ASX Small Caps Lunch Wrap: Who’s been getting out in a cunning disguise this week?

Pic via Getty Images

The ASX 200 burst out of the gates this morn, and promptly face planted. There were reasons for that, which we’ll get into further below.

But first, this gem of a story that’s come all the way from London, in the wake of a multi-multi-million GBP effort to convince the world that “King Charles” is actually a thing, and not just a bafflingly popular breed of cocker spaniel.

King Charles’ recent coronation was, by all accounts, a suitably majestic affair – I will admit to not watching any of it, because the A-League elimination final was on and also, I didn’t care.

But it was impossible to miss all the wonderful palace intrigue, the most visible of which was Meghan Markle’s very public decision not to attend – a call she made for two reasons:

- She hates everyone who would be there, and

- The feeling is, evidently, quite mutual.

But that didn’t stop a panoply of dunces from thinking that for some absurd reason, Ms Markle had decided to don a cunning disguise and slip in to watch the proceedings take place.

The whispers started when this chap appeared on millions of television sets around the globe, and his rather unique personal style gave rise to suspicions that the wardrobe and make-up departments at the BBC had worked overtime to turn former Prince Harry’s missus into a weird old man.

Megan, you’re not fooling us… pic.twitter.com/Ni5wh27keT

— Bob Cryer (@bobbicee) May 6, 2023

Twitter user Jennifer Bridge offered up three different options for who it might be, including an “undercover SAS officer”, or perhaps legendary car salesman Swiss Toni.

She also, correctly, suggested that it might in fact be 79-year-old Welsh composer Sir Karl Jenkins, whose seminal masterwork Lladdodd fy mam y llwchmon spent nine non-consecutive weeks at the top of the Welsh folk-pop charts in 1971.

(That was a lie. Sorry.)

For what it’s worth, though, I have my suspicions that even though Sir Karl has come forward to express his bemusement at being mistaken for Hollywood’s Princess at the coronation, we’re still not being told the truth.

Because I can’t be the only one who sees an uncanny resemblance to the famously abrasive and abusive International Singing Sensation, Tony Clifton – the mercurial alter-ego of comedy legend Andy Kaufman.

I give you this video evidence of the great man himself… you be the judge.

