhead’s master of understatement this morning, reporting that the US bond market climbed (yields slumped) after a report showed that manufacturing in the US “isn’t doing so well”.

This led to further speculation that the Fed Reserve may opt to reduce interest rates later this year. 10-year US treasury yield sank by -10 basis points after the report.

In US stock news, the biggest movers overnight included Gamestop Inc, which rose +21% after Reddit user, ‘Roaring Kitty’ (real name Keith Gill), who sparked the frenzy around meme stocks in 2021, shared a screenshot of his US$116 million investment in the video game retailer.

“Gill is putting his money where his tweets are, and some investors are clearly following his lead and rekindling interest in meme stocks,” Ben Laidler at eToro said.

Nvidia rose +5% after revealing its latest versions of the computer chips fuelling the worldwide surge in AI development.

And ASX-listed Life360 (ASX:360) has this morning announced its intention to list on the Nasdaq.

The $3bn+ market capped company that created a popular family-tracking app plans to sell 5,750,000 shares of its common stock.

The company intends to list on the Nasdaq Global Select Market under the ticker symbol “LIF.”

In Asian market news, things are a little mixed across the region – Japan’s Nikkei is down -0.43% on news that Pizza Hut and Domino’s are locked in an apparent fight to the death over which company can create the worst possible abomination, and still call it “food”.

Domino’s has taken the idea of hiding terrible things on pizza to a whole new level, by introducing a new “stuffed crust” variant, where the crust is stuffed with pineapple – which explains quite a lot of the screams I’ve been hearing coming from Japan late at night.

Meanwhile, not to be outdone, Pizza Hut recently launched the Umegherita – basically a margherita pizza that has been slathered in Japanese pickled plums, and the more I think about that, the more I wish I was dead.

In Hong Kong, the Hang Seng is unusually muted on +0.19%, while Shanghai markets are down -0.14%.

Meanwhile in India, markets are going bananas today, with the delightfully-named Nifty 50 surging +3.25% and the Sensex up by +3.39% ahead of the inevitable election win for Narendra Modi’s not even remotely sinister at all, no matter what anyone tells you, even if they live in India and know what they’re talking about Bharatiya Janata Party.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LSR Lodestar Minerals 0.002 100% 602,771 $2,023,397.35 EDE Eden Innovations 0.003 50% 3,651,342 $7,356,542.23 OIL Optiscan Imaging 0.16 33% 1,938,102 $100,240,896.36 CND Condor Energy Ltd 0.049 32% 19,242,762 $21,386,012.69 BLZ Blaze Minerals Ltd 0.005 25% 218,725 $2,514,232.98 PKO Peako Limited 0.005 25% 2,136,072 $2,108,338.88 RLG Roolife Group Ltd 0.005 25% 253,000 $3,129,526.65 YPB YPB Group Ltd 0.0025 25% 219,785 $1,615,922.94 PEC Perpetual Resources 0.017 21% 1,596,962 $8,960,411.88 CDT Castle Minerals 0.006 20% 908,990 $6,122,464.92 OSL Oncosil Medical 0.006 20% 1,300,786 $16,660,547.90 VFX Visionflex Group Ltd 0.006 20% 120,000 $7,084,955.99 KAL Kalgoorlie Gold Mining 0.033 18% 358,869 $4,438,020.10 AEV Avenira Limited 0.007 17% 1,702,810 $14,094,204.36 ODE Odessa Minerals Ltd 0.0035 17% 1,250,000 $3,129,847.61 ATR Astron Corp Ltd 0.75 15% 109,872 $111,238,446.15 NTU Northern Minerals 0.0415 15% 9,105,556 $212,795,252.71 ADN Andromeda Metals Ltd 0.0195 15% 19,693,051 $52,874,605.84 CR9 Corellares 0.017 13% 60,000 $6,976,386.50 SUM Summit Minerals 0.225 13% 1,310,826 $9,531,425.40 LML Lincoln Minerals 0.009 13% 6,007,759 $13,632,362.01 MVL Marvel Gold Limited 0.009 13% 1,000,000 $6,910,325.62 AZY Antipa Minerals Ltd 0.0145 12% 2,338,117 $53,814,142.56 3DA Amaero International 0.44 11% 246,748 $214,171,456.51 1CG One Click Group Ltd 0.01 11% 2,018,761 $6,193,609.41

Leading the way among Small Caps on Tuesday morning was med-tech player Opticomm (ASX:OPC), after it announced the launch of a “ground-breaking new microscopic medical imaging device” called InVue, which the company says has been designed “to enable precision surgery by putting real-time digital pathology access directly into the hands of surgeons”.

