ASX Small Caps Lunch Wrap: Who’s been fined $50,000 for literally sinking p**s this week?

It was all fun and games until Otto's drunken groping got completely out of hand. Pic via Getty Images.

- ASX down 0.45% at lunchtime

- Local goldies doing (relatively) well this morning, with the XGD All Ords Gold index up 0.60%

- Top small cap winners: Lithium Universe, Noronex, MetalsGrove Mining

Local markets have kicked off the week on a low note today, after the benchmark slumped nearly 0.5% at open, before weaving across several lanes of heavy traffic to slam into the rear end of lunchtime, down -0.45%.

But before I get into the details of that, I’ve got some news of a curious case in the United States this week, which resulted in a couple of would-be wine entrepreneurs copping the full weight of the law over an illegal ‘submerged wine’ operation.

The origins of this particular case go all the way back to 2017, when – in a story as old as time itself – two blokes had a profoundly stupid idea and now they’re in trouble with the law.

The two men, identified as Emanuele Azzaretto and Todd Hahn, spotted a trend among wealthy people – many of them like to show off how rich they are by spending stupid sums of money on equally stupid things.

So, they had a brainwave: What if we took a bunch of otherwise ordinary wine, sunk it to the bottom of the ocean for a year to “age”, and then sold it to those rich idiots for $500 a bottle?

It’s clearly a genius plan – and I’ll let the company’s own words tell the story why.

“Collectors and connoisseurs the world over are driven by the passion for scarcity; for that rare chance to own and add a unique treasure to their coveted collections; and in so doing enhance their persona of success, of importance, of significance,” the company’s website says.

“A single bottle of rare and unique wine can engender unbroken dinner conversation even through the rise of the next morning sun.” – this part of the company’s statement rings true. I’ve spent many a crappy morning bitching about how terrible the wine tastes at dawn of Day 3 of a serious bender.

“However to most, scarcity is expensive; to the affluent it’s simply a part of ‘The Story’” – and if your stomach’s not been turned completely by that particular statement, then I have an opened box of Lindeman’s Chardonnay that I found in a skip for sale.

It’s super-rare, and can be yours for just $6,000. I’ll even throw in a certificate of authenticity, confirming the skip wine’s rarity on the basis that it probably contains every single variant of the herpes virus known to modern science.

Anyway – the plan was to drop crates of wine to the bottom of the sea, in special cages made of recycled material, so that the “specific metals and the salty ocean water create an underwater battery which discharges a natural electricity. The cages, the salt water along with glass bottles conduct and ionise the wine transforming the wine”.

However, it turns out that in an attempt to accelerate the maturation process to get the wine to market as fast as possible, the company also tried to accelerate the process of securing a few permits as well, through a process known as “not securing any permits”.

And so they got done, big time – busted for violation of the US Water Code for illegally discharging material into the water of the United States, selling alcohol without a licence, and aiding and abetting investor fraud.

The two men were placed on probation for their efforts, and ordered to pay back one investor the $50,000 he’d put into the company – and more than 2,000 bottles of barnacle encrusted wine were destroyed.

TO MARKETS

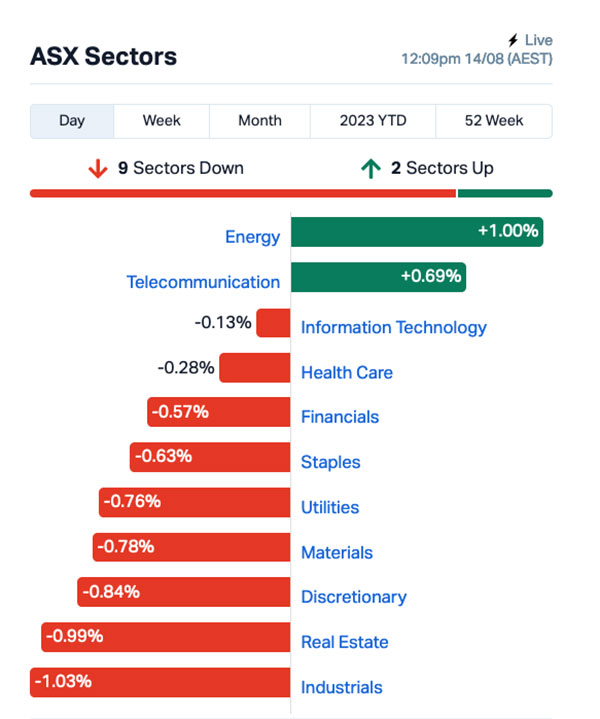

Much like the wine from today’s lead story, local markets are sinking somewhat gracelessly this morning, landing in the lunch queue at -0.45% after a morning spent struggling against gravity, and the weight of several market sectors having a fairly deep strop about life in general.