Right then, I’m off again. Over to you, Rab Bodman, for the boring bits…

TO MARKETS

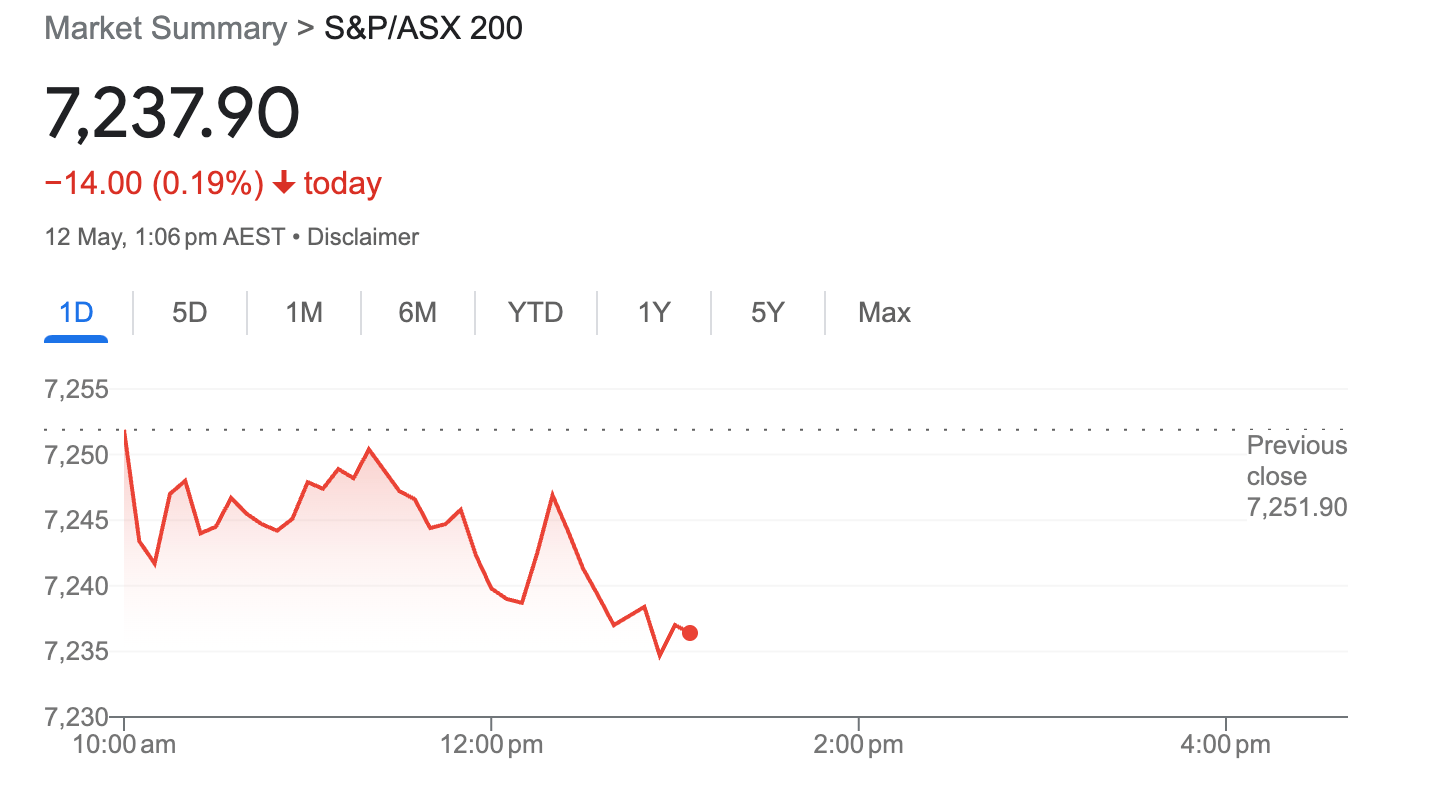

Thanks for that, Goran. The ASX 200, then… It’s squiggled its way to a 0.19% 24-hour loss as we type this. And here’s a chart to prove we didn’t make that up:

Stockhead’s Eddy “What’s the Story Morning Glory?” Sunarto predicted it would do something like this – after first reading a few articles and tweets about the continuing banking sh*tstorm over in the US of A, that is. We’ll glean some more from him and elsewhere about all that in the next section of this article, a little further below.

Not before a quick eyeball of sector-specific ASX happenings, though, courtesy of a handy chart we’ve appropriated from the most-excellent martketindex.com.au. (Thanks, Market Index – we appreciate you very much.)

Healthcare, IT, Staples up… Materials, Energy and Industrials down. Fairly similar scenes to yesterday, then.

Catching a second glance or two in the larger caps, we have:

• Graincorp (ASX:GNC): +5.4%. GNC is still patting itself on the back regarding its you-beaut half-yearly results it was banging on about yesterday.

• Neuren Pharmaceuticals (ASX:NEU): +4.68%, on no particularly fresh news we’re able to grab without a prescription.

And not having such a great day, share-price wise…

• Evolution Mining (ASX:EVN): -5.16%, on no fresh news.

• Sandfire Resources (ASX:SFR): -6%. News? The firm has made an amendment and extension to its US$452m MATSA Syndicated Debt Facility. Make of that what you will, with more info here.

NOT THE ASX

“The banking crisis is not over”, we’re led to believe from several news reports floating about. Not that we, or anyone we’ve spoken to about it, actually believed it was, mind.

As Eddy reported in his morning Market Highlights column:

“Regional lender PacWest Bank plunged 23% on renewed fears after 10% of its customers deposits were withdrawn over the last week. It was not immediately known how much that amounts to in dollars, but PacWest had around US$28 billion in deposits at end of March.”

Good Morning Everyone! PacWest down 25% pre-market. Deposits at the bank fell 9.5% last week. Yet they told the market that same week it was not experiencing "out-of-the-ordinary deposit flows".

I smell a lawsuit. pic.twitter.com/bR0dJoWUWB

— Genevieve Roch-Decter, CFA (@GRDecter) May 11, 2023

Scary stuff… flight to gold and maybe even Bitcoin for US citizens? Actually the prices of both aren’t quite reflecting (yet) what happened for them positively last time around – when SVB, Signature and others were stealing the bank-failure headlines just recently. Give it time.

Gold is, at the time of writing, down by 0.13% and changing hands for US$2,011.90 an ounce. Meanwhile, what crypto diggers refer to as Gold 2.0 – Bitcoin – has just dipped back under US$27k, a level of support it had been holding since mid March.

Overnight, the US stonks markets gave us another mixed bag, with the S&P 500 down by -0.17%, the Dow by -0.66%, and the tech-tastic Nasdaq up by +0.31%.

JP Morgan boss Jamie Dimon wants a swift end to the banking crisis and is calling on US regulators to take drastic, short-selling action. “They should go after them, and vigorously”, he reckons (rubbing his hands together just out of shot, possibly).