Condor Energy (ASX:CND) was moving well on Tuesday morning, after providing an update on exploration progress at its Technical Evaluation Agreement (TEA) off the coast of Peru.

Condor is reporting that there is evidence of multiple petroleum systems at two large oil prospects (Raya and Bonito) and regional mapping shows that the primary source rock interval, the Oligocene/Miocene aged Heath Formation, is mature for oil generation over much of the TEA area.

Perpetual Resources (ASX:PEC) rounded out the top three small caps on Tuesday, delivering news that its maiden due diligence exploration program is now underway at the Raptor REE project, located in the prolific Caldeira REE complex in Minas Gerais, Brazil.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 03 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CAN Cann Group Ltd 0.04 -35% 3,568,670 $27,123,891 CNJ Conico Ltd 0.001 -33% 50,454 $2,707,643 ICU Investor Centre Ltd 0.005 -29% 900,000 $2,131,579 CLZ Classic Minerals 0.003 -25% 5,304,010 $1,634,340 MTB Mount Burgess Mining 0.0015 -25% 1,429 $2,089,627 TD1 Tali Digital Limited 0.0015 -25% 1,597,858 $6,590,311 BCK Brockman Mining Ltd 0.016 -20% 269,588 $185,604,643 PUR Pursuit Minerals 0.004 -20% 227,367 $14,719,857 AQD Ausquest Limited 0.014 -18% 20,000 $14,027,537 ZMM Zimi Ltd 0.019 -17% 5,334 $2,837,005 ME1DE Deferred Settlement 0.025 -17% 367,909 $673,487 88E 88 Energy Ltd 0.0025 -17% 11,119,786 $86,678,016 AHN Athena Resources 0.0025 -17% 166,833 $3,211,403 FIN FIN Resources Ltd 0.01 -17% 861,470 $7,791,224 KCC Kincora Copper 0.055 -15% 370,327 $13,323,016 BC8 Black Cat Syndicate 0.295 -14% 2,356,941 $106,450,939 AAU Antilles Gold Ltd 0.006 -14% 4,399,268 $6,975,745 SGC Sacgasco Ltd 0.006 -14% 64,864 $5,457,810 DY6 DY6 Metals 0.1 -13% 593,450 $4,647,246 BFC Beston Global Ltd 0.0035 -13% 176,798 $7,988,188 EFE Eastern Resources 0.007 -13% 433,333 $9,935,572 HLX Helix Resources 0.0035 -13% 2,435,600 $13,056,775 POL Polymetals Resources 0.35 -13% 147,198 $65,904,266 KNI Kuniko 0.215 -12% 2,053 $21,227,846 EMU EMU NL 0.029 -12% 45,535 $2,557,268

ICYMI – AM EDITION

Aura Energy (ASX:AEE) has kicked off the strategic dual funding workstreams aimed at securing the funds required to develop its flagship Tiris uranium project in Mauritania.

Greenvale Energy (ASX:GRV) has completed the sale of its 20% interest in the Georgina Basin project to Astute Metals (ASX:ASE) for an upfront payment of 5 million ASE shares.

It will receive a further 5 million ASE shares if a drill hole at the project returns the equivalent of either 100m at 1% copper or 1.3g/t gold, the project is sold to a third party, or a resource is estimated on any of the tenements that form the project within a four year period.

GRV now has a 12.27% stake in ASE and retains a 2% net smelter royalty in the Georgina Basin project, which is prospective for iron oxide copper-gold (IOCG) mineralisation.

Vertex Minerals (ASX:VTX) has renewed the six mining leases that cover its Reward gold mine and the broader Hill End gold project in New South Wales for the maximum renewal terms.

The company is positioned for a simple start-up of Reward with the recently purchase Gekko gravity processing plant already located adjacent to the high-grade mine’s portal.

VTX notes that the existing mine development extends into the resource, meaning that only stripping and refurbishment of the access is required.

A second means of egress is already established and some of the underground fleet and utility services are already in place.

Work is also well advanced on the Hill End plant component of the refurbishment with the Morningstar plant to be removed in the coming weeks.

At Stockhead, we tell it like it is. While Aura Energy, Greenvale Energy and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.