ASX Small Caps Lunch Wrap: Who’s been busted placing a dodgy-looking bet this week?

Nothing even remotely dodgy goin' on here, squire... nothing at all. Pic via Getty Images.

Local markets opened higher this morning, thanks to a grand lead-in from Wall Street and some hotly anticipated (but ultimately pretty mid) Aussie jobs data that landed at 11.30am.

The benchmark was tipping the scales at +0.5% at lunchtime, not enough to undo the damage of the past couple of sessions, but a bright enough start for a Thursday morning nonetheless.

I’ll get into the details of it all shortly, but first… we’re off to the UK, where there’s a surprise general election looming, and it’s going about as well as you’d expect given the manner in which it was announced, with British PM Runi Sunak standing in the tepid English rain to call the date for July 04.

Sure, he looked mildly stoic, and sure, someone could have given the poor bugger a brolly – but the optics of the Prime Minister drowning on Downing Street have pretty much set the tone for a campaign that is not going well for the PM.

So far it’s been a weird campaign, with a few notable highlights – including the return of Nigel Farage at the head of the Reform UK party, who has since been making the news for all the wrong reasons.

The histrionic ratchet-jaw who leapt to international prominence as one of the chief cheerleaders for the unmitigated Brexit disaster got a lukewarm welcome back to high stakes politics last week, when he was hit with a milkshake by a disgruntled young woman.

A young girl throws a milkshake over Nigel Farage as he launches his general election campaign! pic.twitter.com/BrZ23fMIXF

— J Stewart (@triffic_stuff_) June 4, 2024

Cracking stuff, that.

Things aren’t looking much better for the current PM, though, after news broke last night that one of his most trusted and closest advisers looks like he might have succumbed to a 1-2 punch of greed and stupid.

Craig Williams, the prime minister’s parliamentary private secretary, has been busted putting a £100 bet on when the election would be held, a few days out from his boss going public with plans to call a very early and very sudden run to the polls.

Williams has admitted placing the bet, which would have netted him a £500 windfall – except Ladbrokes, the betting agency that took the bet, has instead dobbed him into the UK gambling watchdog, which has confirmed that it’s looking into the issue.

It’s not clear yet how this one is going to pan out, but given the incredibly low bar in the UK for politicians falling on their swords whenever they get busted for even the most minor of things – Boris Johnson excluded, of course – I’d be enormously surprised if Williams is still a candidate in 48 hours’ time.

But it’s heartening to know that the UK has the same kind of political problems we have in Australia and the US – because it’s becoming pretty clear that when it comes to democracy, we’re really not sending our best to represent us.

TO MARKETS

Local markets bounced on Thursday morning, arresting a two-day highly inglorious slide after both the Nasdaq and S&P 500 posted record closing highs in New York overnight, and ahead of some highly anticipated Aussie jobs data that was due out mid-morning.

The ASX 200 leapt quickly to around +0.6%, with the tech sector and the goldies leading the way, with the banks hard on their heels as the morning trundled on.

There was some unsettling news from the ACCC this morning, which broke cover on it’s look into the proposed merger between pharmaceutical superstores Chemist Warehouse and Sigma.

The ACCC has hinted that the merger raises “some concerns” about how profoundly it would change the market space in that sector, with the spectres of lack of competition, worsening service and higher prices for consumers looming large in the organisation’s thinking.

The Australian Bureau of Numerical Wizardry delivered its report on the Aussie jobs situation around 11.30am this morning and the news was… not shocking.

The data shows that Australia’s unemployment rate fell to 4.0% in May, down 0.1% points from April, which is fabulous news for people who’ve been looking for work, but not super-welcome news for anyone who’s still holding out hope that interest rates are going anywhere anytime soon.

The RBA has been very clear on the topic of how unemployment looms as a part of the will-they-or-won’t-they interest rates puzzle, and the board’s expecting jobless numbers to go higher before rate cuts are properly on the table.

In finer detail, employment rose by 39,700 people in May, with the number of people “officially listed as unemployed falling by around 9,000.

“Together with elevated levels of job vacancies, this suggests the labour market remains relatively tight, though less than in late 2022 and early 2023,” Bjorn Jarvis, ABS head of labour statistics said in a note.

