ASX Small Caps Lunch Wrap: Who’s been just a bit too entrepreneurial in India recently?

News

News

Local markets are up this morning, helped along by climbing commodities in the energy sector over the weekend, and a muted – but still pretty good – session on Wall Street on Friday.

The big news is a stunning market debut this morning from a little pharma company with the equivalent of the tech sector’s “killer app” in its pocket – but I’ll get to that in a minute.

Because first, I’d like to take the opportunity to applaud the entrepreneurial spirit of a group of ne’er-do-wells from the Indian state of Gujarat, on the Bamanbore-Kutch national highway.

The enterprising group spotted an opportunity to try one of the most brazen heists I’ve seen in many, many years – by building an entire set of tollbooths off to the side of a major highway, and luring traffic through their illegal setup by charging motorists half of the official toll to use the highway.

Now – that’s the kind of thing that you’d expect might work for a few days – maybe a week at most – before some sort of official noticed that there was suddenly a brand new toll booth offering half-price trips down the motorway.

But the scam lasted significantly longer than that, eventually getting rumbled 18 months after it was built and put into operation.

There’s no official word yet on just how much money the scheme managed to rake in, but police have arrested the owner of the land where the fake toll booths were built, along with at least four accomplices.

TO MARKETS

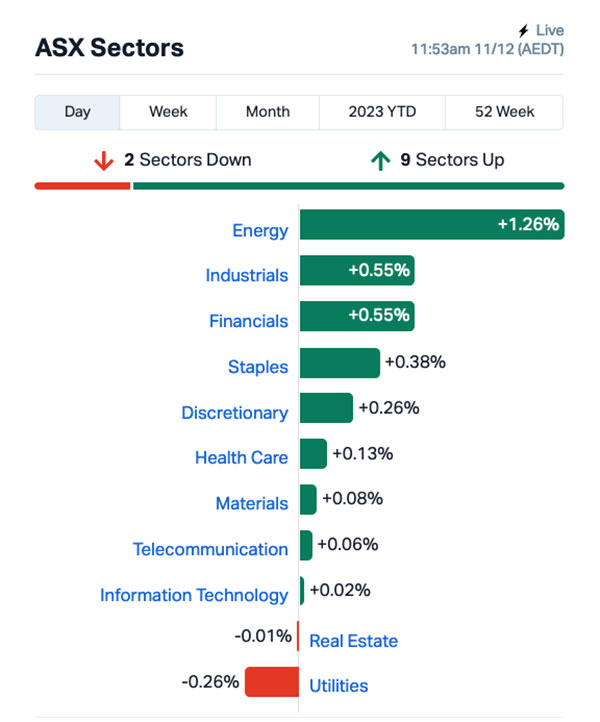

Things got off to a pretty good start this morning, as an early surge in the InfoTech sector helped lend momentum to the benchmark, however, it was the market sectors that are most exposed to broader economic forces – in particular, interest rates – that have been the main motivator this morning.

The Energy sector, which was all over the place last week as the world grappled with oil prices that refused, like a recalcitrant child, to sit still and behave themselves.

Those prices have steadied somewhat over the past few days, though, rising gently along with pretty much every other energy commodity in the past 24 hours.

Oil prices bouncesd back over the weekend, leaving Brent crude on $75.65, and WTI crude on $71.21 a barrel – gains of 1.45% and 2.24% respectively – which, in turn has helped push Energy out to a solid lead ahead of the rest of the major sectors.

The only commodity not making headway today was natural gas, which is down more than 3.3%.

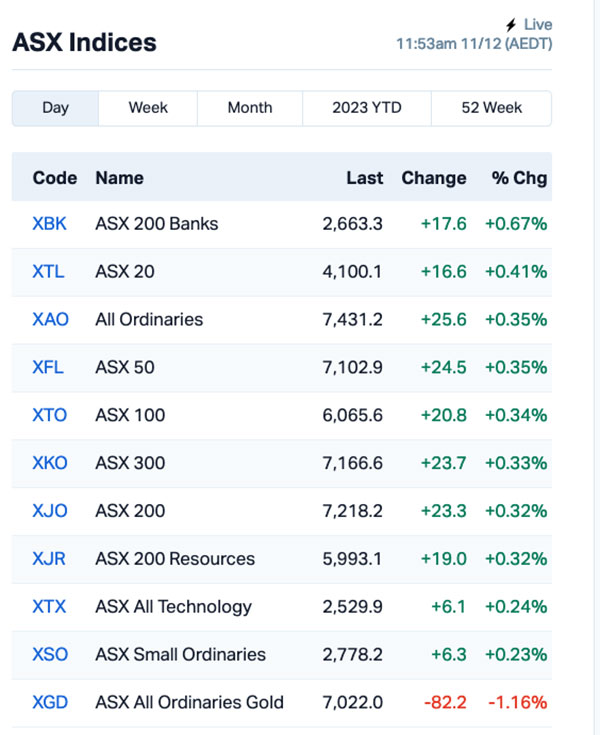

At a more granular level on the local market, the XBK ASX Banks Index is showing that it’s the money hoarders and change-makers that are making the most of the morning’s brisk trade, with that index up 0.67% and out in front of the broader market by a considerable margin.

