ASX Small Caps Lunch Wrap: Who’s about to waste a shedload of money on a useless qualification today?

"I'm so gonna blow up" (Pic via Getty Images)

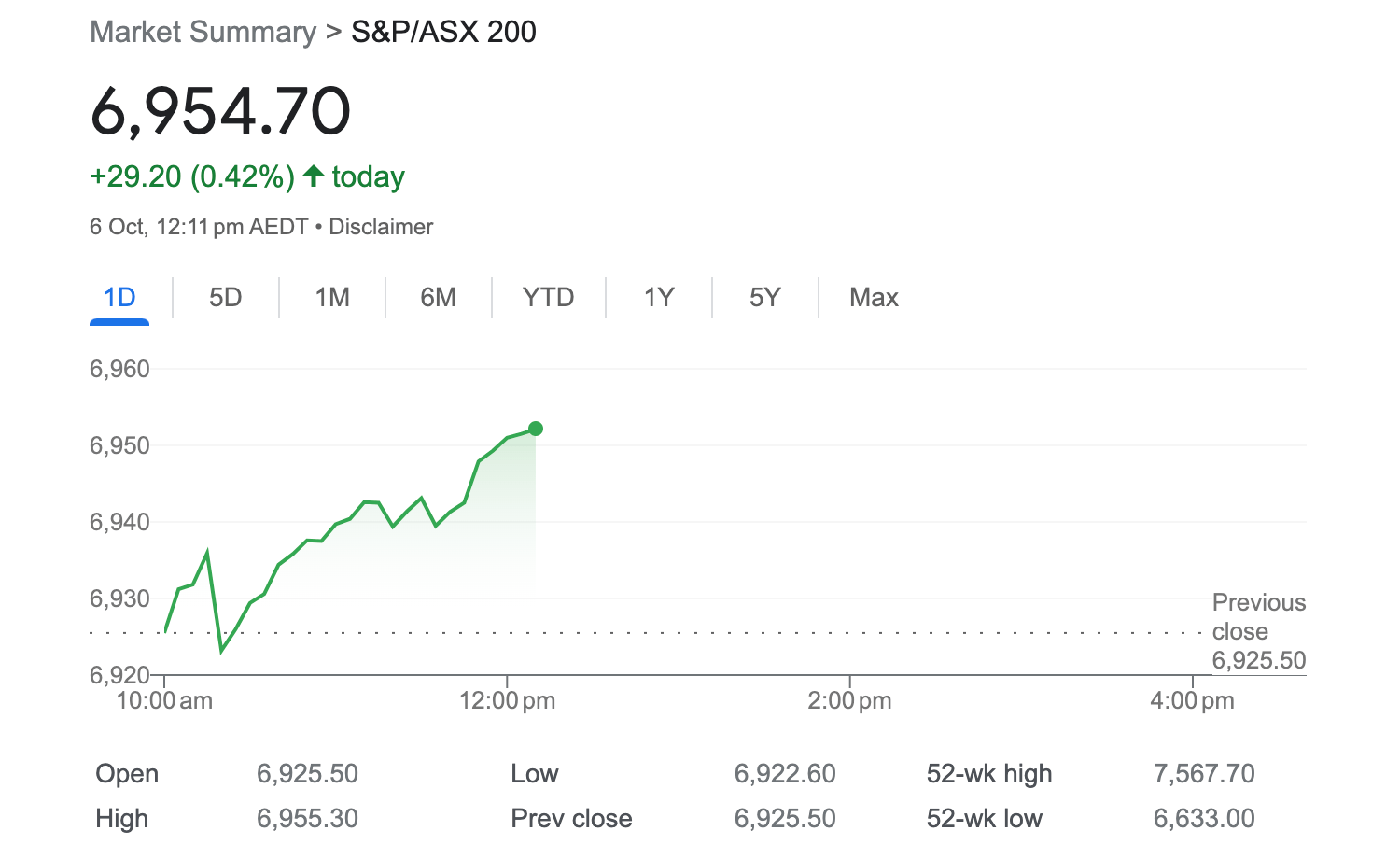

Right then, thank Fed it’s Friday. The ASX200 is doing a pretty good job so far today of pretending it could care less about what the ridiculously influential US Federal Reserve will do next.

Partly correctly predicted by expert analysts to open pretty flat and track US stock exchange indices, the local bourse is actually travelling okay here now for the moment, with some stirring up-and-to-the-right motion. Although that’s probably right royally jinxing it, isn’t it?

So why are US traders chewing nails and all squeaky bottomed? It’s because the MOST IMPORTANT EVER (until the next one) non-farm payrolls report is due out in the US tonight (AEDT). If that comes in strong, it’ll be fuel for more Fed hiking.