It was such a smashing success the last time. https://t.co/Jq6PEUQeyh

— Sven Henrich (@NorthmanTrader) May 11, 2023

Meanwhile, over in the land of magic internet money, crypto prices are looking a little shaky on the whole, as we type. But at least Coinbase has received some support in its spat with the SEC. The US Chamber of Commerce seems to have the exchange’s back. A bit more on that (and more besides) in the morning crypto roundup here.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MEB Medibio Limited 0.002 100% 260,000 4,150,594 CLT Cellnet Group 0.027 50% 3,802,281 4,384,703 MRD Mount Ridley Mines 0.003 50% 26,223,703 15,569,766 VPR Volt Power Group 0.0015 50% 200,062 10,716,208 LYN Lycaon Resources 0.175 30% 298,638 4,444,031 BEL Bentley Capital Ltd 0.051 28% 105,000 3,045,117 SRK Strike Resources 0.075 27% 323,517 16,741,250 CMO Cosmo Metals 0.125 25% 78,301 2,551,000 EPN Epsilon Healthcare 0.02 25% 579,590 4,805,664 NCL Netccentric Ltd 0.055 22% 114,868 12,735,525 ENR Encounter Resources 0.255 21% 4,740,897 74,660,414 GTG Genetic Technologies 0.003 20% 925,000 28,854,145 RBR RBR Group Ltd 0.003 20% 200,000 4,046,012 1MC Morella Corporation 0.0095 19% 6,805,634 48,788,644 LEL Lithenergy 1.03 18% 2,810,018 52,330,500 BLU Blue Energy Limited 0.035 17% 1,123,771 55,523,866 SWP Swoop Holdings Ltd 0.21 17% 63,576 26,687,691 FAU First Au Ltd 0.0035 17% 501,000 3,284,350 NZS New Zealand Coastal 0.0035 17% 941,735 4,962,030 MXR Maximus Resources 0.044 16% 2,031,918 12,124,119 TKM Trek Metals Ltd 0.069 15% 2,134,935 21,836,705 BMO Bastion Minerals 0.031 15% 1,463,928 4,304,113 KNM Kneomedia Limited 0.008 14% 1,157,816 10,533,497 RDN Raiden Resources Ltd 0.004 14% 100,000 6,491,039 RLG Roolife Group Ltd 0.008 14% 281,300 5,036,907

Standouts:

• Cellnet Group (ASX:CLT): +50% on news of a proposed acquisition of the local lifestyle tech retail company by Wentronic – a reasonably large German electronics distribution firm.

• Epsilon Healthcare (ASX:EPN): +25% on news that the weed stock has received a licence renewal to operate in Australia. As Eddy reports: the stock surged this morning “after announcing that the Medicinal Cannabis Permit issued to its subsidiary, THC Pharma, has been successfully renewed.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for May 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AO1 Assetowl Limited 0.001 -50% 166,675 $3,894,260 JNO Juno 0.056 -25% 47,046 $10,174,350 CLE Cyclone Metals 0.0015 -25% 10,518,815 $18,178,496 KEY KEY Petroleum 0.0015 -25% 990,000 $3,935,856 TSI Top Shelf 0.32 -22% 376 $34,509,509 ADS Adslot Ltd. 0.005 -17% 400,000 $13,226,090 SIO Simonds Grp Ltd 0.105 -16% 117,000 $44,988,306 M24 Mamba Exploration 0.08 -16% 282,405 $5,793,417 ERA Energy Resources 0.034 -15% 3,504,366 $147,655,328 BHD Benjamin Horngld Ltd 0.17 -15% 50,000 $4,831,048 CXU Cauldron Energy Ltd 0.006 -14% 4,360,005 $6,520,981 CPT Cipherpoint Limited 0.007 -13% 1,675,786 $9,273,934 IVX Invion Ltd 0.007 -13% 4,300 $51,373,058 PVS Pivotal Systems 0.007 -13% 2,100,017 $4,026,834 NIS Nickel Search 0.064 -12% 63,009 $4,416,896 OLY Olympio Metals Ltd 0.15 -12% 270,080 $6,663,408 DTR Dateline Resources 0.015 -12% 323,758 $10,944,933 MHK Metalhawk. 0.115 -12% 40,000 $8,701,601 ALG Ardent Leisure Group 0.48 -11% 3,231,094 $259,041,249 NES Nelson Resources. 0.004 -11% 750,000 $2,648,674 VAR Variscan Mines Ltd 0.016 -11% 130,353 $5,726,176 EEL Enrg Elements Ltd 0.017 -11% 121,212 $19,175,451 NWC New World Resources 0.035 -10% 2,406,714 $82,114,190 ADG Adelong Gold Limited 0.009 -10% 226,923 $5,338,223 AGR Aguia Res Ltd 0.035 -10% 428,986 $16,920,316

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.