ASX Small Caps Lunch Wrap: Who’s been completely terrible at making plans this week?

Poor bugger's so disorganised, he forgot to put on sleeves. Pic via Getty Images.

Local markets are – once again – down in early trade today, sinking to -0.2% because – once again – Wall Street had a bad session overnight, and there’s been some iffy earnings reports from a few of the ASX large caps as well.

By lunchtime, the benchmark had bottomed out at -0.3%, but in a burst of unexpected (but welcome) zest and zeal, the ASX clawed its way back above ground before coming to rest basically flat by midday.

Before I get into the details today, I’ve got a spot of celebrity news from the UK, where The Last of Us star Pedro Pascal has learned an extremely valuable lesson about planning ahead.

Pascal rocked up to the Rhodes Gallery in the UK town of Margate, Kent, for an unannounced visit to an art show, called “ADHD Hyper Fixation and why it looks like I love Pedro Pascal”, which – as you could probably guess – features a shockingly large number of artworks featuring the actor.

Sadly for Pascal, and even more so for artist Heidi Gentle Burrell, she’d taken the day off and the gallery was closed, leaving the actor locked outside with two mates, described by the always-reliable Metro newspaper as ‘fellow actor Russell Tovey and former musician Robert Diament’.

It remains unclear precisely what Diament did to be barred from being a musician.

Anyhow, the artist says she was “gutted he showed up on a Sunday when the gallery was closed”, adding she “can imagine he’s slightly embarrassed, with all the art being about him”.

As to why she’s done little else but create portraits of the actor, Burrell said: “I wouldn’t call myself an obsessed fan”, adding she “just found he had a really interesting face, from an artistic point-of-view. He’s got two little bald patches in his beard and creases in his eyebrows and bridge of his nose.”

She then (allegedly) delivered a 19-minute monologue on the number, size and location of every mole, freckle and blemish on his body, but the recording of that – sadly – was seized by police to use as evidence in case the actor “mysteriously disappears”.

TO MARKETS

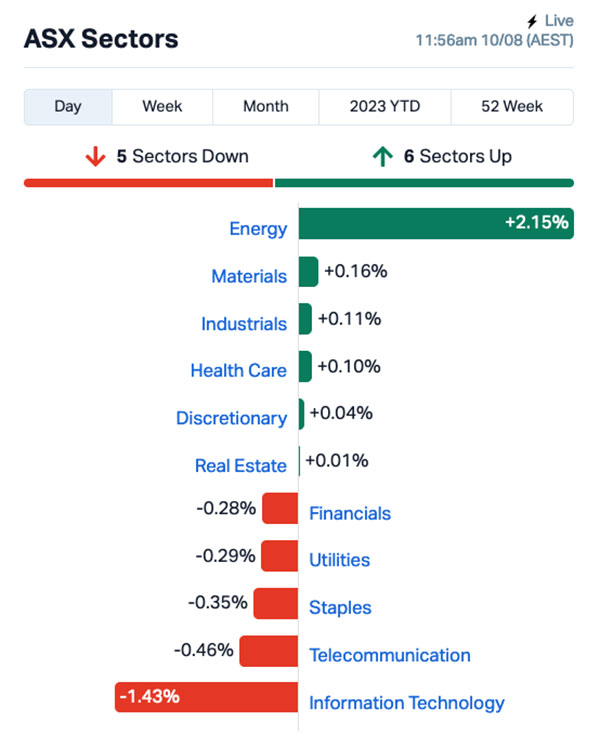

This morning’s overview of the ASX shows a tale as old as time itself – the “irresistable force” of the Energy sector, butting heads with the “actually fairly moveable” object, in the form of a wildly volatile InfoTech sector that can’t quite make up its mind if it’s coming off the boil or not.

Energy’s way out in front of the market, by a considerable margin – a full +2.0% beyond it’s nearest profitable bedfellow in Materials.

Meanwhile, the tech sector’s battling some demons this morning, a full 1.0% below the next-worst on the ladder today (that’d be the Telcos).

A smattering of earnings among the Big Kids on the Bourse today has delivered a predictable set of outcomes.

QBE Insurance (ASX:QBE) posted a $612 million profit for the previous 12 months, an increase of 733% over the prior period’s relatively grim $73.4 million – which is great news for shareholders, who are going to see a $0.14 divvie as a result.