A pissweak result, then, is what portfolio-protecting types everywhere want. That means you, we’re guessing. In the meantime, it’s a waiting game…

And now, for something tenuously segued…

Speaking of twiddling thumbs and waiting for things to happen, now there’s another way for “young adults” (see yesterday’s Lunch Wrap) to spend thousands upon thousands of probably their parents’ hard earned on what’s likely to be an absolutely CRAPTACULAR waste of time. To go with the aforementioned wasted money.

A world-first, four-year university bachelor degree in… wait for it… influencing, from the South East Technological University in Carlow, Ireland has recently been developed and is taking in student admissions.

Insert your own Home Alone-style thumbnail pic here. Hang on, here you go…

“We knew there was a space and need for this, we just needed to develop the course into a bachelor’s degree and get it ratified,” Irene McCormick, a senior lecturer at the university, told the Washington Post.

We’ve definitely heard it all now. Well, not really, but any influencers reading this, feel free to use that – it’s not at-all hackneyed phrasing that you might be able to turn into a signature sign-off or something.

But begorrah, bejaysis, four years. Four of them. By the time students get through the course, surely weaponised AI pleasure-model replicants will have taken over everything anyway, rendering graduates’ pieces of paper (or will they be NFTs?) even more completely and utterly useless.

Apparently influencing has become a US$21 billion industry, according to some influencer we were watching the other day whose name we forget. Data outfit Statista also said it, though.

So, while we might joke about it, we have to admit, through gritted teeth, that successful influencers are making absolute bank – even more than Stockhead journos – so it’s no surprise that one in four Gen-Zers (in America reportedly) plan to become social media influencers.

It’s not that we don’t think it’s necessarily a relevant occupation, either. You’d obvs be an eejit to deny the power and reach of social media and there are tons of excellent content creators out there plying their wares on YouToob et al (amid the megatonnes of crap ones).

It’s more the word “influencer”, really, and the fact that if this bloke (see Bitboy below) can explode a YouTube channel to more than 1.4m followers in the space of about 18 months, then we’re pretty sure a four-year degree isn’t exactly a prerequisite for success in this area.

This is a pretty epic trilogy of remixes.

Something tells me there will be a sequel trilogy. pic.twitter.com/ftuntNgCdR

— 16 years of song a day (@songadaymann) September 27, 2023

Note, “15 Years of a Song Day” bloke, who is great, is parodying Bitboy here, in case that wasn’t clear. Also, Ben ‘Bitboy’ Armstrong was recently booted from the crypto-content channel and brand he built and a legal tussle is ensuing, so maybe he’s actually a bad example. But the point stands.

Also, for the record, according to this Indian media channel Firstpost video, a global survey has determined that the “most regretted college degree” is… wait for it… journalism. So there’s that.

#VantageOnFirstpost: An #Irishuniversity is now offering a degree in influencing. It is tailored to the needs of the growing influencer economy. Question is, can a degree in influencing make someone an influencer? No matter the course, does a degree guarantee success? | @Palkisu pic.twitter.com/UI268LUWOt

— Firstpost (@firstpost) October 4, 2023

Still, could be worse. At least we’re all absolutely investing into the right exploration minnows for maximum potential ROI… r…right?

my culture is not your costume pic.twitter.com/PdZcnZpku3

— CEO🔺CA (@ceodotca) October 4, 2023

To markets

Well, would you look at that… it looks like the ASX200 has jumped off the Wall Street sheep’s back and is doing its own thing today. Let’s hope it’s a frontrunner, as opposed to fronting a bummer later on.