Industrials and Real Estate are right down the tail end of the list this morning, along with just about everything else – only two sectors making headway are Energy and the Telcos.

Local goldies are also doing (relatively) well this morning, with the XGD All Ords Gold index up 0.60%, joining the XTX All Ords Tech index as the only other segment doing well.

Up the fancy end of town, Carsales (ASX:CAR) has jumped 4.9% this morning on news of a jump in reported revenue of 53% to $781 million, paving the way for a reported NPAT of $646 million, a 301% increase over the previous year.

To celebrate, the company says it’s been in touch with the factory, and all of its workers will be fitted with heated leather seats, “just like Jim Morrison”.

NOT THE ASX

Friday was a little hectic on Wall Street, as Big Tech investors raced for the exits leaving the NYSE unsure about which way to steer the ship.

The result was a mixed bag across the indices – The Dow managed a 0.3% climb, but the S&P fell to -0.11% and the tech-heavy Nasdaq sank 0.63%, dragged down significantly by Big Tech.

Earlybird Eddy reported this morning that Wall Street’s FANG+ index dropped more than 1.0% throughout the session, weighed down by higher US Treasury yields, which rose after Bill Gross, the one-time bond king, said Treasuries were “overvalued.”

The former CIO of Pacific Investment told Bloomberg that the fair value of the 10-year Treasury yield is about 4.5%, compared with the current level of 4.15%.

Nvidia was down 3.6%. “Nvidia is down over 13% from its high from just a month ago, and investors are hesitant to buy back in despite this still being an early stage for the AI trade,” said Oanda analyst, Edward Moya.

Among other movers, US listed stocks of Chinese companies Alibaba and JD.com fell 3.5% and 5%, respectively.

It wasn’t all bad news, though – News Corp (to whom we are attached) rose 5% after it beat quarterly profit estimates.

In Japan, the Nikkei is down 0.92%, striking fear into the hearts of citizens around the nation who are highly conscious of what sort of effect a slumping market can have on people.

That sentiment has been compounded by a hugely unfortunate incident that left three people in hospital this weekend, after a 26-year-old man drove his car into a crowd of spectators at a night festival in Shizuoka, because he was “in a bad mood”.

Should the Nikkei continue to fall this week, I suspect we should all be prepared for Prime Minister Fumio Kishida to drive the entire country into the sea.

Meanwhile in China, SHanghai markets are down 0.99%, and in Hong Kong the Hang Seng is in the event of a wayward, high-speed Tokyo.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 14 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LU7 | Lithium Universe Ltd | 0.052 | 73% | 22,059,950 | $11,655,657 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | 538,648 | $11,480,100 |

| EEL | Enrg Elements Ltd | 0.007 | 40% | 1,948,089 | $5,046,171 |

| NRX | Noronex Limited | 0.018 | 38% | 3,830,448 | $4,576,664 |

| MGA | Metals Grove Mining | 0.15 | 36% | 1,616,432 | $4,092,055 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 2,000,000 | $9,831,085 |