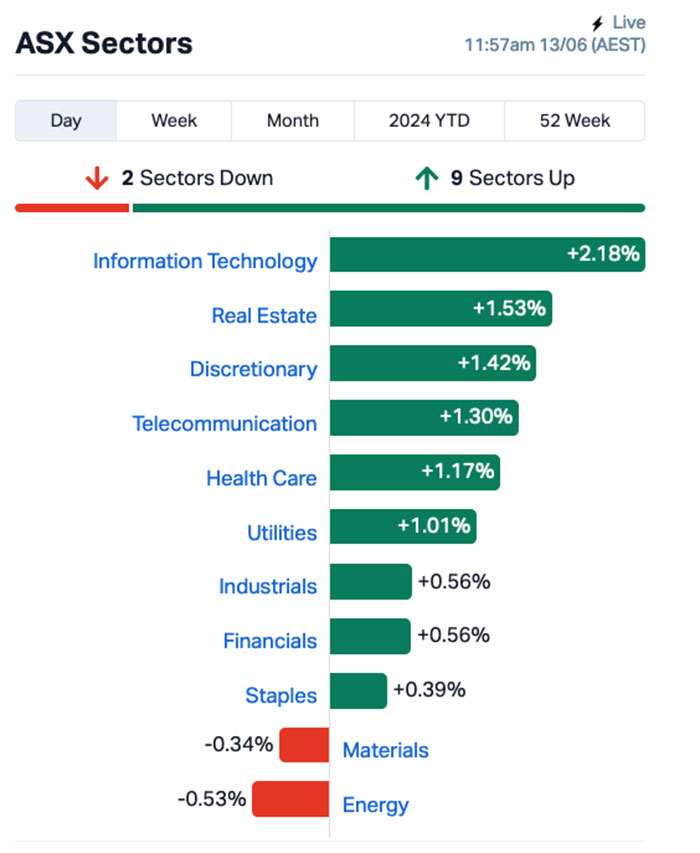

By lunchtime, the market sectors looked like this:

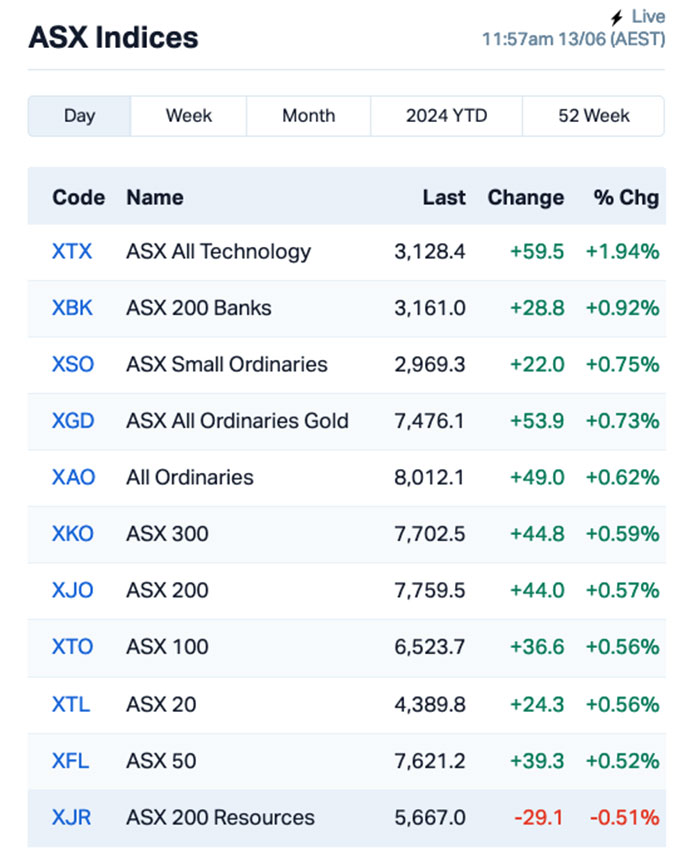

The ASX indices looked like this:

And it’s definitely time for a pie. Possibly two. It’ll be nice to take an actual lunch break for once.

Oh wait… there’s all this next bit to write.

… bugger.

NOT THE ASX

Overnight, Wall Street reset its record highs once again after the much anticipated US inflation data was released, Eddy Sunarto reported this morning.

The S&P 500 rose by +0.85% to another all-time high, the blue chips Dow Jones index was down by -0.09%, and the tech-heavy Nasdaq lifted by +1.33%, so the data obviously told positive tales to US investors.

The core CPI (which doesn’t include food and energy prices) slowed down in May for the second month in a row, up by just 0.2% from April. Compared to the same time last year, it increased by 3.4%, the slowest annual pace in more than three years.