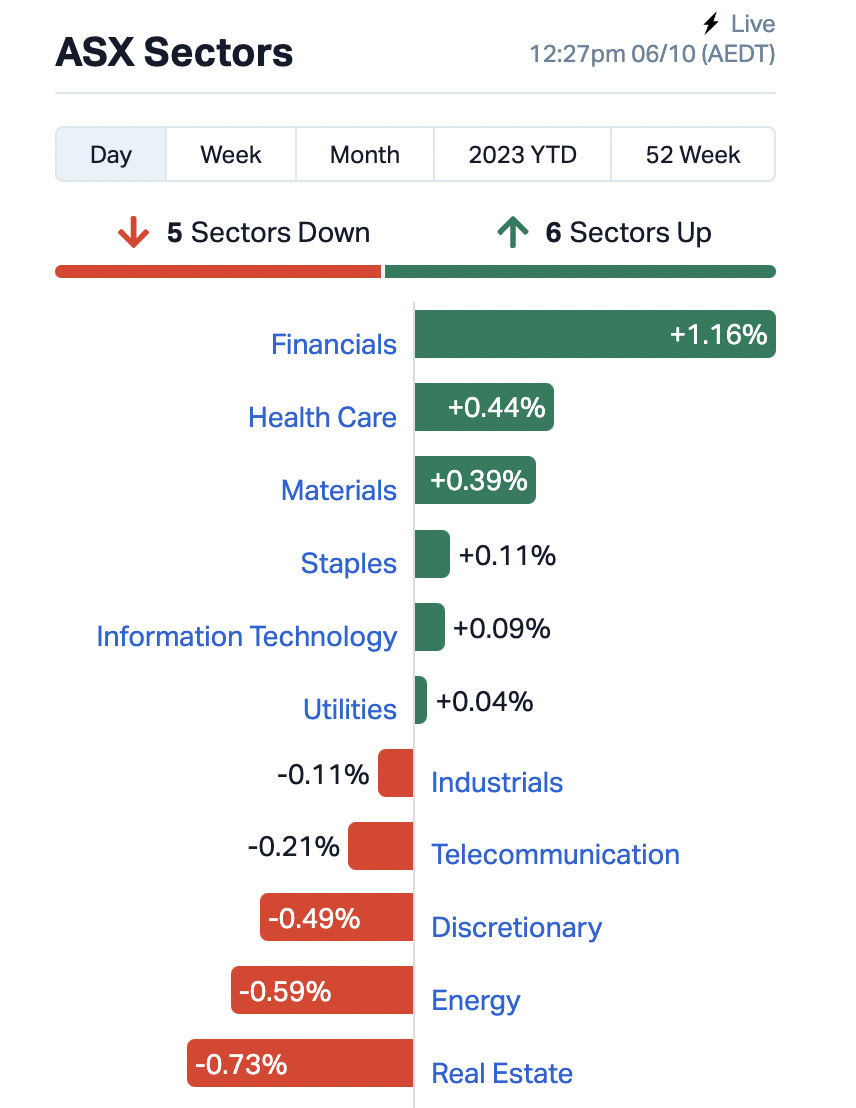

Honing in on the sectors, this is what we’re seeing, via Market Index…

We could talk you through that, but we’re not paid by the word here and the chart tells the story. What we will do, however, is find a couple of standout daily movers in the top-moving sector there, before exploring the more exciting nether regions of the bourse (see further below, of course).

Financials, then…

Fintech Chain (ASX:FTC), an $8m minnow “integrated payment and merchant industry application solution platform” is up about 18% today on no news we’re seeing.

Earlypay (ASX:EPY), a $72m market capped firm that provides services to SME businesses “in the form of secured invoice and trade financing and equipment financing” is also up z– almost 10% – on no news.

We didn’t say it was exciting, but there you have it.

Healthcare…

Dimerix (ASX:DXB) meanwhile, continues on its solid run after yesterday’s barnstorming +100% action. It’s up 29% on the day as we type.

The clinical-stage Aussie biopharm announced it’s entered into an exclusive licence agreement for the European Economic Area, the UK, Switzerland, Canada, Australia, and New Zealand for the commercialisation of Dimerix’ Phase 3 drug candidate DMX-200.

And that’s a treatment in development for focal segmental glomerulosclerosis (FSGS) kidney disease, following regulatory approval.

Not the ASX

On Wall Street, the S&P 500, Dow Jones and Nasdaq indices closed slightly in the red.

The Dow Jones Industrial Average closed 10 points or -0.03% lower, while the S&P 500 gave up more than -0.10% at 4,258.19, and the Nasdaq Composite, -0.12%.

As Christian “Cheds” Edwards, brother of former First XV CGS rugby player Samuel, wrote earlier in Market Highlights:

“In the States, the remarkable bond sell-off appeared to have eased although Treasury yields remain elevated. Benchmark US 10-year bond yields settled at 4.71 per cent, while the two-year bond yield slid to 5.02 per cent.”

Oil prices, meanwhile, fell sharply overnight. Brent crude oil is around $US84 barrel, well down from the recent highs of near $US97 a week ago.