The bad news in amongst that belongs to policyholders, who have been stung with a raft of premium increases, +10.2% in the US, and +11.8% across the Australia Pacific region, mostly because of the weather.

A couple of days ago I predicted that when AMP (ASX:AMP) delivered its report today it would “barf out yet another profound disappointment” – and boy howdy, did I get that one right.

The banner headlines in the report are grim, despite AMP’s attempts to slather the entire pig with lipstick – a 44% profit slump for the year is terrible news, any way you slice it.

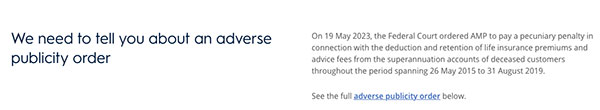

Additionally, AMP’s got legal hassles all the way up wazoo – and indeed, the company’s not been allowed to sweep it under the rug, as this banner on the homepage shows.

The “adverse finding” is essentially the modern-day equivalent of being put in the stocks in the town square, so that the locals can take turns throwing fruit, wild dogs and sharp implements at them.

It relates to the utterly shameful episode where AMP was busted taking – and retaining – premiums and financial advice fees from customers who didn’t need to be paying them, on account of them being dead.

AMP’s trading price is up 3.2% today. Somebody make this make sense…

And lastly, we need to talk about AGL Energy (ASX:AGL), which has managed to misplace more than $1.2 billion over the past 12 months – a staggering loss that the company says is mostly due to it writing down $680 million in value of its coal-fired energy plants.

Plus another $890 million was burnt when the company got caught holding a bunch of energy contracts that fell victim to Gubberman Interference, and the usual bugbear called Market Forces.

But – the company says – if you can overlook those two gaping wounds on the balance sheet, you’d notice that AGL’s “profits” rose by 25% (roughly $288 million). Perfect justification for just how hard we’re all about to be fingerblasted by our power bills over the coming six months.

NOT THE ASX

Wall Street put in a fairly feeble effort again overnight, as investors piled out of the risky end of the market ahead of US CPI figures hitting the headlines later tonight, our time.

They’re obviously predicting some dire news, as the S&P 500 fell 0.7%, the Dow Jones went down 0.54%, and tech-heavy Nasdaq tumbled by -1.17%.

Earlybird Eddy reports that Nvidia fell 5% ahead of its earnings despite FT’s report that it was going to receive billions of dollars in orders from Chinese tech giants.

Walt Disney rose 3% after hours after reporting its Q3 earnings where profits came in at US$1.03 a share, beating the US$0.99 forecast – but that news was tempered by news that the company’s online streaming service fees are set to rise.

In the US, it’s now going to cost US$14 a month to park your kids in front of the telly to watch Wall-E for the 9,000,000th time. 100% worth it, though, because it’s easily the greatest movie about a plucky little mobile garbage compactor with an Apple tech fetish the world has ever seen.

And beleagured WeWork – which I mentioned yesterday had taken a 27% bath – fared even worse than that overnight, shedding almost 40% post-market yesterday when the CEO said there’s “substantial doubt” about its ability to continue operating.

Absolutely no one should be shocked by that, at all, given that the company supplies office space to a populace that just spent two years working from home, has virtually nothing in the way of proprietary tech to back it up, and has never seen the happy side of profitability since the day Super-CEO Adam Neumann shook the entire business out the end of his trouser leg in 2009.

News from Japan this morning is that the Nikkei is up 0.41%, on reports 49-year-old Shoichi Fujita has been arrested for filming up a woman’s skirt while she was shopping in Hekinan, Aichi Prefecture.