That gave US investors, who have really been champing at the bit all year for virtually any sign of interest rate relief, the greenlight to go spending through the tail end of the session – but, once again, it might have been a bit premature.

Following the CPI report, the Fed Reserve maintained its interest rates as anticipated, but indicated it now expects to cut rates only once in 2024, rather than the three times previously projected.

Fed Chair Jerome Powell, who is excellent at souring market sentiment everywhere he goes, reiterated during the post-meeting press conference that the central bank will not lower rates until further data confirms that inflation is really cooling.

“We see gradual cooling, gradual moving toward a better balance,” he said. “We’re monitoring it carefully for signs of something more than that, but we really don’t see that,” Powell said.

But even old Jerome couldn’t knock the gloss off the outlook, and treasury bonds rallied across the curve after his comments, pushing yields on both two-year and 10-year bonds to drop by about 7 basis points.

In US stock news, Broadcom Inc, a chip supplier for Apple, rose by +2% after the company reported better-than-expected results and an optimistic annual forecast, driven by strong demand for AI products.

Virgin Galactic dropped -5% after the company announced a 1-for-20 reverse stock split to keep the stock listed on the New York Stock Exchange.

FedEx Corp fell -1.5% after revealing plans to reduce up to 2,000 jobs in Europe as part of its ongoing efforts to streamline its global workforce and manage costs more effectively.

And Boeing fell a further -1.5% after saying that it received orders for just four new planes in May, and for the second month in a row, none of them were for its popular 737 Max. The result was far behind rival Airbus, which secured net orders for 15 planes in May.

In Asian markets this morning, Japan’s Nikkei is unusually flat at around -0.08%, Hong Kong’s Hang Seng is up a relatively meagre +0.42% and Shanghai markets are down -0.26%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 13 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CE1 Calima Energy 0.008 122% 33,860,105 $2,279,724 MRQ Mrg Metals Limited 0.0025 67% 105,495,513 $3,787,678 RIL Redivium Limited 0.003 50% 300,000 $5,461,710 PNM Pacific Nickel Mines 0.039 39% 546,999 $11,711,087 CC9 Chariot Corporation 0.23 35% 322,094 $14,074,157 CCOR The Calmer Co Int - Rights 17-Jun-24 0.004 33% 2,876,668 $1,514,887 EDE Eden Inv Ltd 0.002 33% 2,512,342 $5,517,407 KPO Kalina Power Limited 0.004 33% 75,948 $7,459,182 R8R Regener8Resourcesnl 0.14 27% 20,000 $2,822,188 1AG Alterra Limited 0.005 25% 260,825 $3,448,586 ATH Alterity Therap Ltd 0.005 25% 100,000 $20,980,461 ESR Estrella Res Ltd 0.005 25% 5,757,652 $7,037,487 HMD Heramed Limited 0.021 24% 526,083 $6,685,247 RC1 Redcastle Resources 0.021 24% 520,653 $5,580,831 NRZ Neurizer Ltd 0.0135 23% 16,873,482 $20,926,737 BNL Blue Star Helium Ltd 0.011 22% 1,304,758 $17,480,388 NAG Nagambie Resources 0.011 22% 468,181 $7,169,721 VN8 Vonex Limited. 0.023 21% 237,598 $6,874,744 AI1 Adisyn Ltd 0.024 20% 436,800 $3,702,640 CDT Castle Minerals 0.006 20% 7,404,706 $6,122,465 ICE Icetana Limited 0.024 20% 185 $5,292,569 FRE Firebrickpharma 0.069 17% 309,123 $11,523,097 BUB Bubs Aust Ltd 0.14 17% 5,998,281 $107,055,605 CLZ Classic Min Ltd 0.0035 17% 2,537,581 $1,366,324 WEC White Energy Company 0.036 16% 131,650 $6,168,513

Leading the winners list on Thursday was MRG Metals (ASX:MRQ) , climbing nicely on news that the company has entered into a Binding Joint Venture Agreement (JVA) with Sinowin Lithium (HK) to develop its Mozambique Corridor Sands projects (Corridor Central and Corridor South) and its other Mozambique Heavy Mineral Sands projects.

Pacific Nickel Mines (ASX:PNM) was rising on an announcement that mining operations at the Kolosori Nickel Project in the Solomon Islands has achieved a significant milestone, achieving a throughput of two ships per month, with ramp-up to full production of 1.5mtpa nearing completion, equivalent to three ships per month during the dry season.