| LCY | Legacy Iron Ore | 0.02 | 25% | 375,613 | $102,509,219 |

| MBK | Metal Bank Ltd | 0.039 | 22% | 729,467 | $8,847,537 |

| ELE | Elmore Ltd | 0.006 | 20% | 2,503,618 | $6,996,919 |

| MXC | MGC Pharmaceuticals | 0.003 | 20% | 2,741,000 | $9,730,899 |

| PNX | PNX Metals Limited | 0.003 | 20% | 45,173 | $13,451,562 |

| FRB | Firebird Metals | 0.125 | 19% | 79,168 | $7,672,875 |

| G1A | Galena Mining | 0.13 | 18% | 1,998,893 | $82,782,556 |

| BNO | Bionomics Limited | 0.013 | 18% | 4,778,692 | $16,156,090 |

| 1CG | One Click Group Ltd | 0.021 | 17% | 3,320,460 | $11,067,848 |

| BEX | Bikeexchange Ltd | 0.007 | 17% | 1,825,979 | $7,134,901 |

| WC8 | Wildcat Resources | 0.255 | 16% | 6,655,414 | $146,425,752 |

| FIN | FIN Resources Ltd | 0.015 | 15% | 625,000 | $8,073,460 |

| BCA | Black Canyon Limited | 0.155 | 15% | 3,335 | $8,033,498 |

| HAL | Halo Technologies | 0.11 | 15% | 6,250 | $12,431,540 |

| AVE | Avecho Biotech Ltd | 0.008 | 14% | 993,685 | $15,135,146 |

| CAV | Carnavale Resources | 0.008 | 14% | 7,389,313 | $23,334,862 |

| MEM | Memphasys Ltd | 0.016 | 14% | 343,750 | $13,433,285 |

| SIS | Simble Solutions | 0.008 | 14% | 90,848 | $4,220,655 |

| TAS | Tasman Resources Ltd | 0.008 | 14% | 500,975 | $4,988,685 |

Up the top of the Small Caps ladder this morning is newbie Lithium Universe (ASX: LU7), which made its debut on the ASX this morning after a $4.5 million public offer at $0.02.

It is, as the name suggests, a lithium play, with Iggy Tan at the helm – and it’s clearly pretty popular with investors, who have been piling in this morning to drive the trading price up 165% to $0.52.

Next best on the list is Noronex (ASX:NRX), which has climbed 38.5% this morning on last week’s news that drilling at the company’s 100% owned Fiesta and Blowhole projects has commenced on schedule, following up on earlier drilling that hit intercepts including 8m @ 2.5% Cu and 9m @ 1.8% Cu, 82 g/t Ag.

And in third spot, it’s MetalsGrove Mining (ASX:MGA), up 36.3% today on some fabulous news from the company’s Arunta Project area in the Northern Territory.

MetalsGrove says drilling has hit high-grade carbonatite rare earth (REE) grades of up to 7,000*ppm (0.70%) TREO, 35% MREO/TREO, 28% NdPr/TREO and 36% Y₂O₃/TREO.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 14 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MGU | Magnum Mining & Exploration | 0.035 | -40% | 32,872,831 | $41,713,822 |

| ADR | Adherium Ltd | 0.004 | -20% | 125,000 | $24,997,042 |

| CTN | Catalina Resources | 0.004 | -20% | 1,778,527 | $6,192,434 |

| GTG | Genetic Technologies | 0.002 | -20% | 309 | $28,854,145 |

| NES | Nelson Resources. | 0.004 | -20% | 34,390 | $3,067,972 |

| NTM | Nt Minerals Limited | 0.008 | -20% | 1 | $8,006,989 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 1,533,807 | $3,531,352 |

| NAE | New Age Exploration | 0.005 | -17% | 123,886 | $8,615,393 |

| RNX | Renegade Exploration | 0.01 | -17% | 3,362,222 | $11,437,485 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 1,137,497 | $11,963,157 |

| HYD | Hydrix Limited | 0.033 | -15% | 24,057 | $9,914,535 |

| AJQDA | Armour Energy Ltd | 0.11 | -15% | 3,005 | $12,795,489 |

| TON | Triton Min Ltd | 0.023 | -15% | 1,958,311 | $42,156,601 |

| RTR | Rumble Res Limited | 0.145 | -15% | 1,353,967 | $108,247,392 |

| ENT | Enterprise Metals | 0.0035 | -13% | 134,113 | $3,197,884 |

| RLC | Reedy Lagoon Corp. | 0.007 | -13% | 392,857 | $4,533,757 |

| CXZ | Connexion Telematics | 0.022 | -12% | 7,370,377 | $23,674,172 |

| FTZ | Fertoz Ltd | 0.097 | -12% | 13,300 | $28,361,830 |

| AGD | Austral Gold | 0.03 | -12% | 266,847 | $20,818,586 |

| AJX | Alexium Int Group | 0.015 | -12% | 208,000 | $11,073,626 |

| APS | Allup Silica Ltd | 0.06 | -12% | 10,000 | $2,616,443 |

| ITM | Itech Minerals Ltd | 0.195 | -11% | 165,214 | $25,725,384 |

| VMC | Venus Metals Cor Ltd | 0.12 | -11% | 16,526 | $25,613,372 |

| ASR | Asra Minerals Ltd | 0.008 | -11% | 1,158,333 | $12,963,484 |

| REZ | Resourc & En Grp Ltd | 0.016 | -11% | 338,130 | $8,996,504 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.