Cheds notes… consensus expectations for the September NFP (that’d be the impending non-farm payrolls data results we mentioned earlier):

• Jobs growth of 170k down from 187k in August

• Unemployment rate to fall to 3.7% from 3.8%

• Wage growth to increase +0.3% MoM from +0.2%

A quick glance over at Asia meanwhile tells the following about their index performances at the time of writing:

China: Shanghai Comp: +0.1%

Hong Kong: Hang Seng: +0.1%

Japan: Nikkei: +1.8%

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort. Note, yellow highlights indicate ASX announcements:

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| Security | Description | Last | % | MktCap |

| CRB | Carbine Resources | 0.008 | 60% | $2,758,689 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | $15,642,574 |

| NOX | Noxopharm Limited | 0.11 | 31% | $24,547,988 |

| AX8 | Accelerate Resources | 0.03 | 30% | $8,753,840 |

| CRS | Caprice Resources | 0.04 | 29% | $3,619,465 |

| DXB | Dimerix Ltd | 0.2 | 29% | $61,248,175 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | $6,605,136 |

| EPN | Epsilon Healthcare | 0.032 | 23% | $7,809,204 |

| VMS | Venture Minerals | 0.011 | 22% | $17,550,117 |

| PAB | Patrys Limited | 0.0085 | 21% | $14,402,131 |

| VN8 | Vonex Limited. | 0.018 | 20% | $5,427,429 |

| CI1 | Credit Intelligence | 0.15 | 20% | $11,005,651 |

| ADV | Ardiden Ltd | 0.006 | 20% | $13,441,677 |

| AHN | Athena Resources | 0.006 | 20% | $5,352,338 |

| BXN | Bioxyne Ltd | 0.012 | 20% | $19,016,454 |

| EMU | EMU NL | 0.003 | 20% | $3,625,053 |

| LSR | Lodestar Minerals | 0.006 | 20% | $10,116,987 |

| TG1 | Techgen Metals Ltd | 0.024 | 20% | $1,543,366 |

| FTC | Fintech Chain Ltd | 0.013 | 18% | $7,158,465 |

| LAM | Laramide Res Ltd | 0.85 | 18% | $933,949 |

| NKL | Nickelxltd | 0.06 | 18% | $4,408,199 |

| AJX | Alexium Int Group | 0.02 | 18% | $11,190,371 |

| RAD | Radiopharm | 0.14 | 17% | $28,717,564 |

| TAS | Tasman Resources Ltd | 0.007 | 17% | $4,276,016 |

| BYH | Bryah Resources Ltd | 0.015 | 15% | $4,661,869 |

Standout:

Bryah Resources (ASX:BYH) – This diverse metals junior explorer (copper, gold, manganese, nickel, cobalt) is up on news today regarding the manganese component of its exploration portfolio.

Manganese is a key stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles.

Bryah, in a joint venture with OM (OMM), has announced it’s been granted two mining licences at the Bryah Basin manganese project in WA.

OMM has 51% of the JV and is a wholly owned subsidiary of OM Holdings (ASX:OMH), one of the world’s leading suppliers of manganese ores.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort. Note, yellow highlights indicate ASX announcements::

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| ICN | Icon Energy Limited | 0.006 | -45% | $8,448,150 |

| ZEU | Zeus Resources Ltd | 0.011 | -27% | $6,889,215 |

| CT1 | Constellation Tech | 0.002 | -20% | $3,678,001 |

| HPR | High Peak Royalties | 0.052 | -20% | $13,523,881 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | $15,368,615 |

| BLZ | Blaze Minerals Ltd | 0.01 | -17% | $7,542,699 |

| CZN | Corazon Ltd | 0.01 | -17% | $7,387,175 |

| FTZ | Fertoz Ltd | 0.064 | -15% | $19,337,612 |

| RML | Resolution Minerals | 0.006 | -14% | $8,801,043 |

| BLU | Blue Energy Limited | 0.013 | -13% | $27,764,604 |

| AGR | Aguia Res Ltd | 0.015 | -13% | $8,055,771 |

| NTI | Neurotech Intl | 0.0585 | -13% | $59,114,735 |

| GPR | Geopacific Resources | 0.014 | -13% | $13,139,058 |

| VAL | Valor Resources Ltd | 0.0035 | -13% | $15,493,339 |

| C1X | Cosmosexploration | 0.14 | -13% | $7,116,000 |

| BMM | Balkanminingandmin | 0.18 | -12% | $14,105,471 |

| GRE | Greentechmetals | 0.34 | -12% | $21,789,289 |

| PRS | Prospech Limited | 0.023 | -12% | $5,713,759 |

| RGL | Riversgold | 0.012 | -11% | $12,842,030 |

| EMC | Everest Metals Corp | 0.12 | -11% | $17,993,220 |

| NVO | Novo Resources Corp | 0.2 | -11% | $8,437,500 |

| OAR | OAR Resources Ltd | 0.004 | -11% | $11,759,111 |

| SCT | Scout Security Ltd | 0.016 | -11% | $4,152,024 |

| SUM | Summitminerals | 0.098 | -11% | $5,242,284 |

| GTH | Gathid Ltd | 0.025 | -11% | $7,375,701 |

| ICN | Icon Energy Limited | 0.006 | -45% | $8,448,150 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.