And it is very much worth noting which way the XGD All Ords Gold Index is pointing this morning, as the precious metal makes its ponderous way back towards the wrong side of US$2,000/oz, the goldies aren’t getting a lot of love today – it’s down 1.16% as of lunchtime.

Up the fancy end of town, Smartgroup Corporation (ASX:SIQ) is up 7.5% this morning, on news that it’s landed a juicy contract with the SA Government, with its subsidiary Smartsalary set to step in as exclusive administrator of salary packaging services and novated leasing services under an initial five-year agreement.

Smartgroup has also revealed its outlook for the year, expecting to reach revenue of approximately $249 million, driven largely by what the company says is strong growth in novated leases.

Part of the reason things were tracking well locally this morning was that Wall Street put in a pretty solid effort, considering it was a Friday and we’re getting perilously close to the holiday season.

Data in the US is starting to take shape in favour of the belief that the US Fed’s aggressive moves to curb inflation might actually be starting to work – a US Dept of Labor report showing that nonfarm payrolls increased by 199,000 jobs in November, well above the 180,000 estimates.

Other data revealed the US unemployment rate dropped to 3.7%, alongside a 0.4% increase in average earnings (on a monthly basis) – again outpacing estimates that were pointing to 0.3% instead, some bozo reported this morning.

“The drop in the unemployment rate in particular will assuage any concerns of a recession, and with payrolls and earnings both rising, it keeps the ‘soft landing’ narrative very much in the ascendancy,” said Stuart Cole, head macro economist at Equiti Capital in London.

“The report will likely see some of those forecasting an early Fed cut next year re-evaluating their positions,” Cole said.

In US stock news, it was a mixed bag for the bug names in tech – chipmaker Nvidia and Facebook-owner Meta Platforms each put on nearly 2%, while Google-parent Alphabet fell 1.4%, giving up gains as the latest AI-company share rush lost momentum and profit-takers did their thing.

In Asia, the Nikkei is up 1.89%, Shanghai markes have fallen 0.95% and Hong Kong’s Hang Seng is sliding gracelessly into the sea, down 1.25% in early trade.

Here are the best performing ASX small cap stocks for 11 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NZS New Zealand Coastal 0.002 100% 60,997 $1,667,010 LTP LTR Pharma Limited 0.355 78% 5,900,872 $14,081,098 ADS Adslot Ltd 0.003 50% 189,995 $6,448,991 CT1 Constellation Tech 0.003 50% 50,000 $2,942,401 BLU Blue Energy Limited 0.031 48% 9,601,682 $38,870,446 GGE Grand Gulf Energy 0.0115 44% 28,362,604 $16,761,976 WC1 West Cobar Metals 0.075 39% 3,588,482 $6,257,538 AVW Avira Resources Ltd 0.002 33% 200,000 $3,200,685 MGA Metals Grove Mining 0.097 29% 679,048 $2,790,038 ILA Island Pharma 0.085 29% 63,061 $5,363,719 FGL Frugl Group Limited 0.009 29% 1,315,316 $6,727,434 NPM Newpeak Metals 0.019 27% 53,458 $1,499,276 EDE Eden Inv Ltd 0.0025 25% 2,500,592 $7,334,027 IVX Invion Ltd 0.005 25% 2,762,274 $25,686,529 TMX Terrain Minerals 0.005 25% 150,000 $5,413,711 PGH Pact Group Hldgs Ltd 0.84 23% 7,559,922 $235,838,686 ADRDA Adherium Ltd 0.033 22% 5 $8,998,935 CXU Cauldron Energy Ltd 0.018 20% 7,125,048 $16,982,452 DOU Douugh Limited 0.006 20% 100,000 $5,338,545 ICR Intelicare Holdings 0.031 19% 945,860 $5,431,801 CCZ Castillo Copper Ltd 0.007 17% 1,700,371 $7,797,032 MTB Mount Burgess Mining 0.0035 17% 120,000 $3,111,940 OAU Ora Gold Limited 0.007 17% 357,856 $33,733,005 TX3 Trinex Minerals Ltd 0.007 17% 184,682 $8,919,424 CL8 Carly Holdings Ltd 0.015 15% 111,416 $3,488,815

Leading the Small Caps winners list – and waaaay out ahead of the rest of the market – is debutante LTR Pharma (ASX:LTP), which made a stunning entrance on the ASX this morning to be up 70% in the space of a couple of hours.