Police say the man has admitted to the crime, but explained that he filmed the woman because he “hadn’t been with a woman for a long time and was feeling sexually frustrated” – probably not realising that shoving your iPhone up in a random woman’s business is not exactly the conversation starter he’d hoped it might be.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap XTC Xantippe Res Ltd 0.0015 50% 550,001 $11,480,100 LKE Lake Resources 0.22 33% 22,962,646 $234,703,377 PXX Polarx Limited 0.012 26% 3,086,026 $14,197,896 ADR Adherium Ltd 0.005 25% 1,122,670 $19,997,633 OPN Openn Negotiation 0.01 25% 2,431,874 $8,933,437 CTT Cettire 3.43 23% 3,748,853 $1,067,467,016 UBI Universal Biosensors 0.3 20% 101,180 $53,092,359 CYQ Cycliq Group Ltd 0.006 20% 2,070,291 $1,737,583 MPR Mpower Group Ltd 0.024 20% 10,183,707 $6,874,066 RML Resolution Minerals 0.006 20% 375,000 $6,286,459 ST1 Spirit Technology 0.05 19% 1,740,656 $30,895,398 RDN Raiden Resources Ltd 0.013 18% 21,063,143 $22,607,958 NGY Nuenergy Gas Ltd 0.033 18% 80,536 $41,466,754 DCL Domacom Limited 0.027 17% 100,000 $10,016,541 TNC True North Copper 0.255 16% 6,058,775 $57,165,119 BCB Bowen Coal Limited 0.1075 16% 7,690,123 $198,646,687 BAS Bass Oil Ltd 0.115 15% 519,500 $26,839,444 AYT Austin Metals Ltd 0.008 14% 1,456,324 $7,111,123 LSR Lodestar Minerals 0.008 14% 2,483,771 $12,903,781 MTB Mount Burgess Mining 0.004 14% 2,475,236 $3,554,764 PRS Prospech Limited 0.032 14% 1,365,712 $6,153,279 THR Thor Energy PLC 0.004 14% 2,065,280 $5,107,520 MSB Mesoblast Limited 0.4 14% 12,548,556 $284,971,689 RHT Resonance Health 0.065 14% 138,264 $26,268,563 PGD Peregrine Gold 0.305 13% 19,792 $15,147,705

In Small Caps news, Lake Resources (ASX:LKE) is at the top of the table this morning, up 33.3% on (apparently) no fresh news, other than a general announcement that the company’s due to present at the XII International Seminar on Lithium in the South American Region later today.

In second place (aside from a couple of no-reason, low volume pops) is MPower (ASX:MPR), after it announced that acquisition accounting for the purchase of the Lakeland Solar & Storage project has been completed, resulting in a profit of $6.1 million being recognised.

The Lakeland project – a 10.8MWac solar farm and an associated 1.4MWac/5.3MWh lithium-ion battery storage facility – was snapped up by MPower about 12 months ago, and the company says that since then it has “implemented significant operational improvements to the project, leveraging the company’s extensive inhouse capabilities and materially boosting Lakeland’s financial performance”.

And in third place, it’s the very fashionable Cettire (ASX:CTT), up 18.6% on news that the company has managed to increase sales revenue by 98% to $416.2 million over the past 12 months, to deliver adjusted EBITDA of $29.3 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 10 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.0015 -25% 1,302,499 $11,649,361 EDE Eden Inv Ltd 0.003 -25% 213,711 $11,987,881 CLA Celsius Resource Ltd 0.012 -20% 35,695,495 $33,690,775 IEC Intra Energy Corp 0.005 -17% 2,831,700 $9,724,690 SFG Seafarms Group Ltd 0.005 -17% 291,780 $29,019,595 FRX Flexiroam Limited 0.027 -16% 30,000 $21,254,135 BDX Bcal Diagnostics 0.12 -14% 306,237 $29,602,129 DOU Douugh Limited 0.006 -14% 212,717 $7,398,827 MRZ Mont Royal Resources 0.185 -14% 155,274 $14,723,774 SP3 Specturltd 0.025 -14% 296,065 $6,547,761 CUF Cufe Ltd 0.013 -13% 191,641 $14,941,685 FIN FIN Resources Ltd 0.013 -13% 515,000 $9,315,530 AMD Arrow Minerals 0.0035 -13% 4,132,218 $12,095,060 CRB Carbine Resources 0.007 -13% 225,000 $4,413,902 KPO Kalina Power Limited 0.007 -13% 61,500 $12,121,566 BBX BBX Minerals Ltd 0.035 -13% 52,002 $20,490,029 ERW Errawarra Resources 0.14 -13% 1,086,550 $9,680,640 CCZ Castillo Copper Ltd 0.008 -11% 100,000 $11,695,548 ETR Entyr Limited 0.008 -11% 969,911 $17,791,685 NOV Novatti Group Ltd 0.125 -11% 41,000 $47,411,916 M2R Miramar 0.05 -11% 164,115 $6,211,901 KCC Kincora Copper 0.043 -10% 489,845 $7,727,341 ADX ADX Energy Ltd 0.009 -10% 970,000 $36,102,138 BFC Beston Global Ltd 0.009 -10% 2,234,886 $19,970,469 HPC The Hydration 0.036 -10% 490,784 $5,877,801

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.