Early leader this morning, Bubs Australia (ASX:BUB) was still chugging along at lunchtime after releasing a trading update to crow about improved sales data from the US, where weekly scan revenue now exceeds US$1m per week with over 24,000 tins sold, up from the Q3 average weekly scan revenue US$750k, and the company’s current position as the #1 best-selling infant formula product on Amazon USA in May 2024.

And, you can ignore the appearance of Calima Energy (ASX:CE1) on the winner’s chart, because that’s not where it’s at right now. It’s lower. A lot lower.

Calima recently sold off a Canadian asset called Blackspur for $81.6 million, $80 million of which was earmarked for capital return to investors. At that stage, it was roughly equivalent to the company’s total market cap.

Today marks the ex-distribution date, which means any shares traded from today onwards are traded without any access to the $80 million payment – and it’s showing a 94.6% loss (and trading’s been paused) at lunchtime today.

We’ll probably have an update for you later, once the smoke has cleared.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 13 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVG Aust Vintage Ltd 0.2 -36% 3,338,797 $79,019,508 ADS Adslot Ltd. 0.001 -33% 11,764,706 $4,836,743 NGS NGS Ltd 0.002 -33% 1,290,000 $753,682 ECT Env Clean Tech Ltd. 0.003 -25% 55,555 $12,687,242 8VI 8Vi Holdings Limited 0.155 -23% 44,669 $8,382,284 ADD Adavale Resource Ltd 0.004 -20% 1,299,591 $5,201,327 MCT Metalicity Limited 0.002 -20% 9,432,000 $11,214,632 MTL Mantle Minerals Ltd 0.002 -20% 1,270,015 $15,493,615 PNX PNX Metals Limited 0.004 -20% 170,417 $29,851,074 ROG Red Sky Energy. 0.004 -20% 140,000 $27,111,136 TX3 Trinex Minerals Ltd 0.002 -20% 1,473 $4,571,631 KNG Kingsland Minerals 0.17 -17% 161,465 $10,768,487 AEV Avenira Limited 0.005 -17% 306,001 $14,094,204 AHN Athena Resources 0.0025 -17% 2,333,333 $3,211,403 AYT Austin Metals Ltd 0.005 -17% 79,201 $7,945,148 EVR Ev Resources Ltd 0.005 -17% 7,685,752 $7,927,629 KLI Killiresources 0.04 -17% 1,221,000 $4,810,740 LPD Lepidico Ltd 0.0025 -17% 962,773 $25,767,358 PRX Prodigy Gold NL 0.0025 -17% 270,667 $6,353,323 TSL Titanium Sands Ltd 0.005 -17% 127,872 $13,270,483 AUE Aurumresources 0.335 -16% 599,999 $36,555,151 IPT Impact Minerals 0.016 -16% 4,254,000 $58,129,241 VTI Vision Tech Inc 0.14 -15% 11,661 $9,081,017 AQX Alice Queen Ltd 0.006 -14% 4,645 $4,836,930 MCL Mighty Craft Ltd 0.006 -14% 20,254 $2,582,365

ICYMI – AM EDITION

Aura Energy (ASX:AEE) has increased the global mineral resources at its Tiris project in Mauritania by 55% to 91.3 Mlbs uranium, up from 58.9 Mlbs.

Lithium Universe (ASX:LU7) has completed two environmental field studies at the proposed site of its lithium refinery at the Bécancour Waterfront Industrial Park in Québec.

These found no significant biological issues including the absence of the short-eared owl, a species of concern – likely due to the site’s proximity to the CEPSA chemical plant, railway, and highway.

Additionally, the identified wetlands were found to have low ecological value.

Further environmental surveys are planned in the coming months.

Maronan Metals (ASX:MMA) has received strong support from shareholders who subscribed for ~$3.37m worth of shares priced at 24c each, well above the $1.5m that it had originally sought.

Due to the overwhelming demand, the company has decided to accept all eligible applications , which it said was a strong endorsement of its namesake project in Queensland.

Along with the $5.65m placement completed in May, proceeds will be used to support exploration and development of the Maronan project through internal scoping studies, drilling programs to expand high-grade zones, and environmental and metallurgical studies.

Funds will also support the start of pre-feasibility study work streams.

At Stockhead, we tell it like it is. While Aura Energy, Lithium Universe and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.