LTR Pharma’s immediate success can be pinned on the fact that it’s done what a lot of microcap pharmaceutical companies don’t do – and that’s come to the ASX with a developed, patent-protected product that makes immediate sense the moment it’s explained.

The company makes a product called Spontan, which looks like a nasal decongestant spray, but acts on an entirely different part of the male anatomy as a rapid, on-demand fix for erectile dysfunction.

The company is in the process of commercialising Spontan, it’s got a successful Phase I human proof of concept study under its belt – which indicates a 6x faster effect compared to oral administration of tablets like Viagra – and the company says it’s got a clear pathway to market, progressing to bioequivalence study with expedited regulatory filings in the US and Australia within 1-2 years.

Our very own Rob Badman has a full round-up of the company’s pre-listing story here, if “fast acting boner spray” isn’t enough info to tingle your tangerines into action.

Coming second is West Cobar Metals (ASX:WC1), which is moving rapidly this morning, apparently in the wake of nearly week-old news from the company’s Salazar rare earth elements project, located 100km north of Esperance in Western Australia.

Cobar dropped a market update on 06 December, outlining how things are progressing at the site, and it’s all looking pretty positive – rare earth element characterisation testwork has been the focus in recent months, including magnetic separation and flotation upgrade trials.

Those have come back from the lab, where using a wet high gradient magnetic separator in a standard configuration yielded a magnetic concentrate grading 0.778% TREO with overall 69% TREO yield at an upgrade ratio of 5.3:1.

Subsequent flotation testwork yielded a concentrate of 5.08% TREO which represents a 34.3:1 upgrade on the original feed. The TREO yield to concentrate was 68%.

And in third place this morning is Grand Gulf Energy (ASX:GGE), rising sharply on news that the Jesse-1A well has unexpectedly flowed significant helium to surface at concentrations consistent with the previous downhole sample of 1% helium, which the company says is “highly encouraging and a massive step forward in the Jesse appraisal and development programme”.

“The compelling commercial pillars of the Red Helium project remain unchanged. In the event of a successful flow-test Grand Gulf has the potential to quickly move to production, potentially within six months, requiring minimal capex given the existing gathering infrastructure and offtake agreement,” Grand Gulf MD Dane Lance said.

Here are the most-worst performing ASX small cap stocks for 11 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAVDF Javelin Minerals Ltd 0.002 -33% 50,990 $2,836,246 RNO Rhinomed Ltd 0.027 -33% 947,904 $11,428,788 AOA Ausmon Resorces 0.003 -25% 250,000 $4,027,997 FAU First Au Ltd 0.003 -25% 1,258,476 $6,647,973 M4M Macro Metals Limited 0.003 -25% 15,000,000 $9,868,311 SIS Simble Solutions 0.003 -25% 350,000 $2,411,803 M2M Mt Malcolm Mines NL 0.025 -22% 221,241 $3,274,992 LNU Linius Tech Limited 0.002 -20% 13,850,000 $11,305,727 PTX Prescient Ltd 0.073 -19% 4,249,025 $72,478,781 BXN Bioxyne Ltd 0.01 -17% 2,000,000 $22,819,745 CNJ Conico Ltd 0.005 -17% 218,518 $9,420,570 RDS Redstone Resources 0.005 -17% 14,691 $5,528,271 FRX Flexiroam Limited 0.021 -16% 62,939 $16,515,180 AI1 Adisyn Ltd 0.022 -15% 71,840 $4,154,472 RVS Revasum 0.145 -15% 163,489 $20,165,313 BFC Beston Global Ltd 0.006 -14% 243,000 $13,979,328 LBT LBT Innovations 0.012 -14% 213,000 $16,182,605 MTL Mantle Minerals Ltd 0.003 -14% 146,211 $21,516,060 PNX PNX Metals Limited 0.003 -14% 1,659 $18,832,187 ROC Rocketboots 0.12 -14% 10,000 $4,555,390 VRC Volt Resources Ltd 0.006 -14% 360,000 $28,910,747 4DX 4DMedical 0.825 -14% 2,214,419 $330,983,903 NKL Nickelxltd 0.051 -14% 419,023 $5,181,095 BMM Balkan Mining & Minerals 0.13 -13% 100,000 $10,656,077 RNE Renu Energy Ltd 0.013 -13% 199,238 $6,712,336